You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Puerto Rico will quite probably default on their $72b debt

- Thread starter Relix

- Start date

- Status

- Not open for further replies.

BattleMonkey

Member

Actually this was in a report jsut release...

Living off the system (welfare, healthcare, housing) a person basically earns nearly $1,800. A full time, minimum wage worker that has to pay taxes and the like will earn around $1,200. Its no wonder people go the easy way.

Yup this has been a problem for a long time and nothing was done. Businesses were forced to offer higher wages for minimum wage level work, which hurt many small businesses, which is much more common in Puerto Rico than in the US.

While kids getting out of high school saw no reason to work, they just went and got welfare.

M3Freak

Banned

Nah, Puerto Rico just piled on its debt for decades without a worry. Now the current generation has to pay the price. All due to political reasons. Now its a sinking ship.

When governments borrow from private banks at compounded market interest rates to run countries/municipalities, the end game is eventually insolvency.

Poorer countries will hit the wall first. Rich countries will take longer to run off the cliff.

mingoguaya

Member

PR-gaf, anyone thinking about leaving to the states? I have the opportunity to get a transfer with my current job and I'm really considering getting the hell outta here ( I am a born Puertorrican btw).

PR-gaf, anyone thinking about leaving to the states? I have the opportunity to get a transfer with my current job and I'm really considering getting the hell outta here ( I am a born Puertorrican btw).

I handed my resignation letter like 15 minutes ago. I am CTO of a Credit Union here in PR. Just requested to train a new member for a month and then I am gone. Moving to USA. I have a software development company here as well but I'll manage it from whenever I end up in.

davepoobond

you can't put a price on sparks

What is preventing the US from needing to default, given its many times larger debt? I know nothing about anything, economy-wise. Is it that the US could still potentially rebound from it's debt?

It's easy to forgive your debt when the person giving you money is you.

CountAntonius

Member

mingoguaya

Member

Good luck to you in all your future endeavors. I can't see myself staying here for more than a year and I'm sorry for my family that won't leave no matter what but come next summer I'm out. Nothing will save this island and my kid doesn't deserve to grow up in such a dysfunctional country.I handed my resignation letter like 15 minutes ago. I am CTO of a Credit Union here in PR. Just requested to train a new member for a month and then I am gone. Moving to USA. I have a software development company here as well but I'll manage it from whenever I end up in.

Coriolanus

Banned

Jacobin put up an article on Puerto Rico's debt a coupla weeks ago. Isn't exactly a simple problem.

It continues and goes into far greater detail.

And yes, Puerto Rico was, in fact, the receiver of a federal program called Operation Bootstrap.

After the US seized the island from Spain at the turn of the nineteenth century, it began destroying Puerto Ricos agricultural economy an informal mix of subsistence farmers and small landowners by allowing US corporations to buy up most of the arable land. By the 1940s, with a militant nationalist movement pushing for independence, the US drew up a plan called Operation Bootstrap, replacing the agricultural economy with one powered by light manufacturing, tourism, and services.

Designed to enrich US corporations, the economic approach momentarily produced a small middleclass, and throughout the Cold War the US showcased Puerto Rico as an anticommunist alternative to Cuba. Yet because of its colonial status, Puerto Rico was never allowed to negotiate bilateral trade agreements and has had to adhere to fiscal policy directed by the US. External control and extraction of profits stunted the countrys productive base, leading to an economic crisis that the pro-independence left had long predicted.

While Puerto Ricos problems are often portrayed as having begun with the 2006 recession, its pattern of borrowing to keep the economy afloat began over thirty years ago. In the 1980s, as the mainland recession dragged down Puerto Ricos economy, the government began taking out loans from US banks to cover deficits.

This was compounded by the ten-year phaseout, starting in 1996, of the notorious Section 936 of the IRS tax code, which was designed to stimulate job creation but instead enabled mass cash outflow from the island. (Even today there are stories of bags of cash being driven from the islands overflow of Walmarts directly to the Luis Muñoz Marín Airport.)

It continues and goes into far greater detail.

And yes, Puerto Rico was, in fact, the receiver of a federal program called Operation Bootstrap.

uncredited male

Member

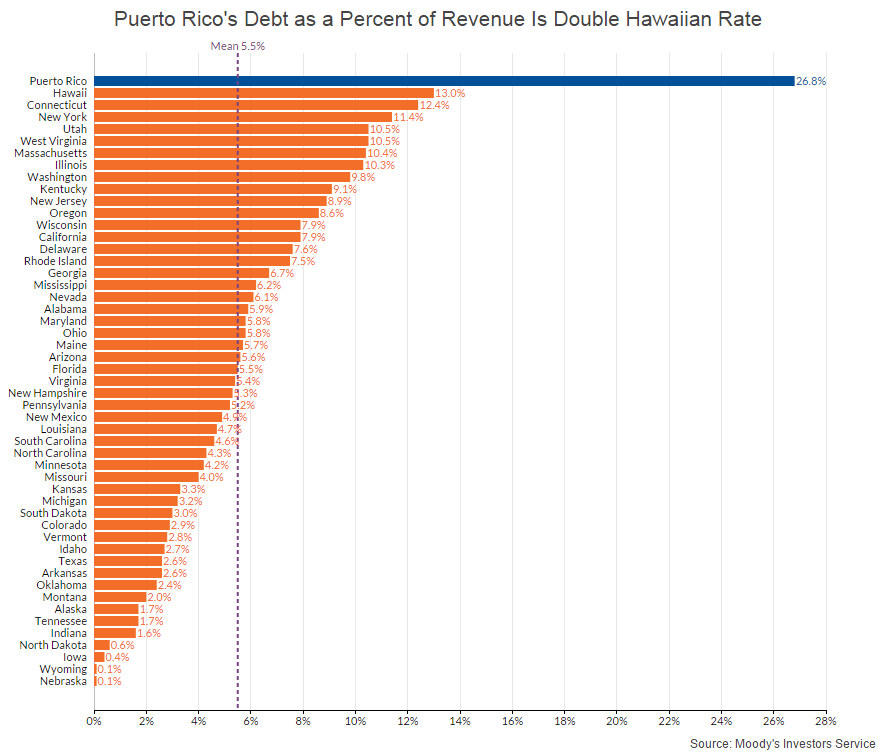

One of the options being tossed around is allowing them to file bankruptcy even though they are not a state. Of course, one of the reasons they were able to acquire so much debt is that their bonds avoid many US taxes (as they are not a state) and are quite desirable.

CrashSimonFaye

Banned

Why dont they just print more money?

DragonSworne

Banned

The concept of "loans" to a government is stupid. Stop treating governments like households.

ok ZimbabweWhy dont they just print more money?

SpiralZilla

Member

As someone who was born in Puerto Rico and still has family over there, this strikes pretty deep.

http://www.cnbc.com/id/102789589

Seems like PR is paying the bills.

Debt-riddled Puerto Rico paid all of its $1.9 billion in obligations due on Wednesday, sources told CNBC.

With the payments, the island, for the moment, avoided sinking further into financial crisis. Puerto Rico Gov. Alejandro Garcia Padilla recently called its roughly $73 billion in debt "not payable," fueling concerns among investors and bond insurers.

The National Public Finance Guarantee Corporationan indirect subsidiary of MBIAseparately confirmed Wednesday that the island's struggling power utility, Prepa, and other Puerto Rico-related institutions made their debt-service payments.

"As a result, there were no claims on any of National's insurance policies," it said in a statement.

Seems like PR is paying the bills.

speculawyer

Member

"zero everyone"

how do you think this would work lol

I've got a couple different plans . . . .

There is this one . . .

And then there is this one:

Me too. I am looking at Texas seriously right now, perhaps even California although the cost of living scares the shit out of me. I may make a move before this year is over though.

Better now than later that's for damn sure. Oh and I suggest not moving to Cali because of the drought. Move to a state that actually has water.

MidgarBlowedUp

Member

It's easy to forgive your debt when the person giving you money is you.

very well put and absolutely true.

AcademicSaucer

Member

They should become a state or seek indepence, being a de-facto colony is not helping them .

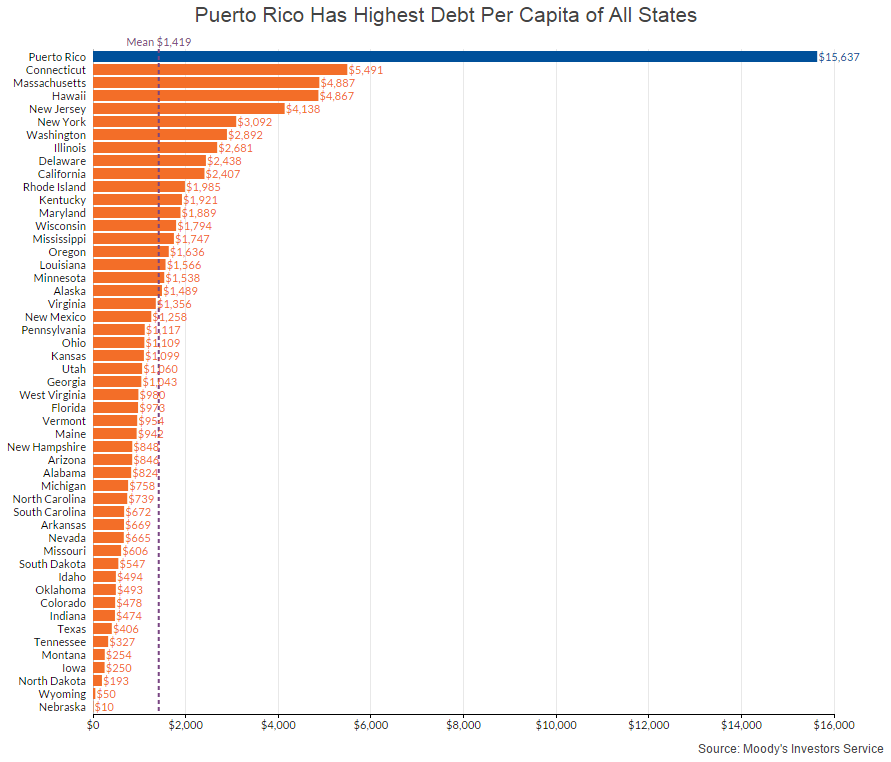

That is a pretty crazy amount of debt.

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

Most young educated people probably leave PR, leaving the country with the bill but little revenue.

- Status

- Not open for further replies.