Yeah I make 70k and my health plan costs my employer 12k, so I would get taxed for 82k right? Yeah no thanks

That removing employee sponsored health care from tax exclusion would, literally, effect the entire middle and upper middle class. It would result in increasing taxes on anyone who actually pays them.

This would be insanity.

Exactly. No sane politician would propose this because it is fucking insane.

I don't mind paying taxes but this is not right.

A great example of the Republican mindset right here.

"Let me have stuff tax free, but don't you DARE use my taxes so OTHER people can have stuff too."

No one making 200K is poor and living on the razor's edge. No one. Not in NY, not in SF. Nowhere in America is the cost of living so high that 200K requires government assistance to get by.

Going by

this calculator

A person making $200k is paying $47k in taxes and saving ~10%.

A person making $30k is paying $3k in taxes and saving ~55%.

Whether you think the person making $200k should be getting any tax break is a somewhat tangential discussion (and you're right, they really don't need much if any at that point). I'm just trying to understand how this isn't more beneficial to lower income people. Is it because, as the article states, they're unaware of the subsidy?

It breaks down to what is being given, not percentages.

The person making $30k/year isn't even likely to have an employer paid health plan. And if they have one, it is not the same plan being given to the person making $200k/year.

Why should the government be focused on subsiding great medical plans for the Upper Middle Class, while ignoring the Lower Middle Class and the Poor?

If the person making $200k/year doesn't want to pay as much in taxes, they can always switch to a cheaper plan. Less total income, means less taxable income.

DUH, that's how employer benefits are supposed work. If they are going to tax me same for benefits, might as well just give it to me all in cash.

That's the way all benefits (except health care) work when given to a specific employee.

Get a company car? Taxable benefit.

Get a cell phone allowance? Taxable benefit.

Any fringe benefit given to you is treated as taxable income.

Source:

https://dqydj.com/household-income-percentile-calculator/

Yes, removing it and redistributing the benefits more progressively would be a good thing!

Making it a flat per capita tax credit, for instance, alleviates many of the issues!

This man is on a roll.

Good thing we have a progressive tax system.

The problem is with billionares getting a number of unfair exemptions (for things only rich people would have) that allow them to avoid paying their proper tax burden

Again you're still taking someone else's money who's not a millionaire - go somewhere else to find it

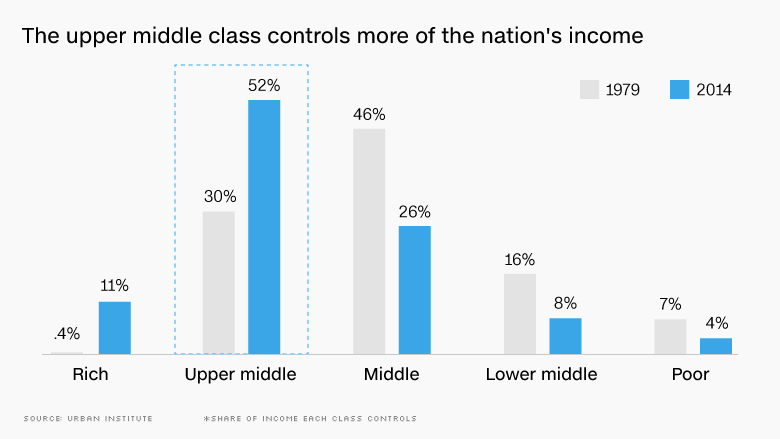

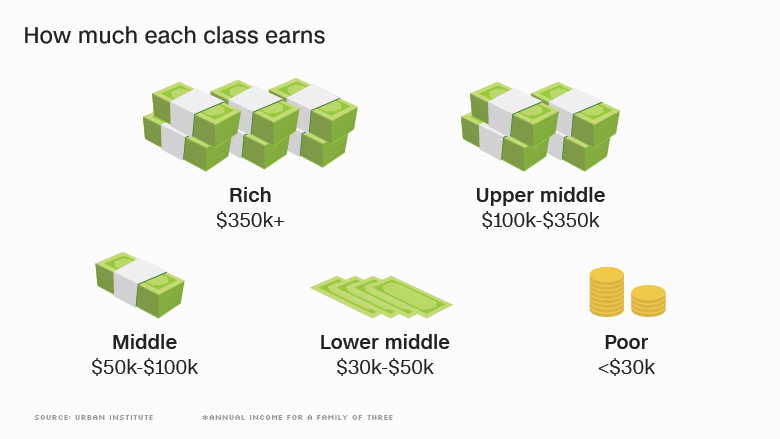

More than half the income in the US is controlled by the Upper Middle Class. "Billionaires" are an easy target, but unless you're going to go to taking existing assets, vs taxing income, there is a limit to what can be taken.

http://money.cnn.com/2016/06/21/news/economy/upper-middle-class/

There needs to be a sliding scale for tax breaks. It's pretty damn ridiculous that me and my wife earned 1000 bucks more than the cutoff for being able to claim a deduction for our student loans. You can't tell me the family that made 1000 leave dollars than us deserved the full deduction while we shouldn't get a damn thing.

We are absolutely starting to see why so many people vote strictly for tax cuts. It's especially infuriating when liberals trash you for even wanting to have the discussion.

Stop listening to conservative outlets and read the IRS tax forms. If you're going to have the discussion, at least ensure that your facts are correct before you start demonizing others.

In 2016 the maximum student loan deduction was $2500.

Someone who made $159,000/year would have been able to deduct $83.33 (assuming they paid the full $2500 in interest; lesser interest would mean a lower maximum deduction).

https://www.irs.gov/publications/p970/ch04.html