Sir_Crocodile

Member

if one of the parties pledged to ensure more amiibo stock for the uk that'd be a real vote winner for me

Vote for patrimonial capitalism.

It must be hard when you are in power to not do that because everyone knows what you are about from the last 5 years so you have to just try to say how that would be better than the other guy.

I'll rename the M25 the Meta Knight Expressway and I will spend the rest of this afternoon patiently listening to your Amiibo anecdotes.if one of the parties pledged to ensure more amiibo stock for the uk that'd be a real vote winner for me

I hope that the manifesto launch coincides with some actual positive messages from the Tories, if only to raise the tone of the campaign.

Well sure, but I have to wonder how effective it really is. Especially when the Tory press were recently banging on about how Ed dated several attractive, successful and intelligent women. Hard to see how that'll damage Ed's image amongst voters.

Throw shit against wall see what sticks really, with the personal attacks. They'll have something else next week. Maybe he was once fired from a job when he was a teenager!

Vote for patrimonial capitalism.

There are rumours he has masturbated occasionally as a teenager.

Are there any taxes which the Conservatives still want? At the moment apart from VAT I'm drawing a blank.

if one of the parties pledged to ensure more amiibo stock for the uk that'd be a real vote winner for me

There are rumours he has masturbated occasionally as a teenager.

Ukip bleeding votes to the Tories are the reason why they're doing well in today's polls.that inheritance tax pledge is pure core vote strategy. might win back some ukip voters, that's about it.

that inheritance tax pledge is pure core vote strategy. might win back some ukip voters, that's about it.

Won't win back many UKIP, may even push some away. UKIP is mostly C2DE workers, they're not affected by the inheritance tax either way.

I like their hats, this ad is not working as intended.The NI Conservatives election material will make any DUP-Tory pact fun:

I like their hats, this ad is not working as intended.

George Osborne said:It's all part of our balanced plan

Unfortunately George, you'll have to try harder to explain how 8bn of extra funding for the NHS will be found.

Chancellor George Osborne has said Conservative plans to remove family homes worth up to £1m from inheritance tax "supports the basic human instinct to provide for your children".

In all seriousness I'm genuinely curious to know what GAF thinks of inheritance tax.

But then again I don't live in London, where a cardboard box on a decent street is worth £100,000.

Do most parents give their children homes worth a million pounds?

In all seriousness I'm genuinely curious to know what GAF thinks of inheritance tax. I'm personally of the opinion it's slightly misguided if the intention is for it to be a progressive tax (seeing as homeownership is a pretty good asset when it comes to social mobility) but I do think it's a good little moneymaker, especially at the top end, and I'd certainly be more in favour of it than not.

"Your estate will owe tax at 40% on anything above the £325,000 inheritance tax threshold when you die (or 36% if you leave at least 10% to a charity). "

Seems ok to me. But then again I don't live in London, where a cardboard box on a decent street is worth £100,000.

"Your estate will owe tax at 40% on anything above the £325,000 inheritance tax threshold when you die (or 36% if you leave at least 10% to a charity). "

Seems ok to me. But then again I don't live in London, where a cardboard box on a decent street is worth £100,000.

I tell my parents that they can probably expect to sell their house to pay for social care. I don't expect to get shit from them. I would love to be pleasantly surprised but I'm not holding my breath.

...and those 22000 families are not in need of assistance.

It is a bribe to the well off.

Hmmm. Sort of. I know a few friends who have had to pay inheritance tax for sales of deceased relatives homes and I wouldn't call them well off.

I think the promise to freeze above inflation train fares over the next five years is a bigger seller though,

...and those 22000 families are not in need of assistance.

It is a bribe to the well off.

So I dunno. £325k just seems like a very low figure to me in today's age. I don't see my parents as particularly rich.

But, having said all that, both us and them are very very very lucky people. Some of the situations people are in in the UK is shocking and we need to spend more money on them. And that's without even thinking about the situations of the people in third world countries.

Cardboard box? Luxury, bloody luxury.

When I moved to London I could only afford a disused manhole. Bloody middle class and their cardboard boxes.

£325k is a lot of money.

Nobody chooses the family that they are born into. You were lucky but most weren't. The state should be doing everything it can through NHS/education/infrastructure to ensure that everyone can prosper regardless of their family conditions. Wealthier people shouldn't be able to hoard their assets. Social mobility is one of the biggest issues facing the UK and it just isn't taken seriously enough (Inheritance tax is a tiny part of dealing with that problem obviously).

I'm sure that there will be some people hit a little unfairly but oh well. People in genuine need are frequently punished and ignored - see welfare under New Labour and the coalition.

I flip flop a lot on this issue but where I currently stand is that the person receiving the money hasn't done anything to earn it. This doesn't automatically make it the property of the state but if we take the position that taxing something disincentivises it, there are worse things to tax than death.

Ultimately this would all be less of an issue if house prices were slightly normal.

I flip flop a lot on this issue but where I currently stand is that the person receiving the money hasn't done anything to earn it. This doesn't automatically make it the property of the state but if we take the position that taxing something disincentivises it, there are worse things to tax than death.

Ultimately this would all be less of an issue if house prices were slightly normal.

Anything that does something like this that increases the tax privilege associated with an asset like housing will drive the price up in the long run.

Parties cant change in four weeks what theyve failed to change in five years

Friday, 10 April, 2015 in Elections

By Lord Ashcroft

My most recent constituency polling has found an increase in support for Labour and the Conservatives and, in their own battlegrounds, the Liberal Democrats while the UKIP share has drifted down since last year. Even so, neither of the main parties has established a clear overall lead, either in national polling or in the marginals. So while the evidence is that voters may be focusing more on the parties capable of forming a government, they are not finding the choice becoming any easier or more palatable.

The latest large-scale national polling I have conducted on the impact of the campaign helps explain why. Over the last month, most party ratings on most attributes have ticked up a couple of points. But the change is not significant and the overall picture remains as it has been throughout the parliament: the Conservatives lead on willingness to take tough decisions for the long term, competence, and (by a much slenderer margin) clarity and reliability.

Attributes

Attributes2

Labour remain ahead when it comes to values, motivation, standing for fairness and being on the side of ordinary voters.

£325k is a lot of money.

Nobody chooses the family that they are born into. You were lucky but most weren't. The state should be doing everything it can through NHS/education/infrastructure to ensure that everyone can prosper regardless of their family conditions. Wealthier people shouldn't be able to hoard their assets. Social mobility is one of the biggest issues facing the UK and it just isn't taken seriously enough (Inheritance tax is a tiny part of dealing with that problem obviously).

I'm sure that there will be some people hit a little unfairly but oh well. People in genuine need are frequently punished and ignored - see welfare under New Labour and the coalition.

IMO the limit should be per recipient rather than as a whole estate. They'd need to be tight on the regulation to stop it just being temporarily given to others for the sake of the will. But I'm sure it's possible.

The vast majority of estates (over 90%) are not liable to IHT at the moment and therefore would not benefit. The Conservatives estimate that their policy would be a giveaway of about £1 billion. With around 50,000 estates forecast to pay IHT over the next few years this gives an average (mean) gain per IHT paying estate of around £20,000. The maximum reduction in IHT on a couple’s estate is £140,000 which will go to married couples with estates worth between £1 million and £2 million. Since the children of those with very large estates are disproportionately towards the top of the income distribution the gains from this (and in fact any) IHT cut will also go disproportionately to those towards the top of the income distribution.

Many features of the policy are similar to one analysed in a Treasury document that was leaked to, and published by, the Guardian last month. This estimates that, based on Budget 2014 forecasts, the policy would reduce the proportion of estates liable for IHT from 8% in 2015–16 to just over 6% by the end of the parliament, rather than see it rise to just over 10% under current policy.

As this HMT document argues (para 16, page 9) “there are not strong economic arguments for introducing an inheritance tax exemption specifically related to main residences”. The document lists a number of problems with the policy for example the fact that it would encourage investment in owner-occupied housing rather than other more productive investments and discourage downsizing late in life when that might otherwise be appropriate.

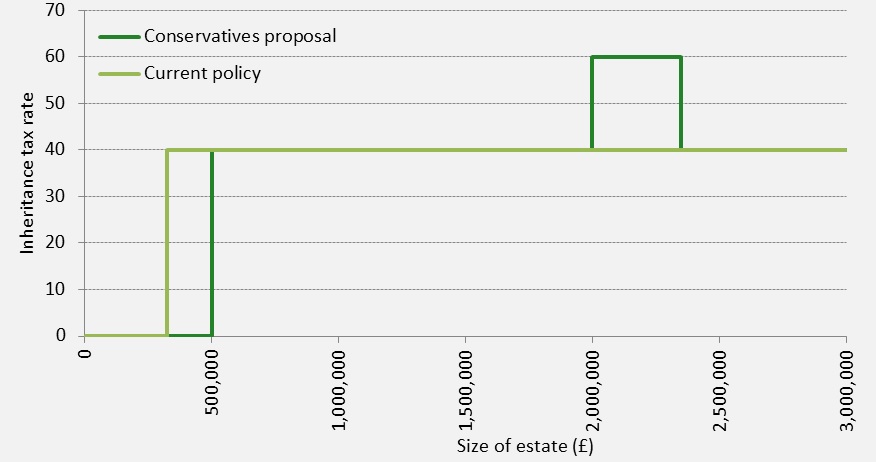

The Conservatives’ proposal would further complicate the IHT system. The Figure below shows the marginal rate of IHT faced by an individual with a home worth £175,000 by the size of their total estate, before and after the change (assuming their estate is to be bequeathed to a child or grandchild). The new effective IHT rate of 60% that kicks in at £2 million is due to the tapering back of the new allowance. Why the IHT rate should go 0%, 40%, 60% and the return to 40% is difficult to justify. A preferable policy would have been simply to increase the existing threshold from £325,000, whereas under current policy it is set to be frozen at this level (which is the level it was at in 2009–10) through to 2017–18.

What if there is a property that has been in the families hands for generations or a family business? If the situation switched over to an amount per individual, that individual may not be able to keep that property or business going.

I don't know how the system works, so genuine question.

Do most parents give their children homes worth a million pounds?

In all seriousness I'm genuinely curious to know what GAF thinks of inheritance tax. I'm personally of the opinion it's slightly misguided if the intention is for it to be a progressive tax (seeing as homeownership is a pretty good asset when it comes to social mobility) but I do think it's a good little moneymaker, especially at the top end, and I'd certainly be more in favour of it than not.

Our current scheme of Inheritance Tax could be improved by introducing a scale similar to Income Tax, but with much higher bands and rates, starting at around 20% on anything above £250k and ramping towards ~100% at a few £million. All index linked of course.