You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock-Age: Stocks, Options and Dividends oh my!

- Thread starter koam

- Start date

StreetsofBeige

Gold Member

Modest rebound of 1%. Need a ton of these to get to back to two weeks ago.

godhandiscen

There are millions of whiny 5-year olds on Earth, and I AM THEIR KING.

Since mid February I have lost a small fortune, but I am still up over 100% in the last 12 months...

CrankyJay™

Member

I feel like every time GME goes up hedge funds are like "time to fuck everyone else in the ass."

HoodWinked

Member

timberrrrrr

HawksWinStanley

Member

Seems like AAPL has some decent support around $120. I think I'll grab some shares as it keeps dipping to

What’s the story here?timberrrrrr

HoodWinked

Member

bubble pop. paramount+ is a joke. them doing a big stock offering was the catalyst.What’s the story here?

SpartanN92

Banned

I was up like 1.4% then a fucking massive drive down on my oil stock in the last 5 minutes and now I’m down 1%

Honestly I think it’s an algo glitch but

Edit: After hours algo glitch. I’m golden.

Honestly I think it’s an algo glitch but

Edit: After hours algo glitch. I’m golden.

Last edited:

ManofOne

Plus Member

SPDR S&P 500 Trust ETF (NYSEARCA:SPY) finished the week on a positive note +1.52% and is +4.59% YTD. See below a breakdown of the eleven sectors of the S&P 500 and their weekly performance. Additionally, see how the accompanying SPDR Select Sector ETF performed from the open on March 22nd to the close on March 26th.

#1: Real Estate, +3.74% and the Real Estate Select Sector SPDR ETF (NYSEARCA:XLRE) +4.26%.

#2: Consumer Staples, +3.43% and the Consumer Staples Select Sector SPDR ETF (NYSEARCA:XLP) +4.08%.

#3: Energy, +2.50% and the Energy Select Sector SPDR ETF (NYSEARCA:XLE) +3.13%.

#4: Utilities, +2.44% and the Utilities Select Sector SPDR ETF (NYSEARCA:XLU) +3.04%.

#5: Materials, +2.02% and the Materials Select Sector SPDR ETF (NYSEARCA:XLB) +2.76%.

#6: Technology, +1.83% and the Technology Select Sector SPDR ETF (NYSEARCA:XLK) +2.04%.

#7: Industrials, +1.67% and the Industrial Select Sector SPDR ETF (NYSEARCA:XLI) +2.03%.

#8: Health Care, +1.62% and the Health Care Select Sect SPDR ETF (NYSEARCA:XLV) +2.11%.

#9: Financials, +0.43% and the Financial Select Sector SPDR ETF (NYSEARCA:XLF) +1.63%.

#10: Consumer Discretionary, -0.78% and the Consumer Discretionary Select Sector SPDR ETF (NYSEARCA:XLY) -0.78%.

#11: Communication Services, -2.31% and the

Communication Services Select Sector SPDR Fund (NYSEARCA:XLC) -4.24%

#1: Real Estate, +3.74% and the Real Estate Select Sector SPDR ETF (NYSEARCA:XLRE) +4.26%.

#2: Consumer Staples, +3.43% and the Consumer Staples Select Sector SPDR ETF (NYSEARCA:XLP) +4.08%.

#3: Energy, +2.50% and the Energy Select Sector SPDR ETF (NYSEARCA:XLE) +3.13%.

#4: Utilities, +2.44% and the Utilities Select Sector SPDR ETF (NYSEARCA:XLU) +3.04%.

#5: Materials, +2.02% and the Materials Select Sector SPDR ETF (NYSEARCA:XLB) +2.76%.

#6: Technology, +1.83% and the Technology Select Sector SPDR ETF (NYSEARCA:XLK) +2.04%.

#7: Industrials, +1.67% and the Industrial Select Sector SPDR ETF (NYSEARCA:XLI) +2.03%.

#8: Health Care, +1.62% and the Health Care Select Sect SPDR ETF (NYSEARCA:XLV) +2.11%.

#9: Financials, +0.43% and the Financial Select Sector SPDR ETF (NYSEARCA:XLF) +1.63%.

#10: Consumer Discretionary, -0.78% and the Consumer Discretionary Select Sector SPDR ETF (NYSEARCA:XLY) -0.78%.

#11: Communication Services, -2.31% and the

Communication Services Select Sector SPDR Fund (NYSEARCA:XLC) -4.24%

HoodWinked

Member

Ya the nice rally pop at the last 5mins was a positive surprise for once.

longdi

Banned

SPDR S&P 500 Trust ETF (NYSEARCA:SPY) finished the week on a positive note +1.52% and is +4.59% YTD. See below a breakdown of the eleven sectors of the S&P 500 and their weekly performance. Additionally, see how the accompanying SPDR Select Sector ETF performed from the open on March 22nd to the close on March 26th.

#1: Real Estate, +3.74% and the Real Estate Select Sector SPDR ETF (NYSEARCA:XLRE) +4.26%.

#2: Consumer Staples, +3.43% and the Consumer Staples Select Sector SPDR ETF (NYSEARCA:XLP) +4.08%.

#3: Energy, +2.50% and the Energy Select Sector SPDR ETF (NYSEARCA:XLE) +3.13%.

#4: Utilities, +2.44% and the Utilities Select Sector SPDR ETF (NYSEARCA:XLU) +3.04%.

#5: Materials, +2.02% and the Materials Select Sector SPDR ETF (NYSEARCA:XLB) +2.76%.

#6: Technology, +1.83% and the Technology Select Sector SPDR ETF (NYSEARCA:XLK) +2.04%.

#7: Industrials, +1.67% and the Industrial Select Sector SPDR ETF (NYSEARCA:XLI) +2.03%.

#8: Health Care, +1.62% and the Health Care Select Sect SPDR ETF (NYSEARCA:XLV) +2.11%.

#9: Financials, +0.43% and the Financial Select Sector SPDR ETF (NYSEARCA:XLF) +1.63%.

#10: Consumer Discretionary, -0.78% and the Consumer Discretionary Select Sector SPDR ETF (NYSEARCA:XLY) -0.78%.

#11: Communication Services, -2.31% and the

Communication Services Select Sector SPDR Fund (NYSEARCA:XLC) -4.24%

SP500 almost passing it's ATH

All that doom and gloom with rates was really isolated to tech and meme stocks like ARK.

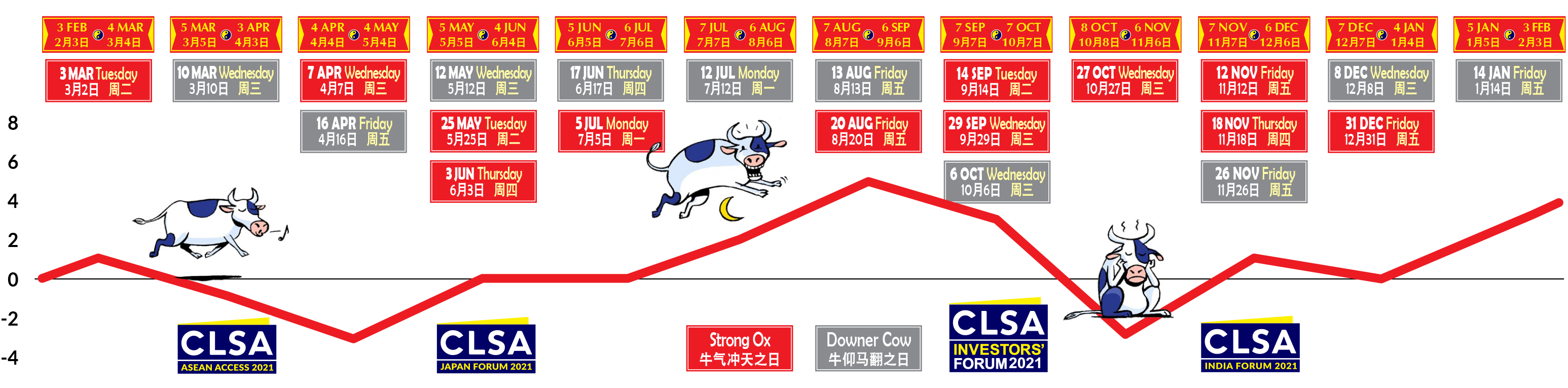

I am kinda worry the stock market drop is lurking....Chinese fengshui points to an Apr recovery?

Last edited:

ipukespiders

Member

Sat down this morning with my coffee to check the markets.

I really need to pay attention to what day of the week it is.

I really need to pay attention to what day of the week it is.

joe_zazen

Member

Goldman sold 10.5B on fri, took 35B off market value. ViacomCBS, Discovery, Baidu, TME, among those hardest hit.

https://www.bnnbloomberg.ca/goldman-sold-10-5-billion-of-stocks-in-block-trade-spree-1.1583195

https://www.bnnbloomberg.ca/goldman-sold-10-5-billion-of-stocks-in-block-trade-spree-1.1583195

SpartanN92

Banned

I hate the weekends nowSat down this morning with my coffee to check the markets.

I really need to pay attention to what day of the week it is.

ManofOne

Plus Member

Goldman sold 10.5B on fri, took 35B off market value. ViacomCBS, Discovery, Baidu, TME, among those hardest hit.

https://www.bnnbloomberg.ca/goldman-sold-10-5-billion-of-stocks-in-block-trade-spree-1.1583195

It was a fire sale but I think the family office is the one who got hit with a margin call. SoftBank owned a shot load of shares, only next quarter would you be able to see who sold it

GHG

Gold Member

Goldman sold 10.5B on fri, took 35B off market value. ViacomCBS, Discovery, Baidu, TME, among those hardest hit.

https://www.bnnbloomberg.ca/goldman-sold-10-5-billion-of-stocks-in-block-trade-spree-1.1583195

Was wondering who this was. People were joking that it was Cathie Wood on Friday, and to be honest it wouldn't have been the most surprising thing.

CrankyJay™

Member

Shows how fast funds can unload and fuck over retail if they wanted.Goldman sold 10.5B on fri, took 35B off market value. ViacomCBS, Discovery, Baidu, TME, among those hardest hit.

https://www.bnnbloomberg.ca/goldman-sold-10-5-billion-of-stocks-in-block-trade-spree-1.1583195

ManofOne

Plus Member

Shows how fast funds can unload and fuck over retail if they wanted.

They can sell otc for pennies and not at market at times. Shit shady as fuck imo

ManofOne

Plus Member

Btw it wasn’t Goldman, they were the executing the trans as toon on behalf of a client.

It was $19 billion dollars fire sale

As per FT

“ The Wall Street investment bank told counterparties that the sales were prompted by a “forced deleveraging,” a signal that a fund may have been hit with a margin call, according to people with knowledge of the matter. Goldman increased the size of the deals several times, they said.

Money managers initially thought the selling was concentrated in US-listed Chinese technology groups ahead of a new measure introduced by the Securities and Exchange Commission that could force them to delist from US exchanges.”

It was $19 billion dollars fire sale

As per FT

“ The Wall Street investment bank told counterparties that the sales were prompted by a “forced deleveraging,” a signal that a fund may have been hit with a margin call, according to people with knowledge of the matter. Goldman increased the size of the deals several times, they said.

Money managers initially thought the selling was concentrated in US-listed Chinese technology groups ahead of a new measure introduced by the Securities and Exchange Commission that could force them to delist from US exchanges.”

Last edited:

BigBooper

Member

I knew next to nothing about the stock market 3 years ago. The more I learn about stuff like margin trading, OTC, etc, the more surprised I am that it was allowed to develop and function as it does. I guess most of these funds are hedged in a multitude of ways to protect against bankruptcy, but the economy seems way more fragile than I would have thought 4 years ago.

I wonder how China reacts to a fund collapse like that.

I wonder how China reacts to a fund collapse like that.

ManofOne

Plus Member

I knew next to nothing about the stock market 3 years ago. The more I learn about stuff like margin trading, OTC, etc, the more surprised I am that it was allowed to develop and function as it does. I guess most of these funds are hedged in a multitude of ways to protect against bankruptcy, but the economy seems way more fragile than I would have thought 4 years ago.

I wonder how China reacts to a fund collapse like that.

They certainly don’t subsidize it the way the FED has been doing it. The FED been buying assets and expanding its balance sheet on a multitude of products that distort the fundamentals.

CrankyJay™

Member

not to go into loony land but my dad pulled out into 95% cash (he’s a dividend investor), he’s convinced a rug pull is coming and this is part of “the great reset”. I love my dad but just nod along.They can sell otc for pennies and not at market at times. Shit shady as fuck imo

ManofOne

Plus Member

not to go into loony land but my dad pulled out into 95% cash (he’s a dividend investor), he’s convinced a rug pull is coming and this is part of “the great reset”. I love my dad but just nod along.

Well it could come, so our dad might not be crazy. Lets take margin debt for example, we haven't seen margin debt in dollar amounts since ever and the low rates make it absurdly cheap to borrow and leverage up your balance sheet.

I myself use margin to trade stocks but only a percentage of my total capital plus I have reduce my reliance on it since the beginning of the year. However, if actual inflation exceeds consensus and forces a change in the FED funds rate, we could see a great reset of the stock market. It could collapse to 45.0% of its current value. Most of these family funds use the market value of their stocks to payoff margins however if stock values plummet it could cause massive amounts of margin calls (like in the case above) which some companies might not be able to cover. Also assuming ( while not massively likely) if the lenders aren't well capitalize to offset losses we could see another 08 scenario.

Next year will certainly be interesting and await to see how inflation plays out over the course of year.

ManofOne

Plus Member

So it’s confirmed Archegos Capital aka Tiger Asia, sold it. Forced liquidation via margin call on stocks. They didn’t hedge and was over exposed on billions of dollars

“ Archegos Capital, a private investment firm, was behind billions of dollars worth of share sales that captivated Wall Street on Friday — a fire sale that has left traders scrambling to calculate how much more it has to offload, according to people with knowledge of the matter.

The fund, which had large exposures to ViacomCBS and several Chinese technology stocks, was hit hard after shares of the US media group began to tumble on Tuesday and Wednesday.

The declines prompted a margin call from one of Archegos’ prime brokers, triggering similar demands for cash from other banks, said people familiar with the matter. Traders buying the large blocks of stock were told the share sales had been prompted by a “forced deleveraging” by a fund”

“ Archegos Capital, a private investment firm, was behind billions of dollars worth of share sales that captivated Wall Street on Friday — a fire sale that has left traders scrambling to calculate how much more it has to offload, according to people with knowledge of the matter.

The fund, which had large exposures to ViacomCBS and several Chinese technology stocks, was hit hard after shares of the US media group began to tumble on Tuesday and Wednesday.

The declines prompted a margin call from one of Archegos’ prime brokers, triggering similar demands for cash from other banks, said people familiar with the matter. Traders buying the large blocks of stock were told the share sales had been prompted by a “forced deleveraging” by a fund”

Last edited:

joe_zazen

Member

not to go into loony land but my dad pulled out into 95% cash (he’s a dividend investor), he’s convinced a rug pull is coming and this is part of “the great reset”. I love my dad but just nod along.

I've heard some convincing arguments not to worry until US fiscal year end, so Sept 30th. that is the way I am going to play it.

longdi

Banned

how the heck did some unknown funds get access to $b of stocks? gme reddit is small changeSo it’s confirmed Archegos Capital aka Tiger Asia, sold it. Forced liquidation via margin call on stocks. They didn’t hedge and was over exposed on billions of dollars

“ Archegos Capital, a private investment firm, was behind billions of dollars worth of share sales that captivated Wall Street on Friday — a fire sale that has left traders scrambling to calculate how much more it has to offload, according to people with knowledge of the matter.

The fund, which had large exposures to ViacomCBS and several Chinese technology stocks, was hit hard after shares of the US media group began to tumble on Tuesday and Wednesday.

The declines prompted a margin call from one of Archegos’ prime brokers, triggering similar demands for cash from other banks, said people familiar with the matter. Traders buying the large blocks of stock were told the share sales had been prompted by a “forced deleveraging” by a fund”

seems like this is it! market going be spooked by the exuberance!

The Lunch Legend

GAF's Nicest Lunch Thief and Nosiest Dildo Archeologist

In a taxable account, if I wanted to use mutual fund (rather than ETF) I would go with Vanguard funds at Vanguard. If you use ETF's, you can buy and hold Vanguard ETF's at any brokerage account and easily move them without creating a taxable event should you decide you don't like whatever broker you're with.Who are you guys using for your brokerage? Any reason to avoid Vanguard or Fidelity?

I currently use Fidelity, and have no qualms about recommending them. I had a Vanguard account in the past, and no issues with them either. Fidelity was better for me when I wanted to consolidate because I already had a workplace 401k their, and Fidelity offers a great CMA account with bank-like features.

Fidelity has a lot more services available (you can call 24/7 [longer wait time nowadays but that should be sorted out soon]).

It has a checking account (Fidelity Cash Management). You can take out money from any domestic ATM without fees. It's easy to transfer money in and out everywhere. And the brokerage allows you to purchase partial shares.

And the UI goes straight to your numbers.

Vanguard on the other hand has a UI that discourages active trading (because the UI is like year 2000 style).

For those who want to keep life simple and just want results, I would recommend Vanguard.

Hence, if you feel completely lost and just want to make life simple, I would recommend Vanguard.

Otherwise, I would use Fidelity instead.

Personally, I prefer Fidelity. Some users get TurboTax Premier for free during tax seasons.

On the other hand, if you travel abroad a lot and you need to do lots of foreign exchange (or use any ATMs globally), then you should look into Schwab. There's no foreign exchange fee when dealing with foreign currency abroad on its checking account. And its brokerage is also top tier for passive investing (along with Fidelity and Vanguard).

ManofOne

Plus Member

how the heck did some unknown funds get access to $b of stocks? gme reddit is small change

seems like this is it! market going be spooked by the exuberance!

Bill Hwang I think is a billionaire and he got caught by the SEC for securities fraud in 2012

The money lost was private and I thin it was mostly internal capital.

Last edited:

HawksWinStanley

Member

Any good looking deals before the job report today?

CrankyJay™

Member

down 3% already....obviously my portfolio isn't balanced, at all, lol

Nikana

Go Go Neo Rangers!

Seems mine is about as balanced as my diet.down 3% already....obviously my portfolio isn't balanced, at all, lol