You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intel Announces Q3 2024 Financial Results: Revenue of $13.3 Billion and Net Loss of $16.6 Billion

Panajev2001a

GAF's Pleasant Genius

TSMC will probably be able to put them to better use too / at a lower risk as they have very high volume from the most demanding customers…Intel only bought the first ones. So they got a head start over TSMC.

But TSMC is going to receive their High NA machines before the end of this year.

@Leonidas on suicide watch for real!!!

The Fuzz damn you!

Gold Member

A $30b operating loss does not mean that they spent $30b + revenue - there's a lot that goes into that number. Those are restructuring costs and impairment charges.

this involves a whole range of calculations.

- Severance packages and legal fees associated with layoff.

- Any reduction in value of an asset is a "loss". Scrapping a facility that costs money will result in a "loss" of the value of the facility as well as any future earnings it might bring in, without any immediate reflection of the future cost savings that will occur.

- Depreciation in the value of assets, such as foundries, will be marked as a loss

- The value of, say, their 18A foundry may fluctuate - if they decide that projected future sales need to be adjusted downwards due to changed market conditions or increased competition, the value of the foundry is effectively lowered and marked as a "loss"

- similarly, changes in the likelihood of the foundry running at a particular scale or success rate or within a particular timeframe will alter its "value" on the books, which will affect that profit/loss statement.

- a whole lot of other shit. Semi-conductor design and manufacturing is complex. A lot of it boils down to changes in the predicted future earnings of a facility being reflected in the quarter that those predictions are made, rather than when those earnings eventually occur.

TL;DR - double-entry book keeping.

this involves a whole range of calculations.

- Severance packages and legal fees associated with layoff.

- Any reduction in value of an asset is a "loss". Scrapping a facility that costs money will result in a "loss" of the value of the facility as well as any future earnings it might bring in, without any immediate reflection of the future cost savings that will occur.

- Depreciation in the value of assets, such as foundries, will be marked as a loss

- The value of, say, their 18A foundry may fluctuate - if they decide that projected future sales need to be adjusted downwards due to changed market conditions or increased competition, the value of the foundry is effectively lowered and marked as a "loss"

- similarly, changes in the likelihood of the foundry running at a particular scale or success rate or within a particular timeframe will alter its "value" on the books, which will affect that profit/loss statement.

- a whole lot of other shit. Semi-conductor design and manufacturing is complex. A lot of it boils down to changes in the predicted future earnings of a facility being reflected in the quarter that those predictions are made, rather than when those earnings eventually occur.

TL;DR - double-entry book keeping.

manfestival

Member

Oof

Chiggs

Gold Member

Nvidia to replace Intel in Dow Jones Industrial Average

Once the dominant force in chipmaking, Intel has in recent years ceded its manufacturing edge to rival TSMC and missed out on the generative artificial intelligence boom after missteps including passing on an investment in ChatGPT-owner OpenAI. Intel's shares have declined 54% this year, making...

Ah for the glory days of "contra-revenue" when they had 90% market share.... huge amount of duplicate roles and needless complexity, no problem back when you were guaranteed sales and mega profits...

www.crn.com

www.crn.com

Intel Plans 35 Percent Cut In Costs For Sales And Marketing Group

Intel’s Sales and Marketing Group plans to cut jobs and ‘simplify programs’ as part of a directive to slash costs by 35 percent by the end of the year, CRN has learned.

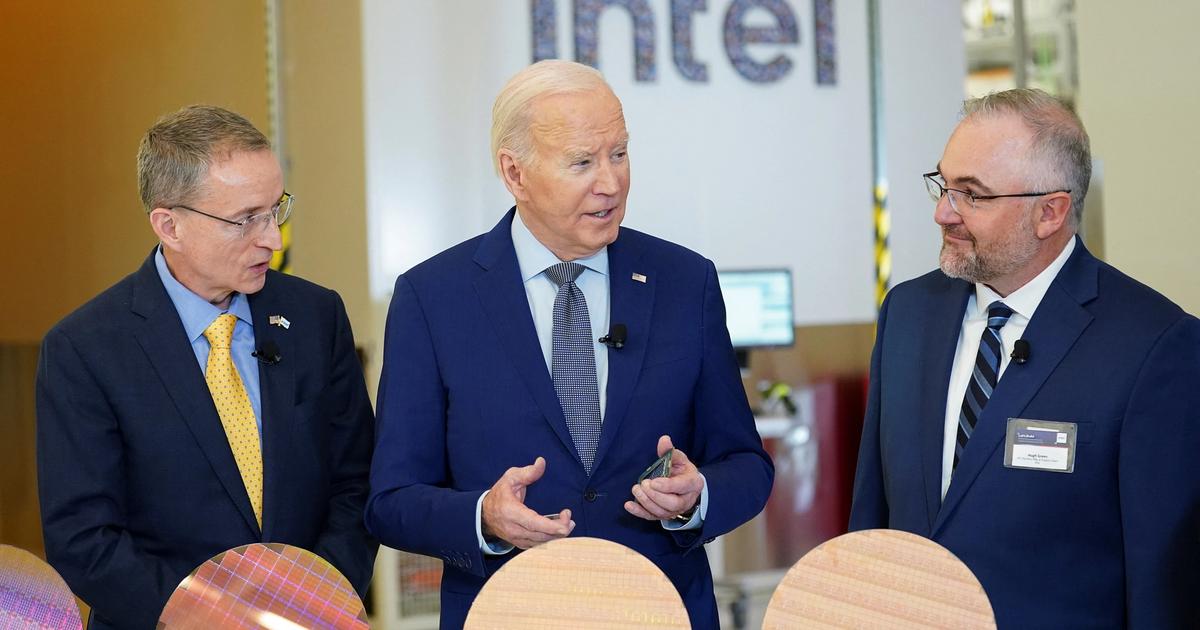

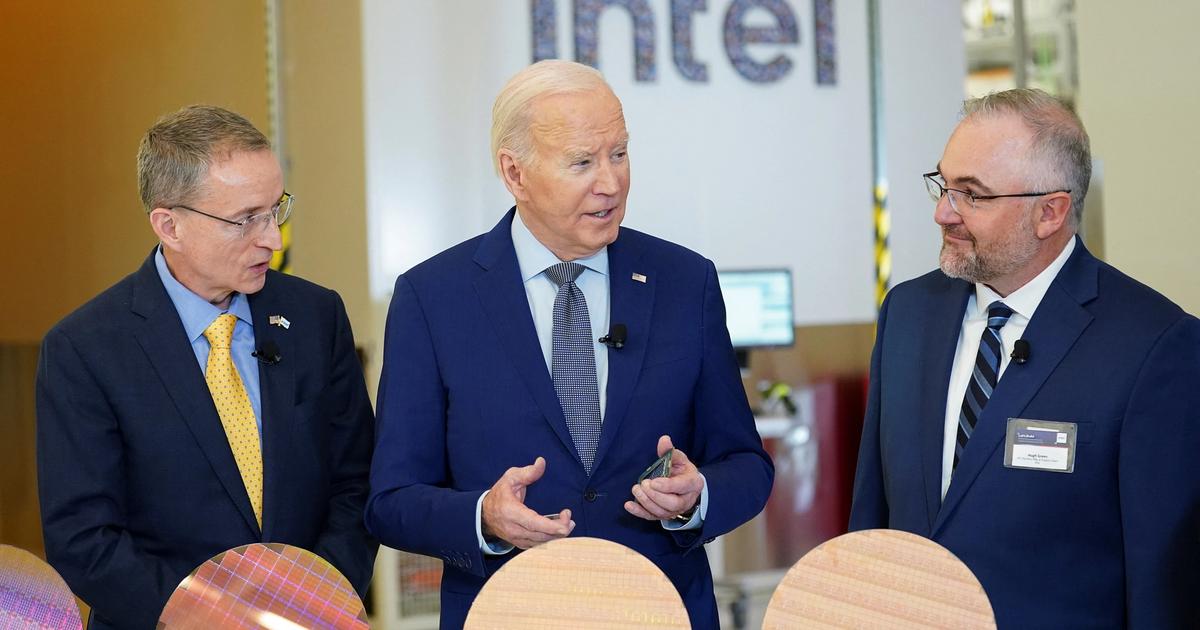

They are going to get $8.5 billion of our taxpayer dollars soon.Damn! And there is no way to blame this one on Wokeness

Intel and Biden Admin Announce up to $8.5 Billion in Direct Funding...

Proposed funding, coupled with an investment tax credit and eligibility for CHIPS Act loans, would help Intel advance American semiconductor manufacturing and technology leadership in the AI era.

SonGoku

Member

Here https://www.extremetech.com/computing/report-intel-bought-all-of-asmls-high-na-euv-machines-for-2024Apparently it is not the case….

Intel is getting its first high-NA machine up and running at its Oregon facility, but it's not expected to be fully operational until 2025. Once it's firing on all cylinders, Intel has stated it will be used to produce the company's 14A process, which isn't due until 2026 or thereabouts.

The quoted article states that in 2025, ASML will likely sell high-NA equipment to both Samsung and SK Hynix, but not until the end of the year. This theoretically will give Intel about a year's head start on both companies.

One has to wonder when TSMC will hop aboard this bandwagon. So far, the company has stated it doesn't see the benefit of high-NA to its customers, so it's sticking with EUV for the foreseeable future.

Chiggs

Gold Member

And the hits just keep on coming...

www.semafor.com

www.semafor.com

I think we're in for a shit-show no matter what happens. Does anyone really believe Intel has anything left in the tank after their latest wet fart?

Also, no matter how much dick Patty boy sucked to juice his stock today, here's JP Morgan's take:

www.tipranks.com

www.tipranks.com

Concerns grow in Washington over Intel

Policymakers have grown worried enough about the chipmaker to quietly discuss scenarios should it need further assistance.

Policymakers in Washington have grown worried enough about chipmaker Intel to begin quietly discussing scenarios should it need further assistance, beyond the billions in government funds the company is already slated to receive, people familiar with the matter said.

A strong quarterly earnings outlook yesterday bought the company breathing room with investors, but abstract concerns in Washington have turned into potential backup options, should Intel's finances continue to deteriorate.

Top officials at the Commerce Department, which oversees implementation of the CHIPS Act funding to reinvigorate American chip production, and members of Congress including Sen. Mark Warner, one of the law's leading champions, have discussed whether the company needs more help, the people said.

Intel's wobbles may force Washington to choose between two of its ideological priorities: promoting national champions and preventing corporate consolidation. On a clear day, there's little chance antitrust regulators would allow Intel to merge with any of its rivals. Expediency often forces policy compromises — see JPMorgan's emergency rescue of First Republic last year — but if Commerce Secretary Gina Raimondo can outmuscle Federal Trade Commission Chair Lina Khan, it will show just how deep Intel's problems run.

I think we're in for a shit-show no matter what happens. Does anyone really believe Intel has anything left in the tank after their latest wet fart?

Also, no matter how much dick Patty boy sucked to juice his stock today, here's JP Morgan's take:

JPMorgan Calls Intel’s (NASDAQ:INTC) Mid-Term Targets “Unattainable” - TipRanks.com

Intel ($INTC) stock is rising today even after an analyst from JPMorgan ($JPM) described the tech company’s mid-term targets as “unattainable.” After reporting stro...

Last edited:

Chiggs

Gold Member

The government will end up bailing them out.

I feel like this is going to happen, but it's going to happen with a major caveat: Intel will no longer be Intel...it will be something else---and with numerous oversight committees.

Imtjnotu

Member

I think company's are slow to it given the machine sizes. With 3nm being a high volume norm right now, reaching 2nm it's pretty much it. Stacking of high-na will have to be the go too

StreetsofBeige

Gold Member

Too lazy to read financials, but going by those blue boxes, it's like getting blue balls. Ouch. Especially the margin part.

Maybe Intel should jump on the manufacturing train like almost every company does from chips to blenders. Make it overseas for cheap. Heck, Intel has to ship their CPUs to Asia anyway for companies to put into computers, so might as well just let those giant Chinese companies make it over there too.

But from what I remember, Intel is in talks with US gov to make more foundries in the US (if they get gov deals), so it doesn't look like they want to give up manufacturing control..

Maybe Intel should jump on the manufacturing train like almost every company does from chips to blenders. Make it overseas for cheap. Heck, Intel has to ship their CPUs to Asia anyway for companies to put into computers, so might as well just let those giant Chinese companies make it over there too.

But from what I remember, Intel is in talks with US gov to make more foundries in the US (if they get gov deals), so it doesn't look like they want to give up manufacturing control..

ap_puff

Banned

Maybe they should have cut out the avocado toastHow do you even have $30B of expenses in a single quarter?

Negotiator

Banned

Damn! And there is no way to blame this one on Wokeness

Inclusion at Intel

At Intel, we are committed to creating a better world through the power of our technology, our global scale, and the expertise and passion of our employees.

Inclusion at Intel

At Intel, we are committed to creating a better world through the power of our technology, our global scale, and the expertise and passion of our employees.

Negotiator

Banned

Not gonna happen: https://www.reuters.com/article/us-asml-holding-usa-china-insight-idUSKBN1Z50HNToo lazy to read financials, but going by those blue boxes, it's like getting blue balls. Ouch. Especially the margin part.

Maybe Intel should jump on the manufacturing train like almost every company does from chips to blenders. Make it overseas for cheap. Heck, Intel has to ship their CPUs to Asia anyway for companies to put into computers, so might as well just let those giant Chinese companies make it over there too.

But from what I remember, Intel is in talks with US gov to make more foundries in the US (if they get gov deals), so it doesn't look like they want to give up manufacturing control..

LordOfChaos

Member

The dark decade of measly 3% silicon gains a year. Everything feels so breakneck fast now with competition all going gung ho at each other. Makes me wonder where we would have been if that previous decade was also so heavily competitive, without AMD's Bullshitdozer misadventure.Ah for the glory days of "contra-revenue" when they had 90% market share.... huge amount of duplicate roles and needless complexity, no problem back when you were guaranteed sales and mega profits...

Intel Plans 35 Percent Cut In Costs For Sales And Marketing Group

Intel’s Sales and Marketing Group plans to cut jobs and ‘simplify programs’ as part of a directive to slash costs by 35 percent by the end of the year, CRN has learned.www.crn.com

Most companies say this now

Inclusion at Intel

At Intel, we are committed to creating a better world through the power of our technology, our global scale, and the expertise and passion of our employees.www.intel.com

Inclusion at Intel

At Intel, we are committed to creating a better world through the power of our technology, our global scale, and the expertise and passion of our employees.www.intel.com

winjer

Member

Is Intel too big to fail? US officials are considering government intervention

Amid growing concerns over Intel's recent financial struggles, top US policymakers are discreetly weighing contingency plans to support the company, which remains central to America's technological ambitions....

www.techspot.com

www.techspot.com

Ironman_Bad

Member

Sony can save them