You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

29 year old with a MBA has $1 MILLION in debt

- Thread starter ManaByte

- Start date

Days like these...

Have a Blessed Day

He's 32. That makes all the difference!

Credit is wild. I have a worse credit rating and lower credit limits than a friend who is 40k in debt (25k is internet spaceships). I have six figures with the same bank as him but I'm limited to a $1500 limit while he has like multiple cards over 10k. Outside the US my credit is excellent because I have zero debt and produce tax records showing my financial position. The US seems like a system to reward gorging on debt by comparison.

StreetsofBeige

Member

At some point people like this claim bankruptcy and the company gets grilled as a loss.

Now you know why prices for shit are jacked up. At my company, our bad debts collection losses are around 1%. Doesn't sound like much but most of our sales come from big retailers who pay up. They arent Joe Bob Broke or Debbie Debt Deadbeat. The amount of bad debt at credit card companies must be through the roof.

But hey they are profitable. All they do is jack up interest rates for the rest of you who need to carry a balance and pay it off.

Think of it like taxes. You pay more taxes to cover everyone else who drains the government of money.

Now you know why prices for shit are jacked up. At my company, our bad debts collection losses are around 1%. Doesn't sound like much but most of our sales come from big retailers who pay up. They arent Joe Bob Broke or Debbie Debt Deadbeat. The amount of bad debt at credit card companies must be through the roof.

But hey they are profitable. All they do is jack up interest rates for the rest of you who need to carry a balance and pay it off.

Think of it like taxes. You pay more taxes to cover everyone else who drains the government of money.

Last edited:

StreetsofBeige

Member

It totally is. Canada is the same. Anyone can get a credit card. Students with zero income will always get granted a low limit credit card. It's worth it to companies to get them started and they eve have credit card sign up tables at universities.The US seems like a system to reward gorging on debt by comparison.

Put it this way. A long time ago, my brother would use his dog's name for stuff. It got on a mailing list because suddenly the dog would get junk mail including credit card applications. So it shows it's no holds barred. I'm 100% confident if my bro filled it in, his dog would get approved for a card.

Ozzy Onya A2Z

Member

Two "secrets" of the USA/many commercialised countries are -

1. They want you in debt and paying the interest, good little consumer sheep for industry and economy. If the numbers add up and a track record shows you can pay the interest with cashflow they don't give two shits about you, your principal or debt ceilings etc. They're in it for profit not your benefit. If you show being smart with money and not having a track record with interest/debt/payments they're not interested in you. I've never loaned for anything beyond cars or houses or quality business reasons. Avoid misuse of credit cards, high interest and save for what you want. Cars are a waste. Smarter investments like real estate, stocks/bonds/ETF or businesses are your friend.

2. The education system is privatised and geared at making profit, not improving society or securing great lifelong skills/occupations/roles for you. They don't give two shits about you or your education per se. Student loans are a massive rip off these days. You can literally get the same education abroad or a "lesser school/online", travel and in many cases a free/low cost education without the need for stupid "occupational gravy train" education racking personal debt all along the way.

1. They want you in debt and paying the interest, good little consumer sheep for industry and economy. If the numbers add up and a track record shows you can pay the interest with cashflow they don't give two shits about you, your principal or debt ceilings etc. They're in it for profit not your benefit. If you show being smart with money and not having a track record with interest/debt/payments they're not interested in you. I've never loaned for anything beyond cars or houses or quality business reasons. Avoid misuse of credit cards, high interest and save for what you want. Cars are a waste. Smarter investments like real estate, stocks/bonds/ETF or businesses are your friend.

2. The education system is privatised and geared at making profit, not improving society or securing great lifelong skills/occupations/roles for you. They don't give two shits about you or your education per se. Student loans are a massive rip off these days. You can literally get the same education abroad or a "lesser school/online", travel and in many cases a free/low cost education without the need for stupid "occupational gravy train" education racking personal debt all along the way.

Cyberpunkd

Banned

Obligatory LOL about the US credit system.

StreetsofBeige

Member

Yup.Two "secrets" of the USA/many commercialised countries are -

1. They want you in debt and paying the interest, good little consumer sheep for industry and economy. If the numbers add up and a track record shows you can pay the interest with cashflow they don't give two shits about you, your principal or debt ceilings etc. They're in it for profit not your benefit. If you show being smart with money and not having a track record with interest/debt/payments they're not interested in you. I've never loaned for anything beyond cars or houses or quality business reasons. Avoid misuse of credit cards, high interest and save for what you want. Cars are a waste. Smarter investments like real estate, stocks/bonds/ETF or businesses are your friend.

2. The education system is privatised and geared at making profit, not improving society or securing great lifelong skills/occupations/roles for you. They don't give two shits about you or your education per se. Student loans are a massive rip off these days. You can literally get the same education abroad or a "lesser school/online", travel and in many cases a free/low cost education without the need for stupid "occupational gravy train" education racking personal debt all along the way.

Banking/Credit Cards are probably the only industries in the world where they WANT people not paying in full. Sounds so weird to say that. Every other business wants the customer paying 100% up front if they can. But when most of their profits come from penalty fees and loans (same thing whether it's a mortgage or a credit card balance), they want that. Not too crazy as they dont want deadbeats claiming bankruptcy right away, but they want that middle ground of people in debt and can pay fees as long as possible.

The last thing they want is someone like me who pays off all bills on time, I get my monthly perks, and I dont overbuy shit. They still make money off from mortgages and making I think 3% on every CC transaction I do, but I get paid back 1-1.5% back in dividend payback. So really they dont make much off me. But that dude with a $20,000 balance at 22% APR taking 10 years to pay off is a gold mine.

You can tell CC companies want to milk you. When I have my usual $1000 monthly bill to pay off, the minimum payment needed to avoid credit score grilling is like $12. So it shows they dont care about getting paid back fast. If they did, they'd make the minimum like $400.

As for education system, no doubt it's rip off. I did grad school way back and it helped me get a good job and boost my resume. But what I learned was absolute trash. I learned more in undergrad. Half the courses I already took in undergrad. And it was MBA school.

Here's a tip for all of you considering an MBA. As long as you show up and d your tests and projects, you cant fail. You literally cant unless you just outright skip doing tests and stuff. I did mine in Toronto and the MBA booklet even said each course is bell curved to a GPA which was equivalent to a B+. When grades were posted outside profs door where you look for your student number and grade (this was before everything was online), all grades were B, B+ and A-. A couple C and A at the extremes. That's the grading in masters school.

They want your money and good reputation. So the last thing they want is to flunk you, lose your ongoing tuition and have you give them a bad survey mark.

Last edited:

Yup.

Banking/Credit Cards are probably the only industries in the world where they WANT people not paying in full. Sounds so weird to say that. Every other business wants the customer paying 100% up front if they can. But when most of their profits come from penalty fees and loans (same thing whether it's a mortgage or a credit card balance), they want that. Not too crazy as they dont want deadbeats claiming bankruptcy right away, but they want that middle ground of people in debt and can pay fees as long as possible.

The last thing they want is someone like me who pays off all bills on time, I get my monthly perks, and I dont overbuy shit. They still make money off from mortgages and making I think 3% on every CC transaction I do, but I get paid back 1-1.5% back in dividend payback. So really they dont make much off me. But that dude with a $20,000 balance at 22% APR taking 10 years to pay off is a gold mine.

As for education system, no doubt it's rip off. I did grad school way back and it helped me get a good job and boost my resume. But what I learned was absolute trash. I learned more in undergrad. Half the courses I already took in undergrad. And it was MBA school.

Here's a tip for all of you considering an MBA. As long as you show up and d your tests and projects, you cant fail. You literally cant unless you just outright skip doing tests and stuff. I did mine in Toronto and the MBA booklet even said each course is bell curved to a GPA which was equivalent to a B+. When grades were posted outside profs door where you look for your student number and grade (this was before everything was online), all grades were B, B+ and A-. A couple C and A at the extremes. That's the grading in masters school.

They want your money and good reputation. So the last thing they want is to flunk you, lose your ongoing tuition and have you give them a bad survey mark.

MBA was such a joke. I was so disillusioned after my course. I was a scholarship student though so the only thing I wasted was my free time (I did not leave the workforce). The cash kids were leeches on the established/scholarship people. I severed ties because I got sick of being asked for jobs and other favors by people I knew to be idiots. Education inflation is a product of the market though. Tuition would plummet if the US government did not offer fully guaranteed debt for people to get C's in bullshit degrees. The smart / valuable students go for free. Practically my entire department received at least half funding through grants and scholarships.

I'm like you. I don't buy many things outside of essentials and never carry credit card debt. I would probably starve myself before eating interest. I never had a credit card until I needed to rent a car. I had enough in the bank to outright buy the car I was renting but the company insisted on credit. The agency was happy to accept a card with a limit of like 5 grand instead. Would you happen to know the logic behind that one?

StreetsofBeige

Member

Im not totally understanding your rental car thing, but companies will often prefer a CC because they can automatically charge you for fees and damages. It's like a hotel. They'll prefer a credit card. To companies it makes no difference if you got a ton of money in the bank because they got no guarantee you'll pay, but if they can grill you a CC charge that's on file and it's in your benefit to pay it off or get dinged credit score points. If they try to go after your bank account, that would involve them taking you to court.MBA was such a joke. I was so disillusioned after my course. I was a scholarship student though so the only thing I wasted was my free time (I did not leave the workforce). The cash kids were leeches on the established/scholarship people. I severed ties because I got sick of being asked for jobs and other favors by people I knew to be idiots. Education inflation is a product of the market though. Tuition would plummet if the US government did not offer fully guaranteed debt for people to get C's in bullshit degrees. The smart / valuable students go for free. Practically my entire department received at least half funding through grants and scholarships.

I'm like you. I don't buy many things outside of essentials and never carry credit card debt. I would probably starve myself before eating interest. I never had a credit card until I needed to rent a car. I had enough in the bank to outright buy the car I was renting but the company insisted on credit. The agency was happy to accept a card with a limit of like 5 grand instead. Would you happen to know the logic behind that one?

It's like getting approved for a mortgage. They care about monthly estimated net income vs. the mortgage they will grant you. They dont care if you got $1M in the bank. They cant risk relying on that, and the next day you blow that $1M at a casino.

For me, paying off my bills on time isn't even so much about credit score. The last time I checked I had a perfect 900 score (Canada is on a 900 pt scale). And getting dinged some points makes no difference to loan rates unless it's a big enough chunk. It's just about being responsible and paying on time. It's like sports pools. I can be the guy who pays at the end where the commissioner drags the $20 out of me 8 months later, or I pay up front right away. I pay right away.

I've never missed a mortgage or car payment. Paid off my furniture bill in full after their 18 month plan. And the only times I missed CC payments were 3 times over the first 10 years I had a card. And each time was because I forgot to. This was before PAP, so it required me to do manual payments at the ATM or online and I just forgot. I remember one time I thought my payment would be the usual 28th-31st of the month but that month it was some reason like the 25th, so I forgot. I paid right away.

Also, tip for all. When you miss a CC payment, your company should give you around a 5 day grace period. As long as you pay up the minimum $ amount, your credit score wont get grilled. But the grace period will likely be different at each place so if youre that worried, ask them. But I dont know if the grace period is there forever, or only for people who rarely miss a payment. Maybe for consistent late payers, there is no grace period. But when I called, they told me 5 days.

Last edited:

badblue

Gold Member

I'm fucking thankful that I've just gotten off that ride. Just paid off $36,000 in debt today and cancelled the cards (curious how it's going to effect my credit score). With my personal situation, there was no way I was going to be able to keep up with 15% interest on that and ever make a dent in the principle. And while I don't like the reason I was able to get $36k quickly, sometimes we just need to bite the bullet and do what we need to do.

Hell, going back to work to pay it off was on the table even if it meant fucking up my neck some more.

Glad a different opportunity opened up for a pretty decent job, once I learn all the stuff I need to do and how to do it.

For that woman, depending on how desperate she is to pay off that debt there's always OnlyFans. I honestly can't think of another way for her to get out of a million dollar debt without bankruptcy.

Hell, going back to work to pay it off was on the table even if it meant fucking up my neck some more.

Glad a different opportunity opened up for a pretty decent job, once I learn all the stuff I need to do and how to do it.

For that woman, depending on how desperate she is to pay off that debt there's always OnlyFans. I honestly can't think of another way for her to get out of a million dollar debt without bankruptcy.

Im not totally understanding your rental car thing, but companies will often prefer a CC because they can automatically charge you for fees and damages. It's like a hotel. They'll prefer a credit card. To companies it makes no different if you got a ton of money in the bank because they got no guarantee you'll pay, but if they can grill you a CC charge that's on file and it's in your benefit to pay it off or get dinged credit score points. If they try to go after your bank account, that would involve them taking you to court.

No rental company I have used allows debit cards to hire a vehicle. They required a credit card even though the card had far less of a limit than what I had in my debit account. I guess its the court thing but even then, I usually have full insurance coverage so its an odd system.

I pay my debts because I owe them. I've never considered credit score. My expenses today are roughly the same as when I started working apart from kid's tuition. I save and try to grow money because its entertaining. Outwardly, I am behind my peers because I drive a modest car and I rent my primary residence. I'm much better off in reality since I gorged on savings instead of debt.

StreetsofBeige

Member

Credit ratings are partly based on ratios. So the smaller the ratio, the more it helps your credit score. So lets say you typically have $1000 in CC charges across $50,000 of CC limits, it'll be a better score than if you got $1000 across only $20,000 of CC limit.I'm fucking thankful that I've just gotten off that ride. Just paid off $36,000 in debt today and cancelled the cards (curious how it's going to effect my credit score). With my personal situation, there was no way I was going to be able to keep up with 15% interest on that and ever make a dent in the principle. And while I don't like the reason I was able to get $36k quickly, sometimes we just need to bite the bullet and do what we need to do.

Hell, going back to work to pay it off was on the table even if it meant fucking up my neck some more.

Glad a different opportunity opened up for a pretty decent job, once I learn all the stuff I need to do and how to do it.

For that woman, depending on how desperate she is to pay off that debt there's always OnlyFans. I honestly can't think of another way for her to get out of a million dollar debt without bankruptcy.

StreetsofBeige

Member

Credit ratings are only really important if someone needs big loans and their credit history is shaky with late payments and skyrocketing balances.No rental company I have used allows debit cards to hire a vehicle. They required a credit card even though the card had far less of a limit than what I had in my debit account. I guess its the court thing but even then, I usually have full insurance coverage so its an odd system.

I pay my debts because I owe them. I've never considered credit score. My expenses today are roughly the same as when I started working apart from kid's tuition. I save and try to grow money because its entertaining. Outwardly, I am behind my peers because I drive a modest car and I rent my primary residence. I'm much better off in reality since I gorged on savings instead of debt.

If anyone pays off their bills on time, their credit rating will be sky high and the rates they get offered in loans will be as low as it can get. It's done in chunks too. My mortgage broker says the mortgage rates I get from banks makes no difference whether I got a 900 perfect score or something like a 760 or 780.

GeorgioCostanzaX

Member

How else do you think teenagers are able to afford $800 - $1500 assault rifles?

badblue

Gold Member

I've just heard closing lines of credit is bad for your credit score.Credit ratings are partly based on ratios. So the smaller the ratio, the more it helps your credit score. So lets say you typically have $1000 in CC charges across $50,000 of CC limits, it'll be a better score than if you got $1000 across only $20,000 of CC limit.

StreetsofBeige

Member

I dont know all the factors, and am too lazy to do a google check, but a credit score will get dinged for numerous things:I've just heard closing lines of credit is bad for your credit score.

- Ratio I said above

- Late payment history

- Bankruptcy

- If there are formal inquiries to apply or close financial vehicles. So checking your credit score wont affect it. But if you open or close a new CC or loan that will affect it. Such as a bank going through a car loan or mortgage with you. I think the reason for this is because if your profile is constantly messing with credit/loans you get dinged because you're getting risky messing around with stuff

I might be wrong regarding these, but this is what I remember.

Last edited:

Scotty W

Banned

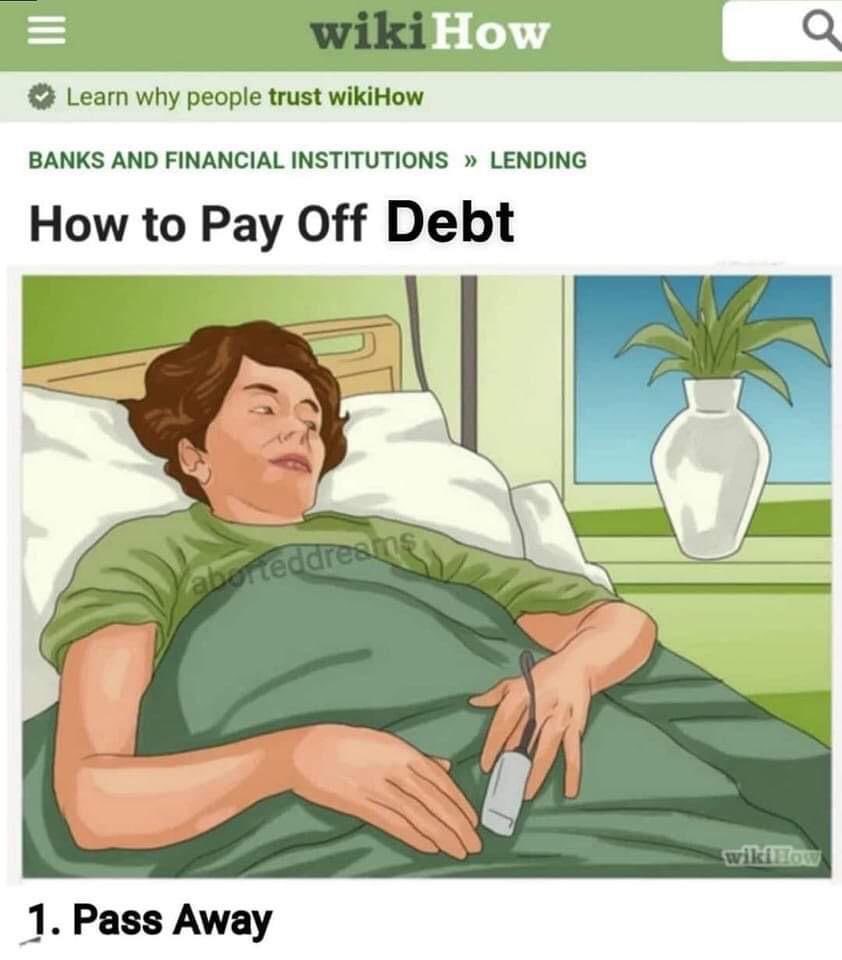

Just thinking about that situation, en masse, reminds me of this:For that woman, depending on how desperate she is to pay off that debt there's always OnlyFans. I honestly can't think of another way for her to get out of a million dollar debt without bankruptcy.

A great sign appeared in heaven: a woman clothed with the sun, with the moon under her feet and a crown of twelve stars on her head. She was pregnant and cried out in pain as she was about to give birth. Then another sign appeared in heaven: an enormous red dragon with seven heads and ten horns and seven crowns on its heads. Its tail swept a third of the stars out of the sky and flung them to the earth. The dragon stood in front of the woman who was about to give birth, so that it might devour her child the moment he was born.

NeoIkaruGAF

Gold Member

Holy effing shit. And here I am, managing to save some money every month, basically never taking a proper vacation, and being terribly worried about just how much I have to spend for the basics of living.

Not being American, it's impossible for me to understand how you can have one tenth of this woman's debt and not thinking of just putting a bullet through your brain.

Not being American, it's impossible for me to understand how you can have one tenth of this woman's debt and not thinking of just putting a bullet through your brain.

Mr Reasonable

Completely Unreasonable

$335k on student loans.

What a ridiculous system.

What a ridiculous system.

BlackTron

Member

I've just heard closing lines of credit is bad for your credit score.

It's true, because one of the factors is credit age. The average age of your credit accounts is longer with those old accounts open. This is why, even with credit cards paid off, I use old ones for things I know I need to buy anyway like gas, and pay it off each month. Just to maintain the accounts. Of course it will matter much more for your oldest CC that is 10 years old than one you've only had a year. And it depends on how many accounts because it comes out as an average.

Open available credit also changes your debt-to-limit ratio which impacts the score. If you have a single CC with a $500 limit and are using $400 of that, it's not a lot of debt but your ratio will be 80% which is way too high and will tank your score. If you add a card with another $1000 of open credit, your usage would be under 30% which is what they like to see. That one change could boost it 30-50 points.

SF Kosmo

Banned

Yeah, there's a certain amount of gamesmanship to building credit in the US. It's not as simple as taking on debt, but proactively opening diverse lines of credit, even if you you don't use them much.Credit is wild. I have a worse credit rating and lower credit limits than a friend who is 40k in debt (25k is internet spaceships). I have six figures with the same bank as him but I'm limited to a $1500 limit while he has like multiple cards over 10k. Outside the US my credit is excellent because I have zero debt and produce tax records showing my financial position. The US seems like a system to reward gorging on debt by comparison.

I am relatively debt free other than a modest amount of student loans, but I have like $50K in revolving credit that never goes above 5% utilization, so I have good credit. It's all about encouraging you to take on cards and having the the discipline not to get in trouble with them and periodically asking for limit increases for no reason.

Last edited:

RJMacready73

Simps for Amouranth

How are they continuously loaned credit with a huge mounting dept pile?? WTF!? there comes a point where surely a bank or cc company has to take responsibility for these fucking idiots purely on the notion that if they claim bankruptcy you're getting fuck all back

Vicetrailia

Banned

Yup credit cards are such a hilarious game.

Companies offer cash back, mileage rewards and etc to get people to use them so that they can make money off the transaction fees. It's a sweet deal for everyone involved if you can avoid getting nailed by their biggest money maker, paying on the high interests.

But no matter what you're just a farm to them.

Companies offer cash back, mileage rewards and etc to get people to use them so that they can make money off the transaction fees. It's a sweet deal for everyone involved if you can avoid getting nailed by their biggest money maker, paying on the high interests.

But no matter what you're just a farm to them.

Last edited:

funkygunther

Banned

That's the price of freedom, some people need a nanny state. Although how to fix their problem is anyone's guess without seeing their finances and how many candles they bought.

Oh it's worse than you think. For undergrad loans the big lender is the US federal government. (FWIW they originate over 90% of all student loans in the US.) Yeah, so even the government is trying to make money off your ass on that.$335k on student loans.

What a ridiculous system.

Smiggs

Member

I paid off my mortgage in about 11 years, and as soon as the payment was processed, my credit went from 825+ to a little under 700. Took over a year to get back to 800. What a joke.Two "secrets" of the USA/many commercialised countries are -

1. They want you in debt and paying the interest, good little consumer sheep for industry and economy. If the numbers add up and a track record shows you can pay the interest with cashflow they don't give two shits about you, your principal or debt ceilings etc. They're in it for profit not your benefit. If you show being smart with money and not having a track record with interest/debt/payments they're not interested in you. I've never loaned for anything beyond cars or houses or quality business reasons. Avoid misuse of credit cards, high interest and save for what you want. Cars are a waste. Smarter investments like real estate, stocks/bonds/ETF or businesses are your friend.

2. The education system is privatised and geared at making profit, not improving society or securing great lifelong skills/occupations/roles for you. They don't give two shits about you or your education per se. Student loans are a massive rip off these days. You can literally get the same education abroad or a "lesser school/online", travel and in many cases a free/low cost education without the need for stupid "occupational gravy train" education racking personal debt all along the way.

That's simple. In the US most student loans aren't dischargeable in bankruptcy and it's been that way since the 70s. So long story short, even when the banks were the ones giving out student loans they made a ton of guaranteed money.How are they continuously loaned credit with a huge mounting dept pile?? WTF!? there comes a point where surely a bank or cc company has to take responsibility for these fucking idiots purely on the notion that if they claim bankruptcy you're getting fuck all back

Ozzy Onya A2Z

Member

I paid off my mortgage in about 11 years, and as soon as the payment was processed, my credit went from 825+ to a little under 700. Took over a year to get back to 800. What a joke.

Yep, the system is built for money making not our success personally. Congrats on being mortgage free!

Last edited:

StreetsofBeige

Member

For those of you who need money or simply want to improve their overall credit score without using any money, just open line of credit accounts. The interest rate will be a fraction of a credit card's rate and every bank will give you one. I have two LOC I set up 15 years ago and never used them. But they are till there. Just dormant. If you dont use them, they will be shut down dormant until you reactivate them. I think mine go dormant after 6 or 12 months.

The drawback is it's like a loan. So it acts like cash. You take money out and pay it back. I got approved like $80,000 when I was young like it was nothing. I got more approved than my credit card limit.

The drawback is I think LOC monthly payback is higher. Like 3% minimum you got pay back. But my credit card, the minimum is like 1%. So if you do a LOC, you got to make sure you can float the required monthly payback.

But the plus side, since it's cash you are limited to what you buy based on the cash in your wallet. And most people probably only carry a couple hundred tops. So you cant get tempted to buy dumb shit like on CC unless you cant control yourself and keep going back to the ATM or bank for more LOC money.

The drawback is it's like a loan. So it acts like cash. You take money out and pay it back. I got approved like $80,000 when I was young like it was nothing. I got more approved than my credit card limit.

The drawback is I think LOC monthly payback is higher. Like 3% minimum you got pay back. But my credit card, the minimum is like 1%. So if you do a LOC, you got to make sure you can float the required monthly payback.

But the plus side, since it's cash you are limited to what you buy based on the cash in your wallet. And most people probably only carry a couple hundred tops. So you cant get tempted to buy dumb shit like on CC unless you cant control yourself and keep going back to the ATM or bank for more LOC money.

Last edited:

That's the price of freedom, some people need a nanny state. Although how to fix their problem is anyone's guess without seeing their finances and how many candles they bought.

Its a perverse form of freedom because people are prohibited from accessing many financial instruments in the interest of protection while allowing for somebody as young as 18 to completely ruin their lives financially with a handful of signatures.

LiquidMetal14

hide your water-based mammals

They need to start teaching more stuff to avoid unnecessary debt vs the crap they're trying to push now.

Credit building, budgeting, social media abstinence, reading, relying less on tech.

Credit building, budgeting, social media abstinence, reading, relying less on tech.

Lukaku's First Touch

Member

230k household income, that's HUGE imo wtf.... what the fuck is the cost of living there.

Billbofet

Member

With that level of debt discussed in the video and with a take-home of $210K annually, I don't even understand how they pay the minimum.

It is extremely difficult to feel sympathy for this couple.

Like, I wonder if at only $500K in debt, they had a conversation and decided to hold off on calling Dave Ramsay or come up with a plan......

This is "fake your own death" levels of debt burden.

It is extremely difficult to feel sympathy for this couple.

Like, I wonder if at only $500K in debt, they had a conversation and decided to hold off on calling Dave Ramsay or come up with a plan......

This is "fake your own death" levels of debt burden.

AJUMP23

Parody of actual AJUMP23

If they are in Nashville it isn't bad. Their house dept was only 250k. Which is not a large house but a decent place to live. Their issue is they live beyond their means. They have no idea how to limit themselves.230k household income, that's HUGE imo wtf.... what the fuck is the cost of living there.

Their house payment may be 1000 a month. So they should have plenty of money for lifestyle. They probably eat out every night. And buy everything.

cormack12

Gold Member

They arent Joe Bob Broke or Debbie Debt Deadbeat. The amount of bad debt at credit card companies must be through the roof.

Dude, no need to badmouth my parents. They still people fam

Billbofet

Member

Yeah, I agree they probably eat out every meal.If they are in Nashville it isn't bad. Their house dept was only 250k. Which is not a large house but a decent place to live. Their issue is they live beyond their means. They have no idea how to limit themselves.

Their house payment may be 1000 a month. So they should have plenty of money for lifestyle. They probably eat out every night. And buy everything.

One of my good friend's daughters was paying $500/month in Uber Eats/Postmates in high school during the tail end of the pandemic as they were doing remote learning.

Just all that nonsense on Starbucks and low-quality fast food with nothing to show for it. She was working part-time, but it barely covered her bullshit expenses.

The top MBA programs are worth it, and ones that you can get a full ride on are worth it, but most people end up in no man's land in-between where they pay almost as much as a top program but get an ROI similar to a cheap program. Goes for a lot of other degrees, too.

Get the full prestige factor or do it cheaply.

Get the full prestige factor or do it cheaply.

StreetsofBeige

Member

How are TVs 98% cheaper than 2000?College loans, gotta love how college tuition and books have gone up over the years.

I've seen other graphs that go back to the 80s and it's even worse, people could pay for college on a part time job back then.

I've heard it said you go for the Harvard MBA program not for the MBA but for the contacts you make at Harvard while doing the MBA. (Since they'll be well connected too.)The top MBA programs are worth it, and ones that you can get a full ride on are worth it, but most people end up in no man's land in-between where they pay almost as much as a top program but get an ROI similar to a cheap program. Goes for a lot of other degrees, too.

Get the full prestige factor or do it cheaply.

They're probably comparing how much say a 40" lcd would have cost back in 2000 vs now. (Not how much a typical TV would cost you in 2000 vs a typical TV in 2023)How are TVs 98% cheaper than 2000?

Yes, the course work is fun but it's not like MBAs are all that differentiated in terms of what you study. But the program is set up so that everyone benefits from each other's perspectives and experience as a cohort of elites, they bring in leaders of industry frequently, and the professors are very well connected and experienced at the top of the business world. It's an environment of success that builds your confidence and your network in every way.I've heard it said you go for the Harvard MBA program not for the MBA but for the contacts you make at Harvard while doing the MBA. (Since they'll be well connected too.)

Dural

Member

How are TVs 98% cheaper than 2000?

I bought a 32" tube tv in 1999 and it was like $600, I can go to Best Buy right now and get a 32" tv for $100. I'm not sure what LCD tvs were even available then, but anything larger than 40" were rear projection and they weren't cheap.