You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bitcoin price skyrockets, crashes, rinse, repeat, internet starts investing in tulips

- Thread starter tipoo

- Start date

Coreda

Member

Interesting tidbit: MtGox hacked? One user has had his email changed without his knowledge, and a friend of his had 1500 BTC emptied.

Either some weird MtGox bug/anomaly, fake, or potentially very interesting news.

Either some weird MtGox bug/anomaly, fake, or potentially very interesting news.

Fury Sense

Member

rebounding now?

$640

wow

such volatile

very volume

much trade

$640

wow

such volatile

very volume

much trade

back down to 570. lolrebounding now?

$640

wow

such volatile

very volume

much trade

Fury Sense

Member

i think if people are interested in getting involved for the long haul, tonight/tomorrow might afford a pretty good entry.

toxicgonzo

Taxes?! Isn't this the line for Metallica?

There's a big resistance level near $600 on MtGox.

Of course, what's on the books now can change fairly quickly.

Edit: I take back what I said as it did drop sub 600

Of course, what's on the books now can change fairly quickly.

Edit: I take back what I said as it did drop sub 600

It feels pretty bad right now to not be able to buy bitcoins.

ditto

Fury Sense

Member

Oh yeah it does.It feels pretty bad right now to not be able to buy bitcoins.

>Volatility becomes widely known

>Swarms of people sign up on trading sites

>Stuff happening right now continues to happen (right now)

>People get approved next week and everyone buys and prices rise again

>Another crash after the surge of new traders loses hype

>Future stuff happens (balance?)

Watching the value change so rapidly is fascinating indeed... but it's also pretty fun to watch everyone on the internet take turns saying "I told you so!"

criesofthepast

Member

The sell walk is still double what the buy wall is for LTC. It should drop more. I just woke up and see it went down to $16. Sub $10 let's go!

It is the most convenient way by far since it uses interact online. Never used them myself but just throwing it out there.

Maybe try www.quickbt.com if you want. You can only buy 0.05 bitcoins right now (about $30 worth) and they take $5 for the transaction but its something. I heard you can email them to buy higher quantities up to 0.5-1 bitcoin and the URL for that would be www.quickbt.com/proIt feels pretty bad right now to not be able to buy bitcoins.

It is the most convenient way by far since it uses interact online. Never used them myself but just throwing it out there.

LeeRoyBrown

Banned

Sold LTC at $34, made a profit.

Sold BTC at $1100 made a profit.

Lol at the fucking idiots buying in trying to catch a falling knife.

Back to earth we go.

Sold BTC at $1100 made a profit.

Lol at the fucking idiots buying in trying to catch a falling knife.

Back to earth we go.

Fury Sense

Member

lol... this is the kind of spectacle I mentioned in my last postSold LTC at $34, made a profit.

Sold BTC at $1100 made a profit.

Lol at the fucking idiots buying in trying to catch a falling knife.

Back to earth we go.

This just amazes me. More than a 10% difference between platforms

LeeRoyBrown

Banned

I simply don't get why people are buying in?

Ok fine, you trying to get in early because it will go up in the long run...but in the mean time, what do you honestly think it will bounce up to?

It has no major backers so it isn't worth shit, speculate all you fucking want, but if it Raises to $800, $800 for what? speculation.

I predict a dead cat bounce and then a fall again.

Also please note, I have no fucking idea what I'm talking about.

If logic applied to Bitcoins, I'd be a millionaire.

Ok fine, you trying to get in early because it will go up in the long run...but in the mean time, what do you honestly think it will bounce up to?

It has no major backers so it isn't worth shit, speculate all you fucking want, but if it Raises to $800, $800 for what? speculation.

I predict a dead cat bounce and then a fall again.

Also please note, I have no fucking idea what I'm talking about.

If logic applied to Bitcoins, I'd be a millionaire.

I simply don't get why people are buying in?

Ok fine, you trying to get in early because it will go up in the long run...but in the mean time, what do you honestly think it will bounce up to?

It has no major backers so it isn't worth shit, speculate all you fucking want, but if it Raises to $800, $800 for what? speculation.

I predict a dead cat bounce and then a fall again.

Also please note, I have no fucking idea what I'm talking about.

If logic applied to Bitcoins, I'd be a millionaire.

What we know about Bitcoin: It's high volatility.

It's highest is $1200. Many are watching. It hasn't gone back down past $500 since the start of this madness.

Make best guesses with available information, hope you roll the dice right.

LeeRoyBrown

Banned

What we know about Bitcoin: It's high volatility.

It's highest is $1200. Many are watching. It hasn't gone back down past $500 since the start of this madness.

Make best guesses with available information, hope you roll the dice right.

Yes but what started the madness was chinas version of google getting on board, now they have abandoned ship, so it should at least go back to $500, the thing is, I won't even consider a buy in until it hits $500.

People are buying in and selling out just a little faster right now.

I think the mean is around $350, getting in at that price would be amazing, if people are smart enough to let it fall that low.

D

Deleted member 1235

Unconfirmed Member

Yes but what started the madness was chinas version of google getting on board, now they have abandoned ship,

that isn't true. the banks are not allowed to trade in it. this is GOOD news. but the news did start the initial panic.

Chinese haven't given up buying it htough.

http://fiatleak.com/

D

Deleted member 13876

Unconfirmed Member

back down to 570. lol

So are you getting raging erections over this?

MikeHattsu

Member

Around $700 now. Quite the rollercoaster the last few days.

kurtrussell

Banned

I found my spare litecoin wallet and have a few more litecoin than I anticipated. I've sold a few on, but I still have around 5 - 6 left for sale at btc-e prices if anyone wants in.

PM me if you're interested!

LIkewise. Easy transaction and thanks for being patient

PM me if you're interested!

Want to leave positive feedback for kurtrussel, bought some LTC from him, super smooth transaction, great user - thanks so much!

LIkewise. Easy transaction and thanks for being patient

D

Deleted member 1235

Unconfirmed Member

crash over back to normal.... crazy stuff.

D

Deleted member 1235

Unconfirmed Member

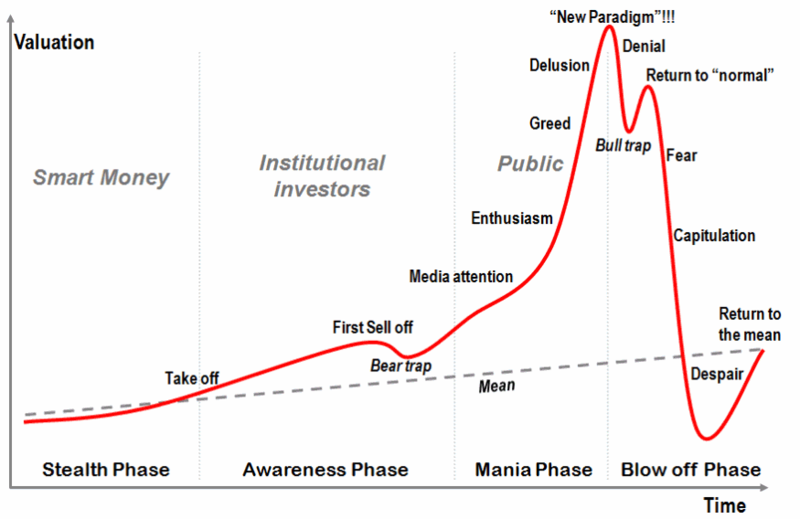

"Normal" on that chart is still run for the hills territory.

probably, but bitcoin has had like.... 5 of these now. Infact in the early days, 90% swings were the norm for this stuff.

Lilalaunebaer

Member

SteveWinwood

Member

crash over back to "normal".... crazy stuff.

.

Taco_Human

Member

BUY THEM ALL

Baraka in the White House

2-Terms of Kombat

Sometimes it's hard to remember that these are currencies we're talking about.

perfectchaos007

Member

Saw on Ron Paul's Facebook that he was going to discuss bitcoin on Fox News today. I missed it but I'm assuming he talked about Americans lack of faith and distrust in the greenback as reason for bitcoins success. Hopefully the interview shows up online later

RunWhiteBoyRun

Member

New to the whole BitCoin thing. Just amazed people need to buy drugs on the internet. Poor local distribution is to blame.

D

Deleted member 1235

Unconfirmed Member

New to the whole BitCoin thing. Just amazed people need to buy drugs on the internet. Poor local distribution is to blame.

it's not just drugs anymore, bitpay mitigates the risk entirely for sellers on the internet, they can sell something for 100bucks and somebody can pay in bitcoin, the seller will receive 100bucks. it's extremely low cost for them to implement and because of the savings they make on the fees (it's roughly 3% cheaper) they can pass that on to the consumer.

Now the consumer still has to take risk, but it's not that crazy. The biggest barrier to bitcoin doing 'better' currently is how hard it is to actually get them. If services like bitpay could also make it easier to get in on the ground floor for joe average, then the bitcoin price would probably go batshit higher again for a while.

there's continuous serious articles coming out from organisations like Merrill lynch

http://dealbook.nytimes.com/2013/12...china-and-an-endorsement-on-wall-street/?_r=0

the verge just ran a front page thing on it yesterday as well. Most of the news reports are semi positive and the only glaring negative they all mention is the volatility remaining a barrier from wide acceptance due to people wanting to hold for the value to increase.

We believe Bitcoin can become a major means of payment for e-commerce and may emerge as a serious competitor to traditional money transfer providers, said the report by Bank of America currency strategists led by David Woo. As a medium of exchange, Bitcoin has clear potential for growth, in our view.

I suppose it's easy to just disregard it all and call it tulips though. although tulips had a lot less demonstratable uses than bitcoin does.

it's not just drugs anymore, bitpay mitigates the risk entirely for sellers on the internet, they can sell something for 100bucks and somebody can pay in bitcoin, the seller will receive 100bucks. it's extremely low cost for them to implement and because of the savings they make on the fees (it's roughly 3% cheaper) they can pass that on to the consumer.

Now the consumer still has to take risk, but it's not that crazy. The biggest barrier to bitcoin doing 'better' currently is how hard it is to actually get them. If services like bitpay could also make it easier to get in on the ground floor for joe average, then the bitcoin price would probably go batshit higher again for a while.

there's continuous serious articles coming out from organisations like Merrill lynch

http://dealbook.nytimes.com/2013/12...china-and-an-endorsement-on-wall-street/?_r=0

the verge just ran a front page thing on it yesterday as well. Most of the news reports are semi positive and the only glaring negative they all mention is the volatility remaining a barrier from wide acceptance due to people wanting to hold for the value to increase.

I suppose it's easy to just disregard it all and call it tulips though. although tulips had a lot less demonstratable uses than bitcoin does.

Very interesting stuff. I still doubt whether this will go much further than speculation though.

D

Deleted member 1235

Unconfirmed Member

Very interesting stuff. I still doubt whether this will go much further than speculation though.

it already has... it's been around since 200...8 or 9 I think? the current bitcoin market is stable compared to the old days of 90% swings in one day, it's been a functioning 'currency' on blackmarkets for ages and has proved it's technical viability/security/hackproofishness over and over again.

it's only the last month ridiculous boom since china made things crazy that massive rampant speculation began on it. There is a fairly strong community of people behind it that want to see it as a functioning currency, it's getting a lot of mainstream notice/coverage and positive reviews as a viable payment method internationally.

Even if regular society rejects it, it's already a functioning and easy way to move currency between 2 people without the bullshit fees.

I'd already use it to send some cash to a buddy overseas. the exchanges have to be more accessible though or more services like bitonic.nl need to start springing up for their own countries.

Zaraki_Kenpachi

Member

lol... this is the kind of spectacle I mentioned in my last post

This just amazes me. More than a 10% difference between platforms

Even 10% is bullshit, it shows you how illiquid and just awful the trading system it has is. Could you imagine that big of a difference between exchanges for apple stock?

DownLikeBCPowder

Member

Very interesting stuff. I still doubt whether this will go much further than speculation though.

BTC is already on the way past speculation as far as I'm concerned. As an early adopter, the level of acceptance I'm seeing already is far more than I would have expected by now.. It may not be in every shop, but it will (should) rise in adoption faster than you'd think I expect.

Even 10% is bullshit, it shows you how illiquid and just awful the trading system it has is. Could you imagine that big of a difference between exchanges for apple stock?

There are actual reasons for the disparity, or at least have been very prominent in the past. Most of which had to do with liquidity or ease of access of fiat from the exchange in question (ie regulatory hurdles, extraction hurdles..). Let the market do its work.

Just because BTC-e is cheaper doesn't mean you're going to make money easily off the exchange rate at Gox. There are reasons behind this.. Eventually they will reach a sort of parity, but it is not being issued from a central bank and isn't (thank god) regulated or controlled. The disparity has nothing to do with BTC not being liquid in and of itself and everything to do with traditional fiat systems, an AML regulations, etc that it is, for the moment, tied to. Bitcoin is not a paper stock.

DownLikeBCPowder

Member

If Bitcoin was liquid arbitrage would quickly level out differences in rates.

It is particular exchanges and -their- liquidity (or roadblocks to liquidity, such as AML, etc) that is the issue.

Extra Sauce

Member

Buying virtual money off the Internet. What could possibly go wrong?

it's not just drugs anymore, bitpay mitigates the risk entirely for sellers on the internet, they can sell something for 100bucks and somebody can pay in bitcoin, the seller will receive 100bucks. it's extremely low cost for them to implement and because of the savings they make on the fees (it's roughly 3% cheaper) they can pass that on to the consumer.

Now the consumer still has to take risk, but it's not that crazy. The biggest barrier to bitcoin doing 'better' currently is how hard it is to actually get them. If services like bitpay could also make it easier to get in on the ground floor for joe average, then the bitcoin price would probably go batshit higher again for a while.

there's continuous serious articles coming out from organisations like Merrill lynch

http://dealbook.nytimes.com/2013/12...china-and-an-endorsement-on-wall-street/?_r=0

the verge just ran a front page thing on it yesterday as well. Most of the news reports are semi positive and the only glaring negative they all mention is the volatility remaining a barrier from wide acceptance due to people wanting to hold for the value to increase.

I suppose it's easy to just disregard it all and call it tulips though. although tulips had a lot less demonstratable uses than bitcoin does.

Exchange fees are usually 3%+ though, so savings in transaction fees only occur with multiple consecutive transactions in btc. This only works if sellers can buy raw materials or wholesale in btc. Does that happen anywhere outside of drugs?

There is also a tax evasion argument of course...

Fury Sense

Member

damn, back over a thousand. totally would have bought when it was under 700... like a 50% increase in under a week...

what happened today?Sex sells. (that's about today's events)

Decided to try out mining Litecoin for shits. Really wishing I would have gone with ATI video card now haha. Even at my 170-180 khash/s, I'll be far above electricity prices so we'll see. ATI equivalent of my GTX 760 can do somewhere around 500-600 khash/s though.

I decided to give this a shot just out of curiosity as well. My GTX 570 gets ~250 khash/s. It's actually pretty interesting stuff!