I Master l

Banned

Update:

Microsoft is very selective in what data it releases on its various divisions. This includes gaming, which is now Microsoft's fourth best-earning business in terms of revenue with $15.4 billion earned in FY23. Every quarter, Microsoft will report three metrics on the Xbox business: content & services earnings, hardware revenues, and a finalized Xbox gaming number. Sometimes Microsoft will also release a new Xbox Game Pass figure, but they haven't done that for some time.

This is a big departure from Nintendo and Sony, both of which reveal revenue and profit numbers for their games businesses. Microsoft, however, has never discussed Xbox's profits. Now thanks to a series of documents and files that were accidentally leaked as part of the FTC v Microsoft federal trial, we have an idea of how healthy Xbox actually is.

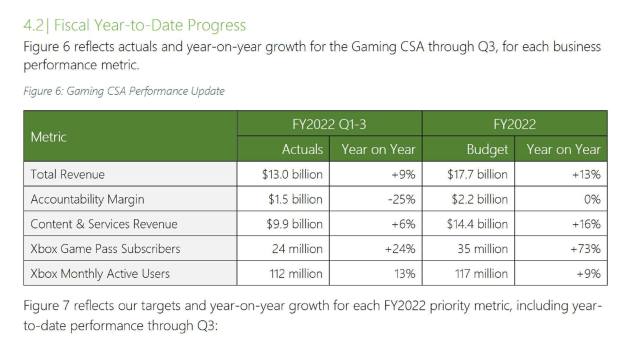

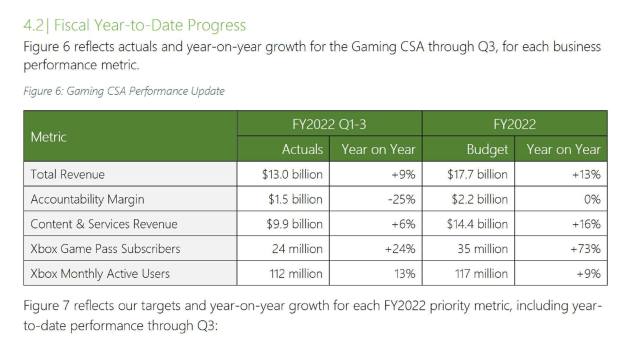

According to an internal Gaming CSA (Customer Service Area) slide deck, the Xbox games division had an accountability margin of $1.5 billion for the first 9 months of FY22 (July 2022 - March 2023)

According to our findings, Xbox gaming had a 12% accountability margin (AM) for 9 month period in FY22. However, in the aforementioned testimony, Spencer says that "the Xbox business today runs at a single-digit profit margin."

Comparing this number with the other Big 3 players isn't exactly straightforward. The accountability methods may be different. We're not entirely sure how Microsoft calculates its accountability margin, but the closest comparisons we have are PlayStation's $1.419 billion in operating income, which represents a 7% margin, and $2.977 billion in net profit from Nintendo, which represents a strong 25% margin.

Source

www.tweaktown.com

www.tweaktown.com

Interesting to see that Xbox profit margin is slightly higher than PS

Btw, the author of the article took down that chart.

OP should be updated.

FYI - margins are not operating profit, as the title of this thread incorrectly suggests. For example, Contribution Margin does not usually include fixed costs.

This CFO and Financial Analyst explains this whole thing well. Folks who have studied accounting would understand it easily.

Microsoft is very selective in what data it releases on its various divisions. This includes gaming, which is now Microsoft's fourth best-earning business in terms of revenue with $15.4 billion earned in FY23. Every quarter, Microsoft will report three metrics on the Xbox business: content & services earnings, hardware revenues, and a finalized Xbox gaming number. Sometimes Microsoft will also release a new Xbox Game Pass figure, but they haven't done that for some time.

This is a big departure from Nintendo and Sony, both of which reveal revenue and profit numbers for their games businesses. Microsoft, however, has never discussed Xbox's profits. Now thanks to a series of documents and files that were accidentally leaked as part of the FTC v Microsoft federal trial, we have an idea of how healthy Xbox actually is.

According to an internal Gaming CSA (Customer Service Area) slide deck, the Xbox games division had an accountability margin of $1.5 billion for the first 9 months of FY22 (July 2022 - March 2023)

According to our findings, Xbox gaming had a 12% accountability margin (AM) for 9 month period in FY22. However, in the aforementioned testimony, Spencer says that "the Xbox business today runs at a single-digit profit margin."

Comparing this number with the other Big 3 players isn't exactly straightforward. The accountability methods may be different. We're not entirely sure how Microsoft calculates its accountability margin, but the closest comparisons we have are PlayStation's $1.419 billion in operating income, which represents a 7% margin, and $2.977 billion in net profit from Nintendo, which represents a strong 25% margin.

Source

Xbox profits revealed in new FTC leak

Gamers, investors, consumers and competitors finally get a concrete answer on just how profitable Microsoft's Xbox video games division actually is.

Interesting to see that Xbox profit margin is slightly higher than PS

Last edited by a moderator: