You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Boehner: Nation on the path to default if Obama doesn't give concessions for ACA

- Thread starter TacticalFox88

- Start date

- Status

- Not open for further replies.

Little did she know --- they're going to die and take the rest of the country with them.

Everybody loses.

I had a dream about this last night. They were 5 votes short on passing the clean. Everyone was sad.

At least you slept. I couldn't fall asleep as I tossed and turned stewing about this last night. Maybe got 1-2 hours of sleep.

The Culture Vulture

Member

It would be really nice if they could make some kind of decision in the next two days so I can have Thursday off instead of working it for free. Seems like this will go another week though.

SteveWinwood

Member

At least you slept. I couldn't fall asleep as I tossed and turned stewing about this last night. Maybe got 1-2 hours of sleep.

Well most of my dream was about my neighbors doing yoga in their yard and a gay guy hitting on me trying to make me learn welding from him.

FlipWilson

Neo Member

it's like the GOP forgot the 2012 elections happened.....

Well most of my dream was about my neighbors doing yoga in their yard and a gay guy hitting on me trying to make me learn welding from him.

At least you slept. I couldn't fall asleep as I tossed and turned stewing about this last night. Maybe got 1-2 hours of sleep.

Look, how can we default on a debt denominated in our own currency?

The GOP forgets a lot of things. Like human decency.it's like the GOP forgot the 2012 elections happened.....

Boehner is already boned. He bet on the wrong horse and now he needs to face the consequences.

Ohhhh I would love to see them try.

Republicans wouldn't bother with the supreme court. They'd just go straight to impeachment.

Ohhhh I would love to see them try.

Look, how can we default on a debt denominated in our own currency?

We can print as much money as we want, but if overseas partners refuse to perform transactions in U.S. dollars the currency will become worthless. Pretending it can't happen is the same as burying your head in the sand. It may not happen right away but it will happen eventually.

So if the nation defaults, do we all die?

No but you come awfully closer to being in the same boat as Greece. Not quite there, but close. The problem is, unlike Greece, you don't have anybody to bail you out except yourselves. You already owe both the house AND the car to China.

Omegasquash

Member

This is true. My parents are diehard Republicans and actually support what is happening right now. When I was in highschool I followed in their footsteps. I was a diehard WASP to the core. I never thought that the nation could be "stupid" enough to elect Obama over McCain. I thought that Obama was a secret Muslim.

Then I went to college and within my freshmen year I completely shed all of that thanks to a combination of tenured labor history professors and actually looking at things critically for once (something kids aren't taught to do in high school anymore). Now I am a Social Democrat for practical purposes and a Utopian Communist for idealistic purposes.

My fiancée is exactly the same way.

Heh, you sound like me, only replace Obama and McCain with Clinton and Dole.

No but you come awfully closer to being in the same boat as Greece. Not quite there, but close. The problem is, unlike Greece, you don't have anybody to bail you out except yourselves. You already owe both the house AND the car to China.

We don't owe anything to China except for dollars. If our dollars becomes worthless, that debt also becomes inconsequential.

We don't owe anything to China except for dollars. If our dollars becomes worthless, that debt also becomes inconsequential.

You don't think China have thought that far ahead? They will make you pay it back somehow, and it won't be in either dollars or warfare.

Noisy Ninj4

Member

Indeed. If we go down economically, China is going to feel the effects of our inflation more than any other country.We don't owe anything to China except for dollars. If our dollars becomes worthless, that debt also becomes inconsequential.

We don't owe anything to China except for dollars. If our dollars becomes worthless, that debt also becomes inconsequential.

It becomes worthless to everybody, not just China. American debt is owned mostly by Americans.

You don't think China have thought that far ahead? They will make you pay it back somehow, and it won't be in either dollars or warfare.

What?

No but you come awfully closer to being in the same boat as Greece. Not quite there, but close. The problem is, unlike Greece, you don't have anybody to bail you out except yourselves. You already owe both the house AND the car to China.

Nope. Default would primarily impact the rate at which a nation could borrow money (as it would hurt the faith in lending of said nation). While Greece defaulting was due to them not having enough money in a regional currency they did not control the U.S. would be defaulting via a currency that is completely under their own control and not tied to any kind of certification standard (i.e. gold).

So the U.S. could effectively just stop borrowing money and instead print what it needs into perpetuity.

That would result in significant inflation and devaluing of the U.S. dollar worldwide mind you, but since the U.S. is probably the lone economic superpower that can actually provide ALL the resources it needs this is actually a navigable path for the U.S. in particular.

The repercussions of this path would actually be more strongly felt throughout the rest of the world, most notably by shrinking the disparity in low skill wages, namely manufacturing. It would rapidly become cheaper to move those jobs back to the U.S., throwing much of the developing world into economic turmoil.

It would also gut a lot of the investment class' portfolio as profits across the board for the companies they're invested in would plummet and the dollar which most of their assets are tied to will decline.

The U.S. defaulting would probably end up being a bigger negative to the rest of the world than individual U.S. citizens. The developing world would take the worst of it in fact. This is what happens when the global economy is built around the entire planet providing non-essential products for only 1/3rd of the entire population's lifestyle. In the U.S. and Europe people won't be able to get absurdly cheap smartphones. In China and Malaysia people will starve. Totally worth it for the good times when we can get an iPhone for $100 with a 2 year contract though, right?

Edit: also, China doesn't own the majority of U.S. debt. Most of it is held by private investors, primarily first world investors. China would take a huge hit from a default, but the investor class would take the worst of the beating.

What?

Political concessions such as support in the U.N, Gold, Oil, other commodities, military hardware...As long as the U.S has something tangible on hand that China can make use of, they will demand it.

Or everything Drek said, just because it sounds too intelligent for me to argue against >.>

No but you come awfully closer to being in the same boat as Greece. Not quite there, but close. The problem is, unlike Greece, you don't have anybody to bail you out except yourselves. You already owe both the house AND the car to China.

China owns a very small percentage of our debt. I believe Japan even holds more at this point, and the overwhelming majority is held by the American public.

No but you come awfully closer to being in the same boat as Greece. Not quite there, but close. The problem is, unlike Greece, you don't have anybody to bail you out except yourselves. You already owe both the house AND the car to China.

Except we don't. China owns about 8% of U.S. debt.

CharlieDigital

Banned

Edit: also, China doesn't own the majority of U.S. debt. Most of it is held by private investors, primarily first world investors. China would take a huge hit from a default, but the investor class would take the worst of the beating.

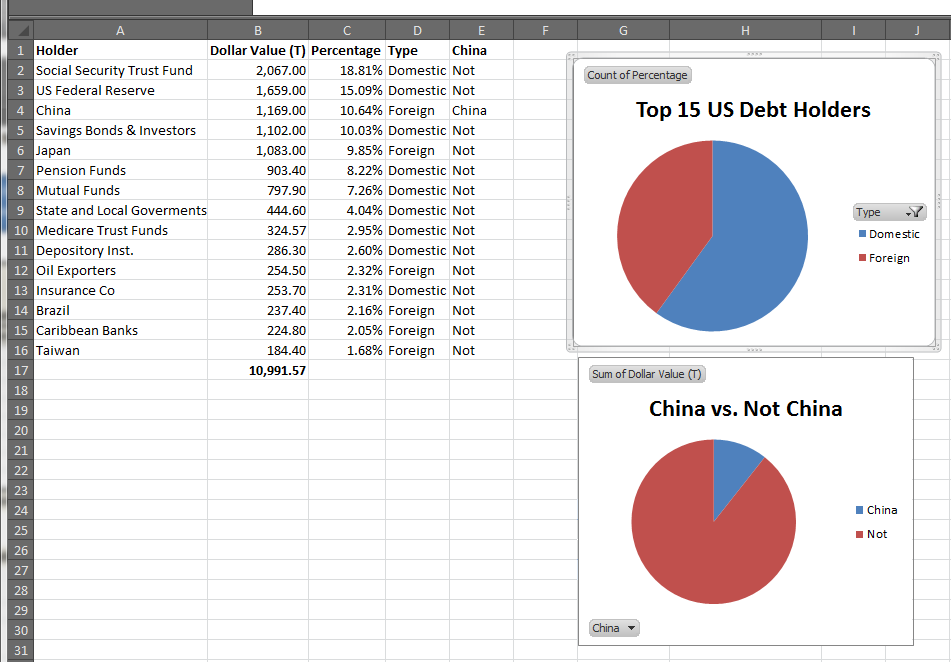

I did the math on this before for another NeoGAF discussion:

AbortedWalrusFetus

Member

China owns a very small percentage of our debt. I believe Japan even holds more at this point, and the overwhelming majority is held by the American public.

I thought China had finally passed Japan? Could be wrong. And I also thought that while it was small compared to domestically held debt, it was still a significant percentage. Not that it's anywhere near the doomsayers though. The overwhelming majority share of US debt is domestically held.

Edit: What a handy post above mine.

CharlieDigital

Banned

I thought China had finally passed Japan? Could be wrong. And I also thought that while it was small compared to domestically held debt, it was still a significant percentage. Not that it's anywhere near the doomsayers though. The overwhelming majority share of US debt is domestically held.

Edit: What a handy post above mine.

My numbers are from a March and may not reflect current day Treasury holdings.

I thought China had finally passed Japan? Could be wrong. And I also thought that while it was small compared to domestically held debt, it was still a significant percentage. Not that it's anywhere near the doomsayers though. The overwhelming majority share of US debt is domestically held.

Edit: What a handy post above mine.

It's pretty small, especially relative to other foreign debt. And besides, they could never demand payment anyway...they pay out when they pay out. And they pay in US dollars, so his idea that they could demand anything is very odd!

efyu_lemonardo

May I have a cookie?

I did the math on this before for another NeoGAF discussion:

Thanks for sharing. Can you also say what that ~1200 Trillion dollars (!) represent to China?

As in what percent of their country's worth is invested in U.S. debt?

Same for Japan, Brazil and Taiwan..

cartoon_soldier

Member

It's pretty small, especially relative to other foreign debt. And besides, they could never demand payment anyway...they pay out when they pay out. And they pay in US dollars, so his idea that they could demand anything is very odd!

And it's still the best investment for their forex reserves.

AbortedWalrusFetus

Member

It's pretty small, especially relative to other foreign debt. And besides, they could never demand payment anyway...they pay out when they pay out. And they pay in US dollars, so his idea that they could demand anything is very odd!

I would also assume most of that debt is in 25 year treasury bonds anyway.

Takamura-San

Member

I did the math on this before for another NeoGAF discussion:

I love this chart. More the China column. The only 2 options to the question if this is China is "not" and "china". I laughed for a good 15 mins.

Hopefully this puts to rest all this China owns the majority of the US debt.

Fenderputty

Banned

That would result in significant inflation and devaluing of the U.S. dollar worldwide mind you, but since the U.S. is probably the lone economic superpower that can actually provide ALL the resources it needs this is actually a navigable path for the U.S. in

What's the difference between the creation of a bond and the creation of a dollar and why would that difference cause inflation?

Can someone explain what is going on like they would explain to a 5 year old foreigner? Americas farts can be smelled all around the world and I'm worried about the effects on the rest of the world.

The GOP is controlled by extremists who live in a fantasy world where science and economics have a liberal bias.

They get away with this because the U.S., courtesy of being the lone super-power during much of the post-industrial era, is the cornerstone of basically every first and second world economy in the world. The financial success of a nation today is as much measured by how much it imports and exports with the United States as it's own internal production.

The United States is basically the rich kid who inherited daddy's market dominating company that employs the whole town and makes horrible decisions with it. The company is so entrenched in it's success that it'll continue to survive, and the rich kid will have only tangential awareness of it's struggles, but the employees will feel every failed product and bad quarter because they're the ones losing bonuses, seeing workforce contraction, and generally seeing their town go into decline.

The failure of Congress to approve a budget has shut down all "non-essential" aspects of the U.S. government. If you want a short and sweet summary of what is essential v. non-essential ask yourself this: is it a branch of the government you'd expect a fascist oligarchy to have? If so it's essential. If not it's "non-essential" (like parks, public works, the agency that sets up house purchases, etc.).

About a month from now this gets substantially worse as the nation's debt ceiling (the amount to which it will borrow) will be reached. If it is not raised (so that the nation can borrow money to make payments on money it has already borrowed) then the government defaults, the faith in the U.S. dollar declines, and the entire world takes an economic punch to the gut. By that I mean the U.S. government will borrow at worse rates should it get an extension on the debt ceiling in the future and all the bonds they've issued (one of the major traded investments in the entire world) will be worth less. Basically, a guy who goes to bed with $5 Billion dollars before the default will wake up with significantly less than $5 Billion dollars the next morning. Now I know you're thinking "significantly less than $5B is still a lot of money though" but not to that guy. He will at that point likely become an irrational actor in a tumultuous market, moving investments around in an erratic fashion. This happening on a near universal scale will destabilize the global markets.

Now maybe that doesn't seem like a big deal if you don't own stock, but most companies acquire a good bit of their capital via stock offerings and the stock valuation of a company more or less determines it's stability. So chaos in the markets could result in healthy companies being cannibalized and financially unstable giants collapsing. Even worse, it could result in the false overvaluation of a company which then allows them to gobble up under valued competition, resulting in less market competition (consolidation) a la the U.S. banking crisis in 2007/2008 where the U.S. went from about a dozen major national banks to about 5 in the span of about a year. I don't think it's hard to picture the dangers such consolidation presents to all the "regular" people.

Unfortunately the last to feel this will be the American people (i.e. the people who could actually avert/fix this), who other than a hard slashing of their 401K will more or less continue life as usual. The economic recovery would likely fall back into a recession, but the global economy would do far, far worse as the world's largest consumer would effectively have cut up their credit cards while simultaneously missing their mortgage payment. Not real likely to see them suddenly make any new luxury purchases in the near future.

The GOP is controlled by extremists who live in a fantasy world where science and economics have a liberal bias.

They get away with this because the U.S., courtesy of being the lone super-power during much of the post-industrial era, is the cornerstone of basically every first and second world economy in the world. The financial success of a nation today is as much measured by how much it imports and exports with the United States as it's own internal production.

The United States is basically the rich kid who inherited daddy's market dominating company that employs the whole town and makes horrible decisions with it. The company is so entrenched in it's success that it'll continue to survive, and the rich kid will have only tangential awareness of it's struggles, but the employees will feel every failed product and bad quarter because they're the ones losing bonuses, seeing workforce contraction, and generally seeing their town go into decline.

The failure of Congress to approve a budget has shut down all "non-essential" aspects of the U.S. government. If you want a short and sweet summary of what is essential v. non-essential ask yourself this: is it a branch of the government you'd expect a fascist oligarchy to have? If so it's essential. If not it's "non-essential" (like parks, public works, the agency that sets up house purchases, etc.).

About a month from now this gets substantially worse as the nation's debt ceiling (the amount to which it will borrow) will be reached. If it is not raised (so that the nation can borrow money to make payments on money it has already borrowed) then the government defaults, the faith in the U.S. dollar declines, and the entire world takes an economic punch to the gut. By that I mean the U.S. government will borrow at worse rates should it get an extension on the debt ceiling in the future and all the bonds they've issued (one of the major traded investments in the entire world) will be worth less. Basically, a guy who goes to bed with $5 Billion dollars before the default will wake up with significantly less than $5 Billion dollars the next morning. Now I know you're thinking "significantly less than $5B is still a lot of money though" but not to that guy. He will at that point likely become an irrational actor in a tumultuous market, moving investments around in an erratic fashion. This happening on a near universal scale will destabilize the global markets.

Now maybe that doesn't seem like a big deal if you don't own stock, but most companies acquire a good bit of their capital via stock offerings and the stock valuation of a company more or less determines it's stability. So chaos in the markets could result in healthy companies being cannibalized and financially unstable giants collapsing. Even worse, it could result in the false overvaluation of a company which then allows them to gobble up under valued competition, resulting in less market competition (consolidation) a la the U.S. banking crisis in 2007/2008 where the U.S. went from about a dozen major national banks to about 5 in the span of about a year. I don't think it's hard to picture the dangers such consolidation presents to all the "regular" people.

Unfortunately the last to feel this will be the American people (i.e. the people who could actually avert/fix this), who other than a hard slashing of their 401K will more or less continue life as usual. The economic recovery would likely fall back into a recession, but the global economy would do far, far worse as the world's largest consumer would effectively have cut up their credit cards while simultaneously missing their mortgage payment. Not real likely to see them suddenly make any new luxury purchases in the near future.

Wow, mich appreciate the time and effort. Follow up question, how could it possibly have come so far?

Sanky Panky

Banned

Why not just mint the damn coins and get this over with? There's no major problems with the idea except for the bitching of republicans. The american public would support the idea and the markets would be fine with it. Win win.

That won't fly in the face of history. Whenever that has happened in the past, it doesn't end well.

For some perspective on the US dollar...

Why not just mint the damn coins and get this over with? There's no major problems with the idea except for the bitching of republicans. The american public would support the idea and the markets would be fine with it. Win win.

this doesn't solve the shutdown thingy

Why not just mint the damn coins and get this over with? There's no major problems with the idea except for the bitching of republicans. The american public would support the idea and the markets would be fine with it. Win win.

Having to invoke the 14th or mint the trillion dollar coin almost feels as much of a failure of government as Obama/Dems conceding on the ACA standoff, imo.

I also don't think think a majority of the public would support it. In fact, given how little so many Republicans (and Americans period) understand how national finances work, I imagine many would just see "Obama mints trillion-dollar coin" as "Obama spends another trillions in blink of an eye, country doomed."

Wow, mich appreciate the time and effort. Follow up question, how could it possibly have come so far?

Half of Congress is controlled by a minority party who have been able to stay in power thanks to gerrymandered voting districts that heavily favor white, anti-government, uneducated Christians who favor those values over new information. A lot of these guys are so divorced from reality that they don't actually have a grasp on how the economy functions, and simply believe that a government shutdown = less government = good for Americans. The same goes for the debt ceiling debate.

They're dangerously ignorant and, perhaps even worse, are holding steady in their position out of a point of pride - many Republicans don't even know what they're holding out for, just that they can't be seen to lose here.

CharlieDigital

Banned

That won't fly in the face of history. Whenever that has happened in the past, it doesn't end well.

For some perspective on the US dollar...

There is at lease one huge difference, though.

Of all of those countries on that list, none of them can match the US in raw resources.

What's the difference between the creation of a bond and the creation of a dollar and why would that difference cause inflation?

A bond is basically the government saying "lend us X dollars and we'll pay you back in Y number of years at X dollars + Z% interest" where Z is an incredibly low number as the U.S. is the most reliable debtor in the world up to this point. It basically hides the need for more money via debt and doesn't change what a single dollar trades at in private global transactions.

Printing more money when the nation's net wealth is stagnant inherently reduces the value of every dollar, since every dollar is X percent of the nation's net worth, where X is the (1/the number of dollars printed) *100, to make it a simple mathematical concept. More dollars printed means every dollar is worth less relative to the nation's net wealth and worth less relative to other currencies that aren't being devalued by additional printing.

That won't fly in the face of history. Whenever that has happened in the past, it doesn't end well.

For some perspective on the US dollar...

You don't actually think that chart is useful in any way, do you?

A bond is basically the government saying "lend us X dollars and we'll pay you back in Y number of years at X dollars + Z% interest" where Z is an incredibly low number as the U.S. is the most reliable debtor in the world up to this point. It basically hides the need for more money via debt and doesn't change what a single dollar trades at in private global transactions.

Printing more money when the nation's net wealth is stagnant inherently reduces the value of every dollar, since every dollar is X percent of the nation's net worth, where X is the (1/the number of dollars printed) *100, to make it a simple mathematical concept. More dollars printed means every dollar is worth less relative to the nation's net wealth and worth less relative to other currencies that aren't being devalued by additional printing.

It's not simply printing that could devalue the dollar, it's those bills actually being used. If they sit in bank reserves never to enter the economy it doesn't impact inflation at all. That's why we don't see monetary inflation at all.

Armoured Priest

Member

What's the difference between the creation of a bond and the creation of a dollar and why would that difference cause inflation?

I think it has to do with maturation over time. With dollars, its a dollar right now, with bonds its a dollar in 20 years...I admit this is a way over simplification, and a little quirky due to intrest rates being so low right now that payout is slightly less when adjusting for inflation then what you paid in.

Also, a couple things about that chart. I'd heard (I'll admit to not having the numbers in front of me) that due to sequestration (and us kind of avoiding from borrowing from them along with the effect of inflation and fluxuation currency amounts) that China's share had dropped to around 8.5%. I could be wrong on this, I haven't looked at the numbers recently.

Finally I had no idea Brazil had that much of our debt.

Fenderputty

Banned

I get that, but it's still a dollar created after the payoff date ... With interest. After the bond has been paid, more money has actually been created than just creating a dollar. You'll have to forgive me as I'm trying my best to channel my inner EV.A bond is basically the government saying "lend us X dollars and we'll pay you back in Y number of years at X dollars + Z% interest" where Z is an incredibly low number as the U.S. is the most reliable debtor in the world up to this point. It basically hides the need for more money via debt and doesn't change what a single dollar trades at in private global

I think, at this point, no one should really care about what the republican supporters think in regard to this situation. Minting the coins gives congress no ability to derail spending. The markets won't go into meltdown over the idea as it saves the economy and the president looks good as he gets to say he saved the economy from Republican cock blocking. Another option would be to print prime bonds. He can get out of this and look damn good doing it.

Wow, mich appreciate the time and effort. Follow up question, how could it possibly have come so far?

Because the U.S. government is almost entirely staffed by second rate people, many of whom are slaves to an ideological constituency who is 1. terrified by change and 2. endowed with a massive sense of over-entitlement.

Barack Obama is, in my opinion, hands down the best POTUS since 1963 and despite that his ability to actually LEAD the nation and the world isn't even worth discussing in comparison to say, FDR, Lincoln, Teddy Roosevelt, Thomas Jefferson, etc. and I mean that in every sense.

He isn't an intelligent enough man to win through overt superiority of vision, a la Thomas Jefferson. He isn't endowed with the sterling strength of moral superiority needed to browbeat and grind down the opposition a la Lincoln. He lacks even a fraction of the political cunning and guile FDR used to be a four term president and someone my grandmother spoke about as the only man to come close to Christ in divinity. And he lacks the iron clad force of willfulness to plow through all opposition shown by Teddy.

He looks to build consensus with people who refuse to collaborate. He looks to debate those who refuse to accept facts. He looks to exert force as only a tool of last resort, not as a the ramrod to prove one's political muscle. He doomed his presidency to mediocrity when he didn't take the 2008 majority and whip the democratic party into an unanimous voting block through which he'd pass a strong, uncompromising agenda.

Still better than being a blight like Ronald (6) Wilson (6) Reagan (6), his arch-rival turned acolyte GHWB, and his mouth-breathing son to follow. Also a good bit better than the horse trader who enabled all this mess when he could have nipped it in the bud (Clinton). But there was a window in which Obama could have taken the reigns and driven home a clear and articulate message for a new America and he allowed that window to shut because he wasn't willing to assert control.

There are recall proceedinga but they're pointless. It would take too long and fail.It's a shame you can't impeach Congress.

It's not simply printing that could devalue the dollar, it's those bills actually being used. If they sit in bank reserves never to enter the economy it doesn't impact inflation at all. That's why we don't see monetary inflation at all.

Sure, but the concept of printing more money to meet the nation's debts generally results in it being circulated.

Robbing Peter to pay Paul. Sure, it creates future obligations. This is how the U.S.'s national debt spiraled out of control in the first place. Doesn't mean it isn't (currently) the best path forward.I get that, but it's still a dollar created after the payoff date ... With interest. After the bond has been paid, more money has actually been created than just creating a dollar. You'll have to forgive me as I'm trying my best to channel my inner EV.

- Status

- Not open for further replies.