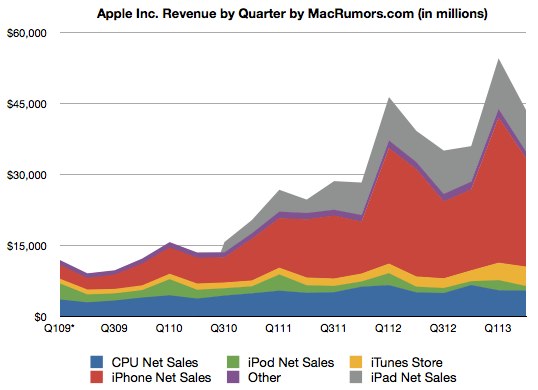

Apple has been on a roll for, well, almost as long as we can remember. Basically since the debut of the iMac, the company has been riding a rocketship back from the brink of irrelevance. The iPod, iPhone and iPad have all led it to post record quarter, after record quarter, after record quarter. Now we're in the second quarter of financial year 2013 and it doesn't appear to be slowing down much. The company posted $43.6 billion in revenue during the quarter and net itself a handsome profit of $9.5 billion. While those numbers do represent the slowest rate of growth Cupertino has seen in years, it's hardly the fall from grace that some analysts were predicting. Compared to the same time last year, revenues are up from $39.2 billion though net income has dropped from the Q2 2012 mark of $11.6 billion. Still, the company managed to move more iPhones and iPads than it did during that quarter, and the drop from Q1's holiday-boosted numbers isn't particularly alarming. In total it moved 19.5 million iPads and 37.4 million iPhones during the three months ending on March 30th, 2013. In Q1 those numbers were an admitedly more impressive 22.9 milion and 47.8 million, respectively. But, compared to Q2 of 2012, things are still looking up from the 35.1 million iPhones and 11.8 million iPads shipped.

Things are a little less rosy around its non-iOS departments, but we'd hardly say the company was in dire straights. Mac sales were more or less flat both sequentially and year-over-year, falling just under four million units. Meanwhile, the iPod continued its steady decline, moving only 5.6 million units. That's not only more than a 50 percent drop from last quarter, but a 27 percent drop from the same period last year. The biggest contributor to Apple's revenue stream continues to be the iPhone, but the iPad is gaining fast and income from iTunes and its other software offerings continues to grow at an impressive rate.

There's a conference call underway, more at the link: http://www.engadget.com/2013/04/23/apple-posts-q2-2013-earnings/

Now they "only" have enough cash in bank to buy EVERY team in NFL, NBA, NHL, and MLB