godhandiscen

There are millions of whiny 5-year olds on Earth, and I AM THEIR KING.

60% of millennials earning over $100,000 say they're living paycheck to paycheck

Millennials known as HENRYs — high earner, not rich yet — prefer a comfy lifestyle, but a new survey found that means things can get tight.

That's partly because of lifestyle choices. Many of these millennials are likely HENRYs — short for high earner, not rich yet. The acronym was invented in 2003, but it has come to characterize a certain group of 30-something six-figure earners who struggle to balance their spending and savings habits.

HENRYs typically fall victim to lifestyle creep, when one increases one's standard of living to match a rise in discretionary income. They prefer a comfortable and often expensive lifestyle that leaves them living paycheck to paycheck.

I remember that I was living paycheck to paycheck until I turned 26 or so when I realized how badly consumerism was dragging me down. What helped me massively was a friend who recommended me this tool:

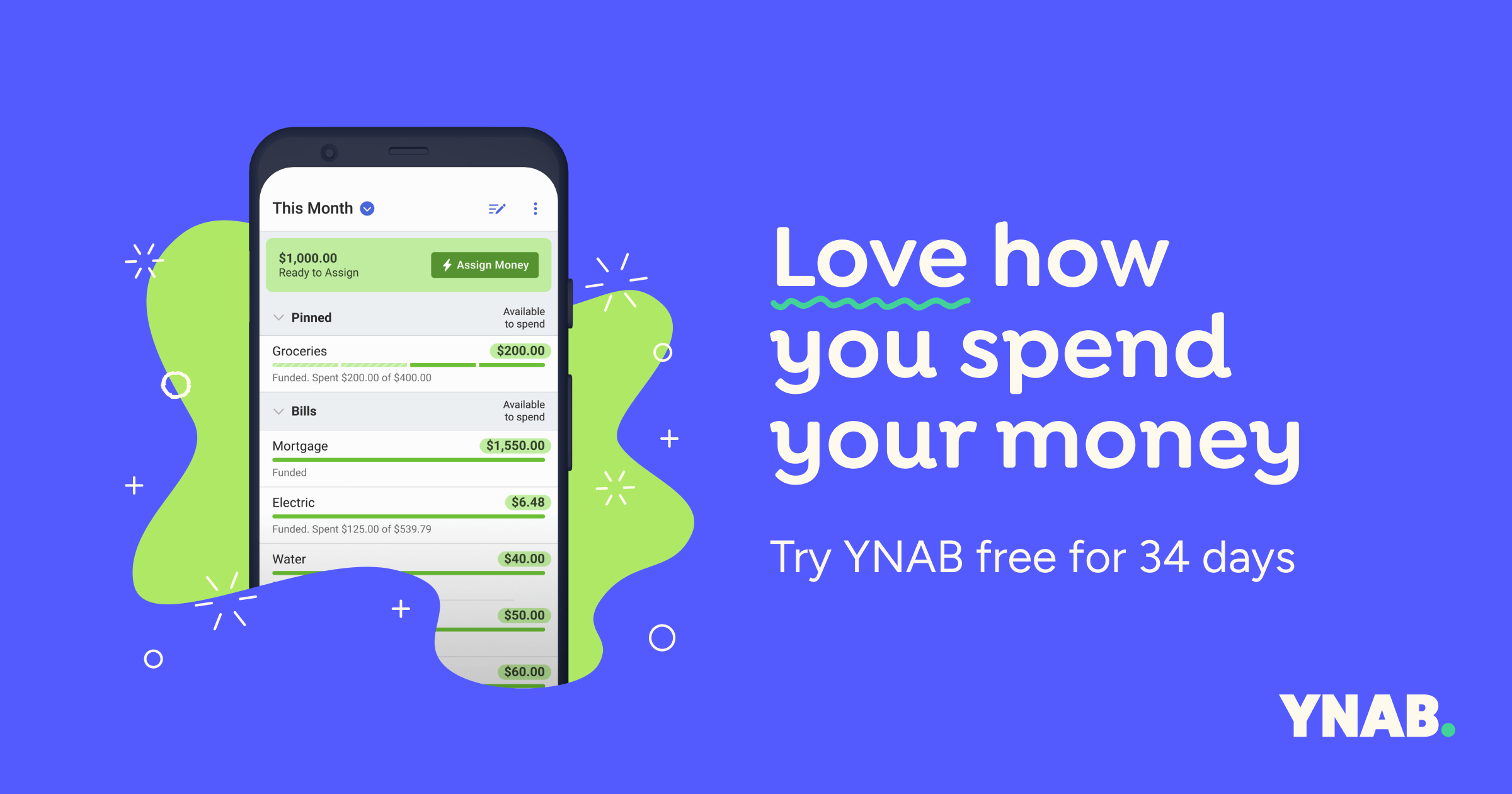

YNAB

Working hard with nothing to show for it? Use your money more efficiently and control your spending and saving with the YNAB app.

www.youneedabudget.com

www.youneedabudget.com

Nowadays, I help other friends by introducing them to investing and similar budget tools. Also, I realize that $100k isn't a lot nowadays, and when you graduate with crippling college debt, it is a different ball game; I went to a public state school anticipating this.

What do you think GAF?

PS: I heard YNAB is kinda shitty and expensive nowadays, but just trying the tool helps you grab the concept of budgeting and gives you visibility into your worst spending habits.