Hey, at least he telegraphed it for everyone. Every time he started a response with the phrase, "I would say it this way..." (paraphrasing) you knew he was about to not say anything at all.It was embarrassing watching Ryan constantly dance around the fact that he had no specifics.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Vice-Presidential Debate |OT| The Big F$@*ing Deal vs. The Randian from Dairyland

- Thread starter pigeon

- Start date

- Status

- Not open for further replies.

The war that Obama called the right war as a candidate in 2008? (He was right in the sense that Taliban victory would be harmful to US security, but wrong in the implication that it was winnable the same way Iraq (eventually) was.

Ryan only said that we should get out according to schedule, but not telegraph our intentions to the enemy and do it the way that preserves as much of the gains made as possible. This is a fine idea, but impractical because we will lose it all.

In reality, Afghanistan will fall apart not long after we leave, but there's no help for it. The people are backward and split into factions, the pols are corrupt and self-serving, and the Taliban are fanatical, formidable, determined, and backed up by Pakistan.

Afghan soldiers cannot replace marines. This is a fantasy. The afghan army will melt away with a whimper once we leave. Our training and arms will end up benefiting the Taliban almost as much as the national forces.

The real question is, what are the consequences for strategic defeat?

It's honestly nice to see a post of yours I can agree with without reservations.

Oh, well, I kind of disagree that Iraq was winnable, but in a strict reading sure. Afghanistan was a bad idea, we're going to leave, it's going to fall apart, and in a sense it's our fault but in another sense it was basically screwed anyway. We need to accept that we lost there, but as a nation we're very unlikely to do so for a while.

But this is why I have to support Obama/Biden when they say let's commit to leaving and actually leave. I'd go further and leave quicker. But there's no magical answer where going to Afghanistan wasn't a fuckup.

Hey, at least he telegraphed it for everyone. Every time he started a response with the phrase, "I would say it this way..." (paraphrasing) you knew he was about to say the script he learned to say this week.

fixed

he is a great memorizer.

Biden speaks from the heart and knows his shit

http://abcnews.go.com/Politics/vide...alysis-reaction-brazile-dowd-wallace-17459507

ABC advisers think that Biden won the debate

See, not everyone in the media is dumb. I feel like this will be the consensus tomorrow.

Care to back up your statement, and avoid stupid hyperbole.

So i should just get you links to the effects of a credit rating downgrade?

speculawyer

Member

It is a very fair point. Obama called it the "right war". But 11 fucking years in . . . . well . . . no war is the "right war" at that point.The war that Obama called the right war as a candidate in 2008? (He was right in the sense that Taliban victory would be harmful to US security, but wrong in the implication that it was winnable the same way Iraq (eventually) was.

Ryan only said that we should get out according to schedule, but not telegraph our intentions to the enemy and do it the way that preserves as much of the gains made as possible. This is a fine idea, but impractical because we will lose it all.

In reality, Afghanistan will fall apart not long after we leave, but there's no help for it. The people are backward and split into factions, the pols are corrupt and self-serving, and the Taliban are fanatical, formidable, determined, and backed up by Pakistan.

Afghan soldiers cannot replace marines. This is a fantasy. The afghan army will melt away with a whimper once we leave. Our training and arms will end up benefiting the Taliban almost as much as the national forces.

The real question is, what are the consequences for strategic defeat?

I understand the telegraph to the enemy point . . . but Biden did a good job of flipping it around. How are the locals going to stand up unless we tell them we are leaving?

And at this point . . . fuck them. If they want the Taliban then let them have it. We'll just rain down missiles from above if another Al-Queada develops. We spent 10 fucking years there trying to show them a better way. If they don't want it then fuck 'em. We just don't have the money to keep fighting. Let China deal with the quagmire on their border.

Sirpopopop

Member

So i should just get you links to the effects of a credit rating downgrade?

That was due to political intransigence. That wasn't solely due to "debt."

That had more to do with the fact that we were having a serious issue about whether or not to raise the debt ceiling.

That pretty much ties in to my general point. As long as we keep the bills paid, we're in good shape. Not raising the debt ceiling meant not keeping the bills paid.

Also: Do you think the most important thing to do is create jobs now, or is to solve "debt?" Do you think the most important thing for the government to do is to cut jobs during a jobs crisis in order to solve debt?

Tragicomedy

Member

It's only a "good point" inasmuch as Romney/Ryan can convincingly prove we would be in a significantly better place if they had been in charge the past four years. Which, they can't.

And no one can overlook the staggering lack of answers whenever anyone asks Ryan or Romney for specifics on how they will do things differently. "We'll do it better." isnt going to win an election. Tonight shone a bright light on the fact that Romney/Ryan speak in platitudes, not facts. It was embarrassing watching Ryan constantly dance around the fact that he had no specifics. Romney/Ryan when pressed on what they'll cut have said one thing - PBS. PBS accounts for next to nothing in the budget. This isn't new news, they've been doing this dodge for months. But tonight the country was watching and Ryan looked like a fool.

Our electoral system is built so that every four years the incumbent has to justify what they've accomplished and why they deserve to stay in office. PLENTY of people have won elections by focusing solely on perceived shortcomings or errors of the incumbent administration, while providing little to no specifics of how they would have done things differently. "Hope and change," anyone? I followed the 2008 elections very closely and don't remember hearing a ton of specifics out of the Obama administration other than the very appropriate argument that the Bush administration had failed.

It worked for Clinton the first time, too. It's an old standard.

Also: Do you think the most important thing to do is create jobs now, or is to solve "debt?" Do you think the most important thing for the government to do is to cut jobs during a jobs crisis in order to solve debt?

Obviously jobs, but you made it sound like the national debt didn't matter.

My fault if i took it wrong.

So i should just get you links to the effects of a credit rating downgrade?

They'd probably go nicely next to the links to the actual downgrades where the credit raters say that they're downgrading America because of irresponsible Republican behavior with regards to raising the debt ceiling, rather than because America can't afford to carry more debt.

My advice: don't. I've been to both Iraq and there, and would go back to Iraq over Afghanistan in a heartbeat. It didn't help that my son was four months old when I left, but in general it's a very, very bad place to be.

That bad, huh? I was talking to my friend Carlos who went on TDY, and he said they basically keep him locked down on base for all the six months, and that it can get scary because sometimes mortars get pretty close. That said, to my knowledge, the Toby Depot hasn't lost any TDY employees in Afghanistan yet... but I'd have to look that up.

Even more than helping the troops, though, is the money. It'd be a boon to make that money. $95,000 in 6 months! And that's not counting per diem ($120 or something per day), which I'd have very little reason to spend out there.

For someone who is just getting married, it'd be a huge headstart in life...

To paraphrase a Facebook post from an hour ago: "I don't blame Ryan for his lack of specifics in tonight's debate. The Romney campaign had just finished re-writing them 30 minutes before it began."

hahaha, good point

He can pull it off because he's Biden and at this point it's kind of expected of him. My wife (who is well-read and socially concerned but about as disinterested in politics as one can be) said earlier today she was looking forward to Biden slapping Ryan around some. That's his modus operandi. I don't care for it in debates, but it appeals to some folks.

I guess, but I think he could have smacked him down without all the weird condescending smirking and giggling. It just felt wrong when I watched it.

I loved Biden's performance, but that really sat with me wrong. Maybe you're right though, that's the game for some people. Some like it.

I wasn't making the case that we're doomed. I was saying that the Romney/Ryan ticket is running on that outlook. It resonates very well with lots of people. Things are certainly still worse than they were in mid-2008. From a personal standpoint, I have yet to see any reasonable economic projections or realistic budgets from either side of the aisle. I'm no more a fan of another round of quantitative easing than I am of budgets that magically will earn bipartisan support to identify ways of closing trillion dollar gaps.

Of course we're worse than we were in mid-2008, Lehman Brothers and all that happened in September.

Still, I understand what you're saying, but I think people worrying about the deficit really miss the forest for the trees. A bad deficit is not going to destroy the country; we print money, literally, and it's really just about making payments back, not how large the deficit is at the moment. The key is to spend during economic downturns, and save during economic upturns.

Tragicomedy said:Our electoral system is built so that every four years the incumbent has to justify what they've accomplished and why they deserve to stay in office. PLENTY of people have won elections by focusing solely on perceived shortcomings or errors of the incumbent administration, while providing little to no specifics of how they would have done things differently. "Hope and change," anyone? I followed the 2008 elections very closely and don't remember hearing a ton of specifics out of the Obama administration other than the very appropriate argument that the Bush administration had failed.

I certainly heard far more specifics from Obama/Biden than I've yet to hear from Romney/Ryan, AND Obama/Biden managed to also cover the shortcomings of their predecessors.

Aaron Strife

Banned

Yeah, but Biden was too aggressive! I'm voting for Romney!I certainly heard far more specifics from Obama/Biden than I've yet to hear from Romney/Ryan, AND Obama/Biden managed to also cover the shortcomings of their predecessors.

Open Source

Banned

It's honestly nice to see a post of yours I can agree with without reservations.

Oh, well, I kind of disagree that Iraq was winnable, but in a strict reading sure. Afghanistan was a bad idea, we're going to leave, it's going to fall apart, and in a sense it's our fault but in another sense it was basically screwed anyway. We need to accept that we lost there, but as a nation we're very unlikely to do so for a while.

But this is why I have to support Obama/Biden when they say let's commit to leaving and actually leave. I'd go further and leave quicker. But there's no magical answer where going to Afghanistan wasn't a fuckup.

Damned if you do, damned if you don't. Bin laden erased, but al Qaeda the hydra still alive and running out the clock.

I wouldn't consider this issue a reason to support either candidate. No one has the guts to tell America that it's a lost cause, which is why none of the candidates can offer anything but wishful thinking and recriminations.

This and Syria were a waste of debate time. Nothing but posturing while shrugging shoulders. Also, what do you offer as a man? Moderator asked some dumb crap.

Thunder Monkey

Banned

Schattenjäger;43111464 said:Haha I'm sure a cock flavored lollipop is useful for some

Cock shaped lollies are a lot of fun.

Cock flavored?

Depends on the flavor.

Baconsammy

Banned

Our electoral system is built so that every four years the incumbent has to justify what they've accomplished and why they deserve to stay in office. PLENTY of people have won elections by focusing solely on perceived shortcomings or errors of the incumbent administration, while providing little to no specifics of how they would have done things differently. "Hope and change," anyone? I followed the 2008 elections very closely and don't remember hearing a ton of specifics out of the Obama administration other than the very appropriate argument that the Bush administration had failed.

It worked for Clinton the first time, too. It's an old standard.

Of course he had specifics. He even had timelines for getting out of Iraq, and plans for Obamacare. You can't go back and find footage of people hounding Obama for specifics and him dancing around it. To compare then with now is disingenuous at best. You can't tell the country that you're going to remove the deficit and then not say how.

Tragicomedy

Member

3. Debt crisis? Pure malarkey. Plain and simple. It can be solved by printing money if one wanted to solve it through that method. As long as we can pay employees, and pay the "bills" when they come due without massive inflation we are in good shape. So far so good. Worrying about the debt is something that you can deal with once the economy recovers.

That was due to political intransigence. That wasn't solely due to "debt."

That had more to do with the fact that we were having a serious issue about whether or not to raise the debt ceiling.

That pretty much ties in to my general point. As long as we keep the bills paid, we're in good shape. Not raising the debt ceiling meant not keeping the bills paid.

You cannot keep paying bills with borrowed money. We do not merely print new money. That's economic suicide. I lived through that in Argentina in the late 80s. Printing large quantities of new money with no strings attached spells economic disaster in the long-term.

Instead, we generate new treasury bonds and then sell them to foreign investors, e.g. China. China does not believe our economy is fundamentally sound. Recall, if you will, a room full of Chinese financial students laughing at Timothy Geithner's claim that our economy is open and stable. They enjoy collecting interest from their payments, but will certainly stop buying the bonds if they don't believe they will recoup their investment.

I'm not an economist, admittedly. Can you link anything from a rational and well-respected economist who does not believe that the debt crises is very real and very dangerous to our economic solvency as a country? I genuinely have not read that viewpoint from anyone.

Thunder Monkey

Banned

Of course he had specifics. He even had timelines for getting out of Iraq, and plans for Obamacare. You can't go back and find footage of people hounding Obama for specifics and him dancing around it. To compare then with now is disingenuous at best. You can't tell the country that you're going to remove the deficit and then not say how.

Apparently you can, and recent polling shows it may just work.

US has been borrowing money for longer than Argentina has been independent. How's that for long-term?You cannot keep paying bills with borrowed money. We do not merely print new money. That's economic suicide. I lived through that in Argentina in the late 80s. Printing large quantities of new money with no strings attached spells economic disaster in the long-term.

Instead, we generate new treasury bonds and then sell them to foreign investors, e.g. China. China does not believe our economy is fundamentally sound. Recall, if you will, a room full of Chinese financial students laughing at Timothy Geithner's claim that our economy is open and stable. They enjoy collecting interest from their payments, but will certainly stop buying the bonds if they don't believe they will recoup their investment.

I'm not an economist, admittedly. Can you link anything from a rational and well-respected economist who does not believe that the debt crises is very real and very dangerous to our economic solvency as a country? I genuinely have not read that viewpoint from anyone.

Synth_floyd

Banned

Biden must've won the debate if all that Fox News can come up with is that Biden smiled too much.

Biden must've won the debate if all that Fox News can come up with is that Biden smiled too much.

Coming up with spin takes time. Smile-gate is a nice placeholder until they can figure out a way to say that asking for specifics is elitist.

Looking back at some debate clips I can definitely see how some conservatives would be steaming over Biden's performance, he was prepared, aggressive, and detailed. But I can also imagine some independents being put off by his tone and aggression. As an Obama supporter I'm glad with how things went.

The patron saint of polls speaks:

http://www.nytimes.com/2012/01/02/opinion/krugman-nobody-understands-debt.html

Krugman delivers on this topic.

@fivethirtyeight said:Instant reaction from polls & pundits suggest debate in awkward middle ground between "tie" and "Biden win".

Probably won't matter much -- VP debates rarely do -- but will test hypothesis that Romney Denver gains were soft.

I'm not an economist, admittedly. Can you link anything from a rational and well-respected economist who does not believe that the debt crises is very real and very dangerous to our economic solvency as a country? I genuinely have not read that viewpoint from anyone.

http://www.nytimes.com/2012/01/02/opinion/krugman-nobody-understands-debt.html

la dama gris said:Deficit-worriers portray a future in which were impoverished by the need to pay back money weve been borrowing. They see America as being like a family that took out too large a mortgage, and will have a hard time making the monthly payments.

This is, however, a really bad analogy in at least two ways.

First, families have to pay back their debt. Governments dont all they need to do is ensure that debt grows more slowly than their tax base. The debt from World War II was never repaid; it just became increasingly irrelevant as the U.S. economy grew, and with it the income subject to taxation.

Second and this is the point almost nobody seems to get an over-borrowed family owes money to someone else; U.S. debt is, to a large extent, money we owe to ourselves....

Its true that foreigners now hold large claims on the United States, including a fair amount of government debt. But every dollars worth of foreign claims on America is matched by 89 cents worth of U.S. claims on foreigners. And because foreigners tend to put their U.S. investments into safe, low-yield assets, America actually earns more from its assets abroad than it pays to foreign investors. If your image is of a nation thats already deep in hock to the Chinese, youve been misinformed. Nor are we heading rapidly in that direction....

And thats why nations with stable, responsible governments that is, governments that are willing to impose modestly higher taxes when the situation warrants it have historically been able to live with much higher levels of debt than todays conventional wisdom would lead you to believe. Britain, in particular, has had debt exceeding 100 percent of G.D.P. for 81 of the last 170 years. When Keynes was writing about the need to spend your way out of a depression, Britain was deeper in debt than any advanced nation today, with the exception of Japan.

Krugman delivers on this topic.

empty vessel

Member

Obviously jobs, but you made it sound like the national debt didn't matter.

My fault if i took it wrong.

The national debt does not matter.

Krugman delivers on this topic.

Krugman actually doesn't get this topic at all. He is a conservative who doesn't understand the US monetary (or banking) system.

Baconsammy

Banned

Biden must've won the debate if all that Fox News can come up with is that Biden smiled too much.

And the mean lady moderating it was a big bad meanie to poor Mr. Ryan.

Doc Holliday

SPOILER: Columbus finds America

Looking back at some debate clips I can definitely see how some conservatives would be steaming over Biden's performance, he was prepared, aggressive, and detailed. But I can also imagine some independents being put off by his tone and aggression. As an Obama supporter I'm glad with how things went.

Agreed, fucking independents are such babies lol

speculawyer

Member

An oldie but goodie . . .You cannot keep paying bills with borrowed money. We do not merely print new money. That's economic suicide. I lived through that in Argentina in the late 80s. Printing large quantities of new money with no strings attached spells economic disaster in the long-term.

Instead, we generate new treasury bonds and then sell them to foreign investors, e.g. China. China does not believe our economy is fundamentally sound. Recall, if you will, a room full of Chinese financial students laughing at Timothy Geithner's claim that our economy is open and stable. They enjoy collecting interest from their payments, but will certainly stop buying the bonds if they don't believe they will recoup their investment.

I'm not an economist, admittedly. Can you link anything from a rational and well-respected economist who does not believe that the debt crises is very real and very dangerous to our economic solvency as a country? I genuinely have not read that viewpoint from anyone.

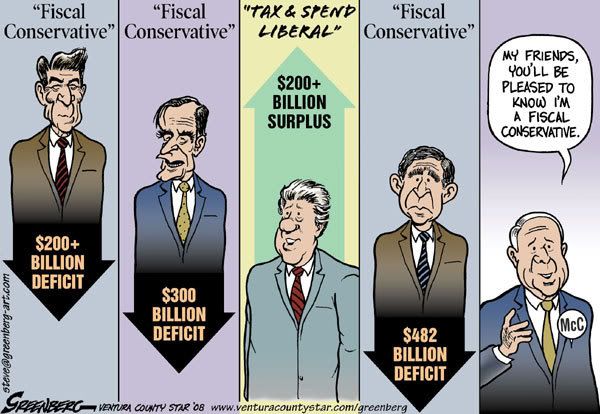

Obama has certainly had massive deficits . . . but at least he has kept them steady & flat.

Tragicomedy

Member

US has been borrowing money for longer than Argentina has been independent. How's that for long-term?

So do you disagree with the notion that there is a general consensus among lenders of a cutoff point? You know, when they realize they aren't going to recover their principal any more and they stop tossing money down the pit?

As a frame of reference, the US has paid $360 billion dollars in interest to our creditors in 2012 alone.

Treasury Direct interest expenses. That doesn't strike you as a problem?

So do you disagree with the notion that there is a general consensus among lenders of a cutoff point? You know, when they realize they aren't going to recover their principal any more and they stop tossing money down the pit?

There absolutely is, but we'd see that cliff coming long in advance, because T-bill interest rates would start going up. Right now they're at historic lows -- people are desperate to lend us money. This is a big reason why I think the argument doesn't hold much water.

No, I think that's a laughable notion. US has never missed a dividend payout, and we can print as much money as we please, so I don't know what "pit" you might be referring to.So do you disagree with the notion that there is a general consensus among lenders of a cutoff point? You know, when they realize they aren't going to recover their principal any more and they stop tossing money down the pit?

As a frame of reference, the US has paid $360 billion dollars in interest to our creditors in 2012 alone.

Treasury Direct interest expenses. That doesn't strike you as a problem?

Tragicomedy

Member

An oldie but goodie . . .

Obama has certainly had massive deficits . . . but at least he has kept them steady & flat.

That cartoon has nothing to do with what I posted. I'm 100% in favor of raising taxes and maintaining a balanced budget (a la Clinton).

empty vessel

Member

So do you disagree with the notion that there is a general consensus among lenders of a cutoff point? You know, when they realize they aren't going to recover their principal any more and they stop tossing money down the pit?

As a frame of reference, the US has paid $360 billion dollars in interest to our creditors in 2012 alone.

Treasury Direct interest expenses. That doesn't strike you as a problem?

Do you understand that the US government is the sole creator of US dollars?

Do you understand what money is? It's a thing fabricated from nothing. A social construct.

AP poll looks like a Nintendo fans poll on a UBI Soft website

There is no AP poll and if there is pls link to it.

So do you disagree with the notion that there is a general consensus among lenders of a cutoff point? You know, when they realize they aren't going to recover their principal any more and they stop tossing money down the pit?

As a frame of reference, the US has paid $360 billion dollars in interest to our creditors in 2012 alone.

Treasury Direct interest expenses. That doesn't strike you as a problem?

Like Krugman implied, credit crises come in times of political disorder. If you want to prevent a crisis, your best hope is to rid the House of the Tea Party.

Sirpopopop

Member

You cannot keep paying bills with borrowed money. We do not merely print new money. That's economic suicide. I lived through that in Argentina in the late 80s. Printing large quantities of new money with no strings attached spells economic disaster in the long-term.

That's my general point. If debt is this huge problem, then that's all you need to do. If debt is something to be managed then you just ensure that you pay off your "bills." (that's what I call bonds)

Instead, we generate new treasury bonds and then sell them to foreign investors, e.g. China. China does not believe our economy is fundamentally sound. Recall, if you will, a room full of Chinese financial students laughing at Timothy Geithner's claim that our economy is open and stable. They enjoy collecting interest from their payments, but will certainly stop buying the bonds if they don't believe they will recoup their investment.

I'm not an economist, admittedly. Can you link anything from a rational and well-respected economist who does not believe that the debt crises is very real and very dangerous to our economic solvency as a country? I genuinely have not read that viewpoint from anyone.

http://www.dallasnews.com/opinion/s...-the-imaginary-monster-d.c.-loves-to-fear.ece

Paul Krugman is the most well known name. You might state that he's not rational or well-respected, but the man has two Nobel Prizes.

http://www.economist.com/blogs/freeexchange/2012/04/sovereign-debt

This article from the Economist seems to make that same general point.

AP poll looks like a Nintendo fans poll on a UBI Soft website

I am not sure what you are trying to say.

eBay Huckster

Member

AP poll looks like a Nintendo fans poll on a UBI Soft website

In that it doesn't actually exist?

Tragicomedy

Member

There absolutely is, but we'd see that cliff coming long in advance, because T-bill interest rates would start going up. Right now they're at historic lows -- people are desperate to lend us money. This is a big reason why I think the argument doesn't hold much water.

That's true. I think it's more of an overall reflection on how piss-poor the global economy is right now (particularly the EU) than any ringing endorsement of our economic policies.

I still maintain this is something we need to get ahead of in advance instead of waiting for that train to come rolling into station. You know, while we still have a say in it versus the next big economic crisis.

As Churchill famously quipped: "You can always count on Americans to do the right thing--after they've tried everything else."

No, I think that's a laughable notion. US has never missed a dividend payout, and we can print as much money as we please, so I don't know what "pit" you might be referring to.

Once again, we cannot just print as much money as we please. It doesn't work that way, never has, and never will. The US dollar is legal tender. It's a piece of paper, but it has intrinsic value based on people's perceptions. If we go hog wild and start printing large amounts of it to pay our debts, that intrinsic value declines.

Sye d'Burns

Member

Should the Democrats start comparing Romney's secret plans to Nixon's secret plan to end the Vietnam War? Or is that going too far?

Why not? In the last week, I've heard the Libya changing, or should I say evolving, story compared to Watergate. All's fair.

Watching some debate clips again I love Paul Ryan's face when Joe Biden's talking. He' got the exact same forced, painful smile as in those workout photos. He looks like he realizes he's losing and needs to do something about it.

I felt like he'd been coached in front of a mirror until he was able to default to that face at all times.

Well, we've been doing it for 230 years, so...That's true. I think it's more of an overall reflection on how piss-poor the global economy is right now (particularly the EU) than any ringing endorsement of our economic policies.

I still maintain this is something we need to get ahead of in advance instead of waiting for that train to come rolling into station. You know, while we still have a say in it versus the next big economic crisis.

As Churchill famously quipped: "You can always count on Americans to do the right thing--after they've tried everything else."

Once again, we cannot just print as much money as we please. It doesn't work that way, never has, and never will. The US dollar is legal tender. It's a piece of paper, but it has intrinsic value based on people's perceptions. If we go hog wild and start printing large amounts of it to pay our debts, that intrinsic value declines.

empty vessel

Member

Once again, we cannot just print as much money as we please.

Of course we can. And we always have.

It doesn't work that way, never has, and never will. The US dollar is legal tender. It's a piece of paper, but it has intrinsic value based on people's perceptions. If we go hog wild and start printing large amounts of it to pay our debts, that intrinsic value declines.

So what you are saying is that we can create as much money as we please, but if we create too much, it will have consequences? I agree with that. The relevant question, then, is what is too much? Do you know how to answer that question?

Bam Bam Baklava

Member

Just got home, looks like a Biden win from what I'm seeing?

Tragicomedy

Member

p.s. Thanks for the Krugman links. I have glanced over his stuff before but not given it a full read. I'm going to edumahcate myself on his economic perspective.

- Status

- Not open for further replies.