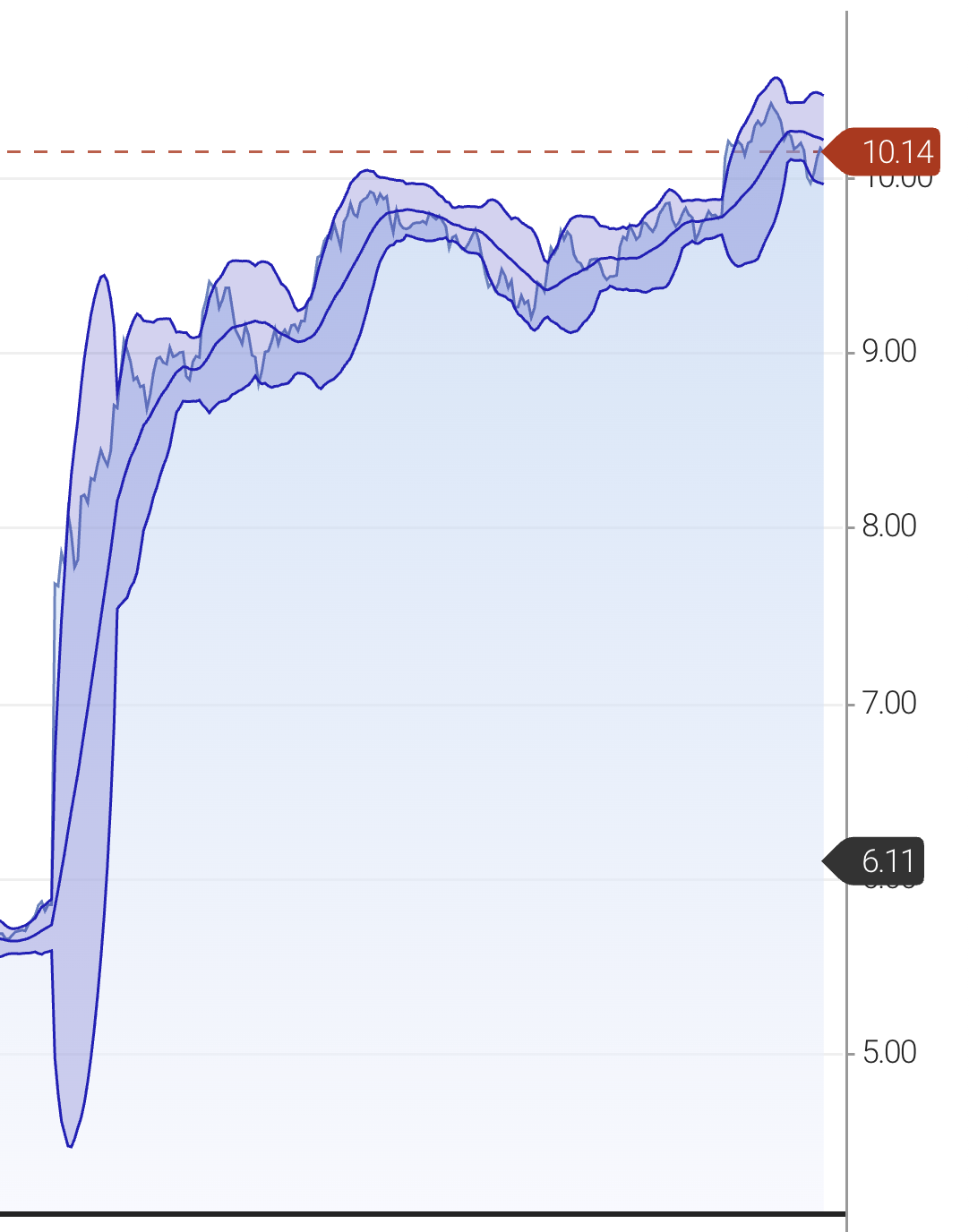

Its crazy how good this run is. Looking at my tracker, in the past 6 weeks (by end of this week), I've had one bad day and a slew of modest lost days. But many big gainer days and more modest gainers too.

My portfolio isnt as crazy good as Nocty's, and my portfolio is hard to analyze since in this time I've had a combo of cash on the side, a slew of safe divvy plays that dont really move, and even some locked in low rate money as I want to think what to do with it.

But as a ballpark my portfolio is +10%. Just looking at the equities stuff only (not cash and safe stocks that dont move), I'd ballpark those regular/volatile stocks are up 30%. And that 30% even still includes baking in some modest losses on some random stocks and one big bomb I got nailed on (Lululemon).

Still, almost everyday is an ATH.