-

Hey Guest. Check out your NeoGAF Wrapped 2025 results here!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock-Age: Stocks, Options and Dividends oh my!

- Thread starter koam

- Start date

HoodWinked

Member

Figma mania

OLED_Gamer

Member

StreetsofBeige

Gold Member

And last week I was trending at my ATH. I think I've had 6 down days in a row and today was the biggest clunker.

Good thing is I've sandbagged a bunch of cash on the side again, but my multi dipping into Micron (made money I think 2-3 times on them before), my latest dip at $120-ish has been a shit move. Got to wait for it to rebound again, or I avg down and hope it scrapes back up.

Good thing is I've sandbagged a bunch of cash on the side again, but my multi dipping into Micron (made money I think 2-3 times on them before), my latest dip at $120-ish has been a shit move. Got to wait for it to rebound again, or I avg down and hope it scrapes back up.

Nocty

Currently Steaming

I gave up trading / swing trading as it's a waste of time. The longer I just hold things the more success I seem to have, even if its years. I had to baghold Tesla for almost 3 years to break even from my buy price, and managed to get out with a measily 5% profit. Better than selling when I was 70% down lolAnd last week I was trending at my ATH. I think I've had 6 down days in a row and today was the biggest clunker.

Good thing is I've sandbagged a bunch of cash on the side again, but my multi dipping into Micron (made money I think 2-3 times on them before), my latest dip at $120-ish has been a shit move. Got to wait for it to rebound again, or I avg down and hope it scrapes back up.

Big-G

Member

Yep, just about everything was down for me today. I was riding high after that MS earnings call, but not so much today.ugh, I should have sold off some coinbase. Rough day

GHG

Member

I am not sure what they expected with the jobs report. Anyone following news could see what was coming...

It's not just the jobs report, it's several things all at once:

- Jobs report and the subsequent fall-out

- Tarrifs

- Trump's latest war of words with Powell

- China drawing up new plans to invade Taiwan

- Trump threatening Russia with nuclear subs

MaestroMike

Gold Member

Nocty

Currently Steaming

Trump is such a fragile little man.

I never really understood why the US population votes the way it does, all this guy seems to do is provoke and then chicken out, other world leaders all know they just have to wait and ignore his threats and provocations.

Is this the 'strong leader' they hoped for that cares about the stock market? it almost seems like he waits for a big rally then deliberately dumps some dumb shit tweet to kill our portfolios on purpose

I never really understood why the US population votes the way it does, all this guy seems to do is provoke and then chicken out, other world leaders all know they just have to wait and ignore his threats and provocations.

Is this the 'strong leader' they hoped for that cares about the stock market? it almost seems like he waits for a big rally then deliberately dumps some dumb shit tweet to kill our portfolios on purpose

GHG

Member

He wants everyone around him to cook the books.

Insanity. This is a country's finances you're talking about here, all of this has huge implications for what is the global reserve currency, not some SME.

Last edited:

The problem is this stuff polls well. I mean both sides say stuff like this because most people are completely economically illiterate and believe crazy things. (Just to name a few they think tariffs are good ideas, the economy is a zero sum game, price controls work, price is objective/labor theory of value makes sense, trade gaps can exist, and of course rich people must have stolen all that money from us. Hell they tricked the voters here in Mass with the millionaires tax because people didn't get that money is fungible.) Anyway you just hope once they get elected they don't actually do the stupid shit the voters want but sometimes they go and do it anyway.Trump is such a fragile little man.

I never really understood why the US population votes the way it does, all this guy seems to do is provoke and then chicken out, other world leaders all know they just have to wait and ignore his threats and provocations.

Is this the 'strong leader' they hoped for that cares about the stock market? it almost seems like he waits for a big rally then deliberately dumps some dumb shit tweet to kill our portfolios on purpose

Badlucktroll

Member

i am like this close  to full porting corn and wheat

to full porting corn and wheat

Nocty

Currently Steaming

Been looking at a lot of data and charts for $OXY (warren buffet's current oil darling stock).

He was buying this heavily in the $60's and $70's and now its been chopped down to $30-40's this past couple of months. It's a tempting buy given how Buffet's track record on Oil stonks has been this last 70 years. I don't know much about it myself but at this level the risk reward despite not being an oil expert seems quite good. I wonder what he see's in the stock

He was buying this heavily in the $60's and $70's and now its been chopped down to $30-40's this past couple of months. It's a tempting buy given how Buffet's track record on Oil stonks has been this last 70 years. I don't know much about it myself but at this level the risk reward despite not being an oil expert seems quite good. I wonder what he see's in the stock

StreetsofBeige

Gold Member

They vote for him due to two things:Trump is such a fragile little man.

I never really understood why the US population votes the way it does, all this guy seems to do is provoke and then chicken out, other world leaders all know they just have to wait and ignore his threats and provocations.

Is this the 'strong leader' they hoped for that cares about the stock market? it almost seems like he waits for a big rally then deliberately dumps some dumb shit tweet to kill our portfolios on purpose

1. The topics he talks about the most relate to people the most.... jobs, taxes, business stuff, immigration. All your usual boring topics probably every candidate in every country talks about for 100 years

2. The other side doesn't have ideas of their own for these topics except declaring Trump's version is bad. Well, if you cant come up with a better version, nobody is going to listen to you. Instead they focus on things like abortion or gender issues which for most people are down the list of priorities. If Trump's ideas are that crappy, it should be a cakewalk to just come up with better solutions to counter them and the people should love them more.

Think of it like sitting in a business meeting. There's a few hot topics discussed as a product line is tanking and someone is being designated the lead to fix it.

One director says he's got some ideas to adjust the product quality, price, and change the look of the packaging. All important things for the consumer.

The other director's ideas are he wants to focus on whether the wholesale cardboard box should be brown or white, if it should carry 8 units or 12, and if the advertising should say he/she/they. His counter to the first guy is his ideas suck. And when the room asks him what his counter ideas are, he's got none and zips his mouth or giggles. Ya, some leader this guy is.

Given that choice, the room will assign the first director as the lead and his ideas will go through. Whether the room likes his ideas or not isnt that important. It'll pass through because they are more important and will move the needle more. And the room trusts he's got some leadership and charisma to make it work. That's not to say the other director's ideas are automatically bad. Believe it or not, wholesale case quantities are important as a company has to make sure it's a reasonable amount not too low or high, and perhaps in certain situations doing multi gender stuff is good. But as a whole, the bigger topics will be pushed through first.

That's how the voting went in the election. I'm not even American and I can tell by people sentiment and watching some speeches what was going on.

Last edited:

Not sure on this. I think this is more of a "why are we just hearing about this now?" The earlier you hear about something the sooner you can do something about it. Are you going to wait until the day you are supposed to ship to tell your boss, oh we can't ship because of x, y, and z. I am not defending him because he knows why, but I think i would be pissed off if I am blindsided by poor numbers.He wants everyone around him to cook the books.

Insanity. This is a country's finances you're talking about here, all of this has huge implications for what is the global reserve currency, not some SME.

rm082e

Gold Member

Not sure on this. I think this is more of a "why are we just hearing about this now?" The earlier you hear about something the sooner you can do something about it. Are you going to wait until the day you are supposed to ship to tell your boss, oh we can't ship because of x, y, and z. I am not defending him because he knows why, but I think i would be pissed off if I am blindsided by poor numbers.

If he doesn't listen to information he doesn't want to hear, there's nothing anyone can do to make him understand. Damn near every economist in the free world said his tariffs were a bad idea that was going to hurt American businesses, but he didn't listen. He got a couple of yes men to be his cheerleaders and plowed ahead.

This is a completely unforced self own, and it's all Trump's responsibility. Maybe the market will keep pretending everything is fine in the hopes he TACOs and finds a shinny new toy to play with. But if he doesn't, the impact on the American business economy is unavoidable. Blaming Biden, blaming the media, blaming the bean counters, etc. isn't going to change the outlook in the boardroom.

And god help us if this AI hype train comes to a stop. The amount of money tied up in the tech companies is enough to cause a serious crash if the public ever really starts pressing them on the P&L for it. If the AI bubble pops at the same time as the tariff impacts really set in, we're going to be in for a ride.

StreetsofBeige

Gold Member

People saying he is always TACOing don't know how negotiations work.If he doesn't listen to information he doesn't want to hear, there's nothing anyone can do to make him understand. Damn near every economist in the free world said his tariffs were a bad idea that was going to hurt American businesses, but he didn't listen. He got a couple of yes men to be his cheerleaders and plowed ahead.

This is a completely unforced self own, and it's all Trump's responsibility. Maybe the market will keep pretending everything is fine in the hopes he TACOs and finds a shinny new toy to play with. But if he doesn't, the impact on the American business economy is unavoidable. Blaming Biden, blaming the media, blaming the bean counters, etc. isn't going to change the outlook in the boardroom.

And god help us if this AI hype train comes to a stop. The amount of money tied up in the tech companies is enough to cause a serious crash if the public ever really starts pressing them on the P&L for it. If the AI bubble pops at the same time as the tariff impacts really set in, we're going to be in for a ride.

Winning a negotiation isn't about batting 1.000 getting only the maxed out end result. The fact Trump has changed so many tariffs in a short time is unheard of. Before this, every country out there must had been screwing the US no wonder the US debt and trade deficits are so high.

Think of it like buying a car. It costs $50k. If a guy wants to low ball a crazy offer at $38k and the sales guys says $48k. After back and forth the guy gets it for $45k both sides can agree on it doesn't mean the buyer lost the deal because he didn't get his shotgun $38k starting offer.

When trump shotguns a rate I don't think he even bases it on anything. Suddenly one morning hell just blurt out country x rate is gonna be 60%. So if you wanna negotiate let's do it. Next thing you know they shake hands at 25%.

Last edited:

DownLikeBCPowder

Member

All of the books have been cooked a long time, so nothing will change there.He wants everyone around him to cook the books.

Insanity. This is a country's finances you're talking about here, all of this has huge implications for what is the global reserve currency, not some SME.

Yoshichan

And they made him a Lord of Cinder. Not for virtue, but for might. Such is a lord, I suppose. But here I ask. Do we have a sodding chance?

ask and yee shall receiveI am thanking the gods for RDDT these days

Please take me back to +-0

GHG

Member

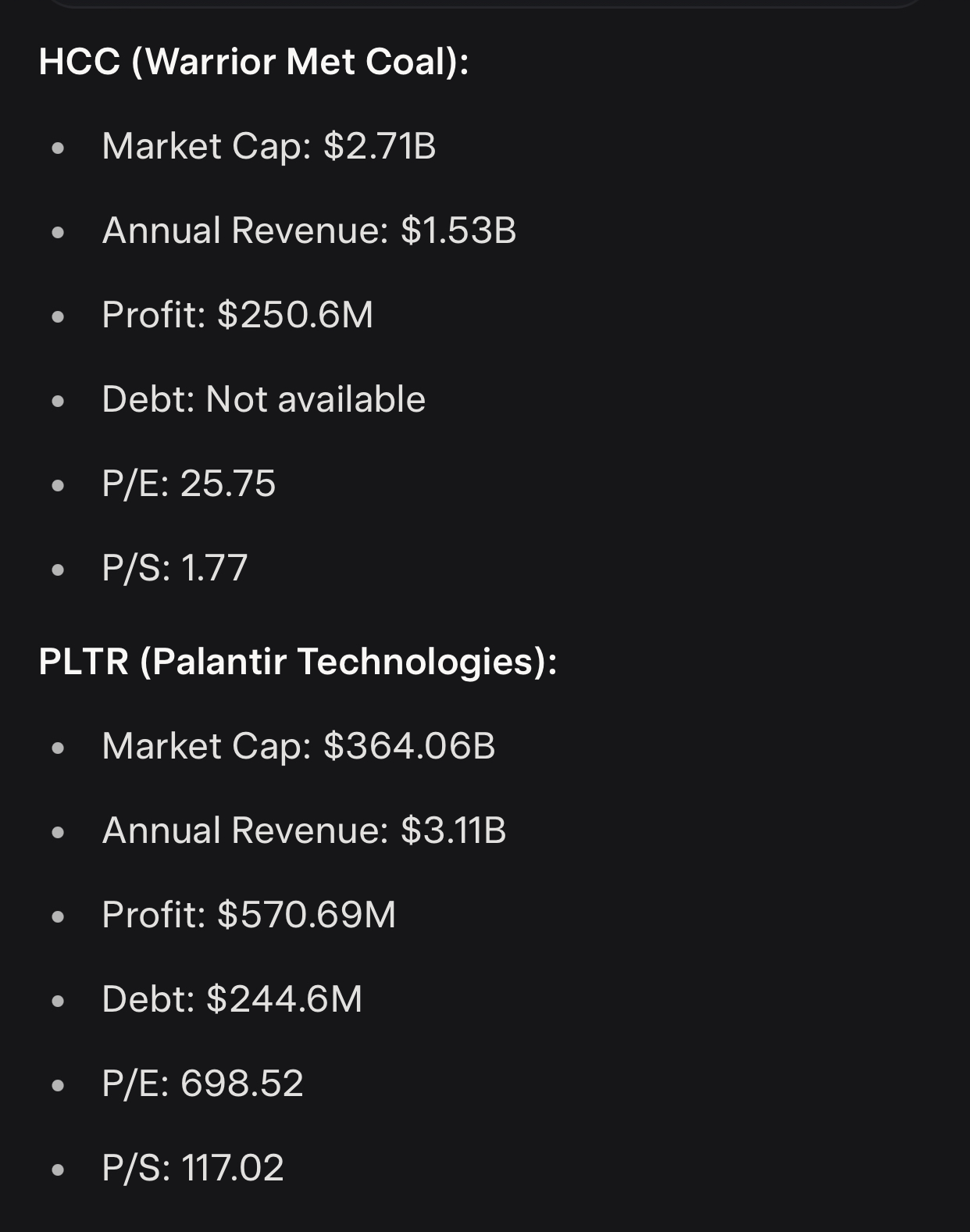

I have 10,000 shares of $APLD bought for like $5k gaf and it's going to the moon, pls hold me. the urge to sell is big. I got in at like $3.4 or something.

So you're about 100k up right?

My advice - start taking some profit, leave double whatever your initial investment was to ride.

You also need to be wary of concentration risk as individual holdings like this become worth a larger % of your overall portfolio. Work on trimming down position sizes until they represent no more than 5% of your overall portfolio size (including cash holdings), it's the most effective way of preserving gains and overall wealth.

For example, if this position represents ~50% of your overall portfolio in terms of cash value (including unrealised gains), an event that causes the stock to crash has the potential to wipe out half of your wealth - this is an unnecessary risk to take considering you are up over 400% on the position.

Also - sell covered calls, the IV is nearing 100% for the stock at the moment, you'd be stupid to not take advantage of this situation.

Last edited:

Nocty

Currently Steaming

98k profit since posting, haha. The tiny % movements are what making it hard. I'ts stomach churning!So you're about 100k up right?

My advice - start taking some profit, leave double whatever your initial investment was to ride.

You also need to be wary of concentration risk as individual holdings like this become worth a larger % of your overall portfolio. Work on trimming down position sizes until they represent no more than 5% of your overall portfolio size (including cash holdings), it's the most effective way of preserving gains and overall wealth.

For example, if this position represents ~50% of your overall portfolio in terms of cash value (including unrealised gains), an event that causes the stock to crash has the potential to wipe out half of your wealth - this is an unnecessary risk to take considering you are up over 400% on the position.

Also - sell covered calls, the IV is nearing 100% for the stock at the moment, you'd be stupid to not take advantage of this situation.

GHG

Member

98k profit since posting, haha. The tiny % movements are what making it hard. I'ts stomach churning!

If that's the case then the position size has likely become too big a % of your overall portfolio.

Calculate what percentage of your overall account this position now represents and work on trimming it down towards the 5% mark.

Nocty

Currently Steaming

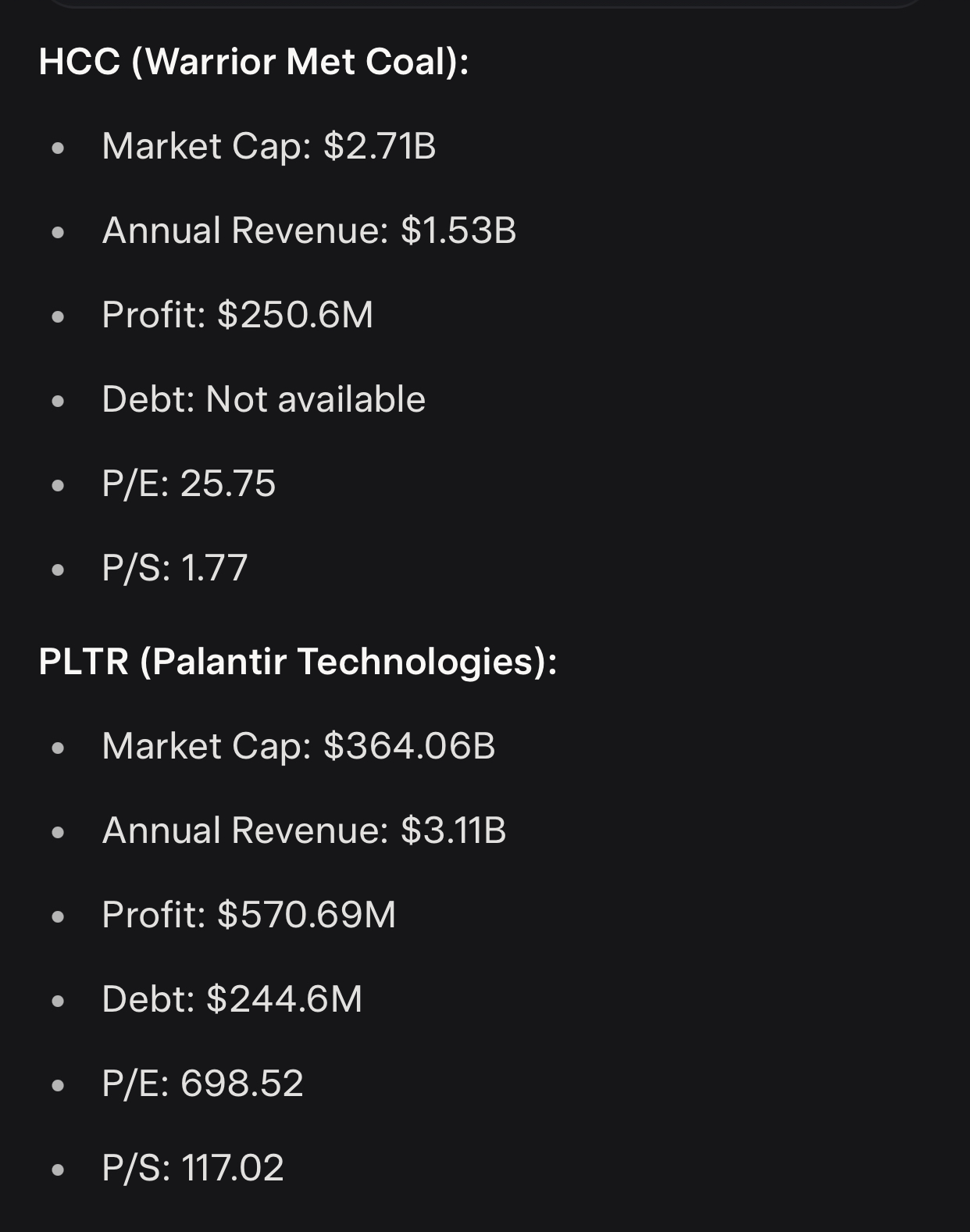

Palantir beats earnings by ~60m

Revenue $1B

stock surges $15B after hours to $400B market cap

make it make sense. Not complaining but I'm selling my shares tomorrow, this valuation is eyewatering

Comparing it to one of my other holdings is absolutely hilarious

Revenue $1B

stock surges $15B after hours to $400B market cap

make it make sense. Not complaining but I'm selling my shares tomorrow, this valuation is eyewatering

Comparing it to one of my other holdings is absolutely hilarious

Last edited:

StreetsofBeige

Gold Member

After it popped to that price, I've had it on watchlist. Could had got it for $12 and change, but it popped again. Might bite this week.holy shit congrats my fellow Applied Digital longs!!

we going to the short squeeze valhalla after that insane earnings beat

But good to see markets finally rebound. Had a nice rebound day. I think I had 5-6 losing days in a row!

What a wild ride for Figma. Missed getting it as it popped to insanity levels. If the stock plunges down to $50 or less I might bite. But it's still around $90. Nope. I had a limit order of $35.... then kept inching it up to $40.

For those of you who didnt follow, the stock had an IPO price range of low $30s. Often times, an IPO wont sell at the opening bell. It'll launch maybe 10:30-11:00. It was such a clusterfuck, it opened around 2 pm or so at $85! Then it zoomed to $120. And peaked after hours at around $150. Crash and burned today -$30+ to $90-ish. It's right now at $87 after hours just $2 more than its open!

Last edited:

StreetsofBeige

Gold Member

APLD.I went short and bought puts on Palantir $PLTR at $174. could be a great move or a stupid one

Time will tell but I think we toppy boys

I'm in bro. Got in at $13.76 today. Let's go!

MaestroMike

Gold Member

Nocty

Currently Steaming

APLD.

I'm in bro. Got in at $13.76 today. Let's go!

I am not going to claim any superior knowledge heer, I bought a tranche of 10,000 shares between $2.40 and $6.00 or so back in April, quite a while ago, so not a huge investment but a lot of shares, and it's popping like hell for some reason. Their deal with Coreweave hit not long after I got in really popped up the price (I literally only bought applied digital to spread my risk a bit from coreweave cause I was heavy into that).

Lets see where we are in a year or two.

ecosse_011172

Banned

Are you claiming that the rich haven't stolen?The problem is this stuff polls well. I mean both sides say stuff like this because most people are completely economically illiterate and believe crazy things. (Just to name a few they think tariffs are good ideas, the economy is a zero sum game, price controls work, price is objective/labor theory of value makes sense, trade gaps can exist, and of course rich people must have stolen all that money from us. Hell they tricked the voters here in Mass with the millionaires tax because people didn't get that money is fungible.) Anyway you just hope once they get elected they don't actually do the stupid shit the voters want but sometimes they go and do it anyway.

MaestroMike

Gold Member

Last edited:

TVexperto

Member

Finally it jumped higher!I put so much money into Take Two I hope they wont delay GTA 6 again, planning to sell it shortly before GTA 6 releases when hype will be through the roof (thinking back how it was simliar with CD Project Red and CYBERPUNK)

Grildon Tundy

Member

NVIDIA makes up 2% of my non-retirement portfolio's buy-in but 10% of its current value.

I don't have any other individual stock that makes up more than 5% of value (I have two ETFs that are 43% and 15%).

I feel like I've heard there's a rule-of-thumb to divest when a single stock makes up more than 5% of a portfolio, but at the same time, NVIDIA seems to be an exception to many rules.

I don't have any other individual stock that makes up more than 5% of value (I have two ETFs that are 43% and 15%).

I feel like I've heard there's a rule-of-thumb to divest when a single stock makes up more than 5% of a portfolio, but at the same time, NVIDIA seems to be an exception to many rules.

GHG

Member

I feel like I've heard there's a rule-of-thumb to divest when a single stock makes up more than 5% of a portfolio, but at the same time, NVIDIA seems to be an exception to many rules.

Yes there is, it's the best wealth building technique known to man but for most people greed takes over and they struggle to adhere to it, meaning it becomes an "all or nothing" mentality when they see a single stock in their portfolio skyrocket.

Also a lot of people misunderstand the method you should use when divesting - you don't need to do it all at once, it can be done gradually.

Good discussion on the topic here:

Steve Holt

Member

I'm looking to get into this.. I know there probably is a lot of good posts about getting started here in this threads, was wondering whether there any good sites to trade via / advice before I do some searching this weekend. Thanks

TVexperto

Member

What the fuck happened.Finally it jumped higher!

dotnotbot

Member

What the fuck happened.

Well, at least I can buy more

Nocty

Currently Steaming

I took a little bit of profits from both $APLD and $NBIS

Seeing them fluctuate my portfolio by $10-15k per day was nauseating. I let the positions run for too long and get too large % wise. Locked it in.

Will redistribute once the market cools off a little, shit is getting crazy out there. My sleeper stock $HCC (warrior met coal) also took off this week after a better than expected earnings, as well as a bit of a dump in $HIMS which kind of balanced out. I am bullish both so will just hold for long haul.

my coreweave reports tuesday, so hoping for some more pop but will see

Seeing them fluctuate my portfolio by $10-15k per day was nauseating. I let the positions run for too long and get too large % wise. Locked it in.

Will redistribute once the market cools off a little, shit is getting crazy out there. My sleeper stock $HCC (warrior met coal) also took off this week after a better than expected earnings, as well as a bit of a dump in $HIMS which kind of balanced out. I am bullish both so will just hold for long haul.

my coreweave reports tuesday, so hoping for some more pop but will see

Unknown?

Member

Most economists don't even know how our monetary system works.If he doesn't listen to information he doesn't want to hear, there's nothing anyone can do to make him understand. Damn near every economist in the free world said his tariffs were a bad idea that was going to hurt American businesses, but he didn't listen. He got a couple of yes men to be his cheerleaders and plowed ahead.

This is a completely unforced self own, and it's all Trump's responsibility. Maybe the market will keep pretending everything is fine in the hopes he TACOs and finds a shinny new toy to play with. But if he doesn't, the impact on the American business economy is unavoidable. Blaming Biden, blaming the media, blaming the bean counters, etc. isn't going to change the outlook in the boardroom.

And god help us if this AI hype train comes to a stop. The amount of money tied up in the tech companies is enough to cause a serious crash if the public ever really starts pressing them on the P&L for it. If the AI bubble pops at the same time as the tariff impacts really set in, we're going to be in for a ride.

Grildon Tundy

Member

Most economists don't even know how our monetary system works.

StreetsofBeige

Gold Member

Just to show how economic theory doesnt make sense sometimes, figure these one out:

- If interest rates rise, it makes things more costly so people have less money to spend. Therefore, prices should come down with less demand while businesses compete more on price to get that sale

- Ok, if that's true then why have prices still rose (or at minimum stabilized and never came down) when interest rates have decreased the past 18 months?

- Maybe companies kept high prices since loan rates are now high

- So do interest rate adjustments increase prices or decrease prices?

- Low interest rates means more money in people's pockets with low prices

- If that's the case, wouldnt low rates and prices from 2008-2021 mean people should amping up buying tons of shit increasing prices?

- I never saw that. During that stretch, prices were low and stable for over 10 years. The only thing which zoomed up was real estate

- If rising interest rates are bad for the economy, then why do most countries still want rates like 2-3%? Wouldnt 0% or 1% be better?

- If interest rates rise, it makes things more costly so people have less money to spend. Therefore, prices should come down with less demand while businesses compete more on price to get that sale

- Ok, if that's true then why have prices still rose (or at minimum stabilized and never came down) when interest rates have decreased the past 18 months?

- Maybe companies kept high prices since loan rates are now high

- So do interest rate adjustments increase prices or decrease prices?

- Low interest rates means more money in people's pockets with low prices

- If that's the case, wouldnt low rates and prices from 2008-2021 mean people should amping up buying tons of shit increasing prices?

- I never saw that. During that stretch, prices were low and stable for over 10 years. The only thing which zoomed up was real estate

- If rising interest rates are bad for the economy, then why do most countries still want rates like 2-3%? Wouldnt 0% or 1% be better?

Last edited:

Nocty

Currently Steaming

Just to show how economic theory doesnt make sense sometimes, figure these one out:

- If interest rates rise, it makes things more costly so people have less money to spend. Therefore, prices should come down with less demand while businesses compete more on price to get that sale

- Ok, if that's true then why have prices still rose (or at minimum stabilized and never came down) when interest rates have decreased the past 18 months?

- Maybe companies kept high prices since loan rates are now high

- So do interest rate adjustments increase prices or decrease prices?

- Low interest rates means more money in people's pockets with low prices

- If that's the case, wouldnt low rates and prices from 2008-2021 mean people should amping up buying tons of shit increasing prices?

- I never saw that. During that stretch, prices were low and stable for over 10 years. The only thing which zoomed up was real estate

- If rising interest rates are bad for the economy, then why do most countries still want rates like 2-3%? Wouldnt 0% or 1% be better?

The biggest problem we have at the moment is that around 95% of all wealth is held by 70+ year old retired white people that do not invest or spend money on anything. Their property is worth trillions, their bank full of dead cash doing nothing, and the small % of them that have stocks similarly do nothing but reinvest dividends into the russel 2000 and or the SPY. It's caused a giant index fund everything bubble

Once these people die, which is soon, we are going to be in deep shit because no one can afford to buy their property and the mass of selling in assets is going to cause a hellscape. The fed has been panicking about it for a decade now.

Last edited:

Unknown?

Member

That line of thinking makes sense on the assumption that we have sound money but unfortunately we do not.Just to show how economic theory doesnt make sense sometimes, figure these one out:

- If interest rates rise, it makes things more costly so people have less money to spend. Therefore, prices should come down with less demand while businesses compete more on price to get that sale

- Ok, if that's true then why have prices still rose (or at minimum stabilized and never came down) when interest rates have decreased the past 18 months?

- So do interest rate adjustments increase prices or decrease prices?

- Low interest rates means more money in people's pockets with low prices

- If that's the case, wouldnt low rates and prices from 2008-2021 mean people should amping up buying tons of shit increasing prices?

- I never saw that. During that stretch, prices were low and stable for over 10 years

- If rising interest rates are bad for the economy, then why do most countries still want rates like 2-3%? Wouldnt 0% or 1% be better?

We got to where we are today because we use fake, trash fiat currency that is not even created by our government(dollars are created by commercial and central banks) and we don't use real money anymore. We have a debt based monetary system where currency is debt and debt is currency. We literally pay off our debts with debt because dollars are a debt instrument. All dollars have been borrowed into existence and have to be paid back with interest. When the dollars are created only the principle is created, not the interest, so in order to pay back the interest more debt needs to be created to pay off the interest and so on and so on. Paying back the debt is an impossibility how our monetary system works and if you were to try, you'd end up not able to pay off all the interest and not a single dollar would be left in circulation. It is a classic pyramid/ponzi scheme and mathematically cannot last forever.

Because of this the currency supply is ALWAYS expanding massively due to irresponsible fiscal spending. The expansion of the money supply is inflation(rising prices happen as a result) and thus prices never really goes down overall. Prices can go down due to supply/demand changing but that is not permanent like inflation. The government does not want prices going down simply due to they lose out on tax revenue. For example, lets say someone makes 100k a year. If they got a 10k raise or if they stayed 100k but deflation was 10% they would have the same purchasing power despite one being nominally lower. However 110k gets taxed more while 100k with the purchasing power of 110k gets taxed less. They can't tax purchasing power gains but they can tax higher wages.

StreetsofBeige

Gold Member

I can only speak for where I live, but property prices here are sky high too.The biggest problem we have at the moment is that around 95% of all wealth is held by 70+ year old retired white people that do not invest or spend money on anything. Their property is worth trillions, their bank full of dead cash doing nothing, and the small % of them that have stocks similarly do nothing but reinvest dividends into the russel 2000 and or the SPY. It's caused a giant index fund everything bubble

Once these people die, which is soon, we are going to be in deep shit because no one can afford to buy their property and the mass of selling in assets is going to cause a hellscape. The fed has been panicking about it for a decade now.

But the funny thing is the gov does things to keep it high to max out fees and property taxes:

- Endless immigrants propping up demand and property values (these arent broke migrants). They got education and jobs

- Enviornmental policies preventing home builders from building in certain areas

- Gov skewing home builders to build condos, not houses or townhomes (which spiked the most the past 20 years)

- Gov mandating new builds to have crazy dev/permit fees. So right off the bat without the builder digging one lump of soil in the ground yet, that starting condo will have $50-100k gov costs

- And for bigger units like a detached house, the development/permit fee is like double

Nocty

Currently Steaming

I can only speak for where I live, but property prices here are sky high too.

But the funny thing is the gov does things to keep it high to max out fees and property taxes:

- Endless immigrants propping up demand and property values (these arent broke migrants). They got education and jobs

- Enviornmental policies preventing home builders from building in certain areas

- Gov skewing home builders to build condos, not houses or townhomes (which spiked the most the past 20 years)

- Gov mandating new builds to have crazy dev/permit fees. So right off the bat without the builder digging one lump of soil in the ground yet, that starting condo will have $50-100k gov costs

- And for bigger units like a detached house, the development/permit fee is like double

yeah canada is FUCKED man.

The UK is also in a very weird place because as I said the wealth gap is literally astronomical. You have 25% of the total population over the age of 60 retired with paid off property that has appreciated by 500+% in the last decade alone, some areas over 1000%+

so these old fucks are sitting on the property market, contributing absolutely nothing to the economy but holding all of the wealth while their grandkids generation starves to death waiting for them to pass on wealth, which then gets taxed massively. And that is if you're lucky!

To make it worse, every time we get some politician that tries to change anything they don't have a chance in hell to beat our rigged system, because these old fucks will vote for the one that keeps their pension pot untouched even though they dont touch it themselves.

Then there is the issue similar where the government is building lots of small houses that are supposedly affordable but still cost £350k+ meaning the deposit required leaves you in debt slavery for your entire life just to own a shitty 2 bed terrace house or 3 bed shoebox in south london.

StreetsofBeige

Gold Member

Sounds exactly like here.yeah canada is FUCKED man.

The UK is also in a very weird place because as I said the wealth gap is literally astronomical. You have 25% of the total population over the age of 60 retired with paid off property that has appreciated by 500+% in the last decade alone, some areas over 1000%+

so these old fucks are sitting on the property market, contributing absolutely nothing to the economy but holding all of the wealth while their grandkids generation starves to death waiting for them to pass on wealth, which then gets taxed massively. And that is if you're lucky!

To make it worse, every time we get some politician that tries to change anything they don't have a chance in hell to beat our rigged system, because these old fucks will vote for the one that keeps their pension pot untouched even though they dont touch it themselves.

Then there is the issue similar where the government is building lots of small houses that are supposedly affordable but still cost £350k+ meaning the deposit required leaves you in debt slavery for your entire life just to own a shitty 2 bed terrace house or 3 bed shoebox in south london.

I dont know exactly when property prices skyrocketed, but everything was dirt cheap here (condo to detached) in 2000s. I'll take a stab and say somewhere in the 2010s everything just went wild. Anyone lucky enough to buy a modest house in 2002 for $200,000 now has a place worth probably $600,000. Fast forward to covid years and it's probably $1.5M. I know for sure there was a big jump in the 2015+ years.

My good buddy from grad school scrimped and saved with his wife buying a snazzy house for $800,000 around 2010-ish. He took a risk as they kind of maxed out their budget. And that was a decent amount back then. Last time I talked to him his place is worth $2.5M. And he's done ZERO renos.

A decent condo probably has a minimum price of I'd ballpark $500k-ish here. Ya, you could probably kind some crappy studio unit for less, or a unit outside the metro, but a 1 bed/1 bath starter condo you're gonna be ponying up a half mill minimum in the Toronto metro area. I know because I sold my 670 sq ft 1 bed/1 bath/1 shitty den area unit earlier this year for just under $700k. Floor plan price was $400k.

My first condo I lived in 25 years ago was about $170-ish. I sold it for $225k and thought I hit the jackpot. I just checked Housesigma to see what similar units are going for now in my old building... almost $600k for a 550-600 sq ft 1 bed/1 bath unit. Crazy.

I dont think govs can do anything about it because selling homes is no different than guys selling used stereos on ebay. If they dont want to sell for cheap, they dont have to. Like you said, anyone in a good spot can do nothing. Unless they are forced to move for a personal reason, they'll just sit tight and watch prices keep going up.

Last edited: