Eddie-Griffin

Banned

https://www.sohu.com/a/651856057_25...8402800010DA5oXoZ_324&_trans_=000011_hwzy_llq

The Japanese VR market has released it's data regarding the PSVR2, one of the smaller but more unique VR markets that may be possibly looking at new growth, at least so far.

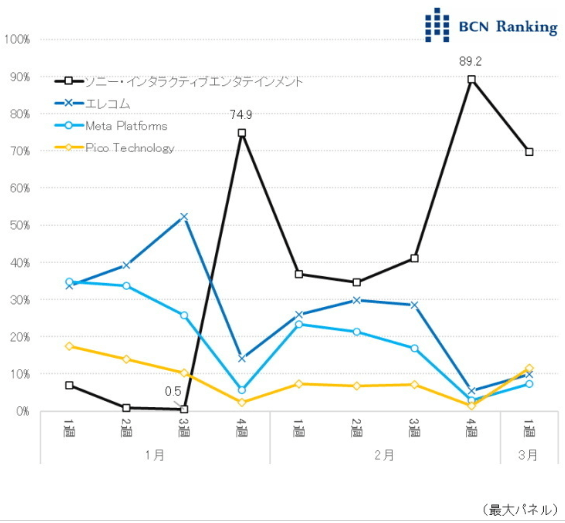

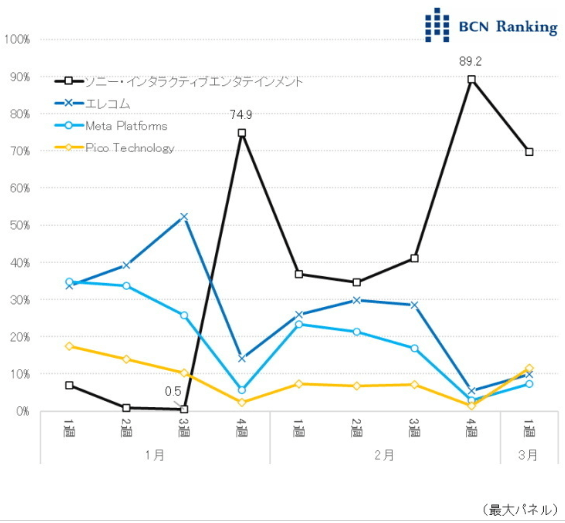

As you can see by the colored lines on the chart, before PSVR2 took off (they are counting pre-launch preorder sales) on January 26th, which is when Japanese preorders started, the VR market was led by a domestic company called Elecom, which surpassed Zuckers Quest VR at the start of the first week in January. Elecom seemed to have had at the peak controlling close to 55% of the japanese VR market, with Quest in decline with less than 30% of the market, before PlayStation VR2 helped Sony VR sales take off.

Then we see in January 26th during the 4th week of the month, the bottled up hype and excitement for PSVR2, blowing up the pre-orders and seeing Sony VR sales (PSVR1 and PSVR2 combined, but mostly PSVR2 of course) skyrocket to 74.9% domestically, followed by the other 3 major players all having deep dives at the same time. Then around the PSVR2's Feb 22 launch, we saw Sony peak in the 4th week gaining almost 90% marketshare with 89.2%.

While there are no numbers anywhere giving us any idea of how much this translates to unit sales, it at least indicates a strong start from launch (really Jan 26th) until the first week of March where there's a slight downslant, but with Sony still controlling 70% marketshare. Now, it's a matter of if Sony has enough to keep PVR2 momentum going in March and beyond, which is the big question, or if this will be a frontloaded exception. So far so good.

From the looks of the chart, all the competitors totally collapsed on week 4 when Sony's marketshare peaked, but then rebounded when Sony dropped down a bit at the start of March. which makes me wonder how low sales are at the bottom of the chart, and how high at the top.

Regardless, If Sony can stop that slant from getting worse, and finds a way to keep momentum going in March, it will likely keep dominating in Japan if they play their cards right. They have a golden opportunity to be long term market leader right now in the country.

Update for year 2022,

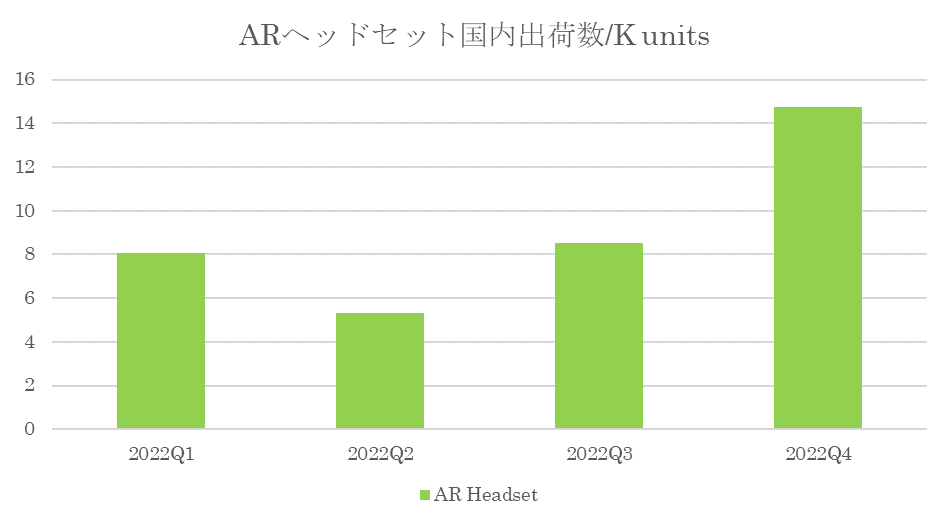

The below is showing VR and AR shipments for the entire year of 2022 to put the above chart in better perspective (which ends march 2023)

This gives us a better picture of Japan VR in 2022 specifically. Looks like VR was in freefall and near death by the end of the year. Whats crazy about this is how Q4 did nothing, not even a boost with being a key buying season and domestic sales on VR. While it seems the first chart shows PSVR2 helping with that some for 2023, it does put into question just how much it's adding. Is it enough to stabilize or do better than Q4 2022?

In 2022 we saw ~130,000 VR units sold domestically drop to ~18,000 in one year.

In the flip side in Japan AR is growing, with only 14,000 or so sold, but growing from 8,000 in Q1,

So in Japan VR dropped ~86% from the start of 2022 till the end of the year.

For AR, it rose 75% from Q1 to the end of the year 2022.

At this pace outside a chance, AR will pass VR in Japan in Q1 or Q2 this year unless Sony PSVR2 and other headsets are able to attract positive unit growth. The only country (so far) that has them this close and VR and AR dropping and rising at such heavy percentage rates. VR adoption was dropping off a cliff, let's see if 2023 sees a rebound.

https://news.yahoo.co.jp/articles/fcbd6631f198d55372893fa569017ba292e26529in the fourth week of February 2023, nearly 90% of the world's VR·AR headset market has been occupied by Sony Interactive Entertainment, and the sales of PSVR1/2 have accounted for 89.2% of the market. The release of the PSVR2 became a major reason for its popularity.

Sony Interactive Entertainment's PSVR2 head display has shown a good momentum as early as the pre-order period. In the fourth week of January 26 after the start of the pre-order, the market share has reached 74.9%, allowing other companies to work hard in the VR head display market for several years HTC and other big manufacturers are envious. In addition to its strong hardware performance and excellent design, of course, Sony Interactive Entertainment's game resources and human connection are also one of the important factors for PSVR2's best-selling.

PSVR2, dedicated to PlayStation 5 (PS5), got off to a good start from the start of reservations. As of January 4th, including January 26th when reservations started, SIE already recorded a 74.9% market share. It surpassed three companies, Elecom , Meta Platforms, and Pico Technology , and took the top spot for the first time in 135 weeks since the week of June 22, 2020. After that, the market share remained around 40%, but the market share surged again in the 4th week of February, which includes the release date of February 22nd. It reached 89.2%, just before 90%. PSVR2, which is essential for the PS5 main unit, is mainly used for games for the time being. In order to maintain and expand sales, it is essential to spread the PS5 console and expand the lineup of PSVR exclusive content. However, if cooperation with other VR compatible services progresses, further demand can be expected.

The Japanese VR market has released it's data regarding the PSVR2, one of the smaller but more unique VR markets that may be possibly looking at new growth, at least so far.

As you can see by the colored lines on the chart, before PSVR2 took off (they are counting pre-launch preorder sales) on January 26th, which is when Japanese preorders started, the VR market was led by a domestic company called Elecom, which surpassed Zuckers Quest VR at the start of the first week in January. Elecom seemed to have had at the peak controlling close to 55% of the japanese VR market, with Quest in decline with less than 30% of the market, before PlayStation VR2 helped Sony VR sales take off.

Then we see in January 26th during the 4th week of the month, the bottled up hype and excitement for PSVR2, blowing up the pre-orders and seeing Sony VR sales (PSVR1 and PSVR2 combined, but mostly PSVR2 of course) skyrocket to 74.9% domestically, followed by the other 3 major players all having deep dives at the same time. Then around the PSVR2's Feb 22 launch, we saw Sony peak in the 4th week gaining almost 90% marketshare with 89.2%.

While there are no numbers anywhere giving us any idea of how much this translates to unit sales, it at least indicates a strong start from launch (really Jan 26th) until the first week of March where there's a slight downslant, but with Sony still controlling 70% marketshare. Now, it's a matter of if Sony has enough to keep PVR2 momentum going in March and beyond, which is the big question, or if this will be a frontloaded exception. So far so good.

From the looks of the chart, all the competitors totally collapsed on week 4 when Sony's marketshare peaked, but then rebounded when Sony dropped down a bit at the start of March. which makes me wonder how low sales are at the bottom of the chart, and how high at the top.

Regardless, If Sony can stop that slant from getting worse, and finds a way to keep momentum going in March, it will likely keep dominating in Japan if they play their cards right. They have a golden opportunity to be long term market leader right now in the country.

Update for year 2022,

The below is showing VR and AR shipments for the entire year of 2022 to put the above chart in better perspective (which ends march 2023)

This gives us a better picture of Japan VR in 2022 specifically. Looks like VR was in freefall and near death by the end of the year. Whats crazy about this is how Q4 did nothing, not even a boost with being a key buying season and domestic sales on VR. While it seems the first chart shows PSVR2 helping with that some for 2023, it does put into question just how much it's adding. Is it enough to stabilize or do better than Q4 2022?

In 2022 we saw ~130,000 VR units sold domestically drop to ~18,000 in one year.

In the flip side in Japan AR is growing, with only 14,000 or so sold, but growing from 8,000 in Q1,

So in Japan VR dropped ~86% from the start of 2022 till the end of the year.

For AR, it rose 75% from Q1 to the end of the year 2022.

At this pace outside a chance, AR will pass VR in Japan in Q1 or Q2 this year unless Sony PSVR2 and other headsets are able to attract positive unit growth. The only country (so far) that has them this close and VR and AR dropping and rising at such heavy percentage rates. VR adoption was dropping off a cliff, let's see if 2023 sees a rebound.

Last edited: