Any tax deduction favors the wealthy, that's a byproduct of our progressive tax system. But I'd say the contribution limits are so low that the benefits aren't all that significant to a wealthy person, to be honest. When you're talking IRA contribution caps (for 2014) at $5500 and 401K personal caps at $17500 (+5500 for catch-ups after age 50), you're not really talking a whole lot of money in the grand scheme of things for someone who is wealthy. Particularly the IRA limit, as it's a joke, and already off limits (pre-tax) to even modest income earners anyway.

To put it in context, someone age 45 in a 39.6% bracket is avoiding exactly $6930 in federal taxes if they're contributing pretax to a 401K up to the IRS limit. The minimum amount someone is paying in taxes at that bracket is $116,000 (2013), and they'll additionally pay 39.6% at anything over $400K. Meanwhile, that $6930 tax benefit is hard capped. So at its highest, it's 6% of the tax bill, and drops as income grows.

For someone earning 80K, the tax bill would be $15,935 (2013). If they max their 401K, the tax bill drops to $11,560, a drop of $4375 (not far off from someone earning $400K!), but also a 27.5% savings off the original amount. That's not a bad deal.

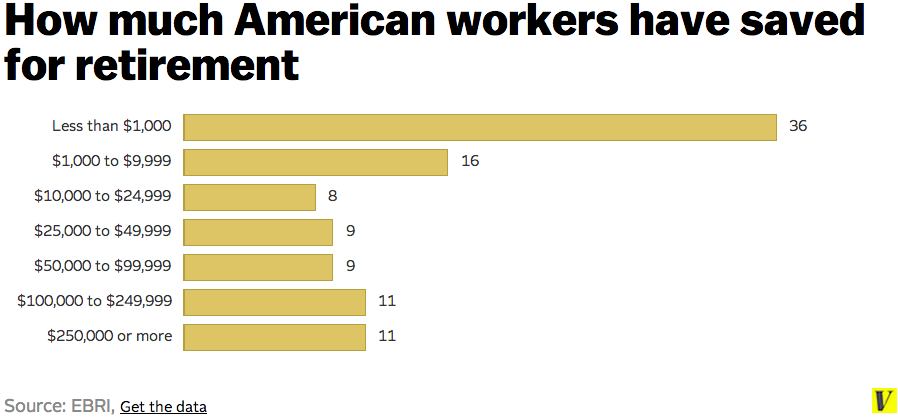

Yes, I want those with lower incomes to save more. I want to abolish the actual regressive "retirement plan" (called the public lottery). I favor 401K plans that are opt-out, not opt-in. But I'm not going to shed any populism tears over tax benefits benefiting those who pay the most in taxes, particularly when the benefits are capped due to low contribution limits, as that's a byproduct of our progressive tax system.

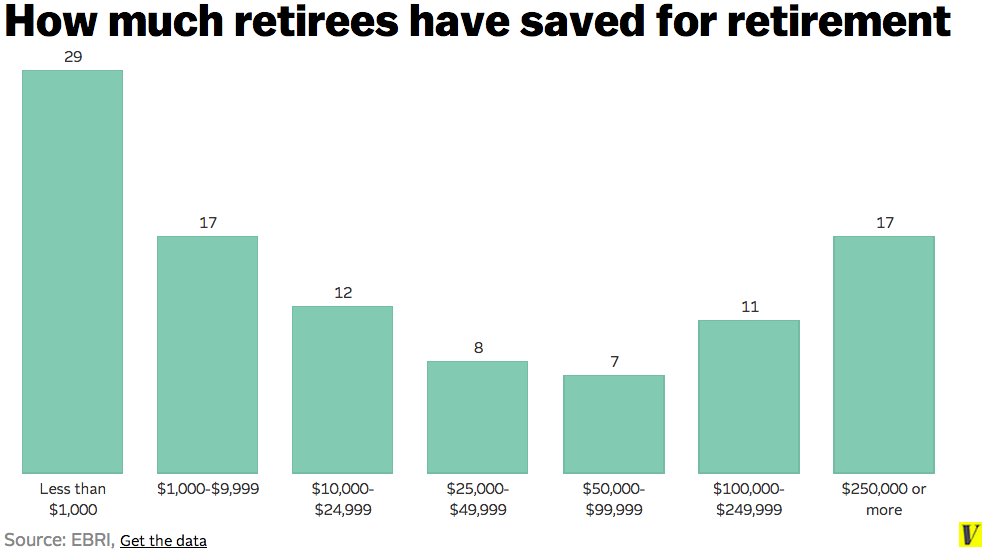

But this....

That's so never happening.

Doesnt Mitt Romney have like 200 million in his Roth IRA?