Hari Seldon

Member

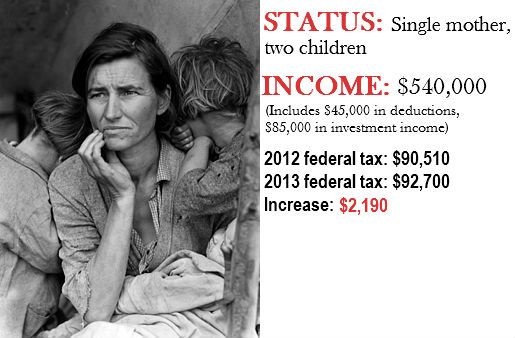

It seems like people in this thread are pro tax simply because the people make more money than them so fuck them. Can't blame them for saying, "fuck the poor, I got mine" if that is the general attitude. I want to know what the fuck the purpose of the tax increase is. More drones to kill brown skins? Seems like they have a right to be pissed even if they make 260k.