I know man. It never does stop. But you can change.Fuck off with this crap. None of the things you mentioned are funded by what is essentially a death tax.

the stupidity never stops

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Samsung Heirs pay 10 billion in inheritance tax. Over half of fortune.

- Thread starter AJUMP23

- Start date

- Status

- Not open for further replies.

Punished Miku

Gaslighter Pro: 16.7 Fireflops

Your view of taxation is too simplistic. Without an entire governmental structure in place to enforce patents, international trade deals, infrastructure, health care, education, and all other aspects of societal function - you wouldn't really be able to accumulate more than you can farm and hold with your own two hands, and then defend from looters. The taxation isn't theft. We started in primitive farming collectives, and the taxation came first to even build what we have. Then wealth accumulation was a result of what was built from taxation.It's coercion but for simplification, theft is a perfectly fine terminology.

No one can accumulate $20 billion personally. It's a fiction. It's allowed to happen only through government support. Multiple governments across the planet enforce patents for Samsung.

Roxkis_ii

Banned

Have you ever concidered working for the Xbox division of Microsoft?I want to be terrible or mediocre and fail my way upwards, but my boss is too sharp and won't let me work that way :/

On topic: I don't think this inheritance tax is a big deal. One billion is likely enough to keep a family good for generations even with inheritance tax. Ten billion k-bucks should keep that Samsung Son good for a while, plus it not like Samsung is not going to keep making money, he'll likely make it back if he wants.

You firstI know man. It never does stop. But you can change.

You can try to make arguments that aren't retarded

You first

You can try to make arguments that aren't retarded

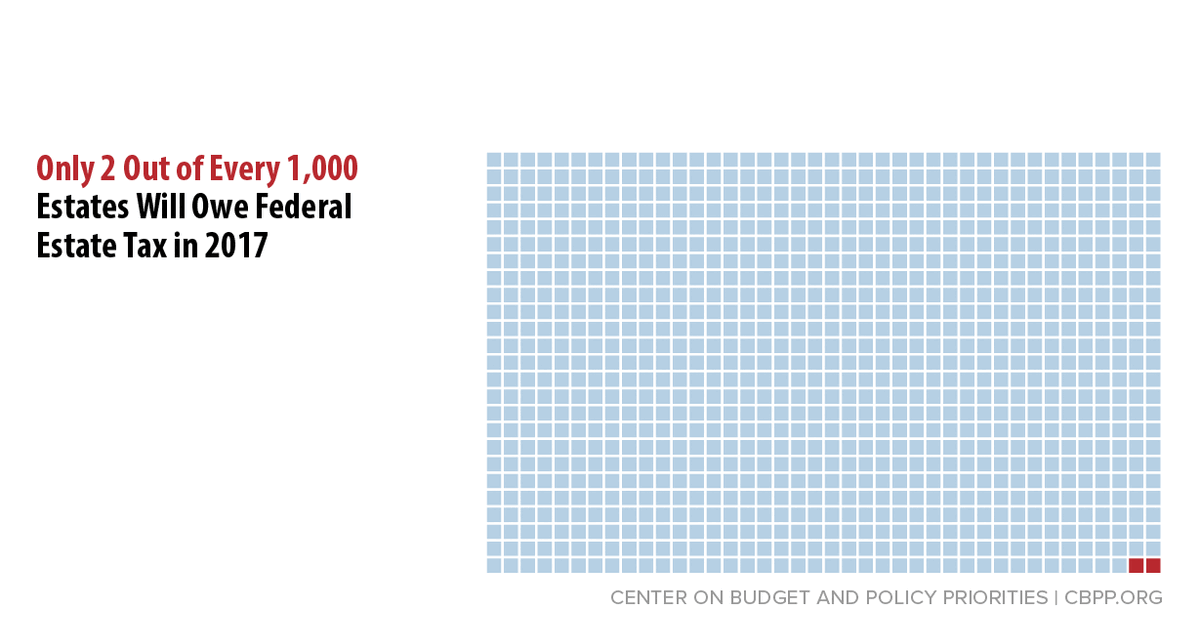

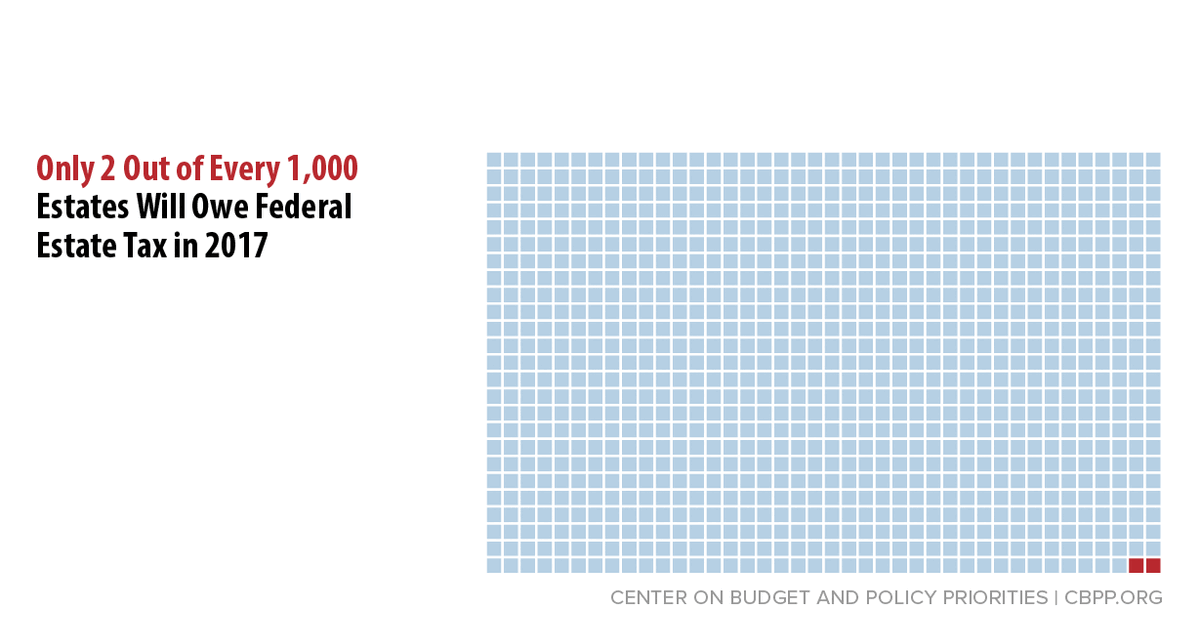

Ten Facts You Should Know About the Federal Estate Tax | Center on Budget and Policy Priorities

The federal estate tax is a tax on property (cash, real estate, stock, or other assets) transferred from deceased persons to their heirs. Only the wealthiest estates pay the tax because it is...

www.cbpp.org

You and your family are too poor to ever experience the estate tax. Just calm your tits.

Last edited:

It is strong property rights that allow people to amass wealth. You can easily do that without estate taxes.Your view of taxation is too simplistic. Without an entire governmental structure in place to enforce patents, international trade deals, infrastructure, health care, education, and all other aspects of societal function - you wouldn't really be able to accumulate more than you can farm and hold with your own two hands, and then defend from looters. The taxation isn't theft. We started in primitive farming collectives, and the taxation came first to even build what we have. Then wealth accumulation was a result of what was built from taxation.

No one can accumulate $20 billion personally. It's a fiction. It's allowed to happen only through government support. Multiple governments across the planet enforce patents for Samsung.

This idea that we must have specific taxes like estate tax, and make them high or else society won't exist or function is bullshit.

Last edited:

1. You don't know my family. Maybe you are poor, that doesn't mean I am.

Ten Facts You Should Know About the Federal Estate Tax | Center on Budget and Policy Priorities

The federal estate tax is a tax on property (cash, real estate, stock, or other assets) transferred from deceased persons to their heirs. Only the wealthiest estates pay the tax because it is...www.cbpp.org

You and your family are too poor to ever experience the estate tax. Just calm your tits.

2. That link doesn't prove anything. Your argument

Is still retardedThe rich don't pay their fair share when alive, so take it when they're dead.

Lol. I'll bet that you'll never reach meeting the estate tax and if I win you'll give me your estate when you die. And if I lose I'll give you my estate when I die. Want to make that bet or do you know I'm right.1. You don't know my family. Maybe you are poor, that doesn't mean I am.

2. That link doesn't prove anything. Your argument

Is still retarded

Punished Miku

Gaslighter Pro: 16.7 Fireflops

Property rights and patents enforced internationally, among dozens of governments. The fact is that wealth accumulation is increasing because of global enforcement. There's some debates to be had about it, but my main point is just that the taxation came first and built the ability to even accumulate that wealth in the first place. It's not as simple as calling it theft.It is strong property rights that allow people to amass wealth. You can easily do that without estate taxes.

This idea that we must have specific taxes like estate tax, and make them high or else society won't exist or function is bullshit.

AJUMP23

Parody of actual AJUMP23

The logical fallacy behind if you refuse the bet then I must be right..... This isn't middle school (it may actually be middle school) where you force people to agree with you through unreasonable expectations and then prover yourself correct. I don't even know what your points and argument is about because I didn't go back and read, I just think you should present your through in the best possible way and not try to force people to agree with you through strong arm tactics.Lol. I'll bet that you'll never reach meeting the estate tax and if I win you'll give me your estate when you die. And if I lose I'll give you my estate when I die. Want to make that bet or do you know I'm right.

Present you ideas.

My idea is that he won't even be bothered by the estate taxes because he's too poor to be bothered by them.The logical fallacy behind if you refuse the bet then I must be right..... This isn't middle school (it may actually be middle school) where you force people to agree with you through unreasonable expectations and then prover yourself correct. I don't even know what your points and argument is about because I didn't go back and read, I just think you should present your through in the best possible way and not try to force people to agree with you through strong arm tactics.

Present you ideas.

AJUMP23

Parody of actual AJUMP23

Just because the current law doesn't affect them personally doesn't mean that overall concept and idea doesn't set a precedent that may affect them in the future. If you look at the state of taxation and spending there is not enough money with the wealthy to cover the cost of all the programs (military and social) that the government has. While it may not affect me now there may come time when government determines it wants more and will start affecting you. The US didn't even have a permeant income tax until 1913 before all revenue was mainly generated from tariffs off of trade. Taxes are fundamentally a punishment, and if you want less of something tax it. If you want people to generate less wealth you can tax it out of existence.My idea is that he won't even be bothered by the estate taxes because he's too poor to be bothered by them.

What does fair share even mean. My version of a fair share would be everyone paying the exact amount as everyone else not this percentage of our pay or wealthThe rich don't pay their fair share when alive, so take it when they're dead.

we have going on.

llien

Banned

It is "fuck you, you fucking rich fucks" and I agree with the sentiment, given my commie background and all.What is the justification for *any* inheritance tax?

llien

Banned

Only <insert slur word> people disagree with you, enlightened one.Only economically ignorant and morally corrupt people think the inheritance tax is a good idea.

Inheritance tax - Wikipedia

- Germany: Erbschaftsteuer (Inheritance tax). Smaller bequests are exempt, i.e., €20,000–€500,000 depending on the family relation between the deceased and the beneficiary. Bequests larger than these values are taxed from 7% to 50%, depending on the family relationship between the deceased and the beneficiary and the size of the taxable amount [12]

Last edited:

Jeez these taxation = theft people are just insufferable. Maybe they should just have an "opt-out" option - i.e. you don't pay tax but you get no police protection, no fire department, can't drive on the roads, can't send your kids to school etc etc etc. Good luck to you I say!

In a lot of cases, comparing the services a government provides directly to a business is awkward. Think about stuff like policing or mental health care. There are perhaps all kinds of ways to cut corners and save money in the short run, but there will be consequences to this (both foreseeable and unforeseeable) that may end up costing more money in the end. I myself work in mental health care (assisted living), it's a private company but the funding comes from the government mostly, so I'm a government employee by proxy.

If you take an ultra-businesslike perspective and ask the question "what is the most efficient way to care for people who cannot take care of themselves" then you'll end up with questions about what quality of life you want to provide for these people? If you want it to be cheap and efficient we could just lock them all in a cage and hurl in some food every so often. If you want them to have at least a decent quality of life, you need to provide an environment which is stable, peaceful and organized. Psychiatric patients can cause chaos in any number of ways so you need a team of employees that cooperates well, can improvise and has a strong sense of internal solidarity. Having a very competitive, business-like mindset isn't actually very conducive in that situation. For example, if there's a lot of internal strife between employees, certain patients (like people with borderline personality disorder) will sense that and start fomenting these divisions. On the other hand, if collegial relationships are good, patients will also sense that and the atmosphere will be more relaxed and peaceful.

If someone from a business background would observe our work, they would probably think we spend too much time socializing with each other and with the patients. But actually that socializing is necessary in order to get a appropriately harmonious environment. Without it, more of our patients would fall back into psychosis and addiction, costing society more money in the end.

Suppose they abolished the income tax in your country but gave you an easy way to give what you would have given in taxes to the government. Would you pay it?

QSD

Member

Don't get me wrong, I don't enjoy paying taxes, I have the same selfish impulses the rest of humanity has. But in the end, there's just no way to run society without taxes, so yeah I would pay. Like i said, I'm a government employee by proxy, so I'd be unemployed before long if I didn't, and all of our clients would be out on the streets, likely to die there.Suppose they abolished the income tax in your country but gave you an easy way to give what you would have given in taxes to the government. Would you pay it?

StreetsofBeige

Member

I'm for universal healthcare. I never even get sick or have been in a hospital for ages. But things like healthcare, education, fire and police are greater society good, and someone alive paying taxes covers each other in case they need help due to an accident as they go about every day life.Jeez these taxation = theft people are just insufferable. Maybe they should just have an "opt-out" option - i.e. you don't pay tax but you get no police protection, no fire department, can't drive on the roads, can't send your kids to school etc etc etc. Good luck to you I say!

In a lot of cases, comparing the services a government provides directly to a business is awkward. Think about stuff like policing or mental health care. There are perhaps all kinds of ways to cut corners and save money in the short run, but there will be consequences to this (both foreseeable and unforeseeable) that may end up costing more money in the end. I myself work in mental health care (assisted living), it's a private company but the funding comes from the government mostly, so I'm a government employee by proxy.

If you take an ultra-businesslike perspective and ask the question "what is the most efficient way to care for people who cannot take care of themselves" then you'll end up with questions about what quality of life you want to provide for these people? If you want it to be cheap and efficient we could just lock them all in a cage and hurl in some food every so often. If you want them to have at least a decent quality of life, you need to provide an environment which is stable, peaceful and organized. Psychiatric patients can cause chaos in any number of ways so you need a team of employees that cooperates well, can improvise and has a strong sense of internal solidarity. Having a very competitive, business-like mindset isn't actually very conducive in that situation. For example, if there's a lot of internal strife between employees, certain patients (like people with borderline personality disorder) will sense that and start fomenting these divisions. On the other hand, if collegial relationships are good, patients will also sense that and the atmosphere will be more relaxed and peaceful.

If someone from a business background would observe our work, they would probably think we spend too much time socializing with each other and with the patients. But actually that socializing is necessary in order to get a appropriately harmonious environment. Without it, more of our patients would fall back into psychosis and addiction, costing society more money in the end.

How does someone who is dead obligated to give away more tax? The guy's estate even has to pay for his own coffin.

You didnt read my post completely because I said businesses have a balance between efficiency and quality and striving for savings (hence my part about worst cost negotiation skills ever). No company lasts long selling the cheapest dollar store stuff that falls apart.

Just like every corporation is required to look in their own backyard for cost savings, gov should do the same. And if gov is still short, then tax.

There is no way the average government in a town or country does the same kind of analysis on efficiency and costs savings compared to a company. And thats because gov has unlimited debts and if they need money they just add it to the deficit bill or pass a law to tax more.

People and companies cant do that to customers. You got to earn it. You cant pass a law forcing dead people to donate money to the company,

Gov goes on a bid system, which will get you bad prices. Someone above said it's their way of giving back to get the economy going. Well, IMO thats your problem. Most big bids are filled by big companies anyway, so all youre doing is making Fortune 500 companies richer because the guys handling the bids are too lazy to cost negotiate.

For those of you who dont work in business kinds of jobs, the big companies have teams of commodity cost analysts. These guys scour industry pricing. this goes for retailers and suppliers. So when a supplier wants to jack up prices, the retailer will say why? Plastic prices are up. Really? Because our commodity team says plastic prices are flat the past 3 years, so get lost. I made up that example, but you get the idea. If the costs team can squeeze an extra 0.2% out of someone after giving the account managers information to support cost structure thats a win. It gets to a point people will wheel and deal on fractions of a % because everyone knows it adds up. 0.2% might not sound like a lot. But what if that account is worth $300,000,000? That's a $600,000 swing. Now multiply that by 5 years and that's a cool $3 million one side is going to win. The right thing to do is put in a best effort to win it for your team.

There's a check and balance. I have never seen government do that ever.

Last edited:

Gp1

Member

It's easy to defend inheritance taxes, even if we are talking about an abusive 50% tax being paid to a body that is known to not spend their money well (yes, i'm generalizing), when we are talking about a global Fortune "20" company that the revenue is close to 15% of the entire country GDP.

The problem lies in the "10%/small" inheritance tax on a "middle class" business. That's plain and simple destruction of value.

The problem lies in the "10%/small" inheritance tax on a "middle class" business. That's plain and simple destruction of value.

QSD

Member

I did actually read your post but I have very little talent or intuition for business and economy so I will probably not have understood it 100%I'm for universal healthcare. I never even get sick or have been in a hospital for ages. But things like healthcare, education, fire and police are greater society good, and someone alive paying taxes covers each other in case they need help due to an accident as they go about every day life.

How does someone who is dead obligated to give away more tax? The guy's estate even has to pay for his own coffin.

You didnt read my post completely because I said businesses have a balance between efficiency and quality and striving for savings (hence my part about worst cost negotiation skills ever). No company lasts long selling the cheapest dollar store stuff that falls apart.

Just like every corporation is required to look in their own backyard for cost savings, gov should do the same. And if gov is still short, then tax.

There is no way the average government in a town or country does the same kind of analysis on efficiency and costs savings compared to a company. And thats because gov has unlimited debts and if they need money they just add it to the deficit bill or pass a law to tax more.

People and companies cant do that to customers. You got to earn it. You cant pass a law forcing dead people to donate money to the company,

Gov goes on a bid system, which will get you bad prices. Someone above said it's their way of giving back to get the economy going. Well, IMO thats your problem. Most big bids are filled by big companies anyway, so all youre doing is making Fortune 500 companies richer because the guys handling the bids are too lazy to cost negotiate.

For those of you who dont work in business kinds of jobs, the big companies have teams of commodity cost analysts. These guys scour industry pricing. this goes for retailers and suppliers. So when a supplier wants to jack up prices, the retailer will say why? Plastic prices are up. Really? Because our commodity team says plastic prices are flat the past 3 years, so get lost. I made up that example, but you get the idea. If the costs team can squeeze an extra 0.2% out of someone after giving the account managers information to support cost structure thats a win. It gets to a point people will wheel and deal on fractions of a % because everyone knows it adds up. 0.2% might not sound like a lot. But what if that account is worth $300,000,000? That's a $600,000 swing. Now multiply that by 5 years and that's a cool $3 million one side is going to win. The right thing to do is put in a best effort to win it for your team.

There's a check and balance. I have never seen government do that ever.

There are a couple of separate issues here: taxation in general, taxation of inheritance, government inefficiency/laxness

I think on taxation in general I think we agree: it's necessary, but (obviously) as little as possible

On taxation of inheritance: I'm in favour of this for a couple of reasons, the most important one being it's more fair towards the next generation if a kid is not either hugely advantaged or disadvantaged because of the succes of the parents. Also, keep in mind what

You ask: How is someone dead obliged to give away more tax? I would counter that with the question "how is someone dead able to give away money at all"? It's just an abstraction we adhere to to make the process manageable.

government inefficiency: obviously a huge problem. The point I was trying to make is that if you look at some services the government provides, "efficiency" in the business sense of the word doesn't really cover it, because the bottom line of say police work is not profit but a sense of justice and safety, which is very hard to quantify. Without it, every other metric of financial success becomes useless because how are you going to hang on to what you've made if looting and theft are widespread?

Other than that I agree that it's a bizarre development (which made me understand even less about economy) that during this COVID crisis governments have the ability to take on near infinite debt. I don't understand how money can sustain its value if there's seemingly infinite amounts of it to give away. It can't be healthy for any bidding system or cost negotiation if one of the parties has an infinite budget, and I can imagine that makes the negotiators ineffective. My general sense of it is that we are probably headed toward a major shift in favor of decentralization, perhaps down to a municipal level, because nations are becoming so large and bureaucratic that government becomes uncontrollable and unaccountable.

What I read in your comment is a doubt that people in government give a fuck, they don't put in their best effort. I don't think that people that go into government start out by not giving a fuck, they become jaded because the system is so large and unwieldy that it's near impossible to solve problems or enact change. Government officials are also often held responsible for problems that started way before they got in office, which is illogical and toxic. What's needed IMHO is a major downsizing/devolution towards more local government. That might lead to better functioning checks & balances. But man what do I know, I just keep the crazies off the streets LOL.

StreetsofBeige

Member

Fair points. We both just come from opposite spectrums.I did actually read your post but I have very little talent or intuition for business and economy so I will probably not have understood it 100%

There are a couple of separate issues here: taxation in general, taxation of inheritance, government inefficiency/laxness

I think on taxation in general I think we agree: it's necessary, but (obviously) as little as possible

On taxation of inheritance: I'm in favour of this for a couple of reasons, the most important one being it's more fair towards the next generation if a kid is not either hugely advantaged or disadvantaged because of the succes of the parents. Also, keep in mind whatEviLore posted about wealth across generations: one of the reasons it's so unstable is probably that if a young person gets a monstrously large inheritance (the kind where you don't need to work and can live off investments or interest) this will cause problems because a kid might never learn the value of money, and will also have difficulties to find purpose in life without any sense of struggle or the need to fulfill a role in society.

You ask: How is someone dead obliged to give away more tax? I would counter that with the question "how is someone dead able to give away money at all"? It's just an abstraction we adhere to to make the process manageable.

government inefficiency: obviously a huge problem. The point I was trying to make is that if you look at some services the government provides, "efficiency" in the business sense of the word doesn't really cover it, because the bottom line of say police work is not profit but a sense of justice and safety, which is very hard to quantify. Without it, every other metric of financial success becomes useless because how are you going to hang on to what you've made if looting and theft are widespread?

Other than that I agree that it's a bizarre development (which made me understand even less about economy) that during this COVID crisis governments have the ability to take on near infinite debt. I don't understand how money can sustain its value if there's seemingly infinite amounts of it to give away. It can't be healthy for any bidding system or cost negotiation if one of the parties has an infinite budget, and I can imagine that makes the negotiators ineffective. My general sense of it is that we are probably headed toward a major shift in favor of decentralization, perhaps down to a municipal level, because nations are becoming so large and bureaucratic that government becomes uncontrollable and unaccountable.

What I read in your comment is a doubt that people in government give a fuck, they don't put in their best effort. I don't think that people that go into government start out by not giving a fuck, they become jaded because the system is so large and unwieldy that it's near impossible to solve problems or enact change. Government officials are also often held responsible for problems that started way before they got in office, which is illogical and toxic. What's needed IMHO is a major downsizing/devolution towards more local government. That might lead to better functioning checks & balances. But man what do I know, I just keep the crazies off the streets LOL.

On the private side, we just dont like how we are tied to being as efficient as possible, get trained on that, but still can be on the firing line because the company didn't make enough profit. So when we see gov with billions of debt and its like nothing and people keep jobs, we subconsciouly all probably think "what the fuck are we doing here?" going through the corporate grind?

I'm not sure what behind closed doors meetings are like in gov, but on this side it's not like the movies where people are screaming and throwing laptops or anything crazy (at least Ive never seen it), but there's still pressure to always hit monthly and quarterly numbers and I have seen my share of people getting grilled behind closed doors (sales people) as everyone walking by see whats going on since it's a windowed office. Grilling wont be in big 50 people meetings. It'll be in one on one chats. Thats where the shit hits the fan because growing at 5% wasnt good enough when the target was 7%.

Last edited:

Mitsuda Maniac

Member

Imagine working hard all your life to secure your child's future and give them their birthright only to have the government swoop in and take half lol

zeorhymer

Member

Grandfather dies. His stuff gets taxed when passed to son.

The father dies a week later from (whatever). Everything he has is taxed when passed to his son.

The government does nothing but take money. There is less and less incentive to leave the next generation with anything because it gets taxed. You know that small house that your grandparents bought 100 years ago? Gets raided by the tax man. The annuity that your parents are going to give you to make sure that you are going to be fine, poof the government snatches it up to pay for their toys.

One day when your parents leave you something and you see how much the gubment takes or when you think about leaving stuff to your kids and realize that half of it will be thrown away. If you don't have a trust, the courts put your shit in probate and have to fork over like $20-60k to take it out. So yeah. Fuck the dead, just rob them of everything.

The father dies a week later from (whatever). Everything he has is taxed when passed to his son.

The government does nothing but take money. There is less and less incentive to leave the next generation with anything because it gets taxed. You know that small house that your grandparents bought 100 years ago? Gets raided by the tax man. The annuity that your parents are going to give you to make sure that you are going to be fine, poof the government snatches it up to pay for their toys.

One day when your parents leave you something and you see how much the gubment takes or when you think about leaving stuff to your kids and realize that half of it will be thrown away. If you don't have a trust, the courts put your shit in probate and have to fork over like $20-60k to take it out. So yeah. Fuck the dead, just rob them of everything.

That's a weird way to say you want to pay MORE tax. If a "fair" number was decided at the current rate then it would be the poorer people who'd end up paying more so the billionaires can pay less.What does fair share even mean. My version of a fair share would be everyone paying the exact amount as everyone else not this percentage of our pay or wealth

we have going on.

QSD

Member

I'm not completely unfamiliar with the private sector (I had various jobs as a student), I used to work part-time in a 2nd hand record store, one of the first to sell online, early 2000's (customers used to call us and have us play records over the phone LOL) so I know a little about how tough it is to run a small business, especially if your employees are all students! I've also had some other jobs for an employment agency, one of them was for a company that does hair styling products and I definitely saw some of the shit you're describing over there, e.g. people being grilled by management in ways that seemed unfair to me. I was there for a couple of months and saw a fair share of crying (it's mostly women in the hair styling business) and awkward interactions. Business is can be brutal and my impression of it was that it's often not meritocratic at all (e.g. toxic and incompetent managers find ways to keep their positions, while fucking over their inferiors)Fair points. We both just come from opposite spectrums.

On the private side, we just dont like how we are tied to being as efficient as possible, get trained on that, but still can be on the firing line because the company didn't make enough profit. So when we see gov with billions of debt and its like nothing and people keep jobs, we subconsciouly all probably think "what the fuck are we doing here?" going through the corporate grind?

I'm not sure what behind closed doors meetings are like in gov, but on this side it's not like the movies where people are screaming and throwing laptops or anything crazy (at least Ive never seen it), but there's still pressure to always hit monthly and quarterly numbers and I have seen my share of people getting grilled behind closed doors (sales people) as everyone walking by see whats going on since it's a windowed office. Grilling wont be in big 50 people meetings. It'll be in one on one chats. Thats where the shit hits the fan because growing at 5% wasnt good enough when the target was 7%.

If you want to compare business to government there's the added complication that there's an army of public servants who are led by elected officials. Elections shift if the people are not satisfied, but the public servants (like you say) keep their positions which raises the question where the power really lies. I don't really have any answers here, other than that I agree that if people put in their best effort and give a fuck, we would all be helped immensely.

Sloth Guevara

Banned

Good

Mihos

Gold Member

The rich don't pay their fair share when alive, so take it when they're dead.

The top 10% accounts for over 70% of all tax revenue, and don't use or need most of the social programs the taxes pay for.

Last edited:

Don't get me wrong, I don't enjoy paying taxes, I have the same selfish impulses the rest of humanity has. But in the end, there's just no way to run society without taxes, so yeah I would pay. Like i said, I'm a government employee by proxy, so I'd be unemployed before long if I didn't, and all of our clients would be out on the streets, likely to die there.

But would you pay your income tax if it were voluntary?

QSD

Member

Yes (provided that most other people are also paying and society isn't collapsing, if nobody is paying I wouldn't pay either because I would need whatever resources I can muster to help me in the coming collapse)But would you pay your income tax if it were voluntary?

Why the focus on income tax?

Yes (provided that most other people are also paying and society isn't collapsing, if nobody is paying I wouldn't pay either because I would need whatever resources I can muster to help me in the coming collapse)

Why the focus on income tax?

I'm using it as an example.

Do you think most people would pay income tax voluntarily?

QSD

Member

I don't know. You'd probably have to do quite a bit of educating before you make it voluntary.I'm using it as an example.

Do you think most people would pay income tax voluntarily?

I don't know. You'd probably have to do quite a bit of educating before you make it voluntary.

So would you say most people would not pay income tax voluntarily?

QSD

Member

I sincerely do not know the answer to this question... some days I'm hopeful about humanity, other days not so much.So would you say most people would not pay income tax voluntarily?

I sincerely do not know the answer to this question... some days I'm hopeful about humanity, other days not so much.

I take it you have roundabouts in Amsterdam.

Some people say that most people would not pay income tax voluntarily. Thus, if an organization such as the government relies on it as revenue it would have its citizens pay it involuntarily. The government can do that because it can enact heavy penalties on its people. As a protestors like to say, "government is a monopoly of force." Since an individual is forced to give up his/her/they's income under threat of penalty, it can be perceived as an immoral action: Someone is taking one's property by force.

While there is certainly nuance and ample discussion about it, saying that taxation is theft is not "insufferable."

The rich usually use more of the resources. They should pay a higher percentage. I like to think of it as roommates. You have a bottle of milk. They drink 80% and you drank 20% why should you pay the same amount for the milk?What does fair share even mean. My version of a fair share would be everyone paying the exact amount as everyone else not this percentage of our pay or wealth

we have going on.

DeafTourette

Perpetually Offended

It isn't though.I doubt anyone here is really concerned about the ultra rich, more like annoyed (some of us) that such a tax can be also be applied to us commoners.

QSD

Member

I take it you have roundabouts in Amsterdam.

Some people say that most people would not pay income tax voluntarily. Thus, if an organization such as the government relies on it as revenue it would have its citizens pay it involuntarily. The government can do that because it can enact heavy penalties on its people. As a protestors like to say, "government is a monopoly of force." Since an individual is forced to give up his/her/they's income under threat of penalty, it can be perceived as an immoral action: Someone is taking one's property by force.

While there is certainly nuance and ample discussion about it, saying that taxation is theft is not "insufferable."

Chill out man, 'insufferable' is a highly subjective term, that also applies to Phil Collins, Twilight movies and console warring in my book. You're perfectly welcome to read from a different one.

I can understand the basic argument that if somebody takes something from you without your consent you consider it theft, but the reason I find this argument exasperating is I never hear any objectivists/libertarians explain what the alternative is? I listened to an interview with Yaron Brook once, and he was clearly insistent that the government should guarantee "freedom from coercion" which is nice but how will we pay for the required police force if there are no taxes?

Also we have no roundabouts in Amsterdam, the tourists are all so high they'd just walk around in circles indefinitely.

Chill out man, 'insufferable' is a highly subjective term, that also applies to Phil Collins, Twilight movies and console warring in my book. You're perfectly welcome to read from a different one.

I can understand the basic argument that if somebody takes something from you without your consent you consider it theft, but the reason I find this argument exasperating is I never hear any objectivists/libertarians explain what the alternative is? I listened to an interview with Yaron Brook once, and he was clearly insistent that the government should guarantee "freedom from coercion" which is nice but how will we pay for the required police force if there are no taxes?

Also we have no roundabouts in Amsterdam, the tourists are all so high they'd just walk around in circles indefinitely.

Perfectly chill. Just making a reasoned argument

Paltheos

Member

Indeed. The assumption I used is that heirs are likely to be children of the wealthy and already in a stable position as a consequence of the upbringing, but this won't apply to every situation and a hypothetical tax code could account for this.Says who? Who says the people get inheritance is generally in a stable money situation too? That's an assumption.

What if Uncle Bob wants to give a bunch of money to people in the family tree who needs it (like parents paying for kids school which leads to a better society)? Why should those people getting some help get nailed?

Regardless, I believe people pay enough taxes. We all get grilled from all sides. Government needs to do the right thing and look in their own backyard for costs savings (that's why I brought up earlier the whole thing about cost negotiation) and not blowing budgets for sake of getting votes trying to look like robin hood.

Government workers also some reason get extremely good job security and pensions which are giant costs, which government has trouble fixing as they wrote and agreed to their own policies. So it snowballs over decades.

Problem is, government budgets are basically infinite. That's why debts grow forever. And they somehow have zero business acumen even though they got the biggest budgets in the whole country.

There's a general mentality problem of being lax. You cant do that in private sector because no company can run forever on big debts and zero profits. Giant loans and unprofitable years can only last so long before chapter 11. That's why companies act with more urgency and try to get the job done lean.

As one of my coworkers who has worked both public and private sector, he's been in both. He quit and came back to private sector. He just couldnt take the gov workers having a lazy office effort. The guy is hired trying to get the department in line and nobody wants to listen. He comes to my company as a high level boss, does the same thing with his department and people listen as they understand a company runs best being efficient, listening to bosses and making money so people keep jobs and the stock doesnt drop 10% with a bad earnings. There's no job security in private sector unless you got a union deal. So everyone understands the best way to keep a job and make a living is to give a good effort and hope the company does well. And that means earning money and keeping costs low, all while offering a good product.

It doesn't even matter if someone works for public, private, or mowing their lawn. There's a right way of putting in effort to do a decent job. And a wrong way to feel entitled and sit back not giving a shit in hopes someone else will do it or give you free tax money for nothing.

Consider that I'm talking only hypothetically in general. There are tons of variables in reality from government waste via poor distribution to political shenanigans getting in the way of enacting the best policies. My point was only in illustrating why an inheritance tax is sound ideologically, divorced from actual consequences (the way you phrased it read to me as objecting to them on principle which is not a position I understand or agree with).

And if they use 90% of the resources, they aren't paying enough.The top 10% accounts for over 70% of all tax revenue, and don't use or need most of the social programs the taxes pay for.

And if they use 90% of the resources, they aren't paying enough.

Whoa, 90%. What's your source?

My ass.Whoa, 90%. What's your source?

Most Consuming More, and the Rich Much More (Published 1998)

United Nations reports that consumption of goods and services was rising phenomenally in industrial and many developing nations before the world slipped into a global financial crisis in 1997 and that it is still rising despite economic setbacks; predicts that cost of public and private...

This is from 1998 and sadly there isn't much on the topic.

"The 20 percent of people in high-income countries account for 86 percent of private consumption; the poorest 20 percent of the world's people consume only 1.3 percent of the pie, the report said."

And sadly, that doesn't break down rich consumers from those top 20% of rich countries to see the total breakdown. But hey 90% from my ass is looking like an alright guesstimate.

Last edited:

My ass.

Most Consuming More, and the Rich Much More (Published 1998)

United Nations reports that consumption of goods and services was rising phenomenally in industrial and many developing nations before the world slipped into a global financial crisis in 1997 and that it is still rising despite economic setbacks; predicts that cost of public and private...www.nytimes.com

This is from 1998 and sadly there isn't much on the topic.

"The 20 percent of people in high-income countries account for 86 percent of private consumption; the poorest 20 percent of the world's people consume only 1.3 percent of the pie, the report said."

And sadly, that doesn't break down rich consumers from those top 20% of rich countries to see the total breakdown. But hey 90% from my ass is looking like an alright guesstimate.

It's amazing what you can do with reader view on Safari.

Ok, the article makes a lot of claims, throwing percentages of consumption without defining what they are consuming. Nor does it attempt to explain those consumption differences. Man, I thought the Old Grey Lady was in decline recently.

It's easy to throw in percentages to "support" an argument. 67% of people know that. And 56% of people have more faith in your ass than the media, so keep up the good work.

Last edited:

It didn't matter anyways. The point was that anything above the 70% mark would mean rich people aren't paying their fair share. And hell I don't even know where he's getting the rich pay 70% from. I've read the rich paid less than the middle class in recent years.It's amazing what you can do with reader view on Safari.

Ok, the article makes a lot of claims, throwing percentages of consumption without defining what they are consuming. Nor does it attempt to explain those consumption differences. Man, I thought the Old Grey Lady was in decline recently.

It's easy to throw in percentages to "support" an argument. 67% of people know that. And 56% of people have more faith in your ass than the media, so keep up the good work.

Opinion | The Rich Really Do Pay Lower Taxes Than You (Published 2019)

The 400 wealthiest Americans now pay a lower rate than the middle class.

The staggering amount of wealth held by the Forbes 400 more than doubled over the last decade. But their tax rates actually dropped.

Lawmakers have repeatedly cut a variety of taxes for the wealthiest Americans. Some experts say that's contributed to accelerating inequality.

So yea, they aren't paying their fair share.

Last edited:

The top 10% accounts for over 70% of all tax revenue, and don't use or need most of the social programs the taxes pay for.

They also control 75+% of all the wealth in the US, so I don't see any injustice there.

It didn't matter anyways. The point was that anything above the 70% mark would mean rich people aren't paying their fair share. And hell I don't even know where he's getting the rich pay 70% from. I've read the rich paid less than the middle class in recent years.

Opinion | The Rich Really Do Pay Lower Taxes Than You (Published 2019)

The 400 wealthiest Americans now pay a lower rate than the middle class.www.nytimes.com

The staggering amount of wealth held by the Forbes 400 more than doubled over the last decade. But their tax rates actually dropped.

Lawmakers have repeatedly cut a variety of taxes for the wealthiest Americans. Some experts say that's contributed to accelerating inequality.www.businessinsider.com

So yea, they aren't paying their fair share.

What is the fair share?

At least enough to match what they've taken.What is the fair share?

At least enough to match what they've taken.

How do you quantify that?

Last edited:

- Status

- Not open for further replies.