You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock-Age: Stocks, Options and Dividends oh my!

- Thread starter koam

- Start date

ManofOne

Plus Member

I doubt stocks will fall too much but you will continue to see a rotation trade out of growth. Not sure how long that's going to last.

Value Stocks will certainly do better over the next quarter or two ( as you can see below). The I'll start optimizing my portfolio for the inflation trade.

Value Stocks will certainly do better over the next quarter or two ( as you can see below). The I'll start optimizing my portfolio for the inflation trade.

CrankyJay™

Member

pre-market looking good. Almost all of my losses yesterday are erased.

ManofOne

Plus Member

ARK INVESTORS PULLOUT SOME FUNDS

Investors pulled $465 million from Ark Investment Management's flagship product, the ARK Innovation ETF (ticker ARKK), in the latest trading session for which flow figures are available, according to data compiled by Bloomberg. They also withdrew $202 million from the ARK Genomic Revolution ETF (ARKG) and $119 million from the ARK Next Generation Internet ETF (ARKW).

Investors pulled $465 million from Ark Investment Management's flagship product, the ARK Innovation ETF (ticker ARKK), in the latest trading session for which flow figures are available, according to data compiled by Bloomberg. They also withdrew $202 million from the ARK Genomic Revolution ETF (ARKG) and $119 million from the ARK Next Generation Internet ETF (ARKW).

CrankyJay™

Member

Futures just nose dived.

Yeah they did. Son of a bitch.

Is it because Chair Powell is speaking once more today? People are the biggest goddamn pussies about this guy.

ManofOne

Plus Member

Yeah they did. Son of a bitch.

Is it because Chair Powell is speaking once more today? People are the biggest goddamn pussies about this guy.

It has mostly to do with the yield curve and its invoking fears of something that happened in 2013, known as a TAPER TANTRUM. The 10 year is up 40 basis points and that has serious reprecussions for the market going forward.

I personally think the market is being manipulated to push for a rate increase.

CrankyJay™

Member

I hate that this is even possible.I personally think the market is being manipulated to push for a rate increase.

ManofOne

Plus Member

I hate that this is even possible.

Inflation is killing returns. TIPS yields are negative which is just nuts.

CrankyJay™

Member

CCIV might have ruined things for the other (smaller) SPACs.

longdi

Banned

Btw, I would get out of transportation stocks if I were you or atleast reduce your holdings.

but why? covid restrictions?

DeepEnigma

Gold Member

ManofOne

Plus Member

but why? covid restrictions?

Transportation cost. If oil hits $100. How much flexibility do airlines have to transfer that cost unto customers alongside their higher debt cost. Be very selective if you want to stay with them.

12Goblins

Lil’ Gobbie

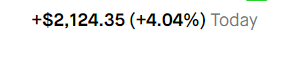

we just getting started bronycould've lost a fuck ton if i had sold but nope held and portfolio has pretty much recovered now.

am i the doomsday guy now

fml

CrankyJay™

Member

Up 3.8% today. These lunch time traders are crazy.

down 2 orth

Member

Is there a general estimation for what percent of the money in the NYSE is from retail investors?

StreetsofBeige

Gold Member

Snoozer. +0.50%. Need a lot of these to counter yesterday's big drop.

Starlight Lotice

Member

Surprised many people pulled out of ARKK really given they go for Disruptive Companies.

Mostly have my Stocks in Value or Dividends and only have like...2 in Growth? (as in large amounts of money in them)

I went from 40% up to 30% up so not too bad really given I am heavily weighted in a Growth Tech stock. (then again, I bought it near its lows and it is a brand new company on the NYSE)

Mostly have my Stocks in Value or Dividends and only have like...2 in Growth? (as in large amounts of money in them)

I went from 40% up to 30% up so not too bad really given I am heavily weighted in a Growth Tech stock. (then again, I bought it near its lows and it is a brand new company on the NYSE)

SpartanN92

Banned

VDE was a solid move for me. Bought yesterday, up 5% already.

ManofOne

Plus Member

Is there a general estimation for what percent of the money in the NYSE is from retail investors?

not sure about nyse specifically but you would have to read their annual reports

Last edited:

HoodWinked

Member

Watching Norwegian cruise line go up another 10%.

sold at the dot.

sold at the dot.

Honey Bunny

Member

ManofOne, how much upside do banks have right now? I get why commodities are doing well but why banks?

ManofOne

Plus Member

ManofOne, how much upside do banks have right now? I get why commodities are doing well but why banks?

Interest rate help banks. Higher rates mean more money. However banks are reducing their interest rates risk by shifting to non interest income like fees and transaction costs.

Goldman Sachs for instance started accepting deposits and providing loans. So when rates are low and liquidity is high. Your average rate on a deposit is fairly low but the interest rate often varies based on the yield curve.

So it leads to higher Net Interest Margins on loans and higher interest income on investments

Bc of BASEL, Banks have a capital requirement they must maintain so you probably won't see a bank fail unless they REALLLY FUCK UP

Last edited:

HoodWinked

Member

ROFL.

BA and RTX both up. Need more plane failures makes the stock go up. Raytheon owns RW that made the engines.

BA and RTX both up. Need more plane failures makes the stock go up. Raytheon owns RW that made the engines.

CrankyJay™

Member

FSR going nuts .... signed a MOU with Foxconn to produce some EV, sitting at 22.55, glad I bought more yestderay in the mid 15's

ManofOne

Plus Member

Can someone help me understand why btc is so valuable if the transactions are so inefficient?

Dumdums

HoodWinked

Member

name brandCan someone help me understand why btc is so valuable if the transactions are so inefficient?

Honey Bunny

Member

Thanks.Interest rate help banks. Higher rates mean more money. However banks are reducing their interest rates risk by shifting to non interest income like fees and transaction costs.

Goldman Sachs for instance started accepting deposits and providing loans. So when rates are low and liquidity is high. Your average rate on a deposit is fairly low but the interest rate often varies based on the yield curve.

So it leads to higher Net Interest Margins on loans and higher interest income on investments

Bc of BASEL, Banks have a capital requirement they must maintain so you probably won't see a bank fail unless they REALLLY FUCK UP

On the last point though, I did learn the other day the EU amazingly counts a bank's investment in software as capital, lol.

BOE Imposes Tougher Rule on Banks in First Post-Brexit Proposal

(Bloomberg) -- The Bank of England used its first major regulatory proposal since the end of the Brexit transition period to impose a tougher rule on British banks than they would face if the U.K. was still part of the bloc.The central bank’s Prudential Regulation Authority said it won’t allow...

HoodWinked

Member

im thinking maybe buying home depot if it drops again tomorrow.

ManofOne

Plus Member

Thanks.

On the last point though, I did learn the other day the EU amazingly counts a bank's investment in software as capital, lol.

BOE Imposes Tougher Rule on Banks in First Post-Brexit Proposal

(Bloomberg) -- The Bank of England used its first major regulatory proposal since the end of the Brexit transition period to impose a tougher rule on British banks than they would face if the U.K. was still part of the bloc.The central bank’s Prudential Regulation Authority said it won’t allow...finance.yahoo.com

Yah you're also seeing non banking raise fees too to reduce interest rate risk. VISA and Master Card raising swiping fees, Paypal roling out new transaction cost mechanism etc.

down 2 orth

Member

not sure about nyse specifically but you would have to read their annual reports

Thanks for sharing. I'm wondering what the implications of that 5% jump from last year are going to be. Historically speaking, it seems that as soon as investing in the stock market becomes widespread throughout society, the rug gets pulled out pretty quickly.

CrankyJay™

Member

GME squeezing again

edit: halted

edit: halted

Last edited:

CrankyJay™

Member

Un-halted and then halted again, lol

Let's see if RH repeats its fuckery

Let's see if RH repeats its fuckery

CrankyJay™

Member

These fucking cowards at the SEC are going to keep it halted into the close, fuck that.

down 2 orth

Member

Grabbed some popcorn to check the reactions at wallstreetbets, but the site is down.