Manos: The Hans of Fate

Banned

Azih said:The drive towards greater regulation of the financial industry is incredibly real and incredibly necessary.

Regulations such as ????

Azih said:The drive towards greater regulation of the financial industry is incredibly real and incredibly necessary.

Karma Kramer said:

Manos: The Hans of Fate said:Regulations such as ????

Xyrmellon said:Sorry, but you can't post a quote or link from Media Matters and expect it to be taken seriously. That site is radically partisan. It's just like if I posted from Foxnews or Brietbart, I would be laughed out of here. So am I saying I don't believe them? Yeah, that's what I'm saying...I am much more inclined to believe the New York Times version.

Krugman: "The Supposedly High-Risk Loans That [Fannie And Freddie] Were Making Or Buying Were, Demonstrably, Not Actually High-Risk." In a blog post, Nobel Prize winning economist Paul Krugman praised Min's report as "a terrific takedown of the claim that Fannie and Freddie caused the housing bubble." Krugman also wrote: "Every time you hear or read someone claiming that Fannie and Freddie were responsible for large amounts of subprime/risky lending, you should remember that this is based on essentially phony numbers: people at AEI invented their own definition of subprime, which isn't the standard definition, and, more important, doesn't work: the supposedly high-risk loans that F&F were making or buying were, demonstrably, not actually high-risk[.]"

Xyrmellon said:Sorry, but you can't post a quote or link from Media Matters and expect it to be taken seriously. That site is radically partisan. It's just like if I posted from Foxnews or Brietbart, I would be laughed out of here. So am I saying I don't believe them? Yeah, that's what I'm saying...I am much more inclined to believe the New York Times version.

dave is ok said:This is like saying the root cause of the forest fire was a match, so we should make it harder to buy matches

You're wrong. The mortgages by themselves weren't the problem. It was the fact that they were packed together, securitized, rated AAA and sold as sound investments to municipal pension accounts and other "safe" investmentsHasphat'sAnts said:What a terrible analogy.

Guess what? Even if all the "Wall Street crooks" weren't working in Wall Street, and the SEC, the Treasury, the Fed were run by your lovely people who were in no way affiliated with Wall Street. Bear, Lehman, AIG would still have happened because these mortgages were toxic assets.

dave is ok said:You're wrong. The mortgages by themselves weren't the problem. It was the fact that they were packed together, securitized, rated AAA and sold.

Karma Kramer said:Not inclined to agree with Paul Krugman?

Xyrmellon said:Nope.

Karma Kramer said:

Manos: The Hans of Fate said:Ones proposed by the OWS people, not by a think tank.

The shitty mortgages were packaged with not-so-shitty ones. They divided them into what was called 'tranches' and the people who always paid their mortgage on time with a 790 credit score were the top tranche, the dude who put no money down on his 300k mortgage and was given the mortgage by a scummy bank who told him his ARM would stay at 2% was in the lowest tranche.ToxicAdam said:What helped them be rated AAA? What would give a ratings group the confidence to attach a AAA rating to them?

dave is ok said:You're wrong. The mortgages by themselves weren't the problem. It was the fact that they were packed together, securitized, rated AAA and sold as sound investments to municipal pension accounts and other "safe" investments

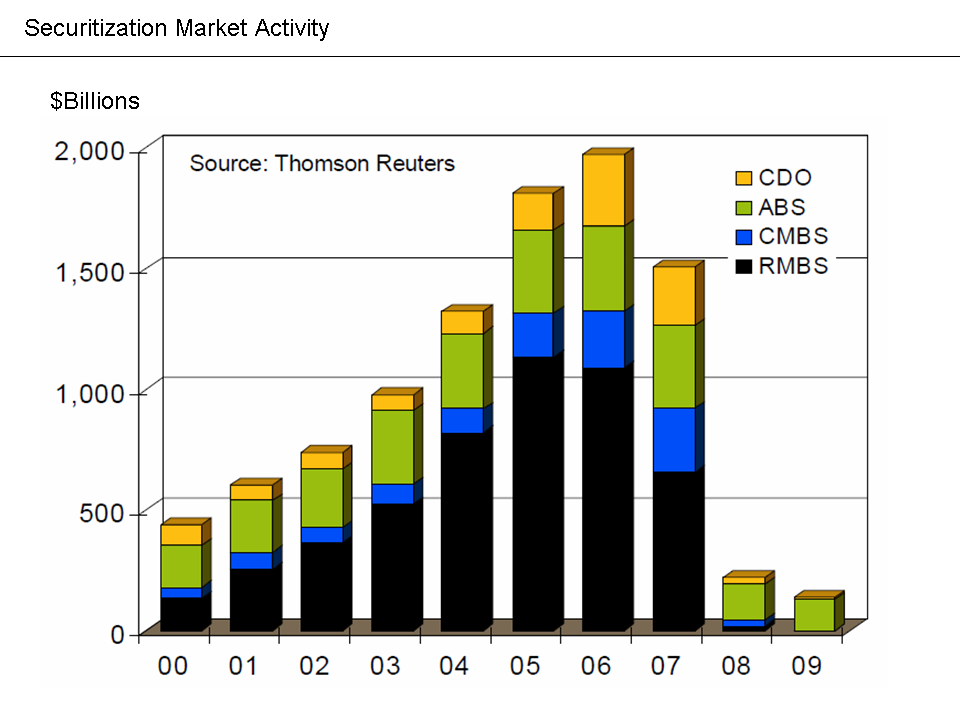

To act like these types of CDOs were being issued at a high volume for two decades is being dishonest.Hasphat'sAnts said:If it weren't for the delusion that housing prices would rise forever, if it weren't for the toxic mortgages that fed into these CDOs, these securities would have been AAA.

The first asset backed security was issued in 1984 by the guys at BofA and Salomon Brothers. It's worked for more than 2 decades. Now ask yourself, why did it stop working now?

What are the regulations and proposal's being suggested by OWS protesters?Karma Kramer said:what?

Karma Kramer said:He writes for the NYTs

Manos: The Hans of Fate said:What are the regulations and proposal's being suggested by OWS protesters?

The drive towards greater regulation of the financial industry is incredibly real and incredibly necessary.

Regulations such as ????

Xyrmellon said:Op-eds.

dave is ok said:To act like these types of CDOs were being issued at a high volume for two decades is being dishonest.

CDO issuance grew from an estimated $20 billion in Q1 2004 to over $180 billion by Q1 2007

Very very bad incentives combined with the opaque-to-fundamentals nature of the CDO elevated it as a vehicle for endemic fraud.Hasphat'sAnts said:If it weren't for the delusion that housing prices would rise forever, if it weren't for the toxic mortgages that fed into these CDOs, these securities would have been AAA.

The first asset backed security was issued in 1984 by the guys at BofA and Salomon Brothers. It's worked for more than 2 decades. Now ask yourself, why did it stop working now?

http://gothamist.com/2011/10/13/protesters_refuse_to_leave_zuccotti.php

After Mayor Bloomberg briefly visited the Occupy Wall Street encampment in Zuccotti Park last night, his office released a statement formally ordering the protesters to cooperate with sanitation workers who will be dispatched to clean the park on Friday. "The cleaning will be done in stages," the announcement reads, "and the protesters will be able to return to the areas that have been cleaned, provided they abide by the rules that Brookfield has established for the park." But the demonstrators, who have been occupying the park for almost four weeks, aren't buying it. Instead, they're going to clean the park themselves.

Their declaration reads:

On Wednesday/Thursday, all campers/supporters should reach out to friends/family/anyone to donate or purchase brooms, mops, squeegees, dust pans, garbage bags, power washers and any other cleaning supplies to be collected at sanitation. The sanitation committee should move full-speed ahead on purchase of bins allocated by consensus at GA.

After General Assembly on Thursday, we'll have a full-camp cleanup session. Sanitation can coordinate, and anyone who is available will help with the massive community effort! Then, Friday morning, we'll awake and position ourselves with our brooms and mops in a human chain around the park, linked at the arms. If NYPD attempts to enter, we'll peacefully/non-violently stand our ground and those who are willing will get arrested.

Afterwards, we'll march with brooms and mops to Wall Street to do a massive #wallstcleanup march, where the real mess is!

It seems unlikely the city will go along with this compromise. Brookfield Properties, which owns the park, recently sent a letter to the NYPD explaining, "Brookfield protocol and practice is to clean the park on a daily basis, power-washing it each weeknight, and to perform necessary inspection, maintenance, and repairs on a regular, as-needed basis. Since the occupation began, we have not been able to perform basic cleaning and maintenance activity, let alone perform more basic repairs. For example, if the lenses to the underground lighting have become cracked, water could infiltrate the electrical system, putting occupants of the Park at risk of an electrical hazard or causing short-circuiting which result in repairs requiring the Park to be be torn apart for rewiring."

The letter goes on to add that any such repairs would require the park to be closed for "indeterminate periods of time." Brookfield wants the NYPD to facilitate clearing the park for cleaning, and, tellingly, to "assist Brookfield in an ongoing basis to ensure the safety of all those using and enjoying the Park." This could mean that when the demonstrators are allowed back in the park after the cleaning, the NYPD could start enforcing the park rules which Brookfield disseminated among protesters two weeks ago.

These rules explicitly prohibit tarps, sleeping bags, storage of personal property on the ground, lying down on the ground, and lying down on benches. It's conceivable that the NYPD could prohibit protesters from returning to the park with such items, which are necessary to sustain any long term encampment. It's unclear if this is the unstated intention behind this official cleaning, but naturally the protesters have little trust in the NYPD and city government, and they're bracing for a confrontation.

Karma Kramer said:I was responding to your question...

you want me to find OWS protestors who go over financial deregulation of the last 30 years... to prove what point exactly?

Azih said:Yeah and the nature of scholarships is that very few students get them.

Look the point that a lot of people are carrying dumb debt is perfectly valid. Buying stupid shit on credit cards is no one's fault but the buyers (though I would point out that society encourages this kind of crazy behavior as the economy has grown dependent on this insane behaviour. Remember Bush's exhortation to the American people wasn't "We must sacrifice" but "Keep Shopping!").

That does not detract *at all* from the fact though that for most people getting a decent education is absurdly expensive, that any sort of a medical emergency can destroy a families finances even if they have insurance and are careful with their budget etc.

Azih said:That people bought houses they couldn't afford was their fault (though it was encouraged by financial advisors that people rely on).

That the economy was running on billions and billions of dollars of bad debt that were packaged up in such a way that they could be rated 'safe' and that rating was used to then spread the bad debt around to infect almost everything was completely the fault of the Banks and other financial institutions.

dave is ok said:I assume you already knew this but I'm not quite sure what your point is or how this vindicates the bank and puts the blame on the homeowner

dave is ok said:You're wrong. The mortgages by themselves weren't the problem. It was the fact that they were packed together, securitized, rated AAA and sold as sound investments to municipal pension accounts and other "safe" investments

Not really.Anabuhabkuss said:The ARMS were heavily sold in the late 90s and early 2000s. You literally can not have bad backed mortgage securities without bad mortgages to begin with! The securities industry got greedy after they saw how much money the banks were making. (I'm an investment advisor, FYI).

Manos: The Hans of Fate said:I said I want to hear their proposals. You seem to be implying that they don't know what they are protesting about.

The drive towards greater regulation of the financial industry is incredibly real and incredibly necessary.

Regulations such as ????

Ones proposed by the OWS people, not by a think tank.

Manos: The Hans of Fate said:http://gothamist.com/2011/10/13/prot...e_zuccotti.php

After Mayor Bloomberg briefly visited the Occupy Wall Street encampment in Zuccotti Park last night, his office released a statement formally ordering the protesters to cooperate with sanitation workers who will be dispatched to clean the park on Friday. "The cleaning will be done in stages," the announcement reads, "and the protesters will be able to return to the areas that have been cleaned, provided they abide by the rules that Brookfield has established for the park." But the demonstrators, who have been occupying the park for almost four weeks, aren't buying it. Instead, they're going to clean the park themselves.

Their declaration reads:

On Wednesday/Thursday, all campers/supporters should reach out to friends/family/anyone to donate or purchase brooms, mops, squeegees, dust pans, garbage bags, power washers and any other cleaning supplies to be collected at sanitation. The sanitation committee should move full-speed ahead on purchase of bins allocated by consensus at GA.

After General Assembly on Thursday, we'll have a full-camp cleanup session. Sanitation can coordinate, and anyone who is available will help with the massive community effort! Then, Friday morning, we'll awake and position ourselves with our brooms and mops in a human chain around the park, linked at the arms. If NYPD attempts to enter, we'll peacefully/non-violently stand our ground and those who are willing will get arrested.

Afterwards, we'll march with brooms and mops to Wall Street to do a massive #wallstcleanup march, where the real mess is!

It seems unlikely the city will go along with this compromise. Brookfield Properties, which owns the park, recently sent a letter to the NYPD explaining, "Brookfield protocol and practice is to clean the park on a daily basis, power-washing it each weeknight, and to perform necessary inspection, maintenance, and repairs on a regular, as-needed basis. Since the occupation began, we have not been able to perform basic cleaning and maintenance activity, let alone perform more basic repairs. For example, if the lenses to the underground lighting have become cracked, water could infiltrate the electrical system, putting occupants of the Park at risk of an electrical hazard or causing short-circuiting which result in repairs requiring the Park to be be torn apart for rewiring."

The letter goes on to add that any such repairs would require the park to be closed for "indeterminate periods of time." Brookfield wants the NYPD to facilitate clearing the park for cleaning, and, tellingly, to "assist Brookfield in an ongoing basis to ensure the safety of all those using and enjoying the Park." This could mean that when the demonstrators are allowed back in the park after the cleaning, the NYPD could start enforcing the park rules which Brookfield disseminated among protesters two weeks ago.

These rules explicitly prohibit tarps, sleeping bags, storage of personal property on the ground, lying down on the ground, and lying down on benches. It's conceivable that the NYPD could prohibit protesters from returning to the park with such items, which are necessary to sustain any long term encampment. It's unclear if this is the unstated intention behind this official cleaning, but naturally the protesters have little trust in the NYPD and city government, and they're bracing for a confrontation.

Oh, I think they deserve plenty of blame. All of the big player mortgage banks do.ToxicAdam said:Before I spend pages dancing around this topic, I just want to know if you feel that F&F played little or no part in the housing bubble and resulting financial crisis that insued?

Because that's my position, they deserve blame as much as the big banks do, as much as the credit rating agencies, as much as the smaller banks who gave the loans to the developers to build up inventories.

Menelaus said:Apparently I'm not as crazy as some people on here would like to believe...

Karma Kramer said:No, you seem more interested in debunking this movement then contributing or educating yourself.

You aren't interested in facts or real issues, but whether or not these facts have been clearly conveyed to the masses through media which can be and often is opposed to regulation/corporate taxation.

Overall though, I feel like you keep repeating yourself throughout this thread. Its becoming quite nauseating.

Wall Street organized to kill itself?empty vessel said:It seems kind of odd to blame debtors for a systemic failure organized by Wall Street.

"As much" is a useless quantification. Precisely as much? If you're implying precision, by what measure? Their share of responsibility for dollars lost in the bust, or something else? If it is "share of dollars lost" how on earth is that measured? Do you have access to an alternate universe in which Fannie and Freddie followed different policies that show their impact?ToxicAdam said:Before I spend pages dancing around this topic, I just want to know if you feel that F&F played little or no part in the housing bubble and resulting financial crisis that insued?

Because that's my position, they deserve blame as much as the big banks do, as much as the credit rating agencies, as much as the smaller banks who gave the loans to the developers to build up inventories.

What you talking about being in denial? Dude has two scholarships. I'm pretty sure if you went to wall street and said "How's about we give everyone two scholarships?!" they'd be cool with that.Menelaus said:Apparently I'm not as crazy as some people on here would like to believe...

Subprime Mortgages are what led to the crisis. Many of them were ARMs. I know the difference, thanks.sangreal said:ARM and Subprime aren't synonyms.

RSTEIN said:Wall Street organized to kill itself?

Karma Kramer said:He won a Nobel Prize?

Care to provide me with your credible sources on the 2008 market crash?

If my using the term 'securities' is offending you somehow, replace it in your mind with 'mortgage backed securities'Anabuhabkuss said:Dave, not sure how or why you think the securities market was booming in 2004/2005? We were rebounding from a recession

Wikipedia said:The total amount of mortgage-backed securities issued almost tripled between 1996 and 2007, to $7.3 trillion. The securitized share of subprime mortgages (i.e., those passed to third-party investors via MBS) increased from 54% in 2001, to 75% in 2006. A sample of 735 CDO deals originated between 1999 and 2007 showed that subprime and other less-than-prime mortgages represented an increasing percentage of CDO assets, rising from 5% in 2000 to 36% in 2007

Wasn't that the whole issue with Graham-Leach-Bliley Act? It removed the barriers between deposit banks and investment banks allowing the creation of conglomerates like Citigroup?Anabuhabkuss said:Dave, not sure how or why you think the securities market was booming in 2004/2005? We were rebounding from a recession but the sentiment is still noted. Unless I'm confused, your original position is that banks are at fault for this crisis, correct? You know the securities industry and the banking industry are not one and the same, yeah?

RSTEIN said:Wall Street organized to kill itself?

Menelaus said:Apparently I'm not as crazy as some people on here would like to believe...

lol, true. Not dead, no. But definitely zombiefied.jorma said:if Wall Street is dead, why we still got protestors?

Anabuhabkuss said:You remove the political factors from the equation. This also includes involvement with the credit agencies. McCain has already discussed this topic in great detail. Also, here's a good article from my favorite site:

http://www.investopedia.com/article...e-freddie-mac-credit-crisis.asp#axzz1ag3vYIBJ

Conclusion: The U.S. Congress is Largely to Blame

Members of the U.S. Congress were strong supporters of Fannie Mae and Freddie Mac. Despite warnings and red flags raised by some, they continued to allow the companies to increase in size and risk, and encouraged them to purchase an increasing number of lower credit quality loans. While it is probable that Wall Street would have introduced innovative mortgage products even in the absence of Fannie Mae and Freddie Mac, it might be concluded that Wall Street's expansion into "exotic" mortgages took place in part in order to compete and take market share from Fannie Mae and Freddie Mac. In other words, Wall Street was looking for a way to compete with the implicit guarantee given to Fannie Mae and Freddie Mac by the U.S. Congress.

Meanwhile, Fannie Mae and Freddie Mac's debt and credit guarantees grew so large that Congress should have recognized the systematic risks to the global financial system these firms posed, and the risks to U.S. taxpayers, who would eventually foot the bill for a government bailout.

Krugman: "The Supposedly High-Risk Loans That [Fannie And Freddie] Were Making Or Buying Were, Demonstrably, Not Actually High-Risk." In a blog post, Nobel Prize winning economist Paul Krugman praised Min's report as "a terrific takedown of the claim that Fannie and Freddie caused the housing bubble." Krugman also wrote: "Every time you hear or read someone claiming that Fannie and Freddie were responsible for large amounts of subprime/risky lending, you should remember that this is based on essentially phony numbers: people at AEI invented their own definition of subprime, which isn't the standard definition, and, more important, doesn't work: the supposedly high-risk loans that F&F were making or buying were, demonstrably, not actually high-risk[.]"

Anabuhabkuss said:Look, I'm as liberal as a gay man is fruity but this lack of common sense if utterly ridiculous.

... That article says next to nothing about any factors linking Fannie and Freddie to the collapse of Bear Sterns, Lehman, AIG, Countrywide and ilk, Wachovia, WaMu, the near death experience of all the other major US investment banks, and the resulting contraction in liquidity. When I talk about the financial crisis, that's the larger story I'm talking about.Anabuhabkuss said:You remove the political factors from the equation. This also includes involvement with the credit agencies. McCain has already discussed this topic in great detail. Also, here's a good article from my favorite site:

http://www.investopedia.com/article...e-freddie-mac-credit-crisis.asp#axzz1ag3vYIBJ