AuthenticM

Member

yep

Over the weekend, President-elect Donald Trump tapped Rep. Mick Mulvaney (R-S.C.) to be his director of the Office of Management and Budget. This Cabinet-level post is responsible for producing the federal budget, overseeing and evaluating executive branch agencies and otherwise advising the president on fiscal matters. Its a position with tremendous, far-reaching power, even if the public doesnt pay much attention to it.

Which is why its so concerning that Trump chose Mulvaney, who seems poised to help Trump ignite another worldwide financial crisis.

Mulvaney was first elected to Congress in 2010 as part of the anti-government, tea party wave. A founding member of the right-wing House Freedom Caucus, he is among Congresss most committed fiscal hawks. He has repeatedly voted against his own partys budget proposals because they were insufficiently conservative.

All this will presumably put him at odds with Trumps plans to balloon federal deficits through a $7 trillion cut in individual and corporate income taxes, another half-trillion in infrastructure subsidies and other major spending expansions.

...

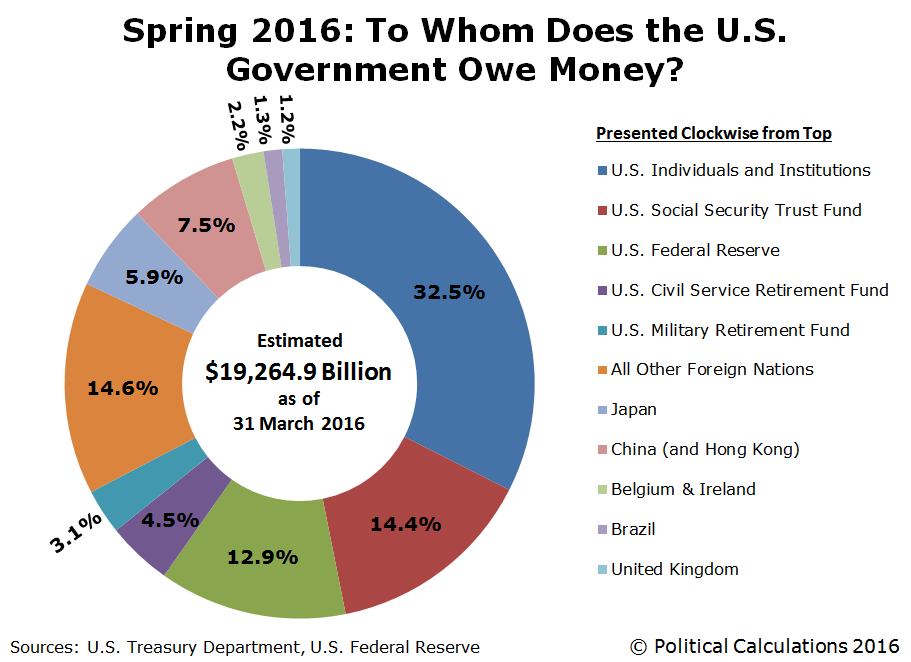

Whatever their differences on line-item details, though, Mulvaney and the president-elect have at least one major thing in common: an alarming openness to defaulting on the federal debt.

As you may recall, during the campaign Trump repeatedly flirted with the idea of defaulting on U.S. debt obligations. In a CNBC interview in May, he suggested that his experience in offloading private debt would translate nicely to federal obligations. That is, hed simply persuade the countrys creditors to accept less than full payment.

I would borrow knowing that if the economy crashed you could make a deal, he said.