IbizaPocholo

NeoGAFs Kent Brockman

Intel anuncia miles de despidos y cancela fábricas en Europa

La compañía pone freno a su expansión industrial y avisa de que si su proceso de nueva generación fracasa, se acerca al desastre.

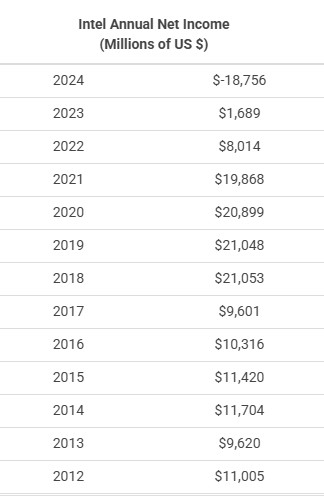

Intel has been unable to clear the storm clouds gathering over its future. The company has released its financial report for the second quarter, and whereas in April it was already "surprising" that it spoke of a reorganization without mentioning layoffs, the latest figures paint a situation that verges on the dramatic.

If we look purely at the financials, year‑over‑year Intel's revenues have remained virtually flat, with a gross cash balance of $12.9 billion during Q2 2025, but its losses have risen by 80%, increasing from $1.6 billion to $2.9 billion.

On the industrial front, the company has confirmed the cancellation of its plans to build a megafactory for processors in Magdeburg, Germany, as well as an assembly and testing plant in Poland. It will also cease operations at its facilities in Costa Rica—where it operated another assembly and testing plant—although it will retain part of its workforce there for other activities.

In total, Intel will lay off around 24,000 workers worldwide. This will reduce its global headcount to approximately 75,000 people, down from 108,900 employees at the end of 2024.

Lip‑Bu Tan, Intel's new CEO, is crystal clear about what he expects from the company in the short term: it must either take off or crash. According to Tan, if Intel fails to secure an external customer for its new 14A process—necessary to fund its foundries—it may pause or even cancel internal development of next‑generation nodes. At that point, the effects would be catastrophic.

While continuing to sell its services as a contract semiconductor manufacturer—competing with Samsung and TSMC—Intel plans to double down on peak performance. The company has announced that it will restore SMT (Hyper‑Threading) for its server‑ and data‑center‑oriented processors, making them more versatile and efficient.

It is not yet entirely clear whether Intel also intends to incorporate this technology into its consumer processor lineup, but we know that the new SMT‑enabled chips will arrive with the Coral Rapids generation, the successor to Diamond Rapids. With this change, Intel hopes to stem its bleeding in the server market, where its share has fallen to 55%.