cormack12

Gold Member

Source: https://www.ign.com/articles/why-fo...n-buy-billion-game-company?utm_source=twitter

Everyone wants to acquire a gaming company these days it seems, including former Sony head Jack Tretton.

Speaking to IGN, Tretton says during his time at Sony and since, he's seen a gradual shift has allowed small studios to be less reliant on large publishers to get their games into the world.

"Thanks to the online stores, anybody can be a publisher," Tretton says. "So the good news is, the barrier to entry is dropped significantly. It's still very costly to build a game, but a fraction of what it was back in the days when you had to do a AAA, a hundred million dollar project to see the light of day on the shelves."

But that doesn't mean that it's easy to release such a game. He says that as indies look for more sources of funding, he's seeing increasing interest in mergers and acquisitions [M&A]. But indies are reluctant, he says, because they don't want to lose their independence, and going public themselves to earn money from investors is an expensive, complex proposition. How, then, can an indie raise money from investors while remaining independent, small, and secure?

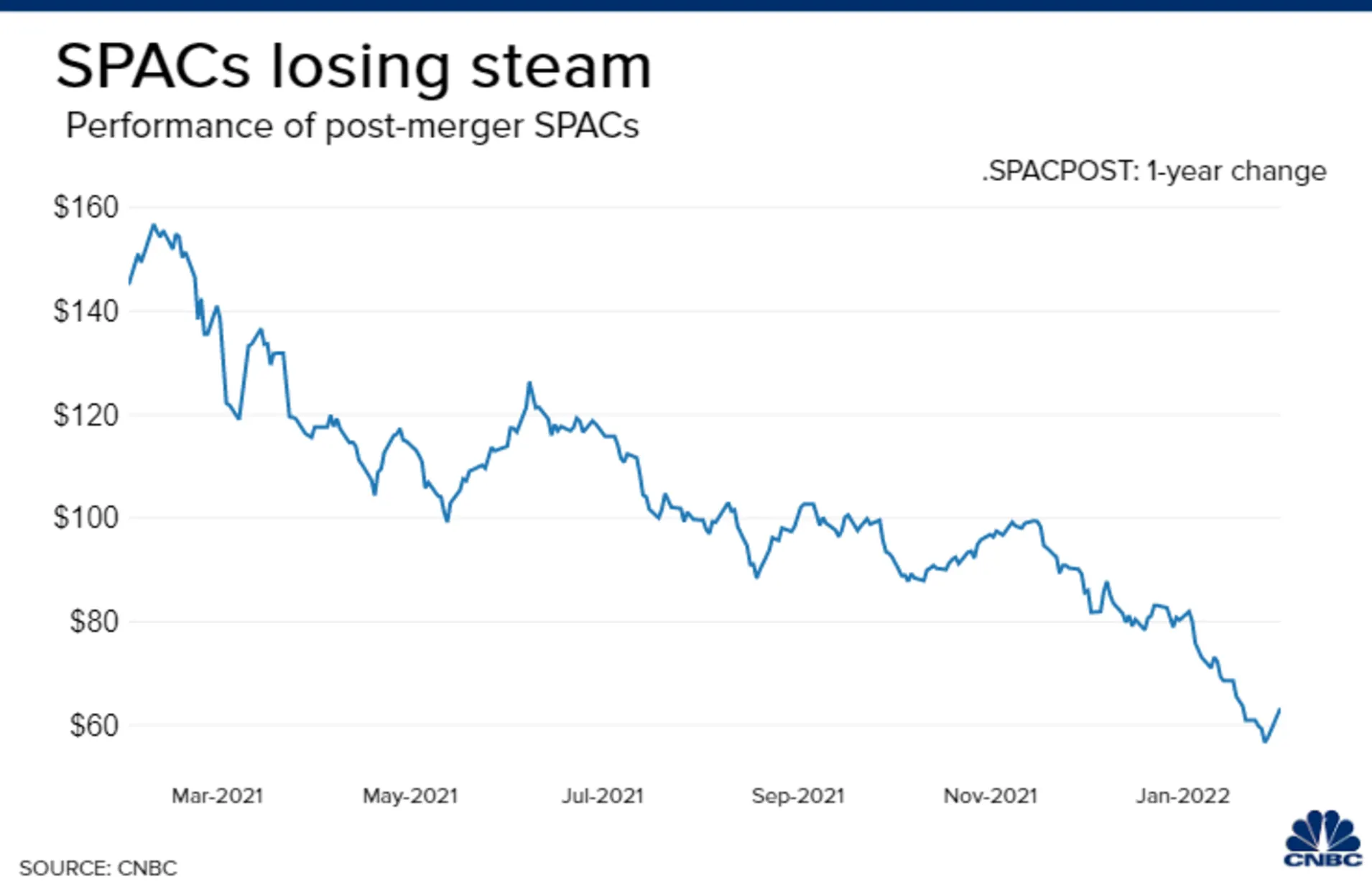

Enter Tretton and his new company: PowerUp. PowerUp is a SPAC: a special purpose acquisition company. As Tretton explains concisely, SPACs are companies that exist for the sole purpose of acquiring or merging with an existing, private company and taking it public as a combined entity. It's an easy route for smaller companies to become publicly traded while simultaneously getting extra financial backing, and potentially, an experienced group of industry professionals at their back who can offer advice, support, and direction. In the case of PowerUp, Tretton says that also means letting the studio stay independent by remaining a minority owner.

"We want to have more of a mentorship role where maybe we take a board seat, but we're not interested in joining the management team or taking the management team over," he explains.

There are hundreds of SPACs out there, but PowerUp is relatively unique as a games industry-specific endeavor. Tretton says the lack of SPACs in the approximately $200 billion dollar games industry, especially as acquisition becomes a hotter topic, was part of what prompted him to start PowerUp with a group of leaders who are already familiar with the game space.

So what's behind the surge in games industry acquisitions lately? Tretton's theory is that the boom is tied to the sheer number of gaming companies compared to 15 or 20 years ago combined with the skyrocketing figures that the biggest gaming companies are raking in each year. There's simply more to be acquired, and more money to do it with. And, he adds, that's a good thing.

"You've got some strategic mergers and acquisitions that I think are good for the industry, because if an Activision becomes part of a Microsoft or a Zynga becomes part of a Take-Two, that creates room for a new Zynga or a new Activision to pop up, and maybe somebody who is a fraction of the size of an Activision or a Zynga becomes the next Activision or a Zynga, and those guys are going to pull up smaller companies with them," Tretton says. "So I think it's a sign of growth in the industry and a sign of the value of the industry and it's all positive."

Everyone wants to acquire a gaming company these days it seems, including former Sony head Jack Tretton.

Speaking to IGN, Tretton says during his time at Sony and since, he's seen a gradual shift has allowed small studios to be less reliant on large publishers to get their games into the world.

"Thanks to the online stores, anybody can be a publisher," Tretton says. "So the good news is, the barrier to entry is dropped significantly. It's still very costly to build a game, but a fraction of what it was back in the days when you had to do a AAA, a hundred million dollar project to see the light of day on the shelves."

But that doesn't mean that it's easy to release such a game. He says that as indies look for more sources of funding, he's seeing increasing interest in mergers and acquisitions [M&A]. But indies are reluctant, he says, because they don't want to lose their independence, and going public themselves to earn money from investors is an expensive, complex proposition. How, then, can an indie raise money from investors while remaining independent, small, and secure?

Enter Tretton and his new company: PowerUp. PowerUp is a SPAC: a special purpose acquisition company. As Tretton explains concisely, SPACs are companies that exist for the sole purpose of acquiring or merging with an existing, private company and taking it public as a combined entity. It's an easy route for smaller companies to become publicly traded while simultaneously getting extra financial backing, and potentially, an experienced group of industry professionals at their back who can offer advice, support, and direction. In the case of PowerUp, Tretton says that also means letting the studio stay independent by remaining a minority owner.

"We want to have more of a mentorship role where maybe we take a board seat, but we're not interested in joining the management team or taking the management team over," he explains.

There are hundreds of SPACs out there, but PowerUp is relatively unique as a games industry-specific endeavor. Tretton says the lack of SPACs in the approximately $200 billion dollar games industry, especially as acquisition becomes a hotter topic, was part of what prompted him to start PowerUp with a group of leaders who are already familiar with the game space.

So what's behind the surge in games industry acquisitions lately? Tretton's theory is that the boom is tied to the sheer number of gaming companies compared to 15 or 20 years ago combined with the skyrocketing figures that the biggest gaming companies are raking in each year. There's simply more to be acquired, and more money to do it with. And, he adds, that's a good thing.

"You've got some strategic mergers and acquisitions that I think are good for the industry, because if an Activision becomes part of a Microsoft or a Zynga becomes part of a Take-Two, that creates room for a new Zynga or a new Activision to pop up, and maybe somebody who is a fraction of the size of an Activision or a Zynga becomes the next Activision or a Zynga, and those guys are going to pull up smaller companies with them," Tretton says. "So I think it's a sign of growth in the industry and a sign of the value of the industry and it's all positive."