While a lot of investors were hitting the panic button Monday, a Japanese day trader who’d made a big bet against the market timed the bottom almost perfectly and narrated a play-by-play of the trade to his 40,000 Twitter followers. He claims to have walked away with $34 million.

As financial markets got crazy this week, many people turned cautious. Some were paralyzed. Not the 36-year-old day trader known by the Internet handle CIS.

“I do my best work when other people are panicking,” he said in an interview Tuesday, about an hour after winding up the biggest trade of a long career betting on stocks. He asked that his real name not be used because he’s worried about robbery or extortion. To support his claims, he shared online brokerage statements showing his trades second by second.

CIS had been shorting futures on the Nikkei 225 Stock Average since mid-August, wagering it would fall. By the market close on Monday, a paper profit of $13 million was staring him in the face. He kept building the position. When he cashed out late that night, a collapse in New York had caused his profit to double.

Instead of celebrating, he kept trading. He started betting the market had bottomed. When he finally took his winnings off the table on Tuesday, he tweeted, “That’s the end of my epic rebound trade.” His profit, he said, had almost tripled.

“It was a perfect trade,” said Naoki Murakami, who follows CIS on Twitter and whose markets blog has made him a minor celebrity in his own right.

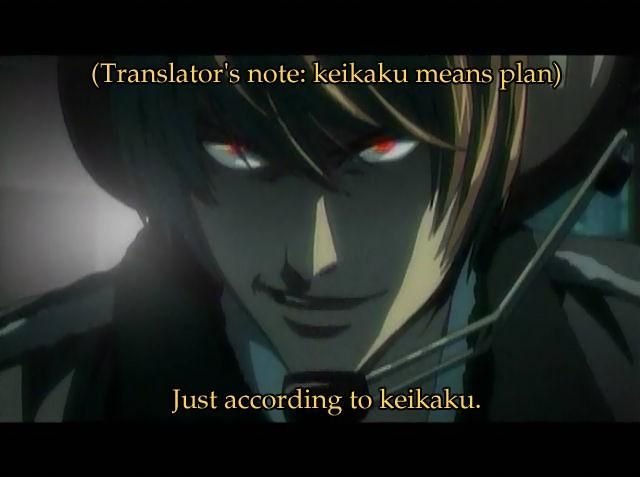

Modern stock market Kira? Some comments in the Asia crash thread were right: people made off with money earlier this week.