-

Hey, guest user. Hope you're enjoying NeoGAF! Have you considered registering for an account? Come join us and add your take to the daily discourse.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The UK votes to leave the European Union

- Thread starter Spring Drive

- Start date

- Status

- Not open for further replies.

s_mirage

Member

Yeah, that one almost had me throwing things at the screen when it was on.

Wait a sec, why no Scottish independence? If there's no other way for them to stay in the EU than seceding, they should have the right to do so. They overwhelmingly voted for the EU and dragging them out against their will and against assurances in the first Scottish referendum is just plain wrong and definitely not "fine". D: I have a Scottish friend who actually voted against independence in the first referendum but is so distraught to be dragged out of the EU by England that he has definitely changed his stance now. So has his family.

I believe Nicola Sturgeon is looking to see if Scotland can stay in the EU in a federalised manner, similar to how Denmark is in the EU and Greenland is not. (Gibraltar, unsurprisingly, is looking for a similar arrangement.)

Sturgeon is most likely waiting until Britain does actually trigger the Article 50 legislation before launching an official referendum campaign. Beyond the possibility of having to simultaneously co-ordinate leaving the UK, leaving the EU and then re-joining the EU one quirk of recent polling is that while support for Scottish independence is polling high support for a second referendum on Scottish independence is below 50%. That may yet change, however, as the British financial system continues to worsen.

It's a hotly contested area of constitutional and administrative Law - why should the HoC have power to push a through and the HoL lose its primacy?

I can answer that!

It's because the HoC is the representative chamber. It's for the same reason that the HoL has no power to initiate spending/appropriations bills. It stems from a clash between the Commons and the Lords in the very early C15 where the Commons argued that since it is they foot the bill, only they get to have control over spending.

The same provision is replicated in Canada, the United States and Australia. Only the lower, representative chamber is allowed to initiate legislation on appropriations.

Thanks, it's really interesting. Especially as we don't really have a constitution, and our law is based on common law. I'm certainly not an expert on this, so appreciate your interpretation!

The UK absolutely has a constitution. It's just not a single written document that has "Constitution of the United Kingdom" written on it.

Lol, they should have let her cough up blood and die in the end of the EU-NHS video for greater effect.

Wait a sec, why no Scottish independence? If there's no other way for them to stay in the EU than seceding, they should have the right to do so. They overwhelmingly voted for the EU and dragging them out against their will and against assurances in the first Scottish referendum is just plain wrong and definitely not "fine". D: I have a Scottish friend who actually voted against independence in the first referendum but is so distraught to be dragged out of the EU by England that he has definitely changed his stance now. So has his family.

They recently had a referendum on staying in the UK knowing full well that the UK might vote to leave. Well, if we believe all of the remainers, then they will move to Scotland and vote to leave the UK. They have the right to do that, they just have to obtain a majority in the Scottish parliament and hold another referendum. So yeah, please do that and stop whinging, I wouldn't like the 40% of Scots who voted to remain in the UK to put them off of holding another referendum. Or the collapse in the oil prices since then. I would actually love for another referndum on Scottish independence to be called now just to shut the matter up for good. Of course, the SNP won't call one, because they know they'll lose.

I can answer that!

It's because the HoC is the representative chamber. It's for the same reason that the HoL has no power to initiate spending/appropriations bills. It stems from a clash between the Commons and the Lords in the very early C15 where the Commons argued that since it is they foot the bill, only they get to have control over spending.

The same provision is replicated in Canada, the United States and Australia. Only the lower, representative chamber is allowed to initiate legislation on appropriations.

The UK absolutely has a constitution. It's just not a single written document that has "Constitution of the United Kingdom" written on it.

Oh no, I already knew why - I was asking in a rhetorical sense. Your answer however will be useful for many people so thanks for adding it onto mine!

It's rather interesting that our 'unwritten constitution' isn't exactly that. It's more of a written one spewed across thousands of bits of different documentation.

Dear Leave voter, when you see the Sterling fall so hard, do you feel patriotic?

I just want Britain to be back British!

Watching that video I was honestly surprised they didn't show a scene with the woman dying.Lol, they should have let her cough up blood and die in the end of the EU-NHS video for greater effect.

Lol, they should have let her cough up blood and die in the end of the EU-NHS video for greater effect.

I was waiting for that as well.

So, it wasn't "just a bus" like Leave claimed. They were running 2 minute TV ads saying they would take the 350 million a week and put it in the NHS as well?

Oh no, I already knew why - I was asking in a rhetorical sense. Your answer however will be useful for many people so thanks for adding it onto mine!

It's rather interesting that our 'unwritten constitution' isn't exactly that. It's more of a written one spewed across thousands of bits of different documentation.

Haha, I figured! Full disclosure: Australian lawyer, comparative constitutional law and the history of liberalism are my main areas.

Despite being a mess of a thing to really study, it really is rather coherent and incredibly straightforward to work with once you know what's what.

Welp. We've crashed Italy's bank... http://www.telegraph.co.uk/business...0bn-bank-rescue-as-first-brexit-domino-falls/

This could backfire on Merkel.

Haha, I figured! Full disclosure: Australian lawyer, comparative constitutional law and the history of liberalism are my main areas.

Just curious, what sort of clients seek advice in those areas? Seems very niche.

I can answer that!

It's because the HoC is the representative chamber. It's for the same reason that the HoL has no power to initiate spending/appropriations bills. It stems from a clash between the Commons and the Lords in the very early C15 where the Commons argued that since it is they foot the bill, only they get to have control over spending.

The same provision is replicated in Canada, the United States and Australia. Only the lower, representative chamber is allowed to initiate legislation on appropriations.

The UK absolutely has a constitution. It's just not a single written document that has "Constitution of the United Kingdom" written on it.

Thanks, that's certainly worth clarifying, but yes, in the traditional sense, the UK doesn't have a constitution, just one that has been passed down through a thousand years of anglo-saxon common law. It's actually quite amazing that this has sufficed for all that time. Well, as I said, I'm not a legal expert, just find the historical context interesting.

Just curious, what sort of clients seek advice in those areas? Seems very niche.

Clients? Lololol I'm basically an Academic.

Edit: I've worked for the government on a few briefs, as a junior. They're basically the only client I'll ever have in my main area of speciality. I did it because I was personally interested in it. I'm probably going to have to practice in another area of law once I get back to Australia.

s_mirage

Member

I believe Nicola Sturgeon is looking to see if Scotland can stay in the EU in a federalised manner, similar to how Denmark is in the EU and Greenland is not. (Gibraltar, unsurprisingly, is looking for a similar arrangement.)

I'd be stunned if they could pull that off. All of the treaties are with the United Kingdom, not its constituent parts. Greenland could leave because it was given home rule after it joined as part of Denmark, while the parent country, the country that signed up to be part of the EU, remained. Scotland would be seeking to remain after the treaty signatory has left. I'm not a lawyer, but I just don't see how that could be achieved under the current treaty arrangements. Hell, the only way I could see it happening is if the UK itself became federalised, rather than Scotland becoming independent.

Oh jeez with an ad like that, of course it can sway voters their way... now the question is, what is the truth ? I don't think UK pays EU like 350 million pounds a week as claimed. What really is the truth of the financial arrangement between UK and EU ?

Palculator

Unconfirmed Member

Well, the figure doesn't matter because they've already taken back the promise of giving whatever money they save to the NHS. They took it back hours after the Referendum result was in.Oh jeez with an ad like that, of course it can sway voters their way... now the question is, what is the truth ? I don't think UK pays EU like 350 million pounds a week as claimed. What really is the truth of the financial arrangement between UK and EU ?

Oh jeez with an ad like that, of course it can sway voters their way... now the question is, what is the truth ? I don't think UK pays EU like 350 million pounds a week as claimed. What really is the truth of the financial arrangement between UK and EU ?

It's less, but there was no way any of that "saved" money from exiting was going to be put in the NHS. It was a bald-faced lie, and Leave admitted it the day the Brexit happened.

Oh jeez with an ad like that, of course it can sway voters their way... now the question is, what is the truth ? I don't think UK pays EU like 350 million pounds a week as claimed. What really is the truth of the financial arrangement between UK and EU ?

They don't pay that much. Watch any video that isn't Leave propaganda and it's not ignored, it's explained away. It's more like 190 million, but we got a lot of benefits in return.

I'd be stunned if they could pull that off. All of the treaties are with the United Kingdom, not its constituent parts. Greenland could leave because it was given home rule after it joined as part of Denmark, while the parent country, the country that signed up to be part of the EU, remained. Scotland would be seeking to remain after the treaty signatory has left. I'm not a lawyer, but I just don't see how that could be achieved under the current treaty arrangements.

Yeah, I don't see the EU doing that, but it's not just Scotland, but NI and Gibraltar too.It's an interesting proposition, and as an "Englander", if there was a way to do that I would support it. I just don't see the EU as accepting that (maybe not the British government either ... but I think they could be persuaded).

This could backfire on Merkel.

I read in German press today that Hollande, who met with Merkel and Renzi in Berlin today (yesterday by now actually), is out for Britain's blood. He wants to punish it hard to show the French at home that exiting the EU, incited by Marine Le Pen, is a very bad idea. Angela Merkel however sees this much more moderately and is at the moment against any punitive measures. They didn't report much about Renzi's stance other than he wants the exit quick...but if his banks are on the line now, Merkel will have a hard time to hold back both Hollande and Renzi. :/

shinra-bansho

Member

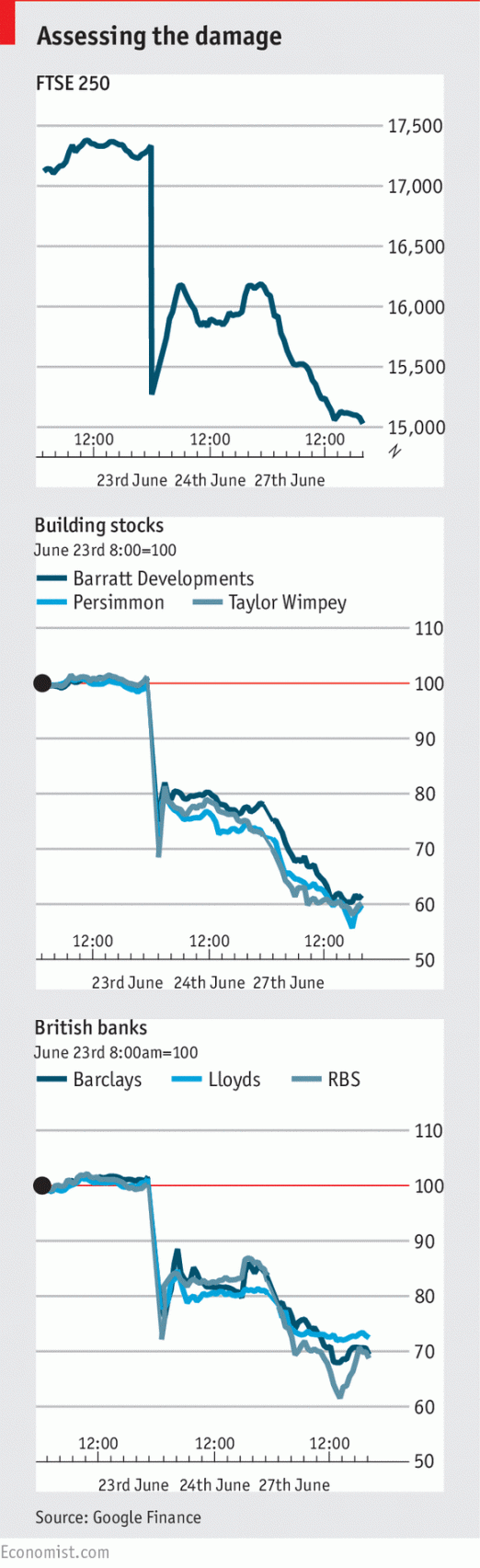

The "FTSE 100 companies are multinationals whose fortunes bear little relation to the British economy, or whose overseas earnings will be boosted (in sterling terms) by recent foreign exchange market movements." It masks the domestic impact.

The FTSE 250 is down over 13%, denominated in GBOunces.

Or graphically.

As for the weak ounce fueling the resurgence of the Great British manufacturing industry.

The FTSE 250 is down over 13%, denominated in GBOunces.

Or graphically.

As for the weak ounce fueling the resurgence of the Great British manufacturing industry.

First, there is the J-curve effect; imports become instantly more expensive and this widens the deficit. It takes time to crank up exports. And Britain's manufacturing sector is quite small; the last big decline in the pound in 2008-09 did not eliminate the current account deficit. What a lower pound does mean is higher inflation (wait for the first "Brexit tax" in the form of higher petrol prices) and thus a squeeze in living standards.

TheExecutive

Member

Is it popular opinion that the vote to leave the EU was largely due to immigration concerns fueled by the refugee crisis? What was the motivation? I am quite certain when this referendum was put out there Cameron was quite sure the UK wouldn't exit the EU. So what is the consensus from experts? Any good articles?

TheExecutive

Member

Doesn't that show more panic then actual good sense? Seems like it's getting close to a good time to buy certain commodities.The "FTSE 100 companies are multinationals whose fortunes bear little relation to the British economy, or whose overseas earnings will be boosted (in sterling terms) by recent foreign exchange market movements." It masks the domestic impact.

The FTSE 250 is down over 13%, denominated in GBOunces.

SuperGamer

Member

So any comment that you disagree with must be from a "foreigner"? This is the kind of comment I'd expect from a Brexiter.When I see these sorts of comments, I must assume that I'm replying to a foreigner.

...Which is almost exactly what I said earlier on. Scotland and Northern Ireland have every right to independence, especially when they're going to be forced out of the EU against their will. But it's odd for Wales, since they voted to leave the EU just like England.In the UK we believe in the right of self-determination. If Wales, Scotland, Gibraltar, Falkland Islands etc want to be independent countries then they are free to do so.

Doesn't that show more panic then actual good sense? Seems like it's getting close to a good time to buy certain commodities.

It's been four days. If it's panic, when do you expect it to subside?

Roland_Gunner

Member

Doesn't that show more panic then actual good sense? Seems like it's getting close to a good time to buy certain commodities.

Depends really. If the British government can convince the market they have a plan to manage the transition out of the Euro, buyers would come back and you'd do well. If they can't then more money will leave the banks, liquidity will dry up and the UK (and maybe the entire EU) slip into recession. If that happens those stocks could go much, much lower. That's why stocks across the world fell during today's question time with Cameron.

Doesn't that show more panic then actual good sense? Seems like it's getting close to a good time to buy certain commodities.

The point is that the FTSE 100 is not doing as bad because it is more multinational and less domestic-focused, but since the FTSE 250 is more domestic-focused, it is doing worse. It actually shows that it is more good sense than panic--the markets are rewarding multinationals that have spread their risk and punishing companies that are UK-focused.

Zaraki_Kenpachi

Member

Doesn't that show more panic then actual good sense? Seems like it's getting close to a good time to buy certain commodities.

What do you mean by good sense? Britain still won't actually talk about it so uncertainty will carry on. I would however, caution about trying to catch a falling knife blade when nothing is currently done by the people who caused it to stop it.

The "FTSE 100 companies are multinationals whose fortunes bear little relation to the British economy, or whose overseas earnings will be boosted (in sterling terms) by recent foreign exchange market movements." It masks the domestic impact.

The FTSE 250 is down over 13%, denominated in GBOunces.

Or graphically.

As for the weak ounce fueling the resurgence of the Great British manufacturing industry.

Let's have some patience, and see some real economic data (which I'm sure will be bad in the short-term). Stock markets, currency, it's just speculation. Actual GDP, feel free to make a thread how much GDP has been affected since Brexit after one quarter. Until then, posting how much people have speculated on markets doesn't reveal too much about the actual economy.

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

This could backfire on Merkel.

If anything it will force a reform because this time, it's not Greece, and it's spreading. But I don't believe Germany will ever accept anything substantial, they'd leave before (as in, you'd reach a point when Eurosceptics would form the government).

TheExecutive

Member

What has actually change in any economy other than speculation and fear? This is panic plain and simple. I am not saying that panic can't bring world economies to their knees but let's call it what it is.It's been four days. If it's panic, when do you expect it to subside?

shinra-bansho

Member

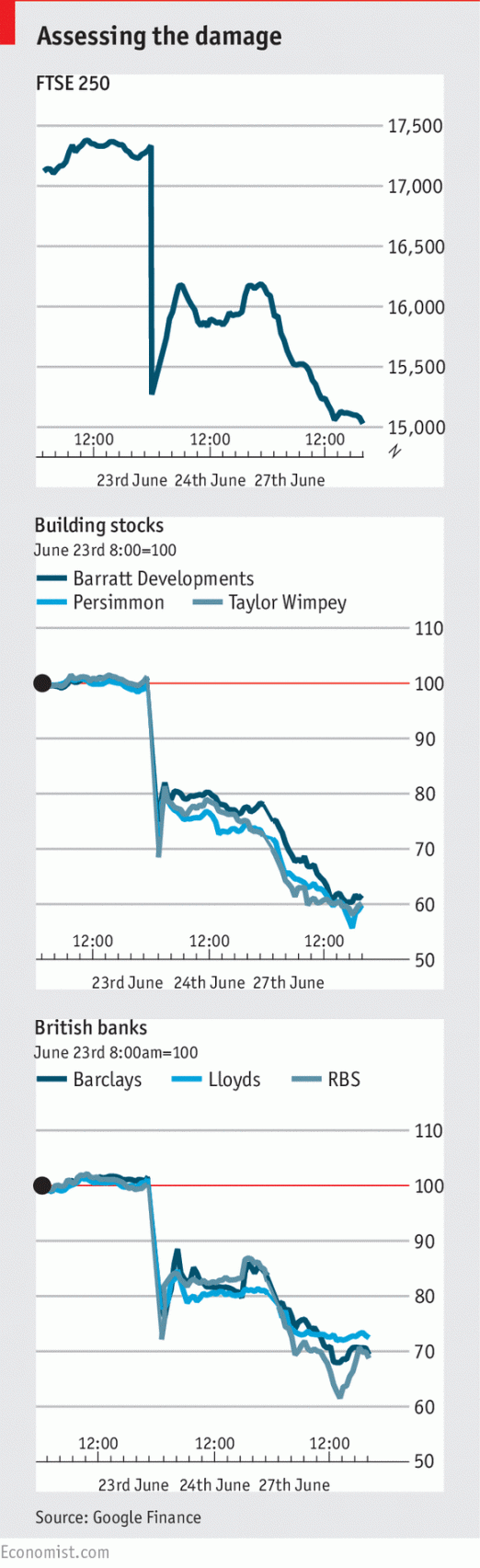

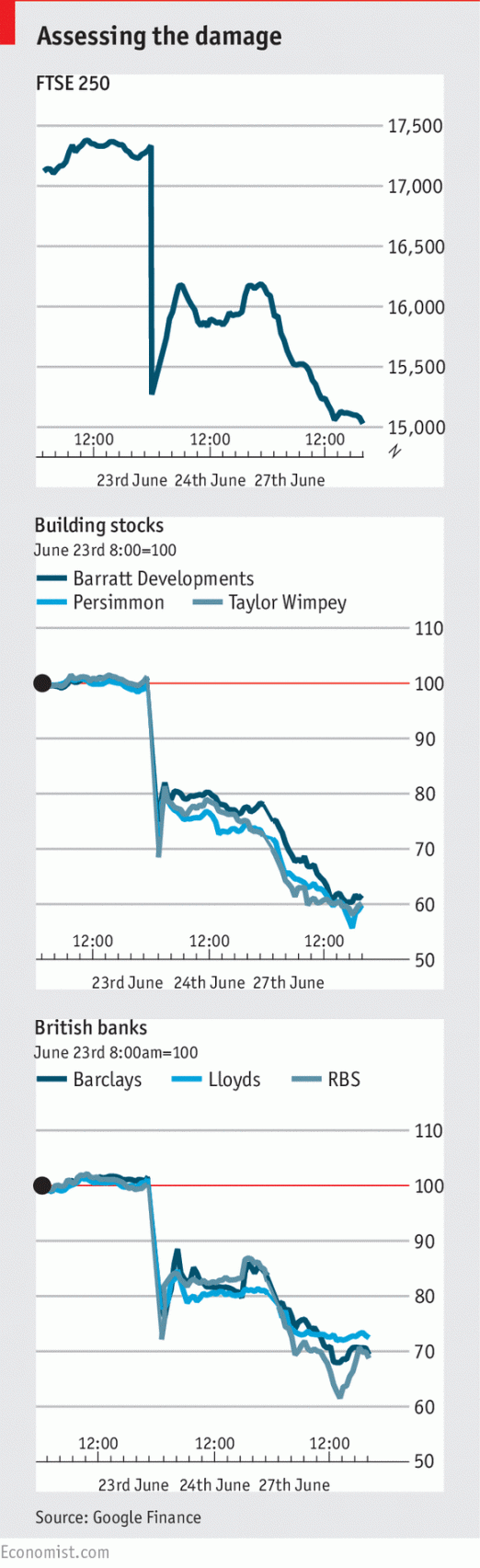

Banking and building sell-off reflects (justified) expectation of increased UK debt and reduced mortgage demand. Companies in the top 100 are more shielded than the midcap. Further noted in the article...Doesn't that show more panic then actual good sense? Seems like it's getting close to a good time to buy certain commodities.

It's not the moves in the markets, by themselves, that is important but what they signify for the economic outlook.

Here is John Van Reenen of the LSE, writing for Vox:

The reasons to expect lower national income when the UK leaves the EU are well-established: prolonged uncertainty, reduced access to the single market, and reduced investment from overseas. Each of these would be highly likely, and the overwhelming weight of evidence is that each would be damaging for the living standards of UK households.

As a result of the decision to leave, we should expect to see:

- lower real wages;

- a lower value of the pound and hence higher prices for goods and services;

- higher borrowing

- lower public spending, or higher taxes;

- in the short run, higher unemployment

Some will dismiss all this as "project fear" but the vote is done and dusted; there is no need to persuade voters any more. This is "project reality".

Why should people wait months to comment on the economic fallout.Let's have some patience, and see some real economic data (which I'm sure will be bad in the short-term). Stock markets, currency, it's just speculation. Actual GDP, feel free to make a thread how much GDP has been affected since Brexit after one quarter. Until then, posting how much people have speculated on markets doesn't reveal too much about the actual economy.

I know, I know. We're all sick of experts.Analysis by the Centre for Economic Performance and the National Institute of Economic and Social Research suggests that if we leave the EU, the economy will be between 1 and 3 percent smaller by 2020, and between 2 and 8 percent smaller by 2030, than if we stay in.

TheExecutive

Member

I missed that very important point. Thanks.The point is that the FTSE 100 is not doing as bad because it is more multinational and less domestic-focused, but since the FTSE 250 is more domestic-focused, it is doing worse. It actually shows that it is more good sense than panic--the markets are rewarding multinationals that have spread their risk and punishing companies that are UK-focused.

SuperGamer

Member

The voting breakdown was as follows:Asians aren't doing themselves any favours by aligning with the side that attracts racists. By supporting Brexit they've contributed to the growing anti-immigrant sentiment.

How the United Kingdom voted on Thursday… and why

White voters voted to leave the EU by 53% to 47%. Two thirds (67%) of those describing themselves as Asian voted to remain, as did three quarters (73%) of black voters. Nearly six in ten (58%) of those describing themselves as Christian voted to leave; seven in ten Muslims voted to remain.

In other words, 33% of Asians voted Leave. The Leave campaign attempted to get Asian votes by saying they'd allow more Commonwealth migration if they reduce EU migration. But that's just a false promise. The Leave campaign's agenda is clearly against all immigration, whether from the EU or the Commonwealth (except for maybe Anglo-Saxon countries).

Doesn't that show more panic then actual good sense? Seems like it's getting close to a good time to buy certain commodities.

Panic... Good Sense... come on. The inner core of the British economy is bleeding uncontrollably. This is what uncertainty does. The multi nationals in the FTSE 1000 they can move around, they're not just in the UK. This is why I said "holy" when it was clear the 250 wouldn't bounce back. What this means is that people don't trust the UK anymore and that hurts, surprise, UK companies the most.

Well, the figure doesn't matter because they've already taken back the promise of giving whatever money they save to the NHS. They took it back hours after the Referendum result was in.

It's less, but there was no way any of that "saved" money from exiting was going to be put in the NHS. It was a bald-faced lie, and Leave admitted it the day the Brexit happened.

They don't pay that much. Watch any video that isn't Leave propaganda and it's not ignored, it's explained away. It's more like 190 million, but we got a lot of benefits in return.

lol what a cluster mess that was. But you have to admit though, that was simple messaging by the Leave campaign. Instead, Remain's more nuanced reply would have been something like, "well look it isn't that much in the first place, and also here's some of the benefits we got in return.... blah blah blah" Simple messaging always work better for the masses. If I am a UK citizen, I'd be so pissed and annoyed at how difficult it is to find good unbiased analysis of the two campaigns.

SuperGamer

Member

Not to mention that the UK economy has already lost £200 billion, and the world economy has already lost $2 trillion.Why should people wait months to comment on the economic fallout.

I know, I know. We're all sick of experts.

Banking and building sell-off reflects (justified) expectation of increased UK debt and reduced mortgage demand. Companies in the top 100 are more shielded than the midcap. Further noted in the article...

There's a pretty obvious reason why house builders shares will go down ... supply and demand. There's an acute housing shortage in the UK. Immigration far outspans emmigration. The whole house building economy is based on figures of a population increase of 500,000 a year. Any decrease in immigration will seriously affect demand.

Now however serious you consider the supply and demand issue, it's certainly an issue that investors should be made aware of. Why did that link not mention it whatsoever in amongst all of the potential issues?

Personally, I've never heard of "Vox" before. It's only recently that I've come across them whilst searching google news for "brexit". Pretty much all of their articles were anti-brexit. Why? you can make money from either direction, so it's not a big deal, just opportunity. But, ok, the general thought was that brexit was bad, so I just assumed that they were going with the flow. But that link has really just made me reconsider. How can they make an article on housing without mentioning immigration figures?

There's a pretty obvious reason why house builders shares will go down ... supply and demand. There's an acute housing shortage in the UK. Immigration far outspans emmigration. The whole house building economy is based on figures of a population increase of 500,000 a year. Any decrease in immigration will seriously affect demand.

Now however serious you consider the supply and demand issue, it's certainly an issue that investors should be made aware of. Why did that link not mention it whatsoever in amongst all of the potential issues?

Personally, I've never heard of "Vox" before. It's only recently that I've come across them whilst searching google news for "brexit". Pretty much all of their articles were anti-brexit. Why? you can make money from either direction, so it's not a big deal, just opportunity. But, ok, the general thought was that brexit was bad, so I just assumed that they were going with the flow. But that link has really just made me reconsider. How can they make an article on housing without mentioning immigration figures?

Vox is a well-known US media outlet. But why not look at the author of the Vox article? He is a professor at a place called the London School of Economics. Have you heard of the London School of Economics?

Anyway, the Vox article was not talking about housing, the Economist article was the one talking about it.

They mentioned reduced housing demand as well as reduced office demand.

The real estate team of Jefferies, for example, has forecast that London office rents will fall 18% and some 10m square feet of demand for office space moves to Paris or Frankfurt (that is because banks will need to shift business to the EU to operate in euro transaction clearing or to have passporting rights in the EU).

https://petition.parliament.uk/petitions/119416

Make it illegal for any UK political figure to knowingly lie or mislead.

The general population of the UK are tired of listening to outright lies and misrepresentation from the political elite in order to gain votes.

With a more honest representation of facts our democracy would hand power back to the people it governs.

Make it illegal for any UK political figure to knowingly lie or mislead.

The general population of the UK are tired of listening to outright lies and misrepresentation from the political elite in order to gain votes.

With a more honest representation of facts our democracy would hand power back to the people it governs.

We're probably effectively in recession now given investment is a big fat 0

It sounds glib but a recession of some sort was practically guaranteed by a "Leave" vote; economists had predicted it (for what that's worth), banks had predicted it, business had predicted it by their negative statements. It shouldn't be a surprise, let's just hope it's short.

figadapaura

Member

I really should have bought some Euros before last week. Fuck me for not planning for an economic crisis.

TheExecutive

Member

Yeah I missed the 250 and read it as 1000.Panic... Good Sense... come on. The inner core of the British economy is bleeding uncontrollably. This is what uncertainty does. The multi nationals in the FTSE 1000 they can move around, they're not just in the UK. This is why I said "holy" when it was clear the 250 wouldn't bounce back. What this means is that people don't trust the UK anymore and that hurts, surprise, UK companies the most.

It sounds glib but a recession of some sort was practically guaranteed by a "Leave" vote; economists had predicted it (for what that's worth), banks had predicted it, business had predicted it by their negative statements. It shouldn't be a surprise, let's just hope it's short.

Well yeah but we've got a guy asking to wait for GDP figures before we starting making judgements on the economic fallout.

figadapaura

Member

https://petition.parliament.uk/petitions/119416

Make it illegal for any UK political figure to knowingly lie or mislead.

The general population of the UK are tired of listening to outright lies and misrepresentation from the political elite in order to gain votes.

With a more honest representation of facts our democracy would hand power back to the people it governs.

Can we make a petition to shut down the Daily Mail?

- Status

- Not open for further replies.