Because I'm a fan of evidence-based beliefs rather than just thinking from my gut.

https://grattan.edu.au/report/hot-property/

The effects of reducing NG by itself aren't that much. Even combined with CGT changes it wouldn't have much of an effect.

Your article says it removing it "won't cause a collapse" but recommendeds it be phased in over time to prevent one. Clearly prices are related to NG for them to make that recommendation.

It says prices will fall about 2% right there. Obviously government policies can cause problems in the markets, especially changes. Which is why any change should be phased in. But don't expect these changes to have a large impact.

2% of $500k is $10k. I wouldn't describe my assets devaluing by tens of thousands of dollars as "very little" but that's a boring language interpretation argument, so I'll leave it at that.

I thought the 2% figure came from a study that projected in a given period where house prices were growing by 7% they would instead go up by 5%. That's not a 2% loss, that's a slower rate of increase.

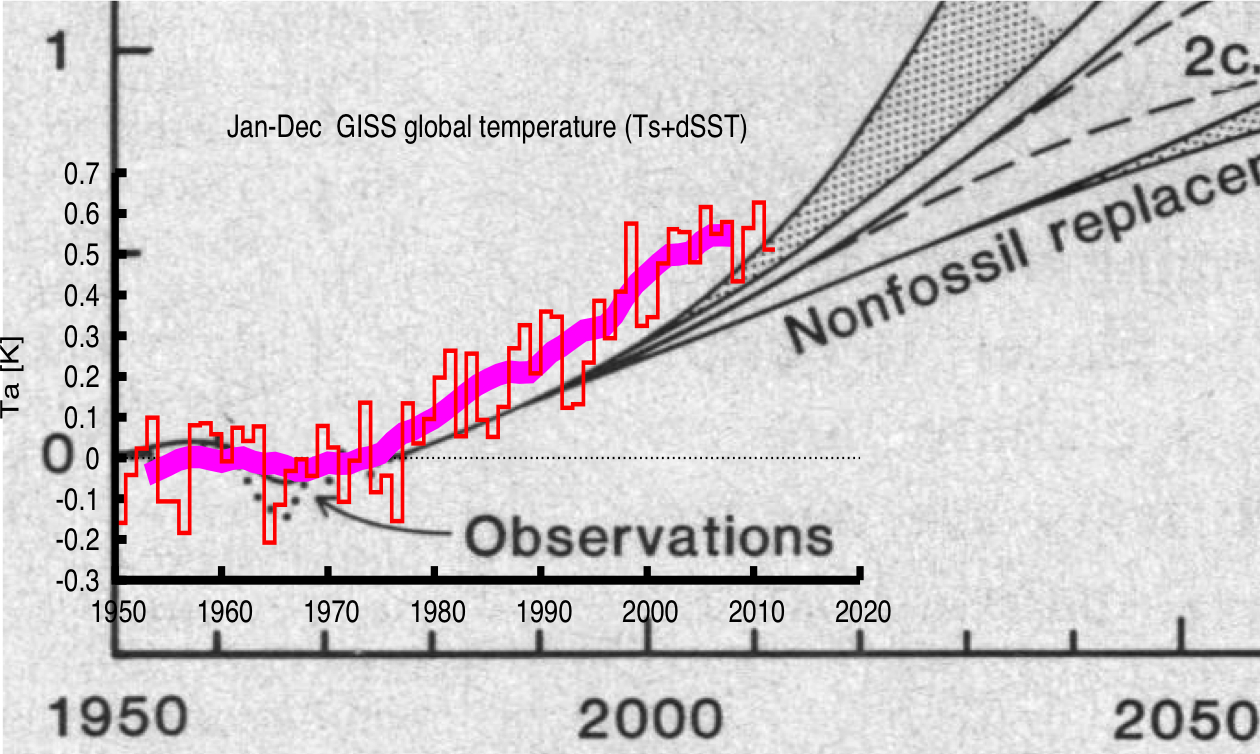

It's the same logic as climate change denialists saying there is a global cooling because the temperature only went up 0.1 degrees every year for a decade.

Anyway here's the article on the negative gearing projection:

http://www.abc.net.au/insiders/content/2015/s4458073.htm

(Insiders transcript)

BARRIE CASSIDY: Now just on negative gearing, why do people deliberately structure an investment to make a loss and why does the Government support them when they do?

SCOTT MORRISON: Well this provision is a normal income tax principle that's been around for more than 100 years and ...

BARRIE CASSIDY: But why is it - why is it normal when you can do it deliberately and then the Government helps you out?

SCOTT MORRISON: Because Barrie - it's a simple tax principle. If you're spending money and it's costing you to earn an income, you can offset it against the income that you have in terms of the tax you pay. It's not something that just applies to property, Barrie; it applies right across the tax system. Two thirds of Australians, one in five police officers actually utilise this long-standing tax arrangement to provide a future for their families. And it is another alternative to the other savings methods that are out there and it is really helping mum and dad investors and particularly small business investors. What Labor is doing is putting what is in effect a housing tax right across the board with this. It will undermine house values. And I hear people say even at the modest level, that it might only be, say, two per cent. Well, two per cent on the value of someone's home. I mean, that can be anywhere between $10,000 and $20,000. I mean, that's someone's entire interest payments and more in many cases.

BARRIE CASSIDY: Yeah, yeah. But the example ...

SCOTT MORRISON: I don't think they'll take too kindly for that to be just wiped off the value of their home.

BARRIE CASSIDY: The example that was given there is that rather than the value of your home going up seven per cent, it will go up five per cent.

SCOTT MORRISON: Well, what people like John Daly were saying is it could undermine house values by about two per cent.

BARRIE CASSIDY: Yeah, that's what he said.

SCOTT MORRISON: Now, the problem with that, Barrie, is that household consumption is what is driving our economy. In the December quarter national accounts, 0.4 per cent out of the 0. 6 per cent growth, that was related to household consumption. Now if you want to crash confidence in the economy, go and play around with the value of the family home, which is what Labor's proposal, their housing tax proposal does. So it has two negative impacts. One, it doesn't do anything about housing affordability. It doesn't do anything material about supply issues. I mean, this applies to people buying shops and factories. But secondly, it really does undermine confidence in people's own - the value of their own home which can affect their consumption, Barrie, and that's the last thing we do that.

BARRIE CASSIDY: How does it not do anything about housing affordability if you're saying that it's gonna take value off the cost of the house?

SCOTT MORRISON: Well what it does, Barrie, is when you go and buy this home, the minute you put the key in the front door of a new home under Labor's housing tax proposal, it turns into an old home. And that means the investors or others you're going to sell it to perhaps down the track to get into your next property, well, they won't be there and it's gonna become harder and harder as you go forward. The family that Malcolm and I visited the other week, he was a plumber. There were a very modest family living in a weatherboard home not more than 20 minutes drive from where I am today. They've been able to use these arrangements to get themselves into the home they are now, to pay down their debt and to buy their next home. And this is a ...

BARRIE CASSIDY: Is that the family that bought the house for the - that's the house that bought the family for the one-year-old?

So basically it's reducing speculation driven increases in prices by Scomo's and Daly's own account.