Hnjohngalt

Member

bruhhhhhh

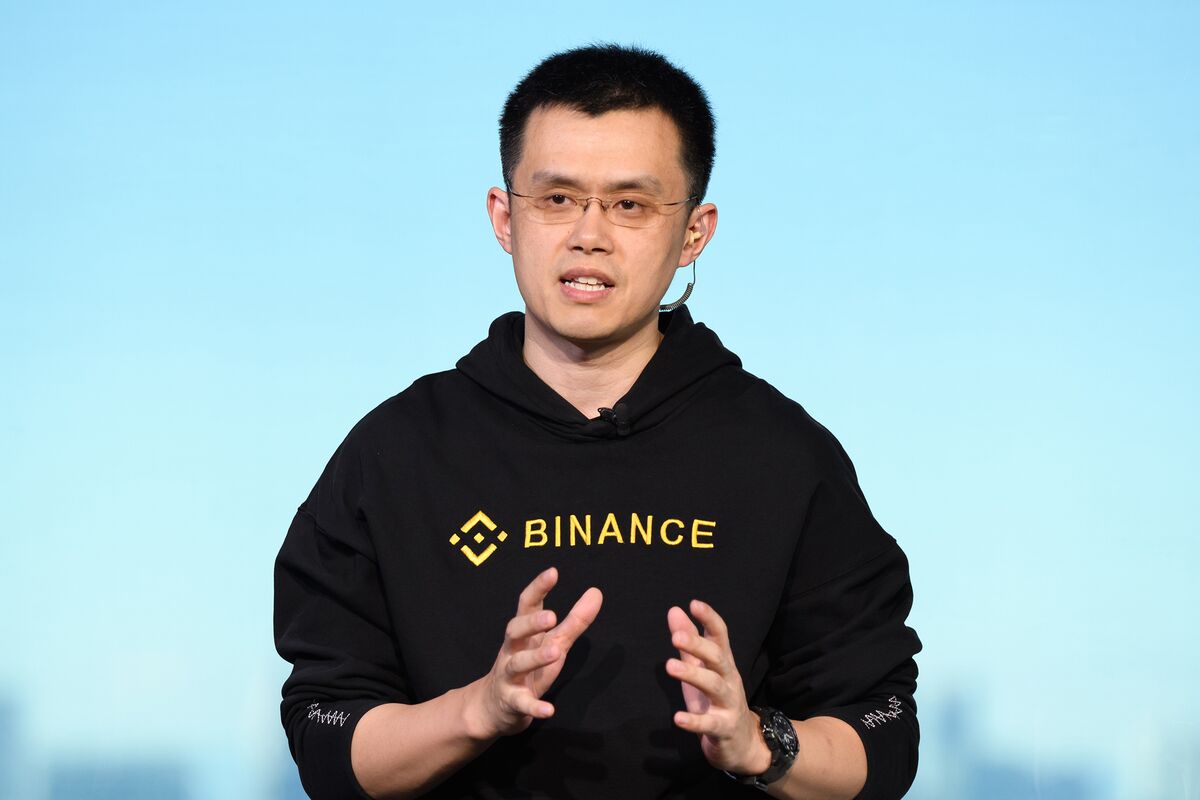

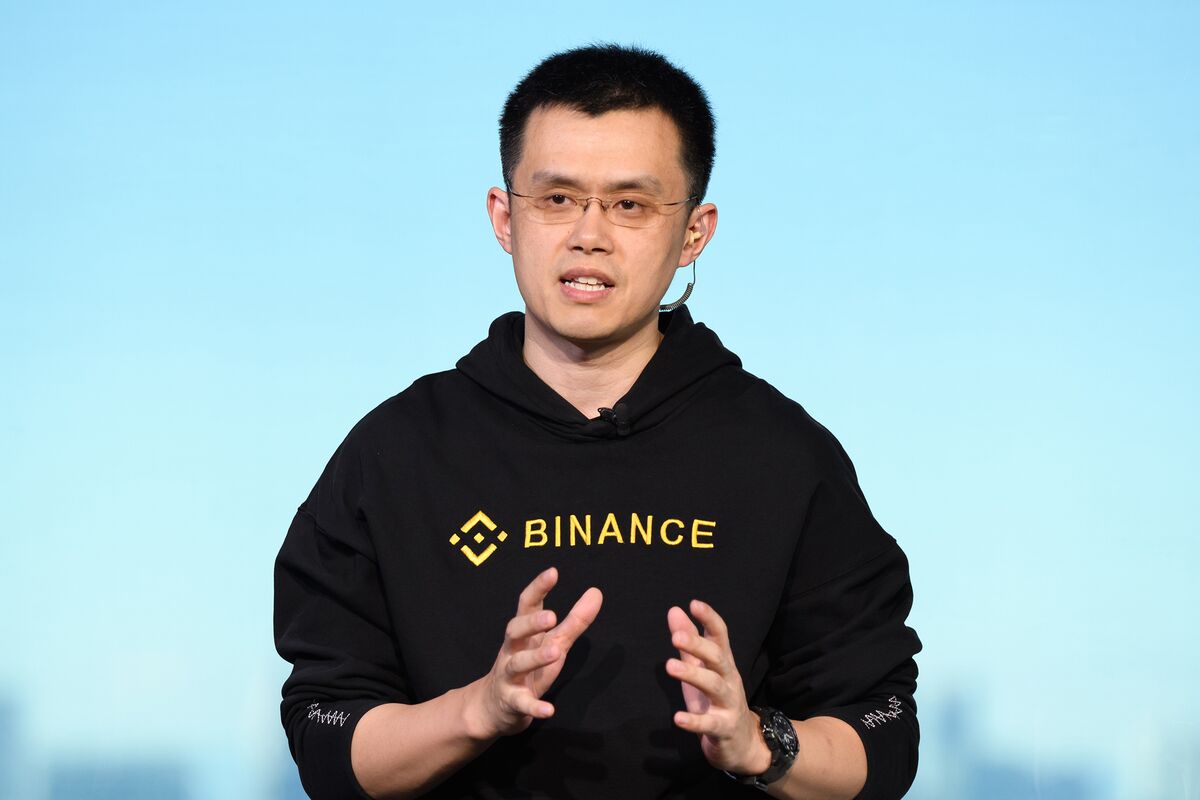

Do I need to pull out of Binance? I use them to stake Vet. I might just move to wallet...

bruhhhhhh

Doesn't seem to be anything special.The federal agencies haven't accused Binance of wrongdoing

Binance Faces Probe by U.S. Money-Laundering and Tax Sleuths

Binance Holdings Ltd. is under investigation by the Justice Department and Internal Revenue Service, ensnaring the world’s biggest cryptocurrency exchange in U.S. efforts to root out illicit activity that’s thrived in the red-hot but mostly unregulated market.www.bloomberg.com

Doesn't seem to be anything special.

Decentralized, Hackproof, Peer-2-Peer transactions. Solving the Byzantine General's Problem.

It is not even remotely sustainable way of transaction processing.Bitcoin= proof of concept that shows blockchain works extremely well. The biggest flaw is that it is not sustainable because the supply is limited.

No, it is not, as stock market stuff has non-zero "end user" value.it is equivalent to the day traders on the stock market.

You don't seem to understand that no one can control BTC. Well they can, but the moment they do, its value literally goes to zero. Who is going to spend over half a billion dollars to take over something that will literally be worth zero after they succeed? Nobody, and especially not China.How long would it take Chineze government to faceroll the "decentralized" aspect of BT, if they wanted to? A week? A day?

It's not that different from stock exchanges.. market is always manipulated with news or other stuff that people shout .. in the end it's the steady hand that wins .I just woke up a bit ago. Saw a thread on Elon Musk needing to STFU. I decided to check my ETH position.

And... WTF happened over night!?

Hahahaa Yeah I know. If BTC flies or crashes, the rest will follow.

I'm not going to cry over this. All the money in there is years old, can afford to lose it, and I'm holding, but still...

If people really did this all because of one mans silly tweet behavior... SMH.

Which user in this thread has bought crypto coins for reasons other than selling them for more?

You don't seem to grasp what the tech is about. Try to search for "51% attack".You don't seem to understand that no one can control BTC.

Could you elaborate about your plans, as I still read it as "bought them... to sell for more" but I might be missing something.Uhh, Hi, me.

No one in this thread would dare say that to me. I know exactly what a 51% attack is. That is one of the most basic concepts of crypto. And that is exactly why taking over the network would make it worthless, because no one would be willing to use it anymore. Either that, or they fork it, leaving the attackers with their own useless chain, like happened with Ethereum.You don't seem to grasp what the tech is about. Try to search for "51% attack".

You don't seem to grasp what the tech is about. Try to search for "51% attack".

Could you elaborate about your plans, as I still read it as "bought them... to sell for more" but I might be missing something.

What is that "other" reason.

No one in this thread would dare say that to me. I know exactly what a 51% attack is. That is one of the most basic concepts of crypto. And that is exactly why taking over the network would make it worthless, because no one would be willing to use it anymore. Either that, or they fork it, leaving the attackers with their own useless chain, like happened with Ethereum.

Secure, hackproof is your normal bank transfer or, if you feel like, paypal (and the likes). And those guys do not waste energy on useless bazinga either.

I guess we misaligned on what "taking control" means.why taking over the network would make it worthless

In other words, you assume that chances of crypto repeating known crashes in 15 years from now (at this point, 10% of US population seems to have been involved in "investing" into crypto) are smaller than chances of US dollar losing significant part of its value.Then I will use my BTC in my retirement.

That was not the point.It also has 12 year track record of that NOT happening

I guess we misaligned on what "taking control" means.

"Bit it would render bitcoin useless" is a cute lens to see it through, chuckle.

In other words, you assume that chances of crypto repeating known crashes in 15 years from now (at this point, 10% of US population seems to have been involved in "investing" into crypto) are smaller than chances of US dollar losing significant part of its value.

That was not the point.

Of all things vs usual bank transfer/paypal, BTC loses miserably at all, but one: being "dezentralized" as in (perhaps it's me misreading it, then correct me please) "governments cannot act against it". There is exactly zero doubt that China alone could wipe the floor with it, if they wanted to.

Someone could also spend a bunch of money to take out a bunch of traditional payment methods. Would people still trust Visa or PayPal if they were compromised, and a bunch of people lost a bunch of money because of no fault of their own?I guess we misaligned on what "taking control" means.

"Bit it would render bitcoin useless" is a cute lens to see it through, chuckle.

It doesn't lose in security. It doesn't lose in immutability. It doesn't lose in store of wealth. It doesn't lose in accessibility. It doesn't lose in international transfer time.Of all things vs usual bank transfer/paypal, BTC loses miserably at all, but one: being "dezentralized" as in (perhaps it's me misreading it, then correct me please) "governments cannot act against it". There is exactly zero doubt that China alone could wipe the floor with it, if they wanted to.

bruhhhhhh

These are all golden. Elon Musk is being roasted lol.

Not that it matters though... I mean, in reality... Anyone that knows anything about how Bitcoin works knows that whether people bought a couple of Tesla cars with Bitcoin or not, that has literally zero influence on Bitcoin's power consumption. There is only one thing that influences that, and that is the amount of miners. So everyone that is losing their minds right now simply never understood Bitcoin or crypto.

This is so wrong it hurts.BTC is faster than a Bank and Cheaper than a Bank.

Western economies are made so that inflaction is non-zero, not to have "people kept money under their pillows" situation.It is guaranteed that the Dollar will lose it's value.

Paypal is just a bank.Someone could also spend a bunch of money to take out a bunch of traditional payment methods. Would people still trust Visa or PayPal if they were compromised, and a bunch of people lost a bunch of money because of no fault of their own?

Bank, paypal (still a bank), credit card transactions are compromised on daily bases.Would people still trust Visa or PayPal if they were compromised, and a bunch of people lost a bunch of money because of no fault of their own?

This is nearly outrageous.It doesn't lose in security. It doesn't lose in immutability. It doesn't lose in store of wealth. It doesn't lose in accessibility. It doesn't lose in international transfer time.

Chinese companies already control 74% of hash power at this point, so there will be no power fluke.llien

llien for China to take the Bitcoin network, they would have to do a 51% attack, and considering that all of the validatiors together consume more energy than small countries, China could potentially lose tens of billions of dollars worth of energy (a real loss which they could not recoup printing money) before everybody realizes there is a bad actor and agrees to fork the chain.

Been in crypto for more than half a decade and I'm quite certain ETH is going to $10K this run (within 12-18 months)

Oh so they can't just freeze your account. Got it.Paypal is just a bank.

There are gazillion of TIGHT regulations managing banks.

The thought that just because a bank belongs to someone, they have some control over what happens to your money, is, well, misinformed.

And although exchanges have been compromised, Bitcoin has never been compromised.Bank, paypal (still a bank), credit card transactions are compromised on daily bases.

So is entire online shopping business

The main thing that crypto tackles is that it makes trust obsolete.This is nearly outrageous.

I happen to not trust "dezentralized" servers handling crypto bazinga, certainly not more than I trust European Central Bank.

Immutability/wealth when referring to something that has already happened to lose half of its value overnight, yeah, cool story.

Credit cards and bank accounts are certainly more accessible (and is accepted much more widely) than any crypto, my grandma would not know how to do crypto. Heck, nor would my spouse.

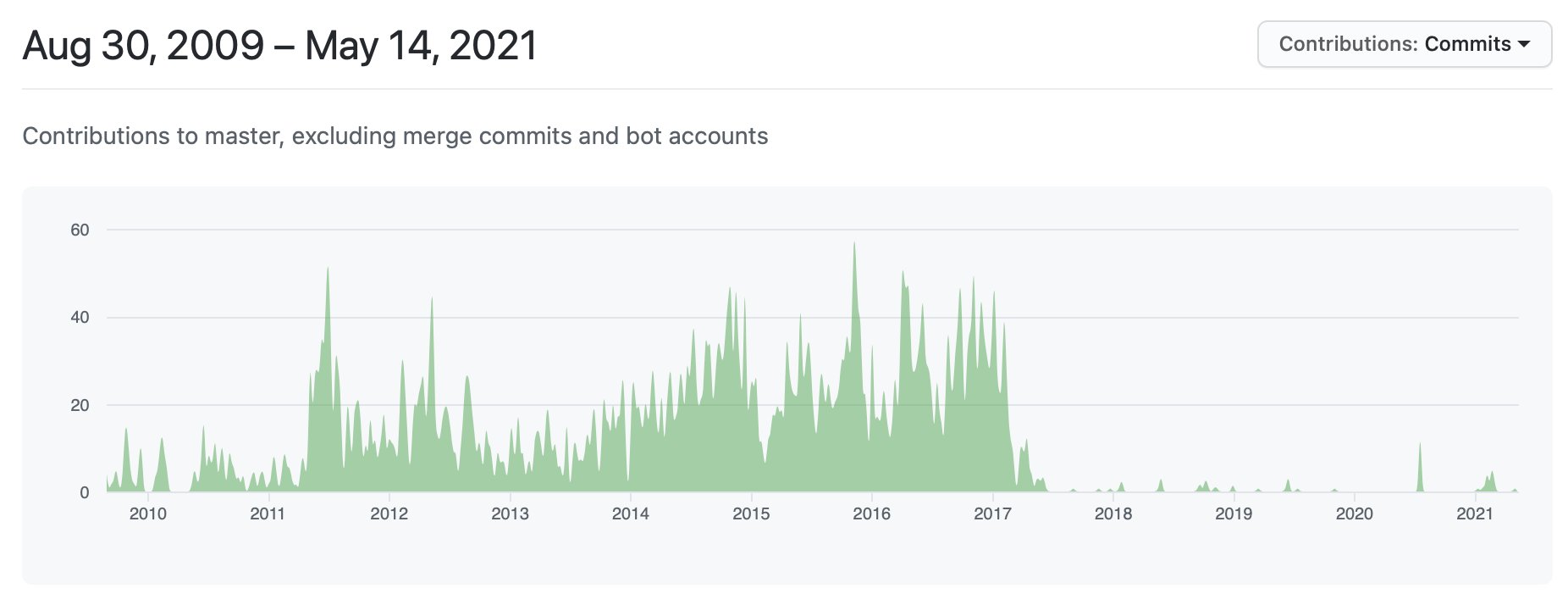

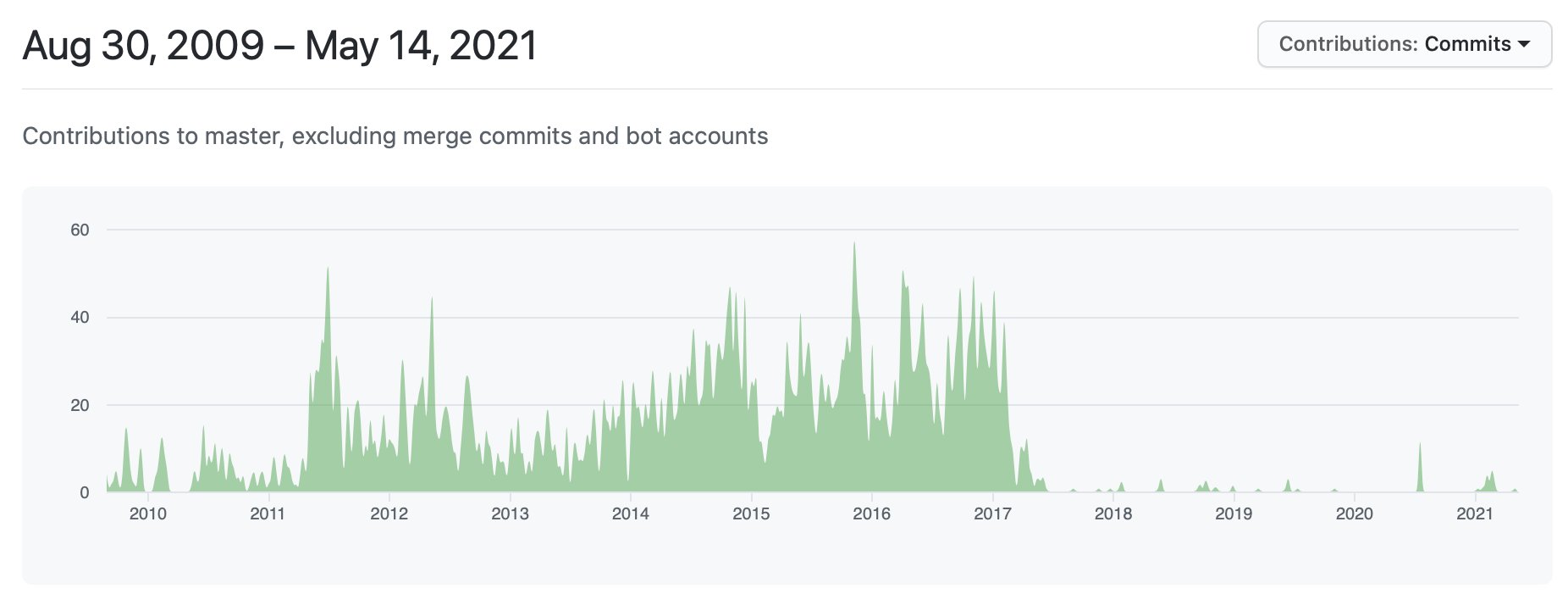

They probably don't even have the repository anymoreWhat devs is he even talking about. Shit been abandoned for so long.

Although that is indeed what it looks like, since the price of DOGE is expressed in US dollars, we have to compare the inflation of both to get a good idea of what should happen with its price.It's going to collapse under it's own weight. DOGE mining is 10,000 coins a minute with no supply cap. To keep that value up long term would be insane.

Damnit, you make my brain hurt.Although that is indeed what it looks like, since the price of DOGE is expressed in US dollars, we have to compare the inflation of both to get a good idea of what should happen with its price.

Money Supply M2 in the United States increased to 19896.20 USD Billion in March from 19669.80 USD Billion in February of 2021.

That is 226 billion in one month. The money supply M1 is even worse, at 271 billion.

10k per minute with doge translates to around 432 million additional coins per month.

Obviously that's not the whole picture, because there are a lot more USD in existence than Doge, so you have to look at it percentage-wise as well.

Dogecoin yearly inflation at this point is 4%, assuming a circulating supply of 129.6 billion.

The USD annual inflation rate is at around 4.2% right now, supposedly. It was 2.3% in 2019. If you calculate it through the extra amount of money printed vs the supply, the number is higher, but we'll ignore that for now.

Although both Doge and the dollar are inflationary, the US dollar is inflating faster as of now, and it's only going to get worse. The supply rate of Dogecoin is constant, which means that percentage-wise, its inflation rate will actually slowly decrease over time. As an example, if the circulating supply of Dogecoin reaches 200 billion, the coin supply still being 10k coins per minute would put its inflation rate at 2.6% rather than 4%. It will still be inflationary, but relatively speaking will inflate more slowly. That is in contrast to the dollar, of which its inflation rate is pretty much guaranteed to keep increasing at this point.

It means you're better off owning Doge than owning USD. Theoretically speaking, anyway.

This is the post I have been looking for. Thanks for explaining it.Although that is indeed what it looks like, since the price of DOGE is expressed in US dollars, we have to compare the inflation of both to get a good idea of what should happen with its price.

Money Supply M2 in the United States increased to 19896.20 USD Billion in March from 19669.80 USD Billion in February of 2021.

That is 226 billion in one month. The money supply M1 is even worse, at 271 billion.

10k per minute with doge translates to around 432 million additional coins per month.

Obviously that's not the whole picture, because there are a lot more USD in existence than Doge, so you have to look at it percentage-wise as well.

Dogecoin yearly inflation at this point is 4%, assuming a circulating supply of 129.6 billion.

The USD annual inflation rate is at around 4.2% right now, supposedly. It was 2.3% in 2019. If you calculate it through the extra amount of money printed vs the supply, the number is higher, but we'll ignore that for now.

Although both Doge and the dollar are inflationary, the US dollar is inflating faster as of now, and it's only going to get worse. The supply rate of Dogecoin is constant, which means that percentage-wise, its inflation rate will actually slowly decrease over time. As an example, if the circulating supply of Dogecoin reaches 200 billion, the coin supply still being 10k coins per minute would put its inflation rate at 2.6% rather than 4%. It will still be inflationary, but relatively speaking will inflate more slowly. That is in contrast to the dollar, of which its inflation rate is pretty much guaranteed to keep increasing at this point.

It means you're better off owning Doge than owning USD. Theoretically speaking, anyway.

Not in EU, at least.Oh so they can't just freeze your account. Got it.

The point is that there is zero doubt China could wipe the floor with it, rendering "but it's decentralized bazinga that costs money" moot.And although exchanges have been compromised, Bitcoin has never been compromised.

As if trust was an issue to begin with.The main thing that crypto tackles is that it makes trust obsolete.

The stock market also had a crash March last year.

It is not even remotely sustainable way of transaction processing.

It's capacity makes it fit only for, wait for it, finance bubble like transactions, perhaps money laundering.

Secure, hackproof is your normal bank transfer or, if you feel like, paypal (and the likes). And those guys do not waste energy on useless bazinga either.

How long would it take Chineze government to faceroll the "decentralized" aspect of BT, if they wanted to? A week? A day?

Which user in this thread has bought crypto coins for reasons other than selling them for more?

No, it is not, as stock market stuff has non-zero "end user" value.

I see you listened to Bill Maher.Speculations using something INHERENTLY VALUABLE and speculations using CumRocket crypto-bazinga which are INHERENTLY NOTHING are two very different kinds of speculations.

I have a bank account in a European country. I got a letter a few months ago from that bank that anyone living outside this country needs to withdraw their money and close their account within 6 months, or their funds will be frozen and made inaccessible. So...Not in EU, at least.

And, I think, there are even official ways to "migrate' your bank account, without changing your account number, the way it is possible with phone numbers, I haven't checked that though.

I've addressed this twice already. If you're gonna keep repeating things that were already addressed, there's no point in carrying this discussion forward.The point is that there is zero doubt China could wipe the floor with it, rendering "but it's decentralized bazinga that costs money" moot.

When the bank runs start, and then they shut you out from withdrawing your own money, don't say you weren't warned.As if trust was an issue to begin with.

Can't expect dinosaurs to understand cyberspace.Bitcoin and other cryptocurrencies have been identified as speculative bubbles by several laureates of the Nobel Memorial Prize in Economic Sciences, central bankers, and investors.

Then why is Bitcoin closely following its stock to flow model?An economic bubble or asset bubble (sometimes also referred to as a speculative bubble, a market bubble, a price bubble, a financial bubble, a speculative mania, or a balloon) is a situation in which asset prices appear to be based on implausible or inconsistent views about the future. It could also be described as trade in an asset at a price or price range that strongly exceeds the asset's intrinsic value.

Why? Did he make up CumRocket coin?I see you listened to Bill Maher.

So, you fell under global EU regulation and bank had to abide, kindly asking you to withdraw you funds over half a year period, how does that align with "someone could kick you out just for fun"?I have a bank account in a European country. I got a letter a few months ago from that bank that anyone living outside this country needs to withdraw their money and close their account within 6 months, or their funds will be frozen and made inaccessible. So...

No, you have not.I've addressed this twice already.

Jesus Christ, Ascend, are you for real?When the bank runs start, and then they shut you out from withdrawing your own money

Just to be more specific here, you have referred to: several Nobel laureates in economics, bankers, investors as "dinosaurs", did I get you right?Can't expect dinosaurs to understand cyberspace.

Dude, this is one hell of a weird statement, when we have this thread:Then why is Bitcoin closely following its stock to flow model?

Doesn't matter if he made it up or not. You never would have encountered that coin by yourself, considering your level of knowledge. It shows where you get your information from, and Bill Maher, like many other old farts, simply don't get the technology and talk about stuff they don't understand. For one, he mentioned crypto making up money out of thin air and slamming it for it since you can't do that, while banks do and have been doing that exact thing for decades.Why? Did he make up CumRocket coin?

Oh, wait, he has not:

CumRocket price today, CUMMIES to USD live price, marketcap and chart | CoinMarketCap

The live CumRocket price today is $0.001823 USD with a 24-hour trading volume of $141,267.14 USD. We update our CUMMIES to USD price in real-time.coinmarketcap.com

Actually I did address your "China can shut down Bitcoin" argument. Multiple witnesses here can attest to that, that your refuse to acknowledge it because it's inconvenient is your problem.No, you have not.

Where did I say that they can kick you out just for fun? I said they can freeze your account. In crypto, nobody can freeze your account.So, you fell under global EU regulation and bank had to abide, kindly asking you to withdraw you funds over half a year period, how does that align with "someone could kick you out just for fun"?

Remember 2008? That was a teaser. But... Believe whatever you want to. Again, don't say I didn't warn you.Jesus Christ, Ascend, are you for real?

Yes. I did. Because they are knowledgeable in the old systems. The old way of doing things. Just like you're not going to ask a horseman how to drive a car, you don't ask people that are successful in an outdated and unfair financial system how crypto works.Just to be more specific here, you have referred to: several Nobel laureates in economics, bankers, investors as "dinosaurs", did I get you right?

The recent sell-off has zero bearings on how close Bitcoin is following its stock to flow model. But I wouldn't expect you to understand that.Dude, this is one hell of a weird statement, when we have this thread:

Cardano has broken 2 bucks. Worth keeping an eye on.Man eth is struggling to get that close above $4000 (candlestick I mean)

"No link between inflation and Bitcoin". DXY and BTC price are directly inversely related. That is data that cannot be ignored.How would you counter these articles?

‘Black Swan’ author calls bitcoin a 'gimmick' and a 'game,' says it resembles a Ponzi scheme

"Black Swan" author Nassim Taleb told CNBC there is "absolutely no reason" bitcoin is linked to economic conditions, adding it's also a bad currency.www.cnbc.com

And this one, which is quite impressive IMO:

There are 6000+ cryptocoins. I wouldn't have encountered any of those.Doesn't matter if he made it up or not. You never would have encountered that coin by yourself

Sorry but "then it would make bitcoin useless" is adorable way to think about things, but no, that doesn't address the fact that China can wipe the floor with BTC if it wants.Actually I did address your "China can shut down Bitcoin" argument

I haven't heard of a single person in Germany who had their account frozen.I said they can freeze your account. In crypto, nobody can freeze your account.

I believe facts, thank you very much.Believe whatever you want to.

Good to have people more in line with"modern systems" that those dinosaur Nobel Laureate and actual bankers.Yes. I did. Because they are knowledgeable in the old systems.

That is mantra, not reality, you are talking about something that has been recorded to lose 65% of its valueBitcoin is following its stock to flow model.

Thanks for confirming you don't know how to navigate the space.There are 6000+ cryptocoins. I wouldn't have encountered any of those.

That doesn't change the fact that CumRocket coin is:

a) real

b) actually traded

It does. Because you would have to spend a bunch of money to then lose it all.Sorry but "then it would make bitcoin useless" is adorable way to think about things, but no, that doesn't address the fact that China can wipe the floor with BTC if it wants.

Yes they can. A simple one. Move to a sanctioned country like Iran, see what happens with your bank account in Germany.I haven't heard of a single person in Germany who had their account frozen.

You make it sound as if banks can do such things at will - no they can't.

A 51% is not irreversible, which is what you fail (or are unwilling) to understand. Furthermore, it's not as if al cryptos work the same way either. Some of them simply cannot suffer a 51% attack. Go try a 51% attack on Solana.What could happen with crypto, though, is them suddenly losing all of its value and 51% attack is just one of the ways to do it.

You think you do. That is the sad part. Tell me something. How long have you investigated crypto?I believe facts, thank you very much.

Considering how much "science" applauds Darwin instead of Jean Baptiste Lamarck or Alfred Russel Wallace, or Thomas Edison instead of Nikola Tesla, tells you everything regarding scientific institutions. Don't conflate science with scientism, and definitely don't conflate science with politics.Good to have people more in line with"modern systems" that those dinosaur Nobel Laureate and actual bankers.

As for Nobel meaning nothing: Nobel in bazingas like "peace" means nothing, it doesn't apply to economics, or physics, or chemistry, or biology, or... I guess you got the pattern: at actual science.

Rather than words, I'll let a historical chart do the talking;That is mantra, not reality, you are talking about something that has been recorded to lose 65% of its value

Bitcoin dropped 8% because Elon the Roflcopter said something.

Venezuelan Bolivar. The route the US dollar will soon follow.Name a single currency on this planet, that is so laughably volatile.

It is comparable in its volatility, not in the direction of its volatility. Two very different things.So now we're comparing Bitcoin to Bolivar? I'm not really sure that's a good thing..