Chavez Emptying Bank of England Vault as Venezuela Brings Back Gold Hoard

By Daniel Cancel and Nathan Crooks - Aug 18, 2011

Venezuelan President Hugo Chavez ordered the central bank to repatriate $11 billion of gold reserves held in developed nations institutions such as the Bank of England as prices for the metal rise to a record.

Venezuela, which holds 211 tons of its 365 tons of gold reserves in U.S., European, Canadian and Swiss banks, will progressively return the bars to its central banks vault, Chavez said yesterday. JPMorgan Chase & Co. (JPM), Barclays Plc (BARC), and Standard Chartered Plc (STAN) also hold Venezuelan gold, he said.

Weve held 99 tons of gold at the Bank of England since 1980. I agree with bringing that home, Chavez said yesterday on state television. Its a healthy decision.

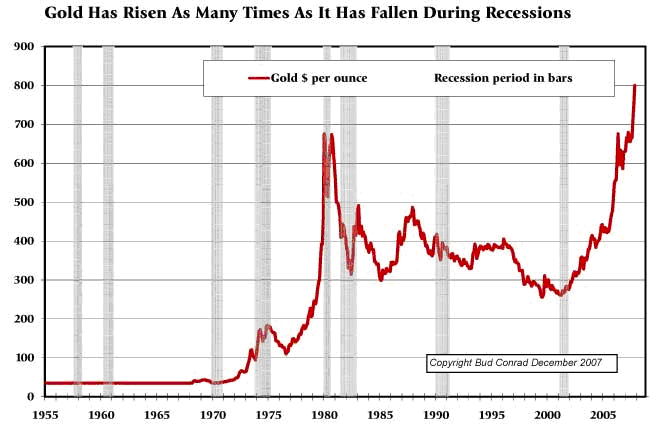

Chavez, whose government depends on oil for 95 percent of its export revenue, is looking to diversify Venezuelas cash reserves from U.S. and European banks to include investments in emerging markets including Brazil, China, India, Russia and South Africa, central bank President Nelson Merentes said yesterday. The worlds 15th-largest holder of gold is bringing back its gold after a 28 percent rally in the price this year.

Venezuelas reserves stood at $28.6 billion on Aug. 16. Finance Minister Jorge Giordani said that the weakening U.S. dollar, a near-default by the U.S. government and the European sovereign debt crisis threaten Venezuelas savings and they will be more secure at home and in allied countries.

Green Light

Chavez, speaking by phone on state television last night, said he signed the document yesterday authorizing the transfer of the gold reserves. I said, I give my absolute approval to this idea, Chavez said. I gave it the green light.

The central bank already has about $7 billion of gold in its vaults. Of the countrys liquid reserves, which amount to about $6.3 billion, 59 percent are held in Switzerland, 18 percent in the U.K and about 11 percent in the U.S., according to a government report.

Venezuela received a capital gain of $9.3 billion on its gold holdings since 2009 on rising prices, according to a Bank of America Merrill Lynch report today.

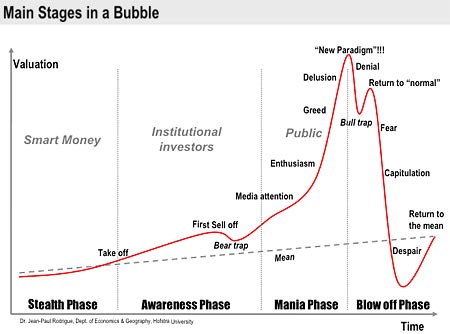

The countrys share of gold reserves is almost eight times the regions 8.3 percent average and leaves Venezuela vulnerable to sharp declines in prices while holding illiquid assets, the report said.

The government may move to repatriate reserves before arbitration case rulings to avoid a so-called attachment risk that could freeze international assets, Boris Segura, a New York-based strategist at Nomura Securities, said in a research note.

The repatriation and diversification of reserves may also cloud transparency of government holdings, which would be a negative for the countrys credit, he said.

Lack of Transparency

We sense that Venezuelan debt prices already incorporate a sizeable lack of transparency premium, Segura said. However, looking at the possible geopolitical signals that these proposed policies communicate, we fear that Venezuelan bond prices may suffer.

In all, Venezuela has 365.8 metric tons of gold reserves, according to the World Gold Council.

Chavezs decision could have worrisome implications because of less data transparency and the threat that the gold stock could be used for politically motivated spending before next years presidential elections, RBS Securities Inc. said.

It is clear that the motivation appears mostly to fit a political agenda to align with strategic political partners and retaliate against the recent U.S. sanctions on fears that assets might at some point be frozen, RBS Latin American analysts Felipe Hernandez and Siobhan Morden said in a note.

Borrowing Costs

Venezuela has the highest borrowing costs among major emerging-market countries. The extra yield investors demand to own Venezuelan government bonds instead of U.S. Treasuries rose 50 basis points, 0.50 percentage point, to 1,239 basis points today at 4:35 p.m. in New York, according to JPMorgan & Chase Co.s EMBI+.

Yields on the governments benchmark 9.25 percent bonds maturing in 2027 rose 60 basis points to 14.14 percent at 4:35 p.m. in New York, according to data compiled by Bloomberg. The price fell 2.88 cents on the dollar to 69.25 cents.

Chavez also said yesterday that hes preparing a decree to nationalize the gold industry to halt illegal mining and dedicate local production to building up reserves.

Mining Arbitration

Of 17 arbitration cases pending against Venezuela in the World Banks International Centre for Settlement of Investment Disputes, at least three of them are over mining ventures, including Crystallex International Corp. (KRY), a Canadian gold producer whose Las Cristinas mine was taken over by the government in February.

Gold Reserve Inc. (GRZ), a Spokane, Washington-based mining company, is seeking $2.1 billion in damages after its Las Brisas gold and copper project was seized in May 2008.

Todays announcement is not surprising, Doug Belander, Gold Reserve president, said yesterday in an interview. We believe that their objective all along was to take over the entire industry.

The South American country, in an effort to boost stalled production and take advantage of rising prices, last year relaxed restrictions on gold exports to allow some companies and joint ventures with the government to send as much as 50 percent of their output abroad.

Rusoros Operations

Rusoro Mining Ltd. (RML), a Vancouver-based mining company, is the last publicly traded gold mining company operating in Venezuela. The companys stock rose 12 percent to 14 Canadian cents as of 4:35 p.m. in Toronto, after yesterday plunging 17 percent to its lowest in almost a decade.

Rusoro Chief Executive Officer Andre Agapov said today that it hadnt received any indications from the Venezuelan government that its projects in the country would be affected.

We believe the governments announcement is targeted toward the many illegal mining operations in Bolivar state, Agapov said in a statement.

Venezuela produces 11 metric tons of gold a year, and illegal miners extract an additional 10 to 11 tons a year, Chavez said in May.

Venezuelas National Guard first seized control of the Las Cristinas mine, which has reserves of about 27 million ounces, in November 2001 from Canadas Vanessa Ventures.

Gold futures for December delivery rose $32.90, or 1.8 percent, to a record settlement of $1,824.10 an ounce on the Comex in New York today.

If there isnt enough room to store the gold in the central bank vaults I can lend you the basement of the Miraflores presidential palace, Chavez said.

To contact the reporters on this story: Daniel Cancel in Caracas at

dcancel@bloomberg.net; Nathan Crooks in Caracas at

ncrooks@bloomberg.net.

To contact the editor responsible for this story: Dale Crofts at

dcrofts@bloomberg.net

®2011 BLOOMBERG L.P. ALL RIGHTS RESERVED.