Topher

Identifies as young

A great deal of attention has been focused on Microsoft's Game Pass subscription service. However, the recent Microsoft quarterly earnings show that the service does not appear to be doing much for Microsoft's bottom line. Revenue from both Xbox hardware and content and services declined during the holiday 2022 season. This begs the question, does Microsoft's game business model make sense?

How Many Subscribers Does Game Pass Have?

As a large conglomerate, it should be noted that Microsoft provides limited insight into its game business. However, the company did note that Game Pass subscribers were up. On the earnings conference call, Microsoft CEO Satya Nadella said Xbox monthly active users reached 120 million.

However, Xbox users is not a relevant number as Xbox basically comes free with any Windows PC or phone. As DFC reported, our company has had issues making sure that we do NOT become active Xbox users on business PCs. The tendency is to get anyone with a Microsoft account into Xbox.

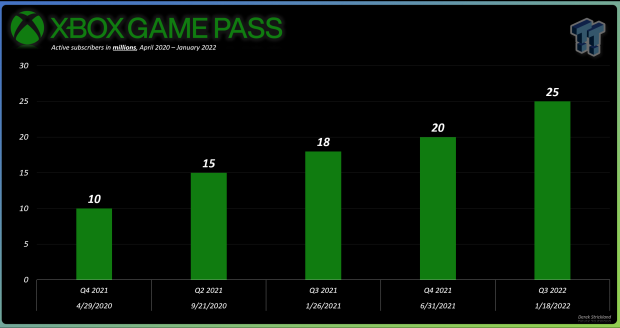

The important metric is Game Pass subscribers. A year ago this time, Phil Spencer, CEO of Microsoft Gaming reported Game Pass had 25 million subscribers. The media has pegged this number at 29 million after Sony filed a comment with the U.K. CMA last October. However, like much of Sony's filing. the source was dubiously cherry-picked and has since been discredited.

Whatever the true number of Game Pass subscribers, it is clear that Game Pass is struggling to grow into a true mass-market service. In its latest financial filings Sony reported 45.4 million PlayStation Plus subscribers (down from a peak of 48 million at the end of 2021). Meanwhile, Nintendo reports 36 million Switch Online subscribers, up from 32 million in the previous year's quarter (ending 9/30).

How Many Subscribers Are Needed for the Business Model to Work?

On the surface, the numbers for the video game industry appear staggering. DFC Intelligence shares some blame for adding to the hype when talking about over 3 billion video game consumers worldwide. However, this is primarily a number thrown out for mass media journalists. The true analysis lies in the many subsegments where a company like Microsoft can report quarterly revenue in video games of $4.8 billion and it feels like a disappointment.

The problem with Game Pass is the business model does not appear to work. Comparing subscriber numbers is not necessarily fair because the services have significantly different prices. However, what is clear is how well Nintendo's subscription service works as an enhancement to the overall business model of selling hardware and software. In contrast, Game Pass appears to be trying to be its own end where Xbox hardware sales are not important.

Xbox Game Pass subscriptions range from $5 month to $15 a month. There is even a $25/$35 a month/for a 2-year financing option that includes an Xbox Series S or X at 0% financing. Sony launched a new PlayStation Plus program last June. The new service is confusing but essentially monthly prices range from $10 to $18 a month, with a significant discount buying yearly of $60 to $120/year/

Meanwhile, there is Nintendo Switch Online which costs only $20 a year or a family plan for 8 accounts is only $35 a year. In late 2021, Nintendo added the option to upgrade to a Nintendo Switch Online + Expansion Pack for $50 a year ($80 for family option).

When one does the math, Game Pass is making probably three times the revenue Nintendo Switch Online currently generates and probably getting close to matching PlayStation+ revenue because it is priced higher. However, Microsoft is giving away a lot to generate that revenue and it does not appear to be a sustainable long-term business model.

Of course, if Game Pass could somehow get 100 million subscribers the economics would change. But that is a big if. Even if the Activision Blizzard user numbers (minus mobile users) are added in the numbers fall far short. A top-selling front-line Call of Duty can only hit 30 million units and Blizzard MAUs have hovered around 30 million for years.

Nintendo Switch Online: Average Service at a Reasonable Price

The beauty of Nintendo's online service is it is not very good in comparison to the competition but offers decent value for the consumer. The basic service gives you online play for a fairly limited number of titles (about 40) as well as a limited number of the 1980s and early 1990s NES and SNES games. The Expansion packs add Sega Genesis (console system launched 1989) and Nintendo 64 (console system launched 1996) games from the mid-to-late 1990s as well as some expansion packs for Mario Kart, Animal Crossing, and Splatoon.

PlayStation Plus gives free monthly downloadable games and the option to upgrade to a catalog of over 400 downloadable games plus over 300 streaming games going back to the first PlayStation. Game Pass is similar to PS+ but takes it a step further by adding PC games, EA games, Ubisoft games and most importantly making all Microsoft first-party content free for subscribers.

The last part of giving away AAA first-party content is the kicker. Nintendo's online service includes extra content for Mario Kart 8 and Animal Crossing: New Horizons. However, these titles respectively sold 48 million and 40 million units at full retail price. In other words, these two titles generated more revenue than a year of Game Pass.

Are Video Games Appropriate For a Netflix-Style Model?

For many years, DFC has argued that it is usually not appropriate to compare video games to viewing traditional non-interactive video. They are a different medium and a major mistake subscription services tend to make is talking about the "Netflix of video games."

The difference with video games is that the content tends to attract a long-term audience who stays around a specific game for the long term. In contrast, once users watch a show on a service like Netflix the majority move on to the next show. This is good news for the overall video game business. Nintendo, and companies like Electronic Arts, have moved to a high-price initial content purchase model followed by live service updates.

The problem with game services like Game Pass is they rotate games before consumers can finish playing them. If a consumer truly likes a game they will tend to buy the full version. The hope is that they will buy it through a Microsoft Xbox channel but the reality is they are likely to choose another distributor.

What About Exclusives?

Take for example the recent release of the Sega/Atlus title Persona 4 Golden across multiple platforms including Switch and Game Pass. Persona 4 Golden was one of the standouts for the poor-selling portable PlayStation Vita. Many consumers did not get to try it because they did not have a Vita. However, a new audience was introduced to the franchise with the 2016 launch of Persona 5.

Persona 4 Golden is a free title on Game Pass, but in the DFC office several people choose the Switch version for $20. The thinking was that this title works well on the portable Switch and $20 is nothing to pay for 40+ hours of entertainment.

Note that as this article was being completed the classic GoldenEye 007 was announced as a January 27 exclusive for both Nintendo Switch Online and Game Pass subscribers. But it appears online play is exclusive to Switch users! DFC did a separate analysis on this but it only highlights our points.

Subscription Services = Value-Add More Than a Complete Solution

The bottom line is that game subscription services seem to work well as a value-add proposition. Nintendo has shown that with Nintendo Switch Online. There are tens of millions of users that will pay $60+ for a game and a cheap mediocre online service. Taking it to the level of a Game Pass requires not only significantly more expenditure but requires giving up a large established revenue stream.

Game Pass is a great service for the consumer. For less than $200 a year, one gets access to all kinds of games. It allows subscribers to save money to spend on Nvidia graphic cards, Nintendo Switch, and PlayStation products. What it does not seem to yet do is drive more revenue to the Xbox side.

The video game market is huge. Asking how many people play video games is like how many watch TV. The answer is basically everyone, the devil is in the details. Surprisingly it is Nintendo and Switch Online that have found an answer that is both compelling for consumers AND the company bottom line.

Not sure I agree with the conclusion of this, but it is an interesting question.