You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Greece votes OXI/No on more Austerity measures

- Thread starter Coriolanus

- Start date

- Status

- Not open for further replies.

But they don't have any Euros and don't have any way of getting them without introducing their own currency first. They could print Euro notes unilaterally, but a) I'm not sure they have sufficient capacity, and b) that would be illegal as fuck, like Russia just printing perfect U.S. dollars to buy U.S. products with.

If they went down this route you can pretty much guarantee their banks would be completely cut off from the financial system in Europe.

D

Deleted member 231381

Unconfirmed Member

If they went down this route you can pretty much guarantee their banks would be completely cut off from the financial system in Europe.

Yes, which is why they wouldn't default then stay in the Euro. It's just not possible.

Yes, which is why they wouldn't default then stay in the Euro. It's just not possible.

But they can't get out either according to current mechanism.

Negotiator

Banned

https://twitter.com/NikosSverkos/status/620006893185052672

"Even if #Tsakalotos chopped down his arm, #Schaeuble would say it's not enough". Words of a European official for today's #Eurogroup

"Even if #Tsakalotos chopped down his arm, #Schaeuble would say it's not enough". Words of a European official for today's #Eurogroup

D

Deleted member 231381

Unconfirmed Member

But they can't get out either according to current mechanism.

Just print their own currency and set it as the legal tender. Nobody will object.

PdotMichael

Banned

Insulting someone won't do you any favors.

You tend to "forget" that Weimar Republic was humiliated and we know how well that ended up... if you fail to see the comparison, it's not my fault. At least Italy is able to see that.

At least read some wikipedia articles before talking about things you don't know anything about.

The NSDAP was not a significant factor (low single digit results in elections) until the Black Thursday in the USA and became the strongest party when the Vasailer Treaty wasn't even a thing anymore.

Negotiator

Banned

You still haven't addressed the humiliation part. I wonder why.

It won't be Greece's fault if Europe is destroyed for the 3rd time in the last 100 years...

It won't be Greece's fault if Europe is destroyed for the 3rd time in the last 100 years...

That... would be a catastrophe for Greece.

I think that ship has sailed.

hydrophilic attack

Member

Conversation between Tsakalotos and Finnish Stubb seems a bit strained.

ClosingADoor

Member

By this point it's like watching a student group project. Nobody wants to do anything or take the lead and in the end they just need to put something together in an hour.There's so much to do that it's just baffling things are going so slowly.

hydrophilic attack

Member

Luxembourg seems to be against Grexit.

Their foreign minister:

It would be fateful for Germanys reputation in the EU and the world. Germanys responsibility is great. Its about not conjuring up the ghosts of the past. If Germany goes for Grexit, it will trigger a deep conflict with France. That would be a catastrophe for Europe.

Translation: A lot is at stake. Let's hope Germany doesnt fuck Europe up again.

Their foreign minister:

It would be fateful for Germanys reputation in the EU and the world. Germanys responsibility is great. Its about not conjuring up the ghosts of the past. If Germany goes for Grexit, it will trigger a deep conflict with France. That would be a catastrophe for Europe.

Translation: A lot is at stake. Let's hope Germany doesnt fuck Europe up again.

Negotiator

Banned

Yeah, let's hope they've learned from their mistakes, although I wouldn't hold my breath.Let's hope Germany doesnt fuck Europe up again.

Gurgelhals

Member

If Germany goes for Grexit, it will trigger a deep conflict with France. That would be a catastrophe for Europe.

Yep, let's go back to 19th / early 20th Century Franco-German relations. That worked out so well the last time... /s

Yep, let's go back to 19th / early 20th Century Franco-German relations. That worked out so well the last time... /s

They are already acting like 14th century rulers now. Let's hang Greece in the central square, so PI_S won't revolt.

This is such a dumb narrative. We didn't cause this shit but we're supposed to pay the lion share, of course we're going to object. Greece was never fit the be part of the Euro, they had years to fix their shit but didn't, there have already been several last calls. This has fuck all to do with historic responsibility, Greece is a bottomless pit and somebody has to put a lid on it.Luxembourg seems to be against Grexit.

Their foreign minister:

It would be fateful for Germanys reputation in the EU and the world.

Germanys responsibility is great. Its about not conjuring up the ghosts of the past,

If Germany goes for Grexit, it will trigger a deep conflict with France. That would be a catastrophe for Europe.

Translation: A lot is at stake. Let's hope Germany doesnt fuck Europe up again.

I can't see a deal at all right now. The smaller and Eastern European countries are against it, Germany wants exorbitant commitments and the bailed-out countries are in a "why should they" kind of mood. Add to that, that most of the proponents are in a weak financial situation themselves and I just can't see how they could decide on a €80bn(!!) package for the next years that also has to go through countless parliaments. It's impossible.

And the rhetoric in this thread is on a level of the worst tabloids. We are still talking about a country paying the harsh bill for decades of mismanagement, not the invasion of Poland.

And the rhetoric in this thread is on a level of the worst tabloids. We are still talking about a country paying the harsh bill for decades of mismanagement, not the invasion of Poland.

D

Deleted member 125677

Unconfirmed Member

Germany pls, have you already forgotten the London conference of 1953?

I can't see a deal at all right now. The smaller and Eastern European countries are against it, Germany wants exorbitant commitments and the bailed-out countries are in a "why should they" kind of mood. Add to that, that most of the proponents are in a weak financial situation themselves and I just can't see how they could decide on a 80bn(!!) package for the next years that also has to go through countless parliaments. It's impossible.

I understand the sentiment, but this kind of prediction has failed many times before. Somehow, so far, they always figure some lousy solution at the last moment when the heat is on.

I wouldn't bet on it either way...

This is such a dumb narrative. We didn't cause this shit but we're supposed to pay the lion share, of course we're going to object. Greece was never fit the be part of the Euro, they had years to fix their shit but didn't, there have already been several last calls. This has fuck all to do with historic responsibility, Greece is a bottomless pit and somebody has to put a lid on it.

Why does this thread read as if Germany is all to blame for this and they are the big, bad bully?

That's how it always goes. If someone doesn't like the german opinion bring up the war. People are still trying to force germans by reminding them of the war and in the next minute they talk about a unified europe.

I understand that it's not convenient/politically correct for Germans to mention Weimar Republic, but you have to deal with it. History is a bitch and it tends to repeat itself.

heh so if my business partner cannot be trusted and yet comes up every time with new plans for improvement just to exhort money out of me but has no intentions of implementing said improvements, clearly what should my answer be?

Kiraly

Member

Let's hope Germany doesnt fuck Europe up again.

Shit like this is just distasteful.

This is such a dumb narrative. We didn't cause this shit but we're supposed to pay the lion share, of course we're going to object. Greece was never fit the be part of the Euro, they had years to fix their shit but didn't, there have already been several last calls. This has fuck all to do with historic responsibility, Greece is a bottomless pit and somebody has to put a lid on it.

Fascinating to read a German's take on it. You're incredibly wrong, this reads like fanaticism (and xenophobia). Really gives insight to the kind of drivel your context feeds you.

Because it's always more convenient to seek responsibility for your own failures somewhere else and Germany is an easy target. Our stance isn't what's causing animosities, polemic bullshit like "remember WW2" and "Germany is the only country to benefit from the Euro" is.Why does this thread read as if Germany is all to blame for this and they are the big, bad bully?

Explain how I'm wrong or what's xenophobic about anything I wrote there please.Fascinating to read a German's take on it. You're incredibly wrong, this reads like fanaticism (and xenophobia). Really gives insight to the kind of drivel your context feeds you.

Fascinating to read a German's take on it. You're incredibly wrong, this reads like fanaticism (and xenophobia). Really gives insight to the kind of drivel your context feeds you.

And same about this post...?

Guys, please stop. I know it's easy to go the "look at your past"-route here but come on. I'm not German (I do live here though) but saying this really undermines all the mistakes that have been done by all parties in the last few months and years.

I know Germany can be frustrating and so can Greece. There's no clear villain here to blame and let's not go down that route please, OK?

I know Germany can be frustrating and so can Greece. There's no clear villain here to blame and let's not go down that route please, OK?

Relaxed Muscle

Member

heh so if my business partner cannot be trusted and yet comes up every time with new plans for improvement just to exhort money out of me but has no intentions of implementing said improvements, clearly what should my answer be?

They don't come with plans, it's the Troika (German included) that asked for measures and Greece had to do them, because they were suposed to know better than those lazy Greeks.

The truth, is that Greece is even in a worst situation than 4 years ago, with unemployment and pverty going rampart in the country. How much has the Troika to drag through the mud Greece until they realize that austerity dosn't work? Didn't Greece paid with plus their past mistakes? Your said improvements are killing the damn country and it's economy, every graphs our there shows it.

Also Greece is not the only faulty here, German and French banks were happy to had a new guy in the town to lend money and benefit from when Greece joined the Euro, which was the whole point of them joining in the first place. Of course banks had the same situation all over the place in Europe and goverments had to pay in full their debts with full losings, but seems like we can't do the same for a country full of people.

sublimit

Banned

It doesn't matter if Greece leaves from Euro or not.Greece is finished either way and thanks to Germany the European Union and it's currency will be finished as well sooner or later.It's just a matter of time.

As long as Germany continues to enforce their policies the European Union goes mathematically towards a collapse.

As long as Germany continues to enforce their policies the European Union goes mathematically towards a collapse.

I think the difference this time is that the responsible government is against the plan it has to implement. You can't convince a parliament that a plan will be successful and a good idea, when there's no trust in the implementation itself.I understand the sentiment, but this kind of prediction has failed many times before. Somehow, so far, they always figure some lousy solution at the last moment when the heat is on.

I wouldn't bet on it either way...

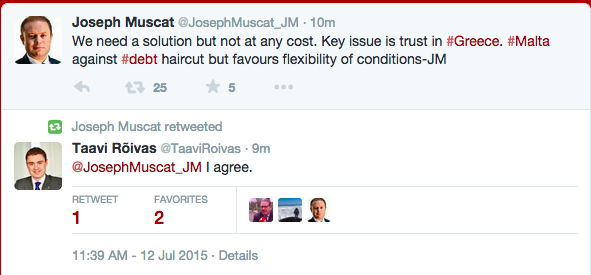

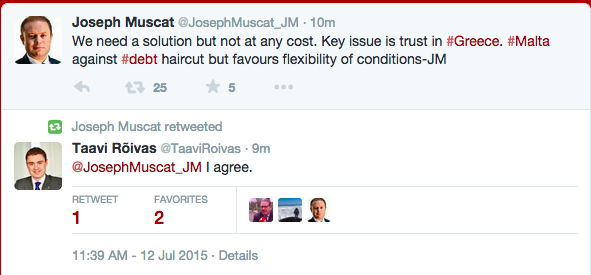

You read stuff like Schäuble's trust fund idea or this (Estonia's and Malta's prime ministers) on Twitter:

and you realise that they're just not convinced they can work with Syriza.

D

Deleted member 231381

Unconfirmed Member

Why does this thread read as if Germany is all to blame for this and they are the big, bad bully?

Because they're the third most obstinate country in discussions and the most obstinate that actually matters (sorry, Finland). For the record, I find all that WW2 bullshit distasteful as well, this is simply nothing at all like that and it's demeaning to the millions of people who died to compare them. Nevertheless, Germany has massively benefited from the Euro and the European project, more than almost other country (except Belgium, the Netherlands, and Luxembourg), and is now the one attempting to break it apart, again for its own benefit. Talk about having your cake and eating it.

I think the difference this time is that the responsible government is against the plan it has to implement. You can't convince a parliament that a plan will be successful and a good idea, when there's no trust in the implementation itself.

You read stuff like Schäuble's trust fund idea or this (Estonia's and Malta's prime ministers) on Twitter:

and you realise that they're just not convinced they can work with Syriza.

Seriously these guys are discussing this via twitter? oh come on

They don't come with plans, it's the Troika (German included) that asked for measures and Greece had to do them, because they were suposed to know better than those lazy Greeks.

The truth, is that Greece is even in a worst situation than 4 years ago, with unemployment and pverty going rampart in the country. How much has the Troika to drag through the mud Greece until they realize that austerity dosn't work? Didn't Greece paid with plus their past mistakes? Your said improvements are killing the damn country and it's economy, every graphs our there shows it.

Also Greece is not the only faulty here, German and French banks were happy to had a new guy in the town to lend money and benefit from when Greece joined the Euro, which was the whole point of them joining in the first place. Of course banks had the same situation all over the place in Europe and goverments had to pay in full their debts with full losings, but seems like we can't do the same for a country full of people.

Portugal, Spain and Ireland are all on the road to recovery or are doing better than they were back in 2008. Why can't the Greek get with the program? The rest of the EU cannot continue to put money in an abyss.

We really should all go back to our former currencies, it is virtually impossible to unify so many different cultures.

Let's continue to blame Germany for everything. It's much more easy and makes everyone feel good because poor old Greece is being squeezed for spending money they never had.

ClosingADoor

Member

The whole politicians on Twitter is mostly just embarrassing to be honest.Seriously these guys are discussing this via twitter? oh come on

https://t.co/zEYaV8MpNNTheres a rumour that last nights eurogroup meeting turned nasty at one point, with Germanys finance minister clashing with the head of the ECB:

Alberto Nardelli (@AlbertoNardelli)

July 12, 2015

"do you think I'm a fool?" - Schäuble reportedly had a row with Draghi yesterday

Germany is isolating itself even further it seems.

Portugal, Spain and Ireland are all on the road to recovery or are doing better than they were back in 2008. Why can't the Greek get with the program? The rest of the EU cannot continue to put money in an abyss.

We really should all go back to our former currencies, it is virtually impossible to unify so many different cultures.

Our debt keep on raising the deficit keep raising, unemployment raised in the last months

D

Deleted member 231381

Unconfirmed Member

The funny part is that Draghi probably does think Schauble's a fool.

Our debt keep on raising the deficit keep raising, unemployment raised in the last months

You are not surprise are you? Portugal has also been paying into the Greek trust fund so they can retire at 60 while the rest of the EU has to work until 67. Madness

The funny part is that Draghi probably does think Schauble's a fool.

Oh the guy who decided to print billions and billions of Euros just for the fuck of it? Sure he would think Schauble is a fool.

The whole politicians on Twitter is mostly just embarrassing to be honest.

"RT for Grexit, fav for bailout"

D

Deleted member 231381

Unconfirmed Member

You are not surprise are you? Portugal has also been paying into the Greek trust fund so they can retire at 60 while the rest of the EU has to work until 67. Madness

Greek retirement age is now 67. Has been at least 65 since 2010.

Oh the guy who decided to print billions and billions of Euros just for the fuck of it? Sure he would think Schauble is a fool.

He decided to print billions of Euros because the Euro is desperately overvalued and it is slowly choking the southern European economies.

Relaxed Muscle

Member

Portugal, Spain and Ireland are all on the road to recovery or are doing better than they were back in 2008. Why can't the Greek get with the program? The rest of the EU cannot continue to put money in an abyss.

We really should all go back to our former currencies, it is virtually impossible to unify so many different cultures.

Let's continue to blame Germany for everything. It's much more easy and makes everyone feel good because poor old Greece is being squeezed for spending money they never had.

You should really check portugal last numbers.

Greek retirement age is now 67. Has been at least 65 since 2010.

He decided to print billions of Euros because the Euro is desperately overvalued and it is slowly choking the southern European economies.

Sure Greece also used to received millions of Euros for a certain river that dried out decades ago.

He decided to print billions of Euros because the Euro is desperately overvalued and it is slowly choking the southern European economies.

Of course but they were happy to join a currency that their economies weren't ready for yet hoping to reap the benefits enjoyed up north right? And if it doesn't work, print print print

You are not surprise are you? Portugal has also been paying into the Greek trust fund so they can retire at 60 while the rest of the EU has to work until 67. Madness

this propaganda is madness, Greece don't retire at that age

D

Deleted member 231381

Unconfirmed Member

Sure Greece also used to received millions of Euros for a certain river that dried out decades ago.

Son, the fuck are you even talking about?

Sure Greece also used to received millions of Euros for a certain river that dried out decades ago.

You should stop reading Bild and start reading about 2010-2014 austerity measures in Greece. I know that tabloids keep telling the same stories as 4 years ago, but most of them are no longer true.

Also, Portugal is in the same spot more or less like Greece in 2010, from the debt point of view. And Spain isn't much healthier either.

Leaked! Eurogroup draft statement pushing for more austerity

Hat-tip to Reuters, who have got hold of the draft statement drawn up by eurozone officials last night.

Its not the final agreement -- more like the starting point for todays meeting.

It shows that the eurozone has demanded even deeper measures from Athens, which Euclid Tsakalotos has apparently acceded to.

It includes getting Greeces primary budget surplus up to a chunky 3.5% in 2018, rigorous labour market and pension reforms, a more solid privatisation programme with improved governance (does that mean external assistance?)

Heres the list:

Eurogroup draft on demands for Greek reforms

And it says that The Eurogroup thus welcomes the additional following commitments of the Greek authorities on the basis of a clear timetable:

fully comply with the medium-term primary surplus target of 3.5 percent of GDP by 2018, according to a yearly schedule to be agreed with the institutions;

carry out ambitious pension reforms and specific policies to fully compensate for the fiscal impact of the Constitutional Court ruling on the 2012 pension reform and to implement the zero deficit clause;

adopt more ambitious product market reforms with a clear timetable for implementation of all OECD toolkit I recommendations, including Sunday trade, sales periods, over-the-counter pharmaceutical products, pharmacy ownership, milk, bakeries. On the follow-up of the OECD toolkit II, manufacturing needs to be included in the prior action;

on energy markets, the privatization of the electricity transmission network operator (ADMIE) must proceed, unless replacement measures can be found that have equivalent effect, as agreed by the institutions;

on labor markets, undertake rigorous reviews of collective bargaining, industrial action and collective dismissals in line with the timetable and the approach suggested by the institutions. Any changes should be based on international and European best practices, and should not involve a return to past policy settings which are not compatible with the goals of promoting sustainable and inclusive growth;

fully implement the relevant provisions of the Treaty on Stability, Coordination and Governance in the Economic and Monetary Union, in particular to make the Fiscal Council fully operational;

adopt the necessary steps to strengthen the financial sector, including decisive action on non-performing loans, transposition of BRRD and measures to strengthen governance of the HFSF and the banks;

develop a significantly scaled up privatization program with improved governance. A working group with the institutions shall provide proposals for better implementation mechanisms;

amend or compensate for legislation adopted during 2015 which have not been agreed with the institutions and run counter to the program commitments;

implement the key remaining elements from the December 2014 state of play of the fifth review of the second economic adjustment program.

This is all in addition to the original plan, so tricky for Athens to commit to and achieve.

http://www.theguardian.com/business...d-no-deal-live#block-55a2303ee4b07fc6a121fb4c

Relaxed Muscle

Member

Sure Greece also used to received millions of Euros for a certain river that dried out decades ago.

Why are we mentioning facts that aren't happening anymore, if it ever happened.

You'd be surprised that corruption is not a Greece monopoly, they are not the only ones that "robbed" euro funds. You should kick Spain to out of the Euro and not gives us a cent more, if that's the reason for the distrust...

D

Deleted member 231381

Unconfirmed Member

3.5% primary surplus? Schauble is a fool.

Gurgelhals

Member

Yay, austerity! More austerity! Everybody gets austerity!

This is Krugman at this very moment:

This is Krugman at this very moment:

- Status

- Not open for further replies.