Eddie-Griffin

Banned

https://morningconsult.com/2023/02/08/dont-write-off-the-metaverse-just-yet/

This is the most detailed and comprehensive breakdown on the general audiences interest in VR made yet. Including mistakes that are made, and where things are. Including removing the marketing terms and just calling VR, well VR.

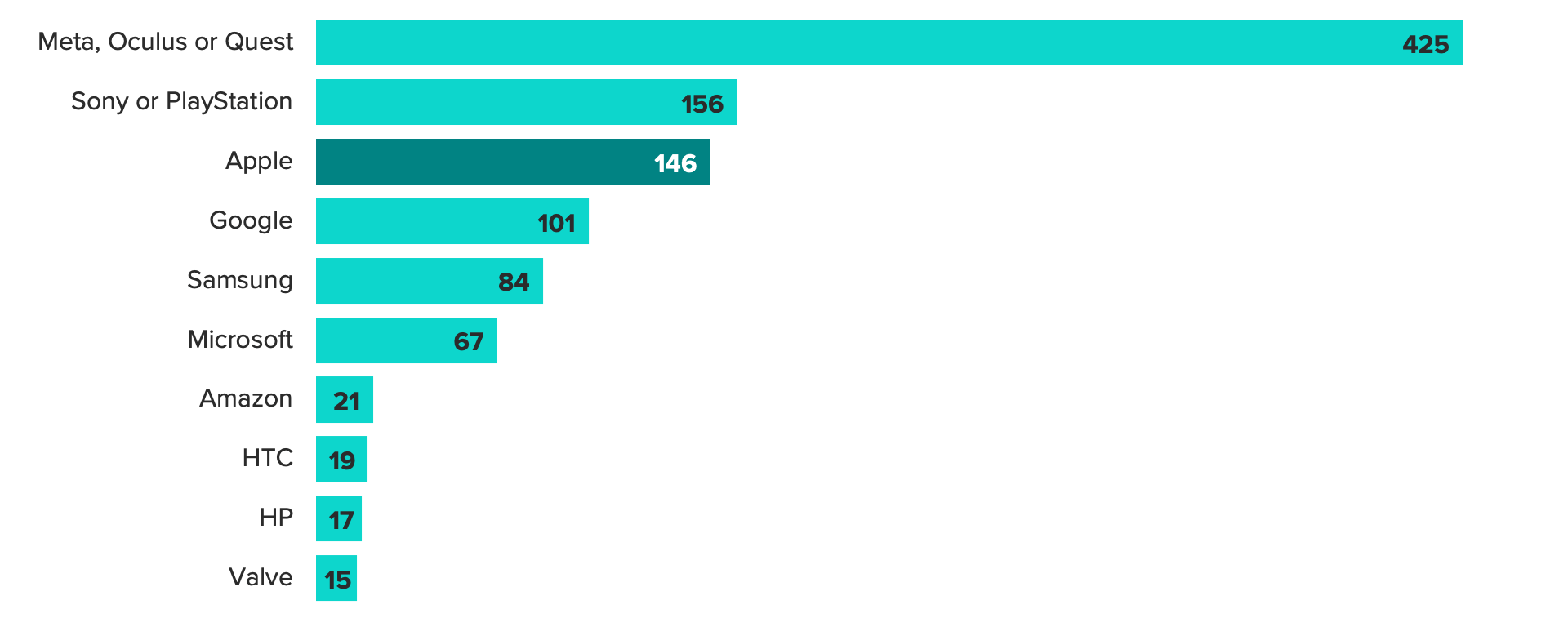

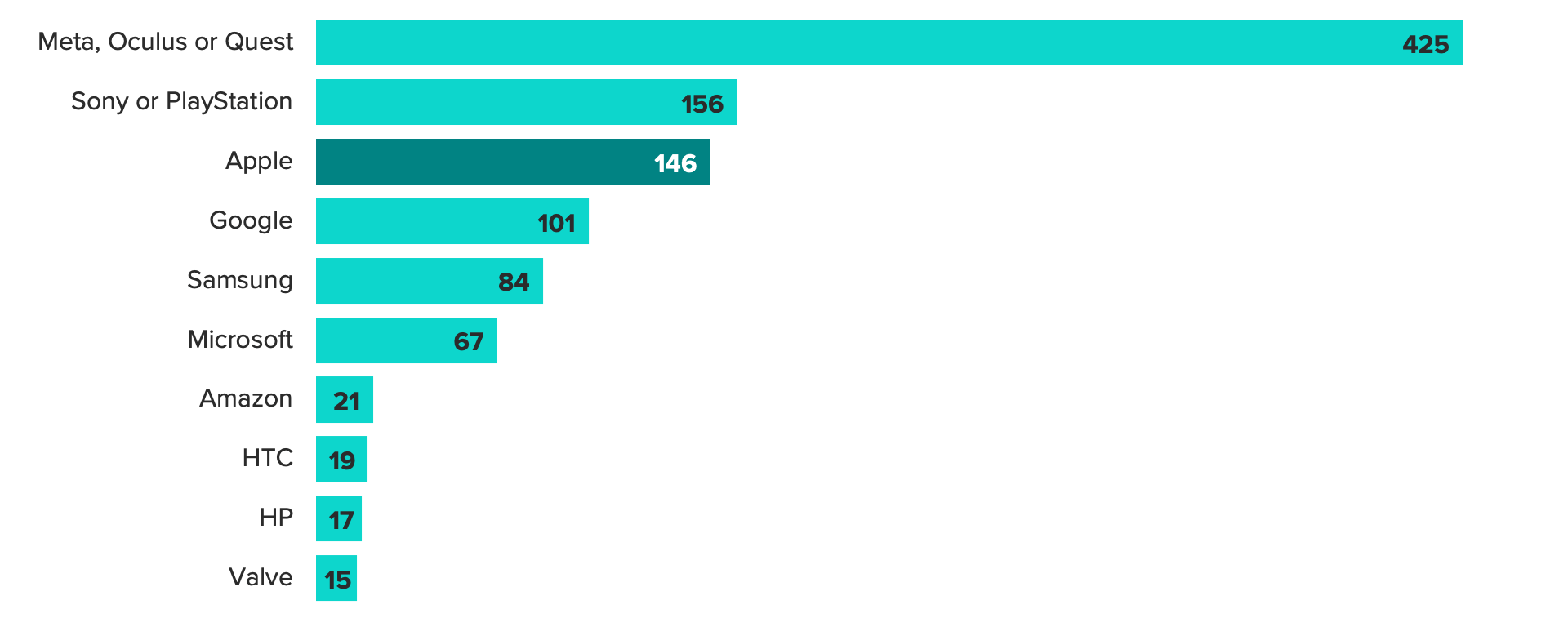

The elephant in the room is the last pic, where Apple who hasn't touched the market, is near the top of the list that consumers are most interested in buying a headset from. This makes a potential reveal and marketing for a shown headset, seem like it would push interest of the VR market to new highs, which goes with the predictions that many people and articles expecting that if executed right, Apple could be instrumental in increasing the possibility of making VR more suitable for mainstream adoption as a whole.

To be right below Sony which is established and is releasing the hyped PSVR2, is pretty impressive. Especially since we've seen Sony's headset ad specs, and have not seen Apples yet.

This also goes for Samsung, who still has a strong standing despite not being involved in VR since the end of the Gear (mobile VR headset) years ago. The interest for a Google VR headset is pretty surprising.

The chart also shows HTC's uphill battle for mindshare, and Valve letting their foot off the pedal. HTC can't seem to improve their preception.

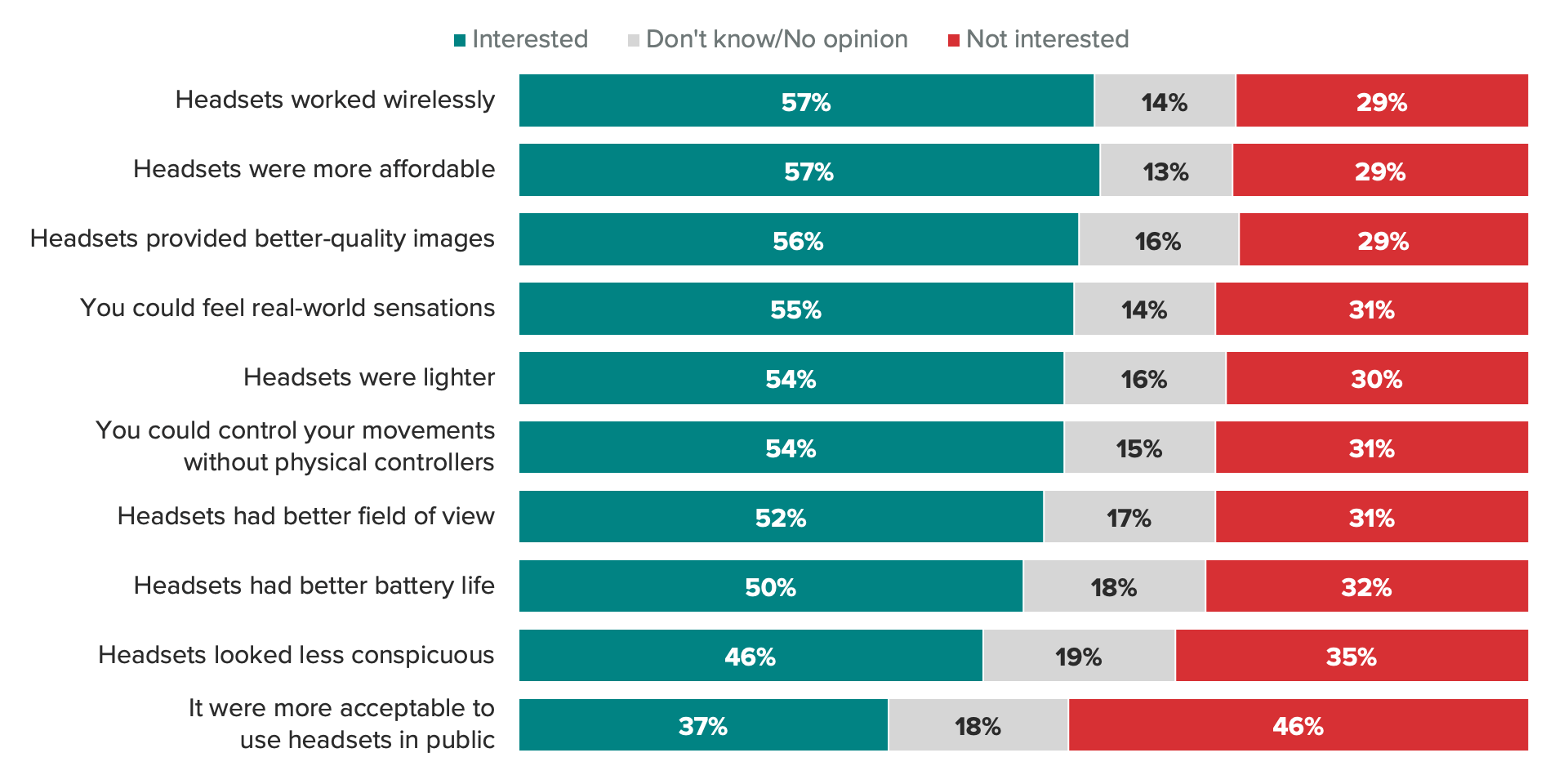

The 2nd pic goes over what people actually want or need VR to change, to actually become more involved and interested in VR. Wireless is top of the list as a must, affordability is 2nd, with better image quality coming up in third.

But overall most consumers want a light, comfortable, wireless headsets with long batter life, good FoV, quality picture/video, and the number 6th best on the list,

It seems as a gaming board, and really this goes for all gaming boards, we are completely disconnected from the general market.

Many people don't want controllers, they want movement without controllers like a sci-fi movie. The leak thread about the Apple headset having a way to control your movements like Kinect was laughed at, but it turns out that's what many people ACTUALLY want.

Apple, based on recent leaks, has not just controller free controls, but rings to aid in more precise movements and actions according to patents. Apple studied the market and the interest of consumers who fell away to VR and has been ahead of everyone based on these leaks. They knew exactly what the consumers wanted. I wonder if Samsung who recently announced reentry into VR, saw the same mistakes and are working on the same remedies?

One thing is for sure, with the many new players in VR this year, it's going to be a make or break for VR imo.

DataConsumers aren't sold on the metaverse right now, but recent analysis shows that Meta's multibillion-dollar bet to usher in a new virtual way of living might not be as far-fetched as headlines would make it seem.

- Fifty-seven percent of U.S. consumers are interested in or can be convinced to take an interest in VR — a sizable market — with adoption most prevalent among younger generations.

- Brands that want to engage in VR need to understand and navigate three main obstacles: understanding who is engaged with VR now, the impact of the metaverse brand and the importance of hardware in driving further adoption.

- As brands think about what it means to engage in VR or the metaverse, they should consider the most relevant utility their products or services can offer in this space to create stronger brand connections as the technology grows and evolves.

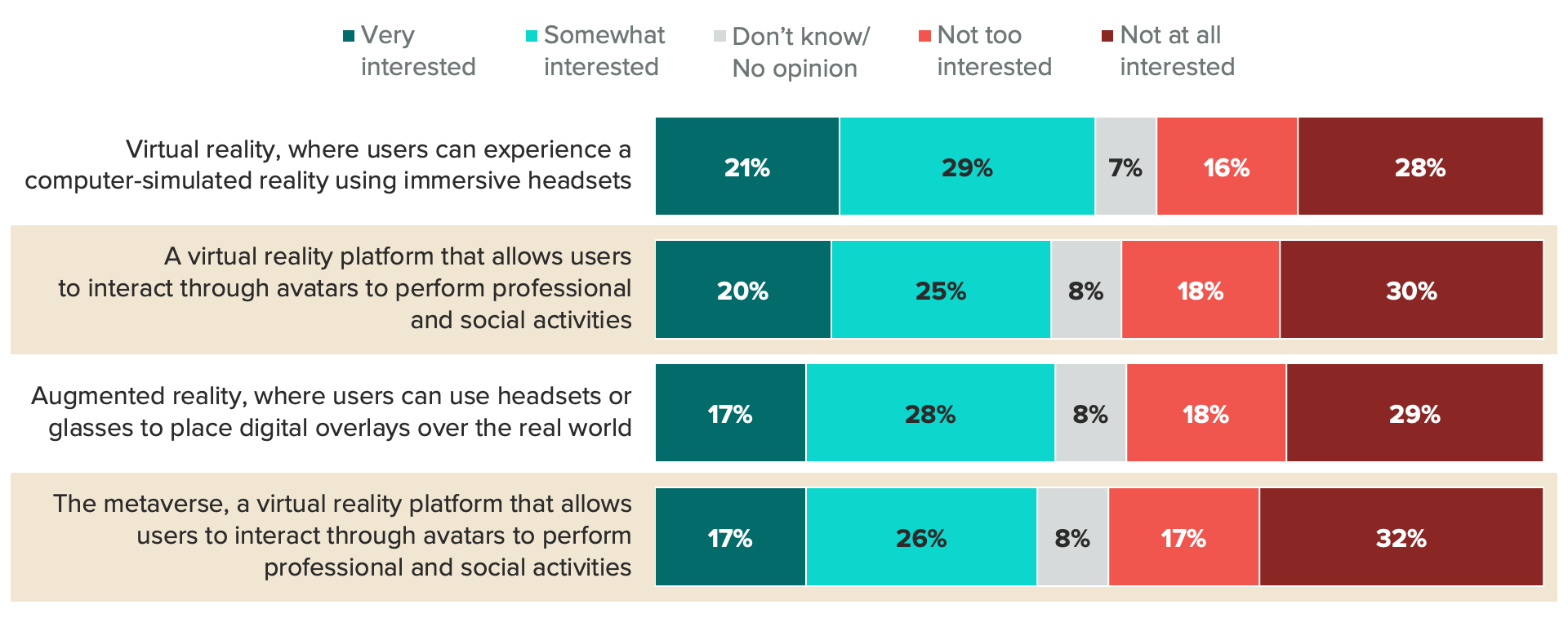

A recent Morning Consult survey initially paints a drab picture for the metaverse: 49% of U.S. adults said they are not interested in experiencing it, slightly more than those who said they would be interested (43%).

But to write off the promise of virtual reality would be myopic. Indeed, what we are experiencing now is the very early stages of a developing technology; essentially, we are the subjects in a large experiment whereby new technologies are being tested, thrown out, refined and eventually perfected. It's a process that nearly every major technological advancement has gone through, and the metaverse is no different.

That's not to say its road to ubiquity won't be without obstacles.

The metaverse's current challenges can be sorted into three categories: understanding core audiences, metaverse branding misses and the absence of that one product that will change everything. Brands looking to plan for a metaverse-focused future should stop focusing on the question "What does my brand look like in the metaverse?" and start figuring out the actual utility of their product or service in virtual reality.

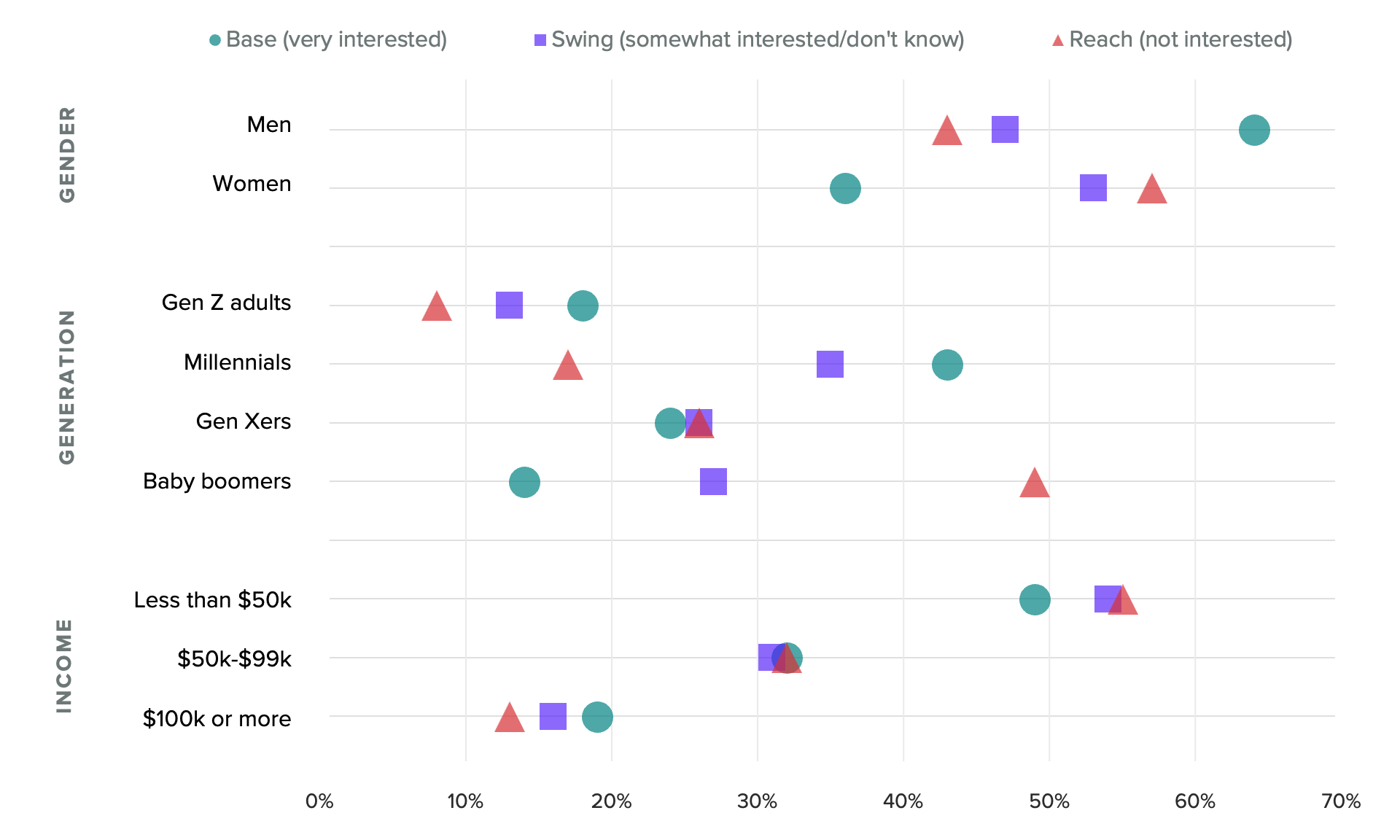

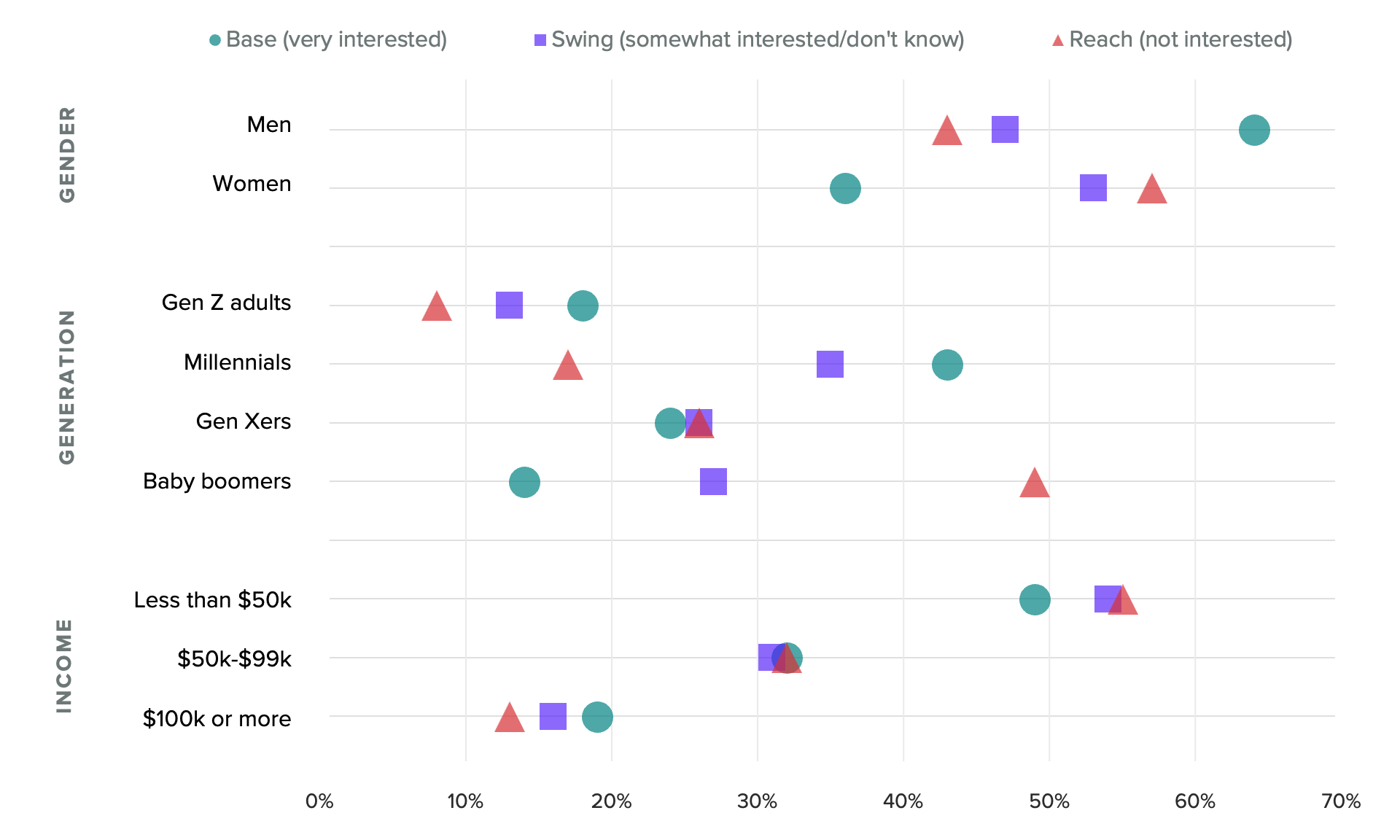

Here, the base — those already sold on the idea of virtual reality — accounts for 21% of the consumer market. Most (62%) have already used a VR device, and many (40%) own a Meta Quest 2, the most popular consumer VR headset on the market. Demographically, this audience skews male (64%) and younger (61% are Gen Zers or millennials). They are also more likely to identify as Hispanic (23%) or Black (16%) relative to the general population.

The reach audience is not at all interested in VR and will be the most difficult to engage on the topic. Especially at early stages of product development, VR products are too expensive and time-intensive for this group to try. This audience makes up 28% of consumers and skews much older relative to the general population — roughly half are baby boomers.

The swing audience, in the middle, is where opportunity lies for companies to engage new people in VR. These consumers are only somewhat interested in VR or haven't made up their minds yet. They make up 36% of all consumers, a generous share of the potential market. Demographically, they are younger and slightly more likely to be women. They also tend to see more promise in VR: 74% of the swing audience said VR is innovative, and 63% said it is the future of the internet, higher shares than the average consumer.

All told, the base and swing audiences that companies can market their virtual reality offerings to make up 57% of the consumer market, indicating a sizable appetite for something that is still very much in development. Looking ahead, engagement with VR is only poised to increase from there. Interest in the technology is largely concentrated among younger consumers like Gen Zers and millennials, who are also the most likely to own VR devices. As these generations and younger ones become larger parts of the broader consumer market, VR adoption is likely to increase as well.

Talk about VR, not the metaverse

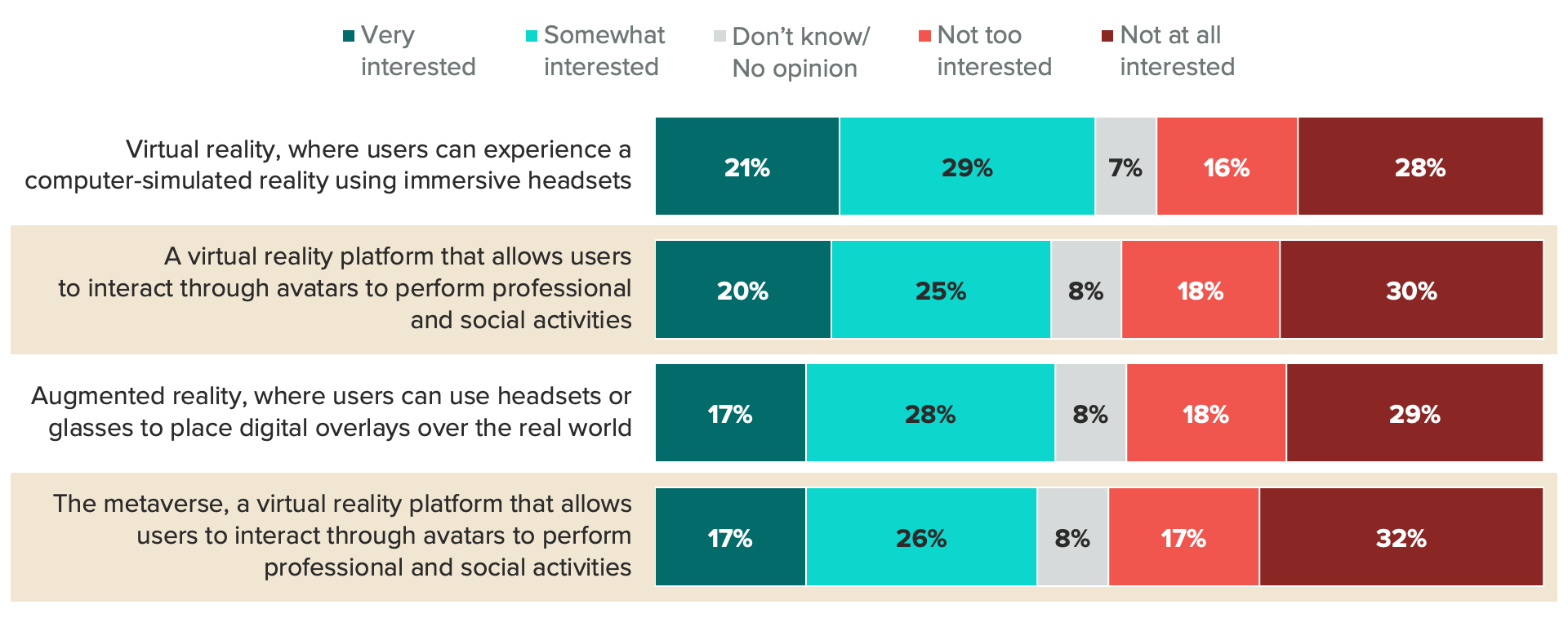

The second challenge is branding. People aren't sold on the metaverse, but they are more excited about virtual reality generally. Roughly half of consumers are at least somewhat interested in VR, a bit more than the share who reported at least some interest in the metaverse (43%). Even among the base audience, 100% of which reported high interest in VR, only 63% said the same about the metaverse itself.

In many ways, VR and the idea of the metaverse are inextricable, and even describe the same thing — a way of engaging with virtual worlds. How this experience is defined plays a role in consumers' imaginations. When presented with two identical definitions of the metaverse — one featuring the word "metaverse" and the other not — consumers were slightly more likely to be interested in the one that didn't explicitly mention the metaverse. But both garnered less interest than VR in general. Brands looking to engage with consumers in this new medium are better off talking about their virtual reality offerings in just those terms — as a virtual reality experience — and should shy away from referencing the metaverse or a platform.

Virtual reality hardware: Build it and they will come

The third challenge is in hardware, and this may be the most important one to overcome. Only 34% of U.S. adults said they have used a VR headset before, and of those, more than a third (37%) rated their experience with the weight of their VR headset as "fair" or "poor." This is not very surprising, as much of the hardware in the VR space is still in its infancy.

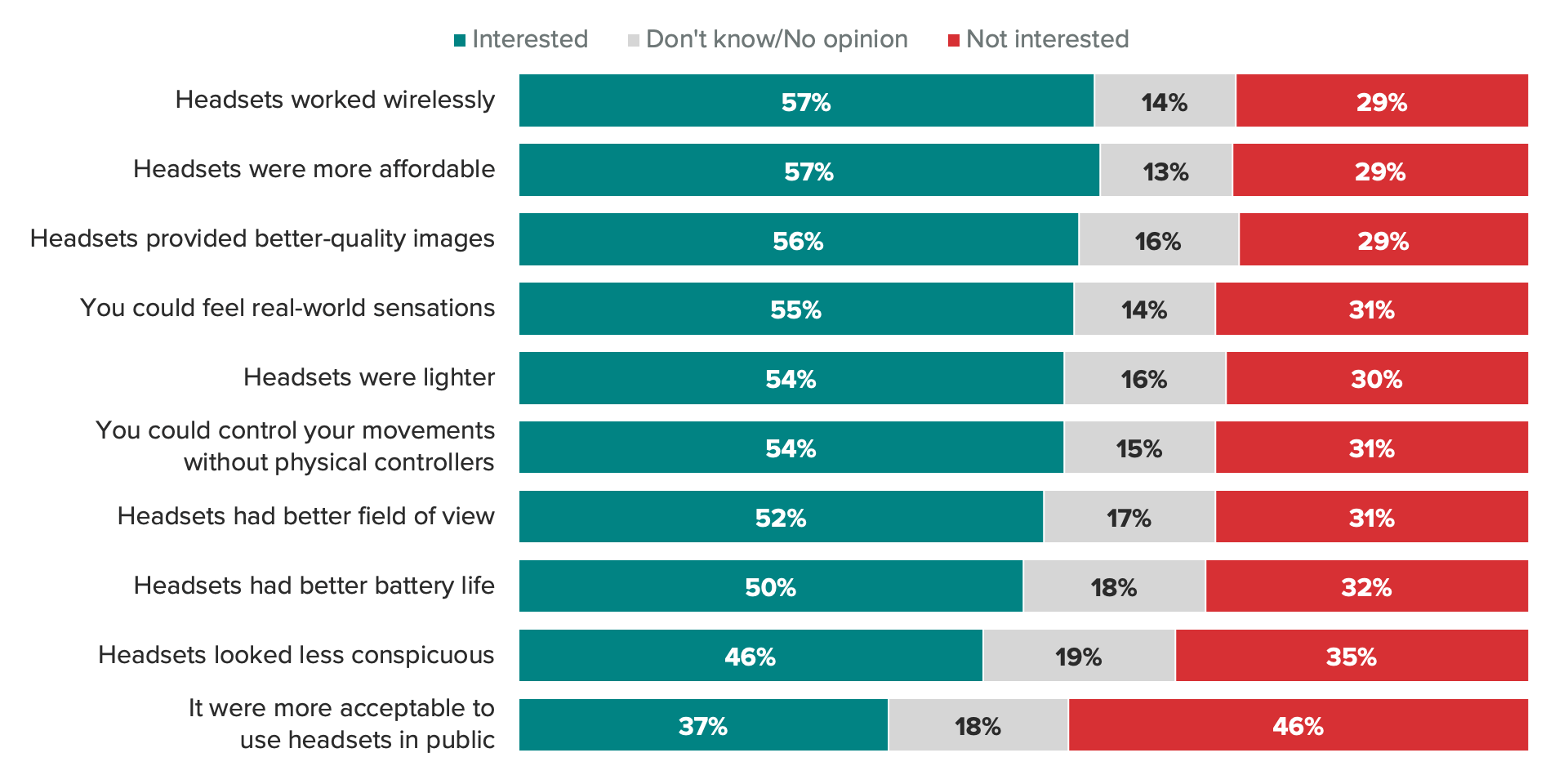

That being said, there are developments on the horizon that may convince consumers to give VR a shot and increase interest in the technology. Affordability, wireless connectivity and image quality topped the list of VR hardware features that would spur additional interest among consumers.

Making the technology more accessible and easier to use is crucial to adoption. The promise of VR is immersion in a world outside of our own, and to achieve this, the experience must be as seamless and unobtrusive as possible.

That will likely take one major breakthrough product that will inspire imaginations and change the way we interact with the virtual and digital space forever — again, as we've seen in the early stages of any technological advancement. And it could be coming from Apple.

The tech giant is reportedly planning on releasing its own VR headset, at a premium price. The company's track record for product innovation could be just the thing the VR industry needs to drive more mainstream interest in the technology.

Number of mentions of the following brands when respondents were asked to name the company they're most interested in buying VR hardware from:

<>In open-ended responses, many respondents pointed to Apple as the company they would be most interested in buying a VR headset from, despite the fact that the company doesn't even have such an offering yet. This could be a strong advantage for Apple. In many cases, the company hasn't been the first to market with hardware products that have come to define the brand, but Apple has a strong track record of taking hardware concepts through consumer-friendly innovations that have come to own and define the space for years. For example, Apple didn't invent the laptop, but the company created the first portable computer with a pointing device (the Macintosh Portable, which featured a trackball), essentially defining the modern design of laptops. Apple didn't invent smartphones either, but the iPhone is now the standard that all companies follow in this space. Apple now has an opportunity to push the envelope in VR much as it did with the iPhone more than 15 years ago.

Brands must understand that VR is a long-term bet

VR and the metaverse are long-term plays. As with the first smartphones and tablets, we are in the early stages of technological advances. Today's headsets will soon be replaced by models reflecting the most recent advances in hardware (like Meta's Quest Pro headset using "pancake" lenses), and the consumer market that will likely be most engaged with VR is still growing up. For brands engaging in VR, the payoff is unlikely to be immediate.

Another element to consider is to not get hung up on the branding and just call it what it is. The metaverse is a brand, and one that is not resoundingly inspiring confidence among consumers. People have more interest in VR broadly, so brands engaging in this space will find it safer and more accurate to simply use that term.

Finally, brands should seek to authentically solve problems for consumers and avoid merely jumping on the bandwagon. Many companies are looking to the metaverse as the next big thing, and they're spending millions of dollars on virtual events and avatars no one will remember just to get in on the action. Instead, brands should lean into their strengths and ask themselves if there are authentic ways their offerings can be improved by VR.

Using VR as a teaching tool is one example of this: Boeing uses VR to train technicians to repair planes without putting expensive equipment at risk. In fact, 61% of consumers say they are excited to use VR to learn new skills. Rooting VR engagement in the solutions a company provides will lead to stronger consumer connections by showing they can use new technologies to solve problems.

This is the most detailed and comprehensive breakdown on the general audiences interest in VR made yet. Including mistakes that are made, and where things are. Including removing the marketing terms and just calling VR, well VR.

The elephant in the room is the last pic, where Apple who hasn't touched the market, is near the top of the list that consumers are most interested in buying a headset from. This makes a potential reveal and marketing for a shown headset, seem like it would push interest of the VR market to new highs, which goes with the predictions that many people and articles expecting that if executed right, Apple could be instrumental in increasing the possibility of making VR more suitable for mainstream adoption as a whole.

To be right below Sony which is established and is releasing the hyped PSVR2, is pretty impressive. Especially since we've seen Sony's headset ad specs, and have not seen Apples yet.

This also goes for Samsung, who still has a strong standing despite not being involved in VR since the end of the Gear (mobile VR headset) years ago. The interest for a Google VR headset is pretty surprising.

The chart also shows HTC's uphill battle for mindshare, and Valve letting their foot off the pedal. HTC can't seem to improve their preception.

The 2nd pic goes over what people actually want or need VR to change, to actually become more involved and interested in VR. Wireless is top of the list as a must, affordability is 2nd, with better image quality coming up in third.

But overall most consumers want a light, comfortable, wireless headsets with long batter life, good FoV, quality picture/video, and the number 6th best on the list,

you could control your movements without physical controllers.

It seems as a gaming board, and really this goes for all gaming boards, we are completely disconnected from the general market.

Many people don't want controllers, they want movement without controllers like a sci-fi movie. The leak thread about the Apple headset having a way to control your movements like Kinect was laughed at, but it turns out that's what many people ACTUALLY want.

Apple, based on recent leaks, has not just controller free controls, but rings to aid in more precise movements and actions according to patents. Apple studied the market and the interest of consumers who fell away to VR and has been ahead of everyone based on these leaks. They knew exactly what the consumers wanted. I wonder if Samsung who recently announced reentry into VR, saw the same mistakes and are working on the same remedies?

One thing is for sure, with the many new players in VR this year, it's going to be a make or break for VR imo.

Last edited: