speculawyer said:

Ignore the big spike to $147 . . . that was largely speculation. Look at the rise to $90/barrel just before the recession. That is the price rise that helped spark the recession. And yes, the housing bubble was a huge part of it too. But oil acted as the pin the helped prick the bubble. People were out living in the exurbs where they were able to buy houses for less and driving long long commutes. But when the price of oil shot up, the value of those exurb homes dropped since the price of the commute rose sharply. What is the value of a lower mortgage payment if you just pay more in gasoline? So the prices of those homes dropped. And the dominoes then started to fall.

Uh . . . what is your point here? Is that supposed to make us feel good? The economy at that time SUCKED. Stagflation. We nearly hit 11% unemployment at the time!

But back then it was just temporary. They got rescued by North sea oil, Alaska oil, Cantarell oil, Saudi oil, Russian oil, etc. A flood of cheap oil that really helped the world economy. There is no oil surge that is going to save us this time. Back then, as they started to recover, the oil price kept dropping. Right now, any time we start to recover a bit the price of oil shoots back up and it strangles the economy as it tries to recover.

I certainly hope you are right. But the data doesn't look good. GDP and oil have been tightly bound for decades. I hope we can outgrow that.

I'm sorry, I don't think that the casual picture you are trying to paint ads up. I'm going to re-post a link to the graph I used because it has a somewhat higher resolution than the one you posted.

Starting in 1967, the U.S. experienced seven recessions. Of those recessions, I would say one is explicable solely by spikes in oil prices, and 3 more were at least partially caused by a rise in oil prices.

1973 - 1975 definitely was triggered by the spike in oil prices caused by the embargo. I don't question that.

The two recessions in the early eighties also involved spiking oil prices, but I would note that oil prices basically remained steady from the start of the first recession, through the brief growth period that interrupted the two recessions, and during the period of growth afterwards until about 1986. I would attribute that to the fact that there were other factors influencing growth during that period, primarily the actions of Paul Volcker, who hiked interest rates in order to end the inflation of the 70's, then loosened them once inflation fell, and the massive military spending campaign that began under Regan.

I would also list a spike in oil prices as a strong cause of the early 90's recession.

Of the rest, the 1969 to 1970 recession appears to have been caused by the combination of an interest rate hike and cuts in government spending. Oil price remained constant,

The early 2000's recession was caused by the collapse of the dot-com bubble and the disruptions of the September 11th attacks (although personally I would put the collapsing dot-com bubble as the main culprit) Oil prices actually dropped from the start of this recession until the end.

The 2007 - 2009 recession was caused by the collapse of the housing market and near collapse of the investment banking system in the United States. I really see the price of oil as a peripheral issue here. For years, housing prices were rising faster than incomes because people would buy a "starter house", wait for the price of that house to rise, "sell" that house (usually just the equity they built up in it) at the higher price, then use that money to afford a larger and more expensive house. As each generation did this, housing prices continued to increase at an ever faster rate.

At the same time, incomes began to diverge as the U.S. shifted away from a tightly regulated economy with strong unions to a loosely regulated economy with sharp differences in income among its citizens. In order to allow people to afford homes, once tight regulations on the types of mortgages that banks were allowed to give to people were loosened, which led to the creation of mortgages that allowed small payments initially, which were affordable to many people, but then had those payments increase beyond the ability of people to pay them. Once those mortgages began to default, the whole bubble popped, since it depended on a constant stream of people buying in to sustain itself.

(omitted the part about how that crash tied into the larger investment banking system for brevity)

It wasn't the first time a bubble of that type occurred in this country. The crash of 1929 featured similar dynamics, although it involved stocks and not real estate. Both crashes would have occurred no matter what the price of oil was.

If you zoom in on the time period on the graph I linked to, you can even see that the price of oil was coming off its high before the recession started.

As for whether I was trying to make people feel better with my other comment .... kinda?

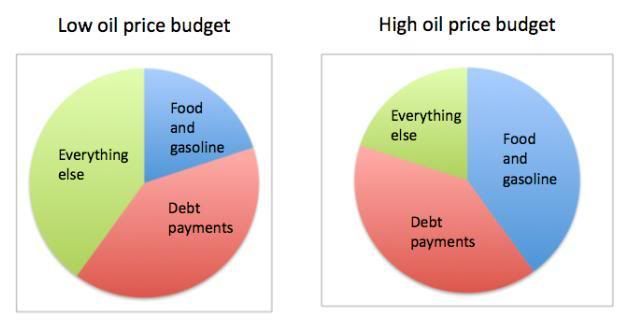

I was just trying to show that we aren't facing anything unprecedented, and that advances in technology can help us. I was also obliquely referring to the fact that households were facing other expenses even greater than their increased gas bills during the period leading up to the housing crash, such as payments on student loans and on mortgages that they really could not afford.

In the end its all a wash though, because what would the solution be? If we went by the subtext of the article, we wouldn't do anything, while people continued to drive around the same old inefficient cars because they could not afford them, lived in the same houses that required lots of resources to heat, and our economy continued to depend on energy sources that, I acknowledge, will continue to rise in price. Which, over the long term, is a very, very bad thing.

What it really be that horrible if, for example, we at the minimum extended and expanded programs like cash for clunkers and combined it with incentives to drive the adoption and development of technologies like that behind the Chevy Volt? Even if it meant adding to the debt?