Kadve

Member

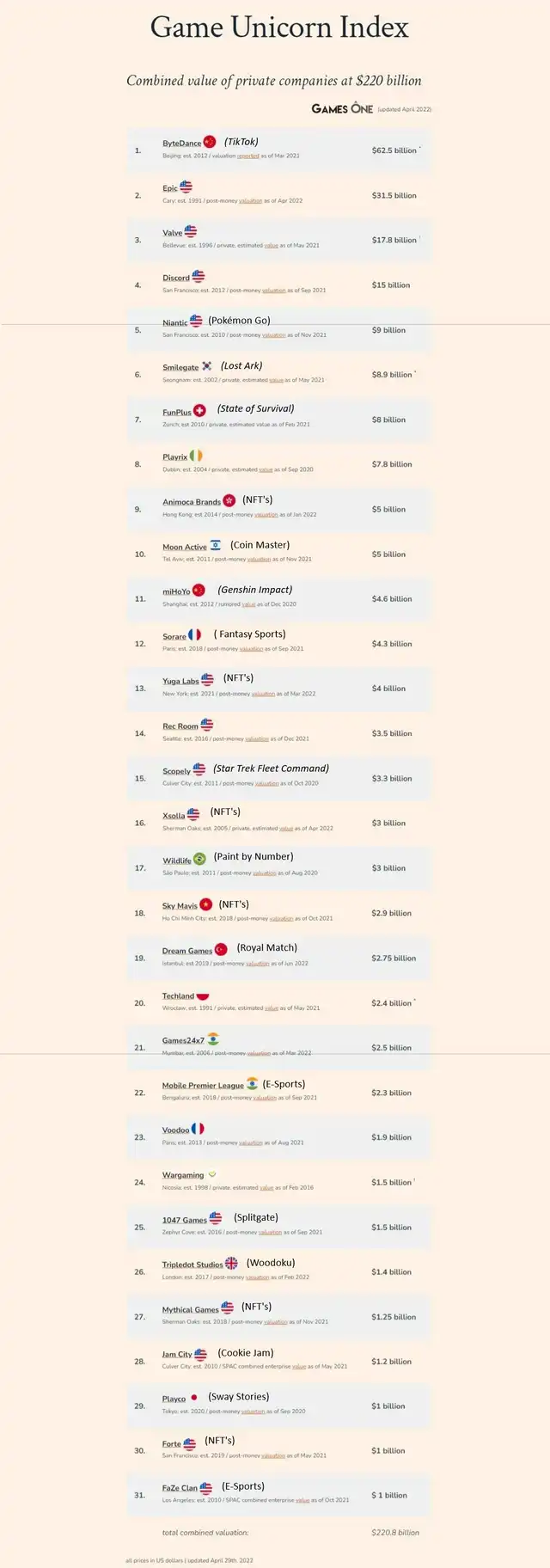

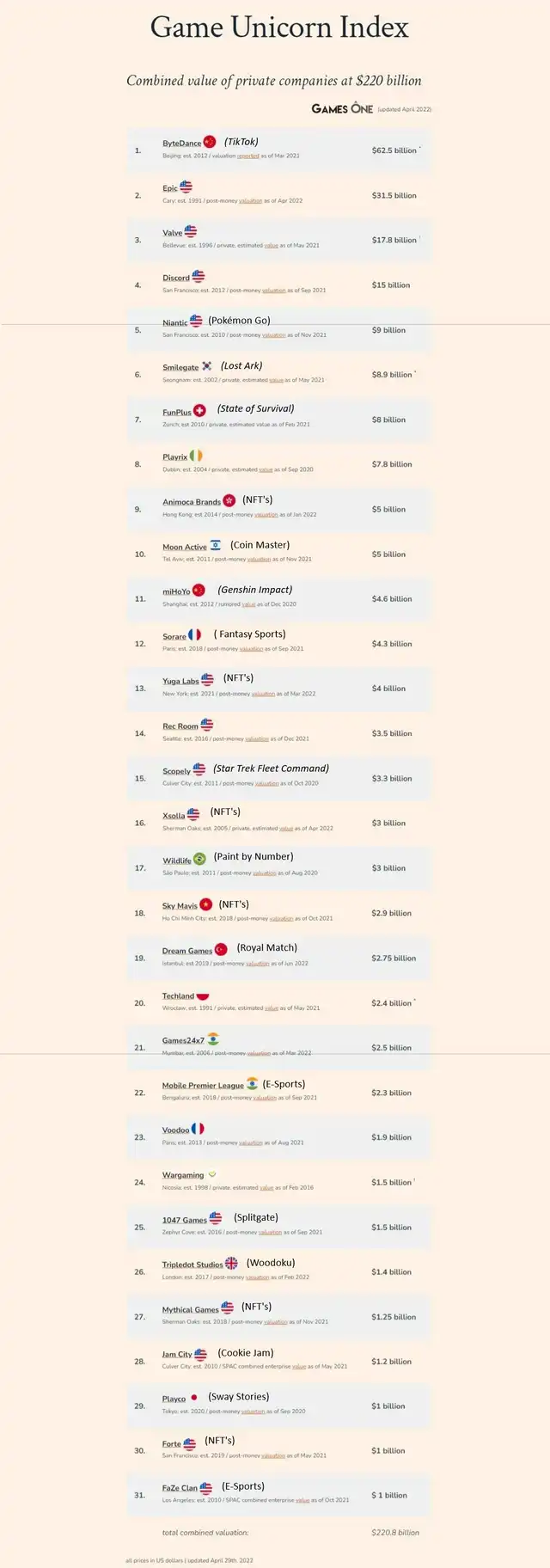

(By estimated value, forgot to add that to the tittle)

Not sure who Games one are but i thought it kinda interesting. "Gaming" in quotes as being from 2021/2022 a lot of them are NFT or companies with a gaming side business. Also debatable whether Epic really is a private company. Nice to see Techland there though

Also added what the more unknown companies are most known for. Sorry for the quality as something seemed to have gone wrong with the web capture, should still be readable though.

(Notes)

Not sure who Games one are but i thought it kinda interesting. "Gaming" in quotes as being from 2021/2022 a lot of them are NFT or companies with a gaming side business. Also debatable whether Epic really is a private company. Nice to see Techland there though

Also added what the more unknown companies are most known for. Sorry for the quality as something seemed to have gone wrong with the web capture, should still be readable though.

(Notes)

*1. ByteDance: GameLook reports 25% of the company revenue comes from gaming. Bloomberg reports shares trading at a $250 billion valuation at the end of March. South China Morning Post reports shares offered at a $400 billion valuation to new investors more recently—but does not confirm transactions closing at that price. For the purposes of this list, Games One features the gaming worth as 1/4 of the the most recent, credible valuation. That number will continue to increase before a final public offering.

† 3. Valve: in March of 2019, Wedbush Morgan analyst Michael Pachter valued Valve at $10 billion on behalf of Bloomberg, who then pegged the company estimate to performance of the Russell US indexes subsection for electronic entertainment, for the purposes of estimating the founder's wealth in real-time. $17.8 billion is the current Pachter-Russell number. Games One neither agrees nor disagrees with that valuation, and presents it un-altered for context.

* 6. Smilegate: if the company ever goes public, it is only to add to their prestige. Smilegate has already reached status as a top five game company in Korea. Locals believe the exchange is not currently rewarding game companies as a sector, and Krafton had delayed IPO because of that—if that process is measured in months, then a Smilegate IPO would be measured in years. The market will appreciate in the interim. For the purposes of this list, Games One assigns a valuation to Smilegate, pegged to 50% of the current reported valuation of Krafton. Both firms had the same revenue in 2020, but the operating profits of Smilegate were some 47% of their competitor. That gives a fair market comparable for today, and should be reassessed upon future developments.

* 20. Techland: in June of 2019, Polish market research firm PMR valued the company at $2.5 billion. PMR's sector analyst maintains an approximate valuation of $2.4 billion for the company today.

† 24. Wargaming: in February of 2016, Bloomberg profiled the founder, putting the company worth at $1.5 billion, less than 3x annual revenues. The valuation has not been revisited since. While the fundamentals of Wargaming have not changed significantly since then, the broader value of public game companies has risen in those five years. Games One neither agrees nor disagrees with the estimate, and presents it unaltered.

Last edited: