havoc00

Member

Roblox Corporation (NYSE: RBLX), a global platform bringing millions of people together through shared experiences, released its first quarter 2025 financial and operational results and issued its second quarter and updated full year 2025 guidance today. Separately, Roblox posted a letter to shareholders and supplemental materials on the Roblox investor relations website at ir.roblox.com.

First Quarter 2025 Financial, Operational, and Liquidity Highlights

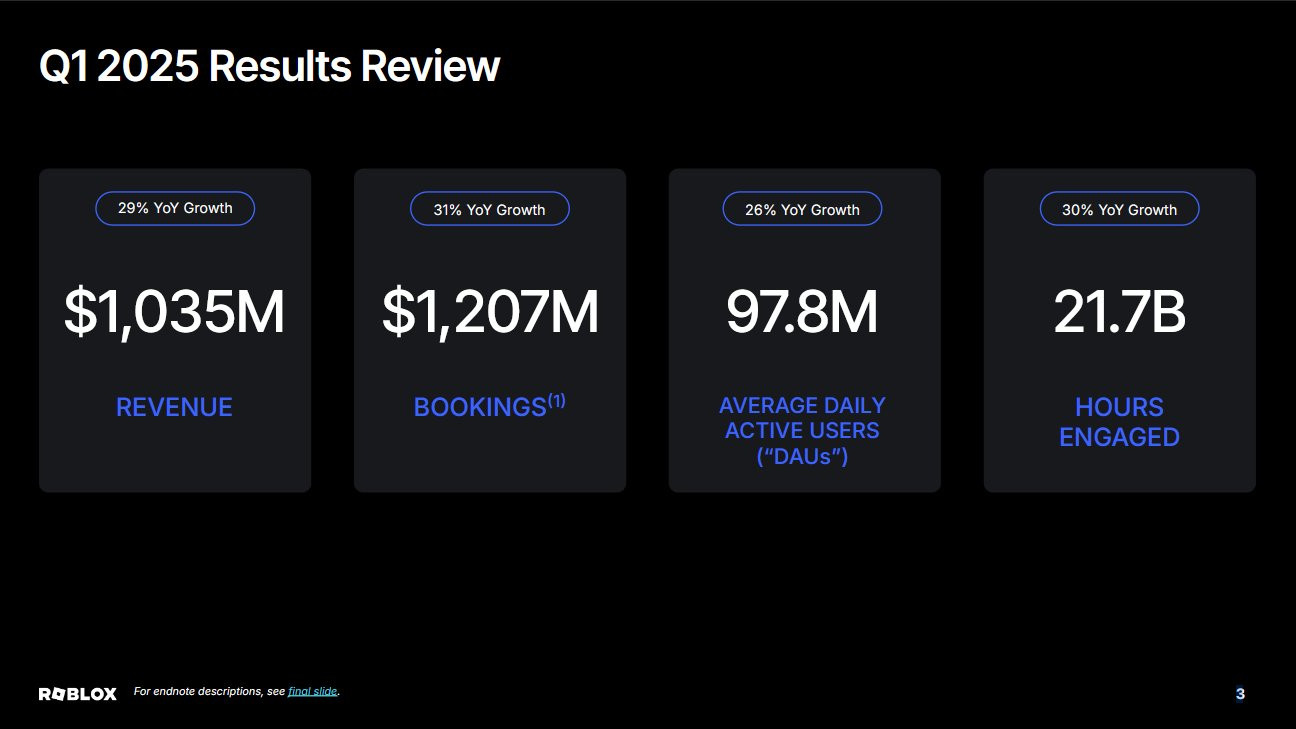

- Revenue was $1,035.2 million, up 29% year-over-year, and up 30% year-over-year on a constant currency basis1.

- Bookings2were $1,206.7 million, up 31% year-over-year, and up 33% year-over-year on a constant currency basis1.

- Net loss attributable to common stockholders was $215.1 million, while consolidated net loss was $216.3 million.

- Adjusted EBITDA2was $58.0 million, which excludes adjustments for increases in deferred revenue and deferred cost of revenue of $177.9 million and $(30.8) million, respectively, or a total change in deferred of $147.1 million.

- Net cash and cash equivalents provided by operating activities were $443.9 million, up 86% year-over-year, while free cash flow2was $426.5 million, up 123% year-over-year.

- Note that both operating cash flow and free cash flow benefited from the delay of a $30 million payout to a developer that we now expect to pay in the second quarter of 2025. Had we made this payment in the first quarter of 2025 as originally intended, operating cash flow for the quarter would have been $413.9 million and free cash flow would have been $396.5 million. The year-over-year growth rates in operating cash flow and free cash flow would have been 73% and 108%, respectively.

- Average Daily Active Users ("DAUs") were 97.8 million, up 26% year-over-year.

- Average monthly unique payers were 20.2 million, up 29% year-over-year, and average bookings per monthly unique payer was $19.92.

- Hours engaged were 21.7 billion, up 30% year-over-year.

- Average bookings per DAU ("ABPDAU") was $12.34, up 4% year-over-year, and up 6% year-over-year on a constant currency basis1.

- Cash and cash equivalents, short-term investments, and long-term investments totaled $4,510.5 million; net liquidity3was $3,503.8 million.

"We accelerated topline growth in Q1 2025 with revenue growing 29% year-over-year and bookings growing 31% year-over-year. Topline growth was strong in all regions. We continued to deliver high rates of improvement in margins as a result of both strong topline growth and operating efficiencies primarily related to the cost of headcount and infrastructure and trust and safety. Cash flow from operations and free cash flow both reached record levels, grew year-over-year at high rates, and exceeded our prior guidance," said Michael Guthrie, chief financial officer of Roblox.