I don't know if you'll be open to it, but would you mind sharing your portfolio and some strategies? I know you brought up diversification for different sectors, but how do you personally have it allocated? The fact that you are green today is pretty awesome.

Do you do a lot of day/swing trading or mostly long term investing? Just want to see what kind of exit strategies you have in place? Thanks for all you do.

So my allocation strategy is based on the economic environment and value investing tactics.

So a lot of fundamental analysis.

1)

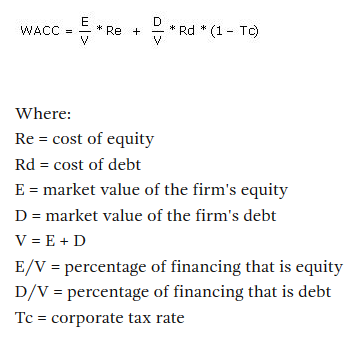

ALWAYS LOOK AT THE 10 YEAR YIELD CURVE - Always look at the 10 year because it is the most used rate for calculating behaviors and valuations. In valuations we use something called WACC or the

weighted average cost of capital which is very simple to use. See below. It looks intimidating but its VERY EASY TO CALCULATE.

The most important figures there are the cost of equity and the cost of debt. The cost of debt is based the current interest rate being paid on a bond by a company. So if Apple has a bond that is paying 4.0%. If the 10 year yield curve rises then it has to pay more for debt so from 4.0% to 5.0%.

The cost of equity is also a very simple formula known as CAPM which again varies based on the 10 year yield curve. So a change in the 10 year yield curve will increase the cost of debt and equity which in turn increases the cost of capital (WACC).

So if WACC increases then stocks with the highest equity duration meaning stocks that are the most susceptible to changes in the underlying 10 year yield curve will fall in value. This is what is happening now.

The 10 year can also tell you what the market is thinking example - inverse yield curve, convexity, reverse convexity etc.

2) DIVERSIFY - Based on the yield curve and economic conditions if you have QUALITY STOCKS in almost every sector you can adjust the weight of your portfolio based on the underlying conditions.

So for example lets say you have a portfolio with 10% energy, 40% technology, 20% financials, 30% etfs. If the yield curve changes you can adjust the weights of your portolfiio easy. You sell more tech (you don't have to sell all of it) and shift more towards energy and financials.

You average price in energy and financials increase but b/c your portfolio is weighted more to energy and financials, when the market is down in tech, your portolfio does not suffer b/c you have a higher weight in energy and financials

When the market favors growth and tech, you then shift more of your weight away from energy and financials and into tech easily.

WHAT MATTERS IS YOU CHOOSE HIGH QUALITY, LOW VOLATILITY STOCKS

3) Understand VALUE AT RISK

Always know how much of your portoflio is at risk base on every standard deviation away from the mean. I posted a video on this, I recommend you watch it.

4) QUALITY ALWAYS WIN IN THE LONG RUN

Good companies will always win in the long run. I posted research on this. In bear markets, they are the quickest to return to their initial value when the market shifts from bear to bull.

There are other tips but they are far more complicated and these are easier to understand.