winjer

Member

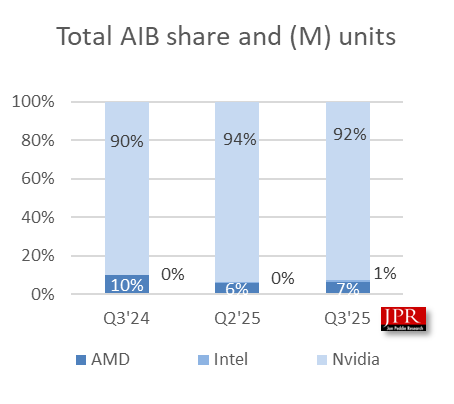

Intel Arc discrete GPUs have reached 1% desktop AIB market share

Intel Arc discrete GPUs have reached 1% market share in the desktop add-in board market, according to the latest Jon Peddie Research (JPR) report cited by TechPowerUp. Intel had hovered around roughly half a percent since Arc "Alchemist" entered the gaming segment, so this small numerical step is the first time Arc appears as a full single digit in JPR's discrete GPU charts. AMD and NVIDIA still control the remaining 99% of the market, but the move gives Arc owners some reassurance that Intel is not exiting the space and is slowly expanding its footprint.

JPR's Q3 2025 data shows AMD at 7% share, up 0.8 percentage points compared to the previous quarter, while NVIDIA remains dominant at 92% after a 1.2 point drop. These shifts are tied to short term factors such as board availability, pricing, and channel inventory adjustments, which can move a few points of share between vendors from one quarter to the next. JPR notes that Intel's share increased by 0.4 points in the same period, which lines up with Arc crossing the 1% mark in the add-in board segment.

Behind those shares sits an add-in board market worth $8.8B in Q3 2025, with shipments reaching $12.0M units and growing 2.8% quarter to quarter, but still below the 10 year seasonal average of 11.4%. Shipments jumped 47.5% compared to the same quarter a year earlier, helped by unusual strength in the prior quarters and strong data center demand, where GPU boards rose by an average of 145.5% versus Q2.

JPR projects a compound annual growth rate of -0.7% for add-in boards between 2024 and 2029, with the installed base expected to reach 152 million units and desktop AIB penetration approaching 120% by the end of the forecast window.

Meanwhile at Intel headquarters...