What caused their fisical operation income forecast being halved?

http://www.nintendo.co.jp/ir/pdf/2015/150128_3e.pdf

Based on the sales performance for the nine months ended December 31, 2014 and afterwards, net sales and operating income are expected to be lower than our original forecasts.

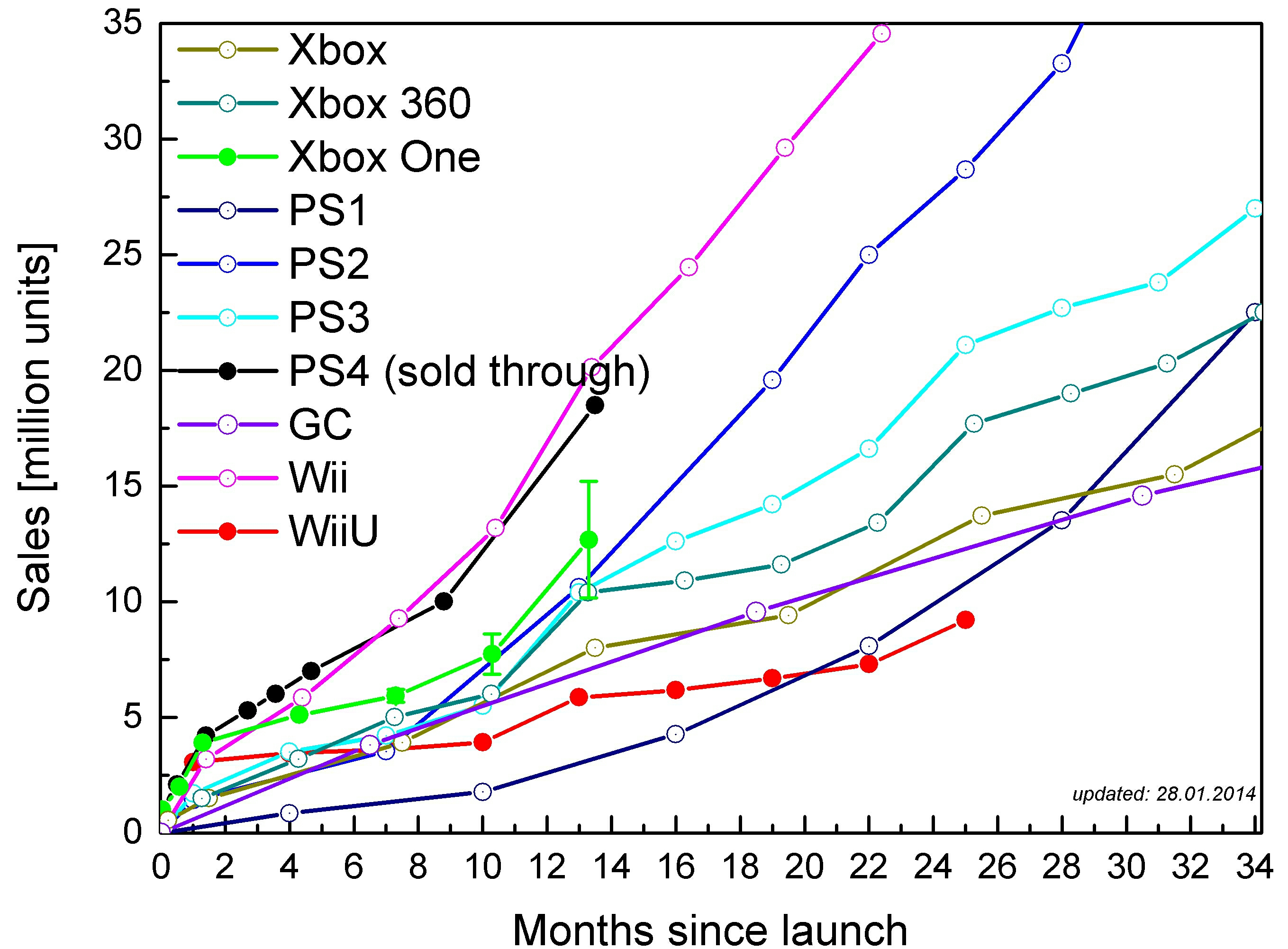

Basically their video game business is selling worse than what they hoped for.

However:

Also, considering recent trends in foreign currency exchanges, assumed exchange rates for the fourth financial quarter as well as at the end of the full fiscal year have been revised as follows: 115 yen per U.S. dollar (previous rate: 100 yen), 130 yen per euro (previous rate: 140 yen). As a result, we have revised up the ordinary income and net income forecasts.

The strong climb of the Dollar in the past few months means they can go in their spreadsheets and increase the Yen value of their bank investments kept with the American currency. Thus, the increase in forecast Net Income, despite worse sales and Operating Income.

Exemplifying the foreign exchange situation, if Nintendo had:

- in June 30, 2014, 1 billion dollars in a bank = 100 billion yen.

- today, that same 1 billion dollars = 115 billion yen.

So, they declare profit of 15 billion yen from foreign exchange.

As a matter of fact, Nintendo profit in the last 9 months has been:

31.6 billion yen from selling video games

51.1 billion yen from foreign exchange

Regardless of foreign exchange, their cost cutting and accounting measures were effective, because, despite selling worse this fiscal year, their video games have turned a profit, when in the last fiscal year they had lost 1.6 billion yen in the first 9 months.