That is the question right. I am wondering whether Crypto works in cycles like the stock market (including supercycles) but on a much quicker timeline since the digitization has sped up our lives so much. In the 10 years that we have seen crypto (and mostly based on Bitcoin which we could use as a index basically to mirror the entire crypto world somewhat similarly to the SP500)

Everyone has seen this picture, but it is mostly interpreted in the way that confirms the bias of the interpreter.

Obviously the big question is whether we are at "Bull Trad - Return to normal" or at "First Sell of - Bear trap".

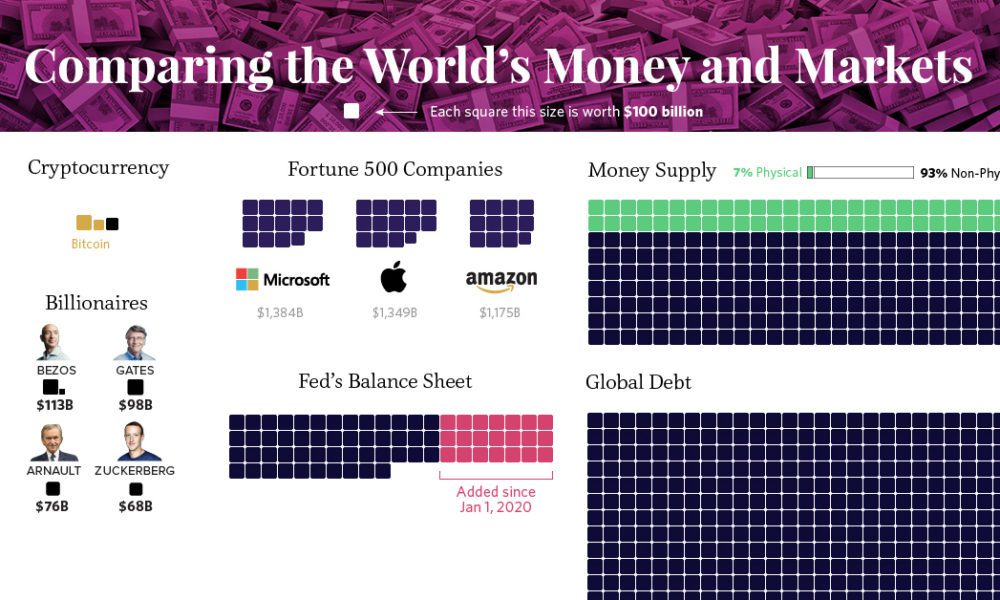

Or maybe this is complete BS and the rules don't apply to the new age. Very good possibility given how much money has been printed and seeing a new challenger that is limited in supply.

If I had to purely guess out of the blue I would say the current and past spikes where done by whales who use the pumps to get attention and have other people join and accumulate and then to slowly and gradually dump a portion of it only to buy in again later and repeat the process of taking money from the people that buy high sell low.

I could be very wrong and crypto is the new age where things get completely out of hand and it overthrows Fiat money and somehow an infrastructure is created that allows it to thrive as a decentralized currency free of the money printing fiat madness.

That is the point where I am at and why I am not really invested in crypto, because I have no idea where this goes. There is close to 2 trillion dollar in crypto. It is mostly a speculative asset now, but the underlying technology of it is a lot bigger than most people realize. I am certain that the idea, conviction, push and technology of crypto will stay and improve, but where the price of specific coins is going to be in the future I dare not say, because that would be guessing as worthful as rollig a dice.

www.coindesk.com