ISLAMABAD: The Joint Investigation Team (JIT), constituted by the Supreme Court to probe money laundering allegations against the Sharif family, set in motion a political upheaval by reporting that the prime minister and his children had accumulated wealth beyond their known sources of income.

The JITs damning report, submitted to the Supreme Court and spread over ten volumes, declared that both Hussain and Hassan Nawaz were used as proxies to build family assets.

Key developments

Maintains that PMs family has assets beyond known sources of income

Recommends NAB reference against PM, his children

Says Sharif-owned enterprises mostly loss-making, dont justify familys wealth

Qatari letters declared a myth

Unearths new offshore company chaired by Sharif

Ministers reject JIT report as trash

Consequently, the six-man JIT concluded that it was compelled to refer to sections 9(a)(v) and 14(c) of the National Accountability Ordinance (NAO) 1999, which deal with corruption and corrupt practices, though such charges are yet to be proven in an accountability court.

A final decision on whether to submit a reference to the National Accountability Bureau (NAB) will be reached when the three-judge Supreme Court, headed by Justice Ejaz Afzal Khan, gives an order to this effect.

The court will hear both the petitioner, namely Imran Khan and others, and the respondents, before handing down its final verdict.

The JIT report also highlighted Articles 122, 117, 129 and other sections of the Qanoon-i-Shahadat Order 1984 (Law of Evidence), which places the burden of disproving the allegations on the person facing accusations.

The JIT pointed out failure on the part of the Sharifs to produce the required information that would confirm their known sources of income, saying that prima facie, it amounted to saying that they were not able to reconcile their assets with their means of income.

The report said the financial structure and health of companies in Pakistan that are linked to the Sharifs also do not substantiate the familys wealth and a significant disparity exists between the wealth declared by the Sharifs and the means through which they generated income.

Irregular movement of money

Moreover, the report highlights the irregular movement of huge amounts in shape of loans and gifts from the Saudi-based company Hill Metals Establishment, the UK-based Flagship Investments Limited and the UAE-based Capital FZE, to Nawaz Sharif, Hussain Nawaz and the Pakistan-based companies of the prime minister and his family.

The role of offshore companies is critically important as several offshore companies (Nescoll Limited, Nielson Enterprises Limited, Alanna Services Ltd, Lamkin S.A. Coomber Group Inc and Hiltern International Ltd) have been identified to be linked with their businesses in UK, the report states.

These companies, it said, were mainly used for inflow of funds into UK-based companies, which not only acquired expensive properties in UK from such funds but also revolve these funds amongst their companies of UK, KSA, UAE and Pakistan.

The JIT also highlighted that the companies where the Sharifs were acting as shareholders, directors or beneficial owners were primarily family-owned businesses. These companies were incorporated in the 1980s and 1990s, when Nawaz Sharif was holding public office.

Being shareholders, the Sharifs injected nominal capital as seed money and these companies were mainly entrusted with borrowed funds from banks, financial institutions or foreign-incorporated special purpose vehicles.

The companies also borrowed funds, at their inception, and rolled over funds with other facilities; foreign currency funds were generated to install plants and machinery.

But going forward, a majority of the companies were either non-operational or were not functioning at maximum capacity and were in loss, having negative equity, such as Mohammad Buksh Textile Mills Limited, Hudaibya Paper Mills Limited, Hudaibya Engineering Company Private Limited, Hamza Board Mills Limited, and Mehran Ramzan Textile Mills Ltd.

Due to weak performance and in absence of accumulated or operational profits, dividends were not declared, except for a few years. These companies were mainly loss-making units and no significant turnaround was observed over the past 20 years or so.

Accumulating assets by proxy

About Ms Kulsoom Nawaz, wife of Nawaz Sharif, the JIT stated she had been part of the family business and filing tax returns since 1984-85. Her total assets increased 17.5 times during the course of one year; from Rs1.64 million in 1991-92 to Rs28.62 million in 1992-93, against a reported income of only Rs279,400.

The JIT found that the accumulation of Hussain Nawaz assets showed a sharp spike in the early 1990s, and then again in 1997-98, with no declared source of income.

The JIT believed that this build-up of assets was through irregular means and that Hussain was used as a proxy to build the familys assets.

Hassan Nawaz assets also showed a similar spike in the early 1990s with no declared source of income. This was a period when the Sharif family was in power.

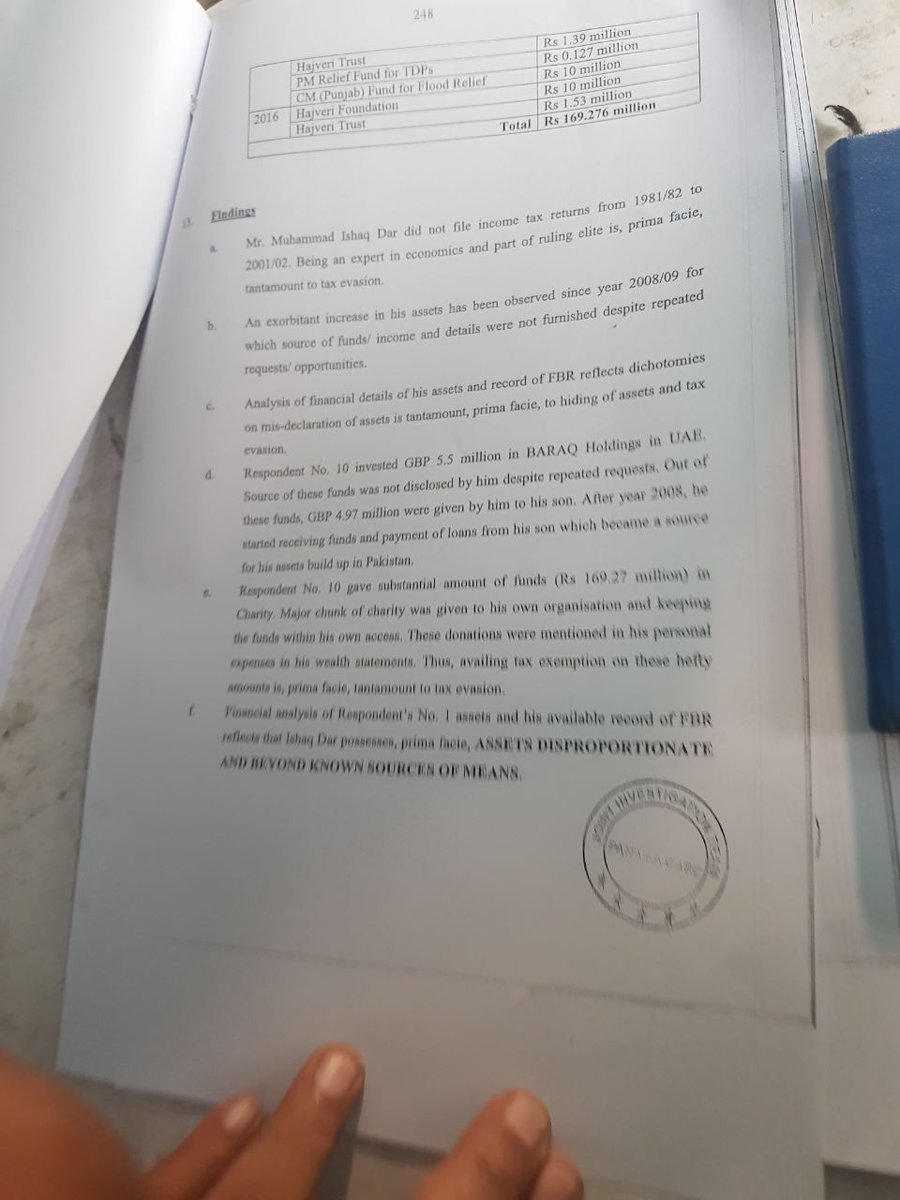

The report did not spare Finance Minister Ishaq Dar, either. It pointed out that he did not file income tax returns between 1981-82 and 2001-02, which amounted to tax evasion.

An exorbitant increase was also observed in his assets since 2008-09, for which source of funds and income details were not furnished, despite repeated requests.

The JIT clearly stated that prima facie, Mr Dar possessed assets disproportionate and beyond his known means, adding that he invested 5.5 million British pounds in Baraq Holdings in the UAE, but the source of these funds was not disclosed, only that around 4.97 million pounds were given to him by his son.

Mr Dar also gave Rs169.27 million to charity, but a major chunk of that was given to his own organisation, keeping the funds within his own access.

Similarly, National Bank of Pakistan President Saeed Ahmed registered as a tax-payer in 2015, but no record of his returns was available prior to 2015. In his income tax returns for 2014-15, Saeed Ahmed declared foreign income amounting to Rs20 million, but no evidence was available regarding the source of that income. In his wealth statement for the same year, Mr Ahmed declared foreign remittances worth Rs17.13 million, the source of which cannot be ascertained.

The JIT also recommends re-opening the cases of Hudabiya Paper Mills Ltd and Hudabiya Engineering Ltd for further investigation and re-trial on the basis of new evidence.

The Hudaibiya mills reference remained in the cold storage for 12 years after it was adjourned in 2007 because the Sharifs were in exile. It was later quashed by the Lahore High Court in 2014, after the incumbent Qamar Zaman Chaudhry was appointed NAB chief.

Suspicious transactions

Investigations also revealed that the process of money laundering actually started in Sept 1991, as opposed to the first transaction in Aug 1992 identified by FIA and NAB investigations.

These transactions showed that funds of $2.23 million were deposited in the first two accounts, opened in the name of incumbent NBP president Saeed Ahmad and Mukhtar Hussain.

Subsequently, all the money from these accounts were transferred to the accounts of Musa Ghani and Talat Masud Qazi through dollar bearer certificates (DBCs) to hide the source of the funds.

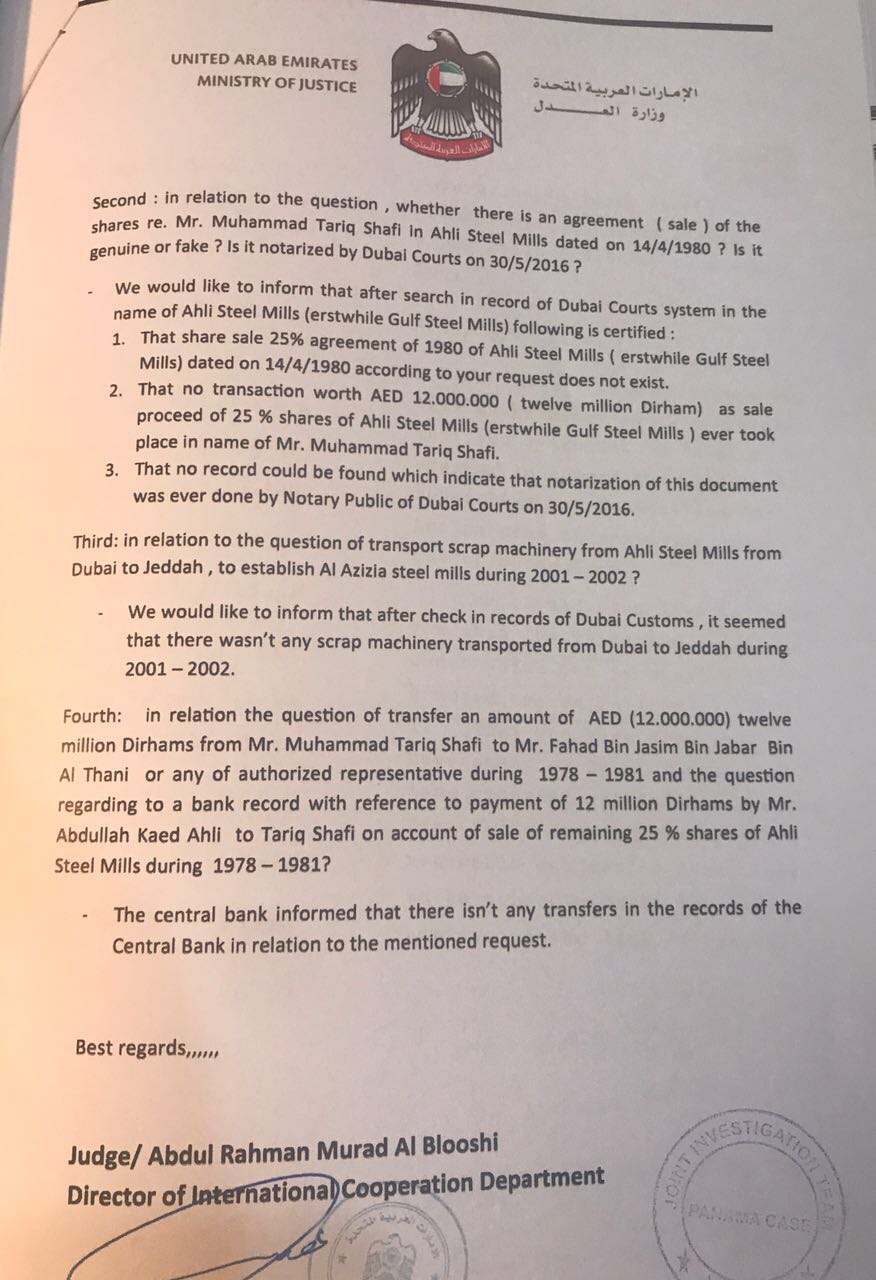

Referring to mutual legal assistance provided by the UAE Ministry of Justice, the JIT held that no transaction worth 12 million UAE Dirhams, claimed by Sharifs to be the sale proceeds of 25pc shares of Ahli Steel Mills (previously known as Gulf Steel Mills) ever took place in the name of Muhammad Tariq Shafi the prime ministers cousin.

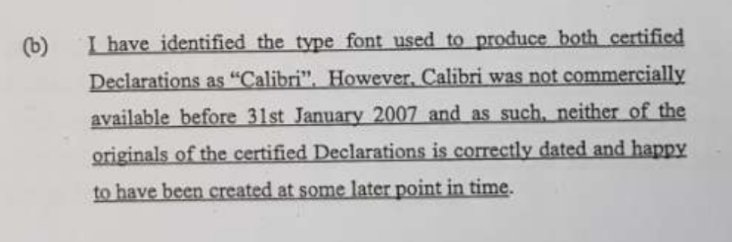

There is not a single document that can provide the basis for any money trail for the purchase of the Avenfield London properties and the businesses of the sons of the prime minister, the JIT observes, declaring the documents produced as fabricated and fake.

After checking with Dubai Customs, the JIT concluded that no scrap machinery was transported from Dubai to Jeddah in 2001-02.

Thus, the team concluded, it was proven that the documents or record produced by the Sharifs regarding the sale of 25pc of the mills shares were unauthentic, unverified, fake and fabricated.

Besides, the attached share sale agreement of 1980 and the letter of credit for the transportation of scrap machinery from Dubai to Jeddah were also declared fictitious.

Similarly, Tariq Shafi never handed over 12 million dirhams to former Qatari prime minister Shiekh Hamad bin Jassim bin Jaber Al Thani in 1980, as claimed by Sharifs before the apex court. Mr Shafi, in fact, tried to mislead the Supreme Court, the JIT deplored.

Evasive PM

During his interrogation, the JIT said, PM Sharif was visibly evasive on most of the questions related to Gulf Steel Mills and, after two and half hours of questioning, the prime minister only admitted to knowing Mohammad Hussain as his maternal uncle.

The JIT also dubbed the two letters from Sheikh Al Thani a myth and not a reality.

The JIT highlighted how the prime minister not only concealed assets to the tune of Rs45 million, but also misreported in his wealth statement for the year 2013.

The prime minister, the report said, enjoyed pecuniary benefits other than dividends from his businesses in the shape of unexplained inflows to his personal bank accounts on a regular basis from the business profits of his son and businesses run by him, purportedly in the form of gifts.

The prime minister is a minor direct shareholder in the closely-held family companies when they are not profit-bearing, but these companies are continuously revolving funds amongst themselves and their shareholders/directors/sponsors and offshore companies, the JIT said.

The JIT also unearthed a new offshore company, FZE Capital in the UAE, which had Prime Minister Nawaz Sharif as its chairman.

The report said the prime minister kept shares in the name of his wife, sons and daughters, who were not financially independent at the time; thereby retaining control over the business due to his strong political and family influence.