Edit: For reference it was 23 million more in 2026 relative to ACA under House bill

Senate bill:

https://twitter.com/BraddJaffy/status/879436602833063937

thanks cameron for heads up about this tweet

Edit:

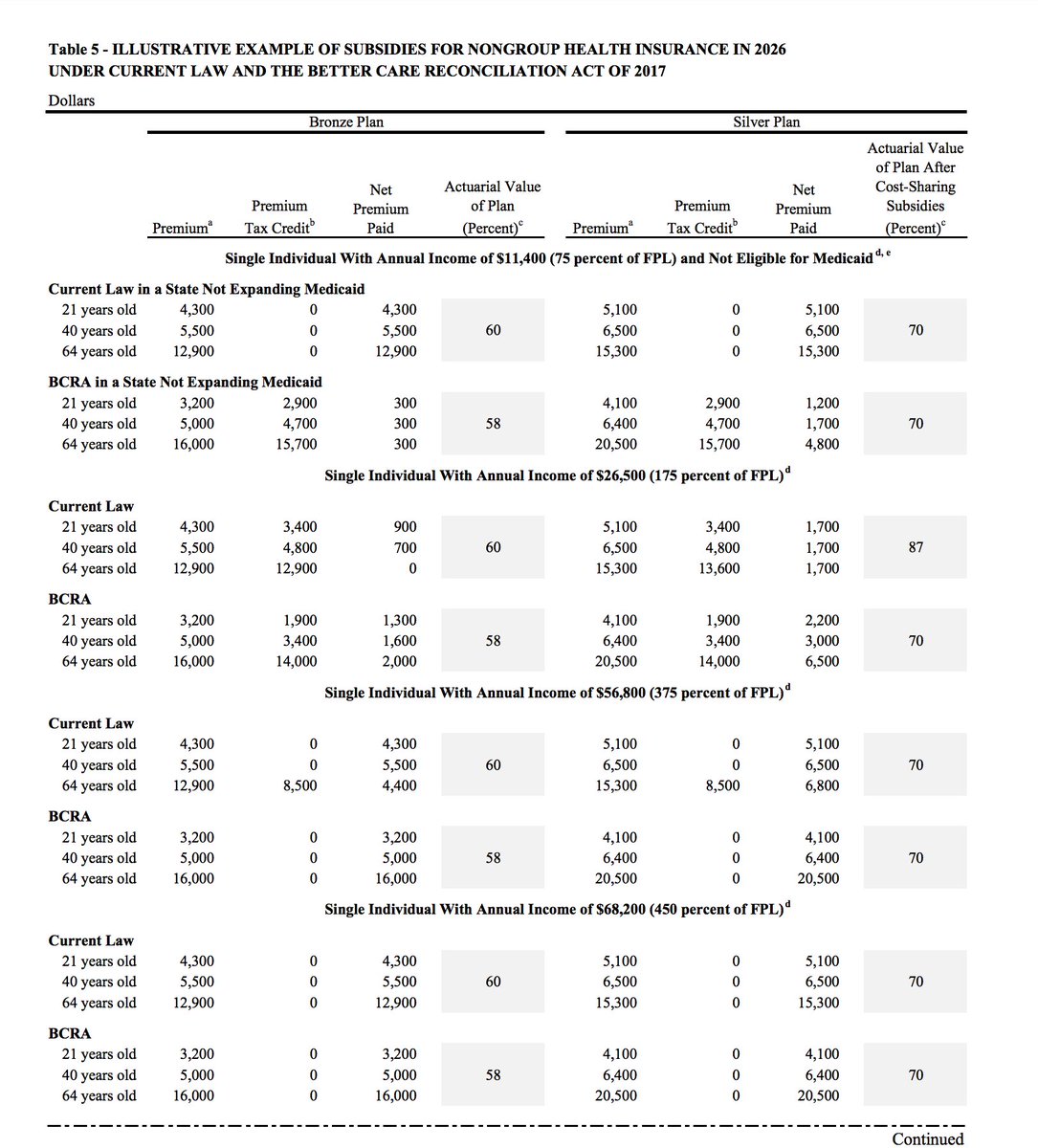

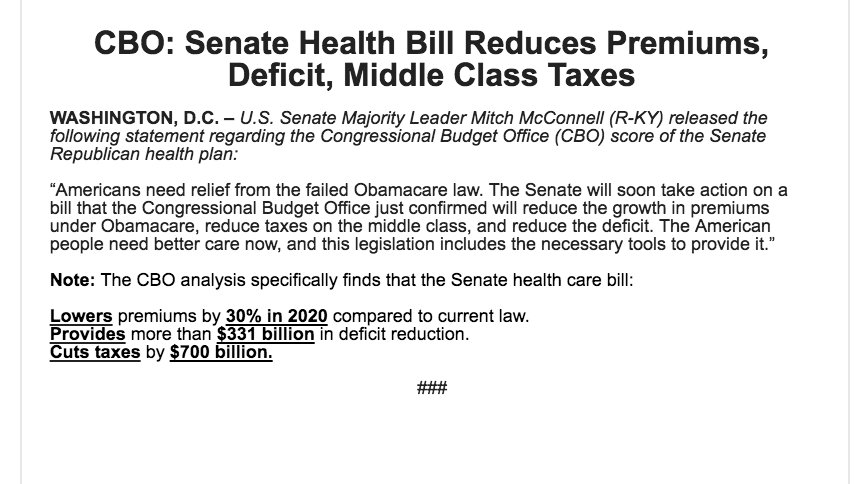

Premiums: Senate GOP plan vs. current law (via CBO)

https://twitter.com/ZekeJMiller/status/879458289888763904

https://twitter.com/ZekeJMiller/status/879466879911424000

Senate bill:

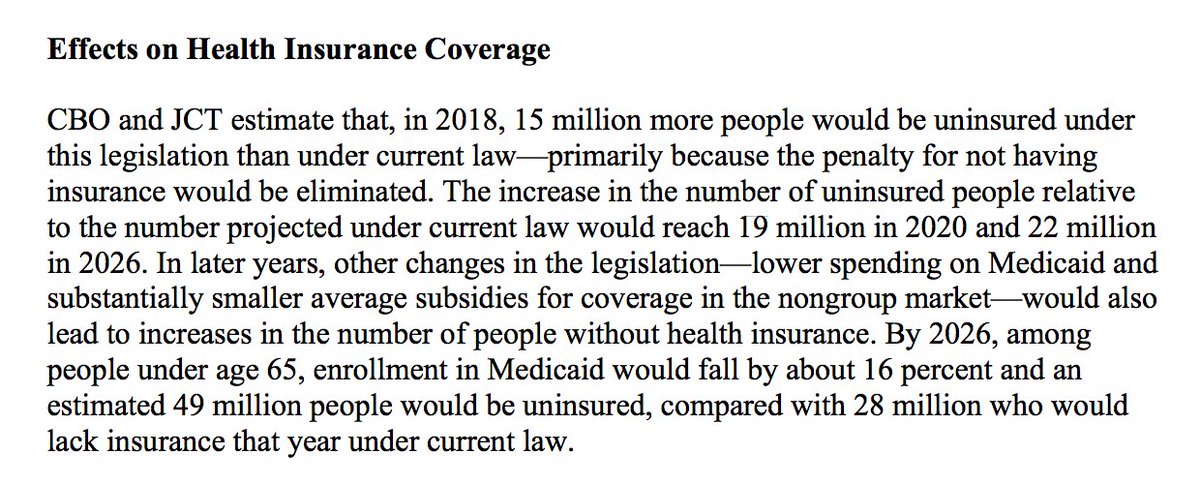

- 2018: 15 million more would be uninsured than under Obamacare

- 2020: 19 million more

- 2026: 22 million more

https://twitter.com/BraddJaffy/status/879435749770264576

https://twitter.com/BraddJaffy/status/879436602833063937

thanks cameron for heads up about this tweet

Source: https://www.cbo.gov/publication/52849CBO and JCT estimate that enacting the Better Care Reconciliation Act of 2017 would reduce federal deficits by $321 billion over the coming decade and increase the number of people who are uninsured by 22 million in 2026 relative to current law.

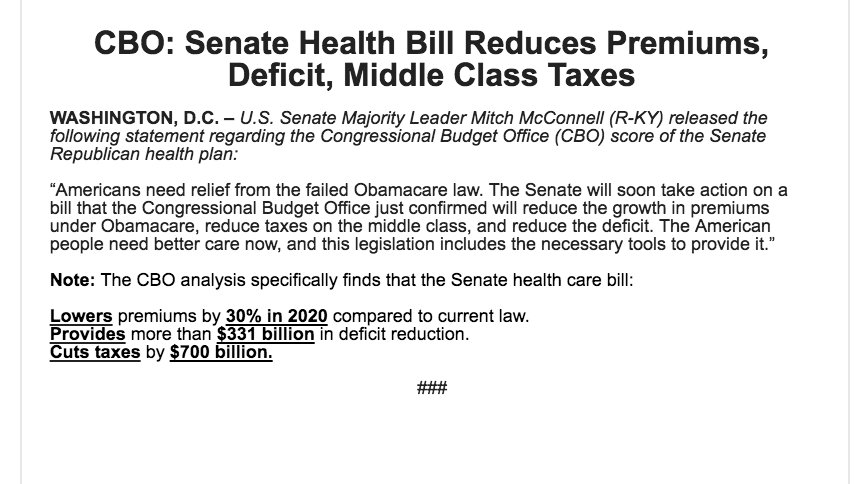

The Congressional Budget Office and the staff of the Joint Committee on Taxation (JCT) have completed an estimate of the direct spending and revenue effects of the Better Care Reconciliation Act of 2017, a Senate amendment in the nature of a substitute to H.R. 1628. CBO and JCT estimate that enacting this legislation would reduce the cumulative federal deficit over the 2017-2026 period by $321 billion. That amount is $202 billion more than the estimated net savings for the version of H.R. 1628 that was passed by the House of Representatives.

The Senate bill would increase the number of people who are uninsured by 22 million in 2026 relative to the number under current law, slightly fewer than the increase in the number of uninsured estimated for the House-passed legislation. By 2026, an estimated 49 million people would be uninsured, compared with 28 million who would lack insurance that year under current law.

Effects on the Federal Budget

CBO and JCT estimate that, over the 2017-2026 period, enacting this legislation would reduce direct spending by $1,022 billion and reduce revenues by $701 billion, for a net reduction of $321 billion in the deficit over that period (see Table 1, at the end of this document):

- The largest savings would come from reductions in outlays for Medicaid—spending on the program would decline in 2026 by 26 percent in comparison with what CBO projects under current law—and from changes to the Affordable Care Act's (ACA's) subsidies for nongroup health insurance (see Figure 1). Those savings would be partially offset by the effects of other changes to the ACA's provisions dealing with insurance coverage: additional spending designed to reduce premiums and a reduction in revenues from repealing penalties on employers who do not offer insurance and on people who do not purchase insurance.

- The largest increases in deficits would come from repealing or modifying tax provisions in the ACA that are not directly related to health insurance coverage, including repealing a surtax on net investment income and repealing annual fees imposed on health insurers.

Edit:

Premiums: Senate GOP plan vs. current law (via CBO)

https://twitter.com/BraddJaffy/status/879439096921419777

https://twitter.com/ZekeJMiller/status/879458289888763904

https://twitter.com/ZekeJMiller/status/879466879911424000