You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How much tax do you pay in your country?

- Thread starter OZ9000

- Start date

Fuck me, that is highway robbery. Where do you live?49,5%, its funny how its under 50% so u totally don't have the feeling u get the better deal out of this.

chromhound

Member

15% Minimum in Canada. But 50% on stock market gains ...

Kenpachii

Member

Fuck me, that is highway robbery. Where do you live?

Netherlands.

Platinumstorm

Member

It's a bit "complex" in the US because we tax at varying levels, and then we have ways to reduce your tax burden and/or defer your tax burden, and in some regards eliminate the tax burden entirely.

I oversimplified this in my own calculations, but about 23%.

This number isn't including what I deferred into retirement savings, nor what I had to blow up on medical expenses.

We also need to consider that the OP pays taxes into healthcare for himself and probably the olds, whereas we only pay healthcare in our taxes for the olds.

If we consider my employer based healthcare a tax [also considering the employer], that brings me to a rough calculation of 29%.

We also have employer based taxes that are not counted as part of an employee's taxes, but end up affecting compensation for employees, so that pushes an invisible tax rate to something that is closer to 40%

I oversimplified this in my own calculations, but about 23%.

This number isn't including what I deferred into retirement savings, nor what I had to blow up on medical expenses.

We also need to consider that the OP pays taxes into healthcare for himself and probably the olds, whereas we only pay healthcare in our taxes for the olds.

If we consider my employer based healthcare a tax [also considering the employer], that brings me to a rough calculation of 29%.

We also have employer based taxes that are not counted as part of an employee's taxes, but end up affecting compensation for employees, so that pushes an invisible tax rate to something that is closer to 40%

It's not 40% on all taxes. taxes are progressive.I live in the UK and I always felt the tax was too high.

I am paying 40% tax on all my income, and I feel I am being punished by working harder.

I'm curious how this compares to other countries?

AnotherOne

Member

Too damn much

fran.fernandez

Member

Japan. Around 24% . It goes up with you salary, start at 5% to 45%

Im ok with that, some times is better to decline a promotion to get more. Health system and other are prettyyyyy goood

Im ok with that, some times is better to decline a promotion to get more. Health system and other are prettyyyyy goood

sankt-Antonio

Banned

Germany, 42%, but its not all tax, a lot of it is mandatory social contributions.

The bad thing is, nearly half my wage is gone, the good thing is, Its pretty save here, everyone has healthcare, old people get some retirement money, smart people get higher education and people who are without jobs get something to live off of too.

All in all, a good deal imo.

Edit:

Since some of you have mentioned it, on top of this everything I buy in a store/online, as a non business peasant, has 19% VAT on it. Some commodities like gas even more...

The bad thing is, nearly half my wage is gone, the good thing is, Its pretty save here, everyone has healthcare, old people get some retirement money, smart people get higher education and people who are without jobs get something to live off of too.

All in all, a good deal imo.

Edit:

Since some of you have mentioned it, on top of this everything I buy in a store/online, as a non business peasant, has 19% VAT on it. Some commodities like gas even more...

Last edited:

StreetsofBeige

Gold Member

Ontario

- According to a tax calculator, 32% is deducted for income tax for my pay level (this includes some money for pension and EI)

- 13% tax on most things bought (some things are 0% or half that, but most are the full 13%). As a ballpark, I'll just say that I pay 10% on avg as a whole

- Property tax I pay is about 4% of my income (the gov uses a residential rate x government assessed value of property)

Total: 46% (using 32% +10% +4%). So around half my money is gone.

Side note

- Gas and booze have tons of tax. A case of 24 Heinekens goes for $57 (about $42 US). My car uses 91 octane gas which right now prices have cooled off but still about $1.70/L (about $4.75/gallon US). It used to be about $2.00/L last year

- Mortgage interest is not deductible. I think in the US it's partially or fully deductible

- It wont move the needle, but Canada is a tipping country. So every time you order food, take a taxi or Uber or eat at a restaurant that isnt a fast food joint, servers expect you to pay them 15-25% (on top of the taxed final price)

- Capital gains tax on investments is a one sided street. Without getting into all the nuances, you get taxed on 50% of your profits and are expected to pay up. But if your stock was a loser and you lost money on it, you dont get that back as a refund the same way. In fact, they never will. You can only apply that loss against a future winning stock pick as a countering investment loss credit. In other words, when you win the gov wants you to pay up asap. But when you got a loss, instead of paying you back the same way fast, they basically say they'll take it off your next bill (future winning pick). If you have a stock loss, but no future winning picks to apply it against then the tax loss credit sits there doing nothing

- And for all you Canucks who complain about not getting enough handouts or breaks in life, dont forget this you cheap asses. I snipped only the key stat parts of the article

nationalpost.com

nationalpost.com

Author of the article:

Published Oct 27, 2022

However, the report, which uses a tax simulation the Fraser Institute developed, says that the 20 per cent of Canadian families with an income of more than $227,486 actually pay 61.4 per cent of income taxes and 53 per cent of the country's total taxes. That would include taxes such as payroll tax, sales tax and property tax.

"High-income families already pay a disproportionately large share of all Canadian taxes," it says.

The bottom 20 per cent of families that earn less than $56,516 pay just 0.8 per cent of income taxes and 2.1 per cent of total taxes.

The middle 60 per cent of income earners, making between $56,517 and $227,486, pay 37.8 per cent of Canada's total income taxes, and 45 per cent of the nation's total taxes.

- According to a tax calculator, 32% is deducted for income tax for my pay level (this includes some money for pension and EI)

- 13% tax on most things bought (some things are 0% or half that, but most are the full 13%). As a ballpark, I'll just say that I pay 10% on avg as a whole

- Property tax I pay is about 4% of my income (the gov uses a residential rate x government assessed value of property)

Total: 46% (using 32% +10% +4%). So around half my money is gone.

Side note

- Gas and booze have tons of tax. A case of 24 Heinekens goes for $57 (about $42 US). My car uses 91 octane gas which right now prices have cooled off but still about $1.70/L (about $4.75/gallon US). It used to be about $2.00/L last year

- Mortgage interest is not deductible. I think in the US it's partially or fully deductible

- It wont move the needle, but Canada is a tipping country. So every time you order food, take a taxi or Uber or eat at a restaurant that isnt a fast food joint, servers expect you to pay them 15-25% (on top of the taxed final price)

- Capital gains tax on investments is a one sided street. Without getting into all the nuances, you get taxed on 50% of your profits and are expected to pay up. But if your stock was a loser and you lost money on it, you dont get that back as a refund the same way. In fact, they never will. You can only apply that loss against a future winning stock pick as a countering investment loss credit. In other words, when you win the gov wants you to pay up asap. But when you got a loss, instead of paying you back the same way fast, they basically say they'll take it off your next bill (future winning pick). If you have a stock loss, but no future winning picks to apply it against then the tax loss credit sits there doing nothing

- And for all you Canucks who complain about not getting enough handouts or breaks in life, dont forget this you cheap asses. I snipped only the key stat parts of the article

Top 20 per cent pay 61 per cent of Canada's income taxes, 'more than their share': study

They also pay 53 per cent of the country's total taxes. Read more to find out how this compares to their income and to other Canadians

Top 20 per cent pay 61 per cent of Canada's income taxes, 'more than their share': study

'High-income families already pay a disproportionately large share of all Canadian taxes,' according to a new report from the Fraser InstituteAuthor of the article:

Published Oct 27, 2022

However, the report, which uses a tax simulation the Fraser Institute developed, says that the 20 per cent of Canadian families with an income of more than $227,486 actually pay 61.4 per cent of income taxes and 53 per cent of the country's total taxes. That would include taxes such as payroll tax, sales tax and property tax.

"High-income families already pay a disproportionately large share of all Canadian taxes," it says.

The bottom 20 per cent of families that earn less than $56,516 pay just 0.8 per cent of income taxes and 2.1 per cent of total taxes.

The middle 60 per cent of income earners, making between $56,517 and $227,486, pay 37.8 per cent of Canada's total income taxes, and 45 per cent of the nation's total taxes.

Last edited:

NeoIkaruGAF

Gold Member

In Italy it's somewhere between 40% to more than 50% of your income all considered.

Which would be somewhat acceptable if we had services comparable to other countries that have taxes this high, but we don't and we all know a lot (a LOT) of it just feeds various degrees of corruption.

Which would be somewhat acceptable if we had services comparable to other countries that have taxes this high, but we don't and we all know a lot (a LOT) of it just feeds various degrees of corruption.

deriks

4-Time GIF/Meme God

Brazil; it's weird how taxes work here because every type of product has a number, and services also has a number, and there other stuff... but I guess we can put 34% with official data from the country

www.gov.br

www.gov.br

We are poor, and we have state high ups getting paid like too much. It's just not fair

Ministério da Economia

Portal institucional do Ministério da Economia. Aqui você encontra informações e serviços oferecidos pelo Ministério da Economia para o cidadão brasileiro.

We are poor, and we have state high ups getting paid like too much. It's just not fair

Iced Arcade

Member

Canadian here so I lost count. Taxes on taxes paid with taxed dollars etc

T.v

Gold Member

Add to that the various other taxes we have to pay and I'd say the number is at least 60%. Health insurance goes up every year as well even though we get less coverage, because they squander money on dumb shit. And I'm not even going to mention every other cost rising at a ridiculous speed.Netherlands.

chromhound

Member

They might taxe you on C02 soonIm in europe, so a fucking lot. At levels that are straight up theft and confiscation. At least my farts aren't taxed (yet).

Mr Reasonable

Completely Unreasonable

Couple of things, as noted above by B Blade2.0 , taxation is progressive.I live in the UK and I always felt the tax was too high.

I am paying 40% tax on all my income, and I feel I am being punished by working harder.

I'm curious how this compares to other countries?

In the UK nobody pays any tax on the first £12,750 they earn. Then you pay 20% on everything over £12,750 but less than £50,270.

Between £50,270 and £150,000 you pay 40%. After £150,000 you pay 45%.

If you're earning £51k, you'll only pay 40% on £730 of your earnings and you'll pay 20% on about £37k of your earnings, and nothing on the remainder.

If you're squarely in the 1% of the UK's top earners and are earning something like £20k a week then some of your earnings will be taxed at 45% keep increasing your income and that share will start to overshadow those lower brackets and you'll start paying an overall 40%b once you're earning something like half a million a year.

So if you're on £20k a week, congratulations, I hope you're managing to scrape by on the £1,700 after tax that you get 365 days of the year (worth noting that UK average monthly pay is £1,950).

That is true although I am almost taxed 50% (40% income tax, remainder national insurance) on some of my income. I receive two separate payslips per month and I am losing a notable amount of money per month.Couple of things, as noted above by B Blade2.0 , taxation is progressive.

In the UK nobody pays any tax on the first £12,750 they earn. Then you pay 20% on everything over £12,750 but less than £50,270.

Between £50,270 and £150,000 you pay 40%. After £150,000 you pay 45%.

If you're earning £51k, you'll only pay 40% on £730 of your earnings and you'll pay 20% on about £37k of your earnings, and nothing on the remainder.

If you're squarely in the 1% of the UK's top earners and are earning something like £20k a week then some of your earnings will be taxed at 45% keep increasing your income and that share will start to overshadow those lower brackets and you'll start paying an overall 40%b once you're earning something like half a million a year.

So if you're on £20k a week, congratulations, I hope you're managing to scrape by on the £1,700 after tax that you get 365 days of the year (worth noting that UK average monthly pay is £1,950).

Worst yet, your personal allowance dwindles for income over £100k, and no PA if you earn £125k or more.

edit: A quick calculation shows I pay 41% total (PAYE + NI) on my total income. 35% would be a fairer figure.

Last edited:

Denton

Banned

Would be nice if people included ALL the tax, incl. VAT and everything.

When counting everything, I give around 62% of what I earn to government every month in Czechland. This includes the social and healthcare "insurance" (which is just a tax by a different name) that funds current pensioners and state healthcare. And the state provided service is of course of low quality, since there is no competition and no incentive to improve.

This realization made me a liberal (or libertarian, or whatever the fuck word is for someone who wants smaller, cheaper and less intrusive government). Well this, and reading some economics books (Economics in one lesson by Henry Hazlitt in particular).

When counting everything, I give around 62% of what I earn to government every month in Czechland. This includes the social and healthcare "insurance" (which is just a tax by a different name) that funds current pensioners and state healthcare. And the state provided service is of course of low quality, since there is no competition and no incentive to improve.

This realization made me a liberal (or libertarian, or whatever the fuck word is for someone who wants smaller, cheaper and less intrusive government). Well this, and reading some economics books (Economics in one lesson by Henry Hazlitt in particular).

Last edited:

GnomeChimpsky

Member

Same. Didn't use to mind it either but when the public sector starts breaking down you're just paying a lot of money for shit service.Sweden - 34% on salary, 12% food VAT, 50% on luxury goods, too much on gas - would not mind it one bit, but the last 25 years have shown that the money is just being wasted on the wrong things.

I would prefer to keep more myself and fixup my own living better.

Mr Reasonable

Completely Unreasonable

N/a

Last edited:

Tams

Member

Around 40% seems the norm.

Which I honestly don't think is too bad considering how much the state offers and for some things no private company could offer, especially if it is a progressive tax. Taxes help keep society together. Perhaps you don't benefit from them as much if you are wealthy, but people you depend on do far more. And if their lives end up too shitty, then services that you enjoy will suffer or cease to exist.

To the Libertarians out there (and no, this isn't political), I suggest you read "A Libertarian Walks Into a Bear: The Utopian Plot to Liberate an American Town (And Some Bears)" by Matthew Hongoltz-Hetling.

Surely that's not including health insurance (and covers 70% of the cost) and state pension?

Which I honestly don't think is too bad considering how much the state offers and for some things no private company could offer, especially if it is a progressive tax. Taxes help keep society together. Perhaps you don't benefit from them as much if you are wealthy, but people you depend on do far more. And if their lives end up too shitty, then services that you enjoy will suffer or cease to exist.

To the Libertarians out there (and no, this isn't political), I suggest you read "A Libertarian Walks Into a Bear: The Utopian Plot to Liberate an American Town (And Some Bears)" by Matthew Hongoltz-Hetling.

Japan. Around 24% . It goes up with you salary, start at 5% to 45%

Im ok with that, some times is better to decline a promotion to get more. Health system and other are prettyyyyy goood

Surely that's not including health insurance (and covers 70% of the cost) and state pension?

Last edited:

Mr Reasonable

Completely Unreasonable

That is true although I am almost taxed 50% (40% income tax, remainder national insurance) on some of my income. I receive two separate payslips per month and I am losing a notable amount of money per month.

Worst yet, your personal allowance dwindles for income over £100k, and no PA if you earn £125k or more.

edit: A quick calculation shows I pay 41% total (PAYE + NI) on my total income. 35% would be a fairer figure.

What's your annual salary? I wouldn't ask but you seem quite comfortable talking about it.

Last edited:

Mr Reasonable

Completely Unreasonable

Yeah, I always think that people who are doing well and are resentful of having to pay into the system that has enabled their success are either not seeing the big picture or have a distorted view of how much they would achieve in other circumstances.Around 40% seems the norm.

Which I honestly don't think is too bad considering how much the state offers and for some things no private company could offer, especially if it is a progressive tax.

I don't think I have benefited from the system in any meaningful way. My university fees were extortionate.Yeah, I always think that people who are doing well and are resentful of having to pay into the system that has enabled their success are either not seeing the big picture or have a distorted view of how much they would achieve in other circumstances.

I am however a little annoyed at how I am paying for a lot of people who are capable of working but choose to coast along life without any meaningful contribution to society. This does not apply to those who are physically disabled for example.

Next year if I continue working at my current pace I'd expect to be at the threshold where I will have no personal allowance. However I am feeling the cost of living crisis despite my current wage.What's your annual salary? I wouldn't ask but you seem quite comfortable talking about it.

Last edited:

Mr Reasonable

Completely Unreasonable

Of course you benefitted. If you were born in the UK, before you were even born you'd have been benefiting from the structures and systems that are paid for with taxation. There are countries where people don't get antenatal care or can't access healthcare for even the most serious if conditions or countries where getting vaccinated against deadly disease doesn't reach even 20% of children. You probably went to a school paid for by the state. Your life was probably generally kept safe and stable owing to security services, justice and policing. Etc. Etc. Etc.I don't think I have benefited from the system in any meaningful way. My university fees were extortionate.

I am however a little annoyed at how I am paying for a lot of people who are capable of working but choose to coast along life without any meaningful contribution to society. This does not apply to those who are physically disabled for example.

You can trace it further too, the people who understand the opportunity the country offered and chose to set up business in this country or choose to live here because it has a generally good standard of living. They are all contributing to the way the country works and what the country is.

Unfortunately for you, you don't get to opt out of part of it, you take all the good stuff and pay into the system or you try and make a go of it elsewhere.

Good luck!

Tams

Member

It goes beyond just you.I don't think I have benefited from the system in any meaningful way. My university fees were extortionate.

I am however a little annoyed at how I am paying for a lot of people who are capable of working but choose to coast along life without any meaningful contribution to society. This does not apply to those who are physically disabled for example.

Next year if I continue working at my current pace I'd expect to be at the threshold where I will have no personal allowance. However I am feeling the cost of living crisis despite my current wage.

- You directly benefit from a lot. From infrastructure to education.

- Indirectly you benefit too. That food you buy at the supermarket? It was delivered by a lorry that travelled along roads that the government (and therefore people through taxes) paid for.

- Further, other people benefiting from government help make your life better. That person who stack those supermarket selves not having to worry about healthcare? Yeah, they do a better job as a result.

fran.fernandez

Member

That's is including health insurance and state pension !Around 40% seems the norm.

Which I honestly don't think is too bad considering how much the state offers and for some things no private company could offer, especially if it is a progressive tax. Taxes help keep society together. Perhaps you don't benefit from them as much if you are wealthy, but people you depend on do far more. And if their lives end up too shitty, then services that you enjoy will suffer or cease to exist.

To the Libertarians out there (and no, this isn't political), I suggest you read "A Libertarian Walks Into a Bear: The Utopian Plot to Liberate an American Town (And Some Bears)" by Matthew Hongoltz-Hetling.

Surely that's not including health insurance (and covers 70% of the cost) and state pension?

It also include the employment (when u get fired )

Does not include the resident one, depends where u live but maybe around 5%?

I also get deduction for kids and wife, there's a tax for owning a house (I pay around 1800 year, downtown Osaka)

But salary here are not good compared to western.

Last edited:

Fortunately there are legal loopholes which allow you to pay less slightly tax which I fully intend to make use of next year.Of course you benefitted. If you were born in the UK, before you were even born you'd have been benefiting from the structures and systems that are paid for with taxation. There are countries where people don't get antenatal care or can't access healthcare for even the most serious if conditions or countries where getting vaccinated against deadly disease doesn't reach even 20% of children. You probably went to a school paid for by the state. Your life was probably generally kept safe and stable owing to security services, justice and policing. Etc. Etc. Etc.

You can trace it further too, the people who understand the opportunity the country offered and chose to set up business in this country or choose to live here because it has a generally good standard of living. They are all contributing to the way the country works and what the country is.

Unfortunately for you, you don't get to opt out of part of it, you take all the good stuff and pay into the system or you try and make a go of it elsewhere.

Good luck!

But if we count tax on all aspects of life

- income tax

- property tax/council tax (I have the highest council tax banding in the country which is absolutely shit)

- VAT

- inheritance tax

- capital gains tax

For the vast majority, life is a suckers game.

Last edited:

I'm guessing it's around 50% for me in the US but that's a guess. I mean there's income tax, both federal and state and fica taxes. Beyond that local property tax, sales tax, and of course gas taxes. (Gas is both federal and state.) Of course a lot of people around here move up to New Hampshire and trade the income tax for a state property tax. (A lot fewer services but I guess the tax burden is lower.) Of course there's the question of should the feds be involved with taxes for things like education and roads or should that be done solely at the state level. (Admittedly it's even harder to calculate this year because the state had a budget surplus so I got an additional refund a month ago.)

Georges Chiellins

Member

None in my country, none where I reside.

Got lucky enough to find a way around it.

Got lucky enough to find a way around it.

Ziglax

Member

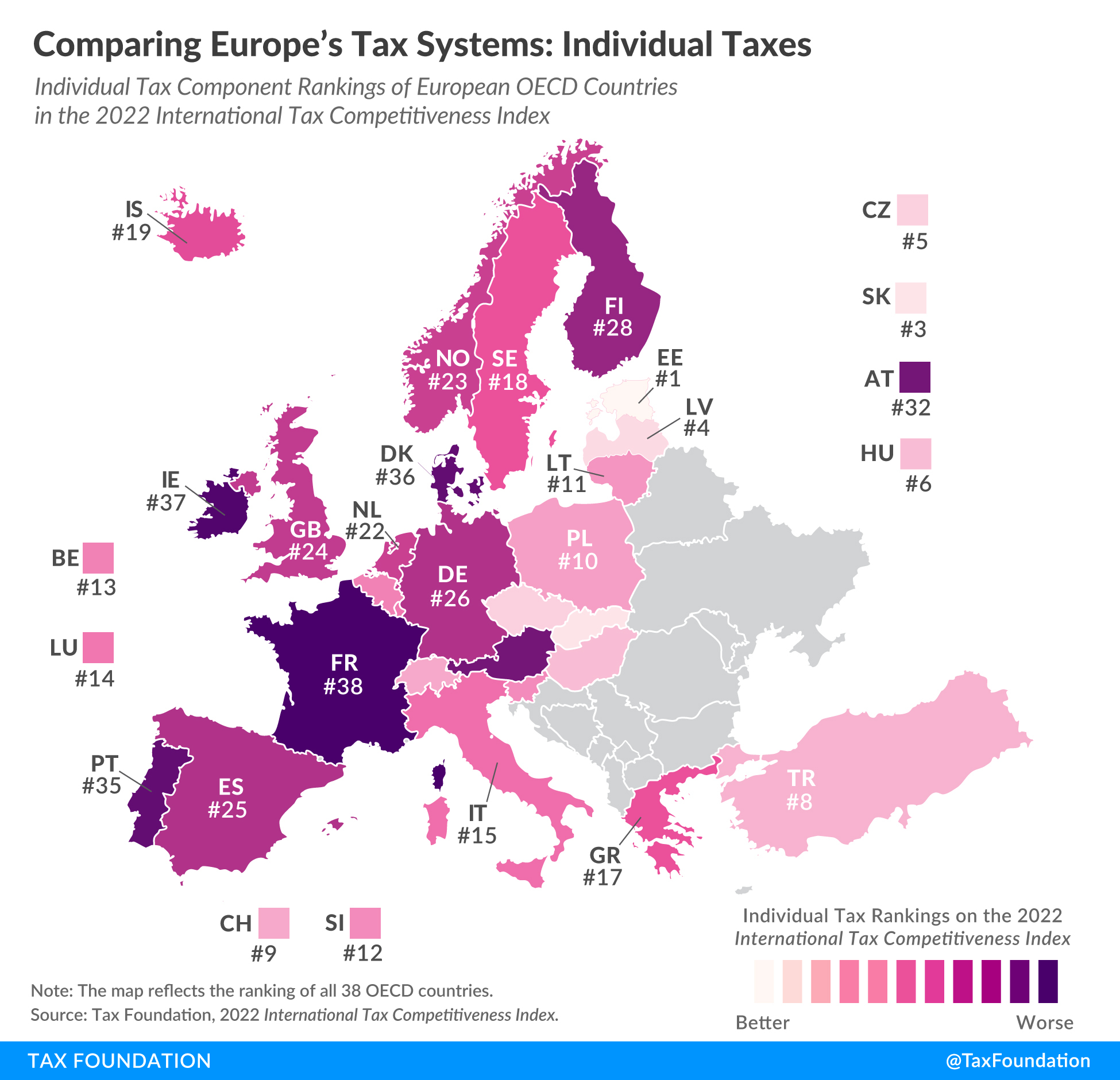

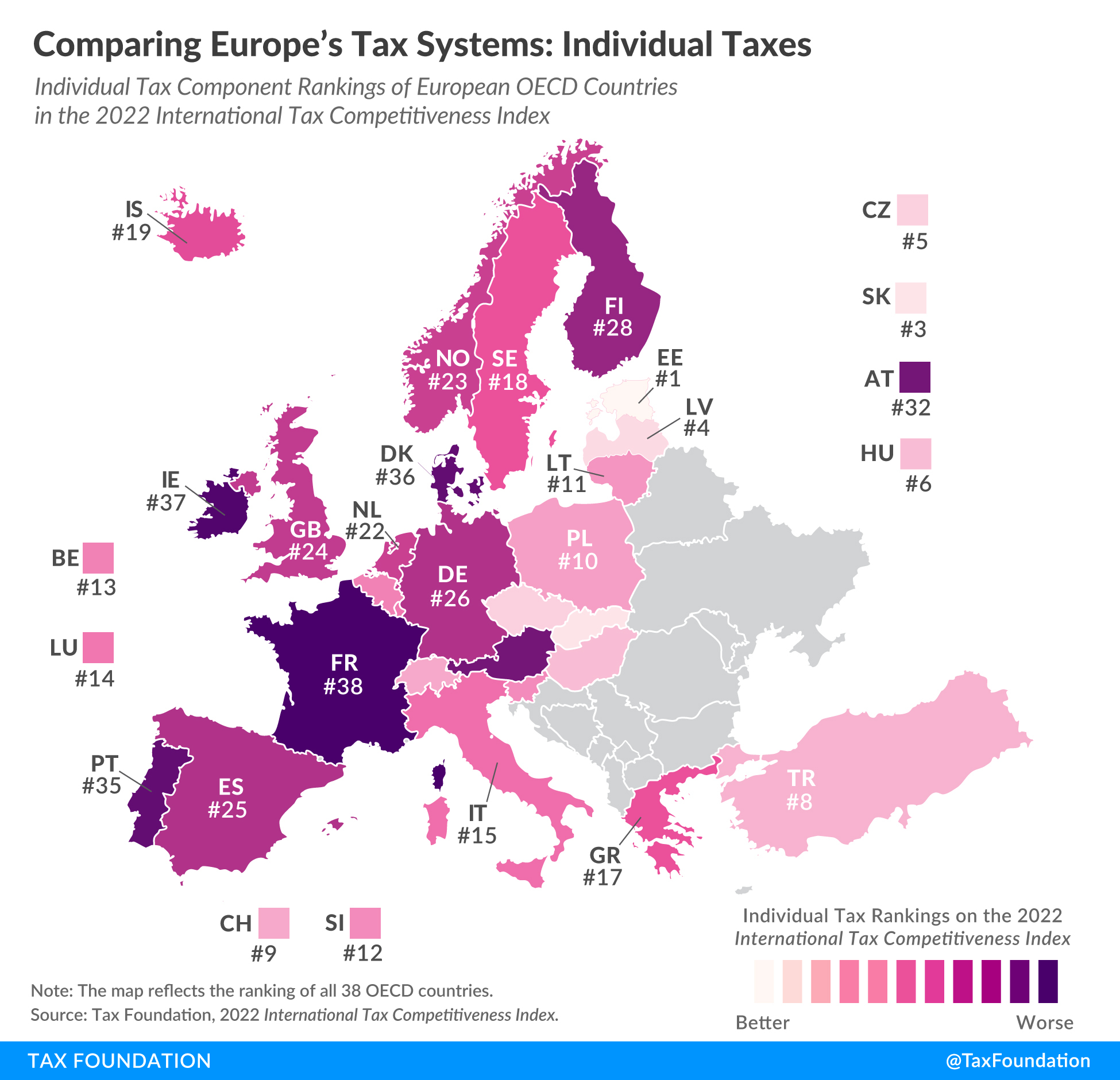

I've found this website usefull for comparing taxes : https://taxfoundation.org/global-tax-maps/

According to this site's indicator, taxes in France suck. I suppose I can only agree, when you work and start earning a bit more money than average, it feels like theft, to the point of wondering if working harder, or working at all, is actually worth it.

Meanwhile the weathlier pay much less taxes on capital and get richer without doing anything.

According to this site's indicator, taxes in France suck. I suppose I can only agree, when you work and start earning a bit more money than average, it feels like theft, to the point of wondering if working harder, or working at all, is actually worth it.

Meanwhile the weathlier pay much less taxes on capital and get richer without doing anything.