You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock-Age: Stocks, Options and Dividends oh my!

- Thread starter koam

- Start date

cpp_is_king

Member

Liquidated 90% of my portfolio, with good gain. Man trump makes me nervous. How is everything keep going up? Its gotta be too good to be true. There is gotta be a market correction some time soon.

I did the same. I sold 100%. Once it settles I will probably put 10% into bank stocks. What's a good ETF that tracks the banking industry?

Captain Smoker

Member

While Trump is a disaster, there are still no signs that large american companies are going to earn less in the future, or smaller ones either.Liquidated 90% of my portfolio, with good gain. Man trump makes me nervous. How is everything keep going up? Its gotta be too good to be true. There is gotta be a market correction some time soon.

Furthermore, there is no imminent, large conflict between the US and another country and his deregulations are only going to benefit companies (or at least give the illusion of potentially higher margins).

But I can't wrap my head around it either.

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

His actions risk distorting expected trade channels, and lower cohesive responses during conflicts of any sort. This will make markets more nervous, increasing volatility, but as we have seen over the past few years we keep breaking through everything, from ebola terrorism, Grexit and Brexit, etc. At some point the house will fall.

cpp_is_king

Member

While Trump is a disaster, there are still no signs that large american companies are going to earn less in the future, or smaller ones either.

Furthermore, there is no imminent, large conflict between the US and another country and his deregulations are only going to benefit companies (or at least give the illusion of potentially higher margins).

But I can't wrap my head around it either.

Things don't have to be imminent. The one thing the stock market can be certain to react to is uncertainty, and the level of uncertainty in the environment right now is unparallelled.

The market prices this kind of uncertainty in gradually. But things can change in a moment's notice. If anything were "imminent", then it would already be too late to sell.

Unknown Soldier

Member

AMD is on fire. Gotta keep holding, I know it will go higher.

The best part is how NVDA is getting a nice bump too riding on AMD's surge.

The best part is how NVDA is getting a nice bump too riding on AMD's surge.

I had a rough spell after the election, but after a strong January, my account is up to all time highs

My main positions right now:

short nasdaq

short s&p 500

short 30 year bonds

smaller positions:

strangle in 10 year notes

strangle in wheat

strangle in natural gas

short cotton

strangle in Euro

Short $C

Short $JPM

Short $WFC

long $XLV

strangle $FXY

Iron Condor in $AMZN

My main positions right now:

short nasdaq

short s&p 500

short 30 year bonds

smaller positions:

strangle in 10 year notes

strangle in wheat

strangle in natural gas

short cotton

strangle in Euro

Short $C

Short $JPM

Short $WFC

long $XLV

strangle $FXY

Iron Condor in $AMZN

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

What stocks or industries do you think will be hit the hardest if there is a global recession from Trump in a couple of years?

Banks. But probably much sooner than that, they jumped way too high way too quick after Trump won. I don't think deregulation will magically fill their coffers. They need the environment for it, and it's gone. Pre-2008 isn't coming back by removing Dodd-Frank.

Banks. But probably much sooner than that, they jumped way too high way too quick after Trump won. I don't think deregulation will magically fill their coffers. They need the environment for it, and it's gone. Pre-2008 isn't coming back by removing Dodd-Frank.

Yeah, banks are pretty much the answer. They outperform during booms and crash harder during busts.

Depends if interest rates are higher. Higher rates means they make more money for doing the same thing. Also people use credit cards more, and take out more loans.

Glad I only have 20 shares of Gilead. Another bomba earnings you always should sell before Gilead earnings as more often than not disappoint.

Earnings are good on a whole and economic data is good. This is what keeps the markets from crashing. The current upside of the market isn't an illusion but it is possible some Trump tweet could lead to a pullback or worse.

Liquidated 90% of my portfolio, with good gain. Man trump makes me nervous. How is everything keep going up? Its gotta be too good to be true. There is gotta be a market correction some time soon.

Earnings are good on a whole and economic data is good. This is what keeps the markets from crashing. The current upside of the market isn't an illusion but it is possible some Trump tweet could lead to a pullback or worse.

Banks. But probably much sooner than that, they jumped way too high way too quick after Trump won. I don't think deregulation will magically fill their coffers. They need the environment for it, and it's gone. Pre-2008 isn't coming back by removing Dodd-Frank.

Yeah I am thinking banks but any specific stocks that have a potential to go under or go to zero? Like Lehman did?

cpp_is_king

Member

AFAIC, there is a small to modest amount of potential upside in the current market, but a huge amount of potential downside. That alone is enough to make me pull out.

Yeah I can't say I'm heavily invested outside of my retirement etfs.

One of my bigger investments is still EXEL. After that $15 price point I sold at I bought in again at 11 and almost doubled my money once more. They say let your winners run but I'm getting nervous again holding this stock. As much as it has ran I feel like its one bad news story away from dropping 50% plus. But I also dont want to miss out on an Nvidia type move if this thing just keeps going to new 52 week highs daily.

One of my bigger investments is still EXEL. After that $15 price point I sold at I bought in again at 11 and almost doubled my money once more. They say let your winners run but I'm getting nervous again holding this stock. As much as it has ran I feel like its one bad news story away from dropping 50% plus. But I also dont want to miss out on an Nvidia type move if this thing just keeps going to new 52 week highs daily.

cpp_is_king

Member

I wonder if oil & gas stocks would be a good long term strategy. All the oil / gas stocks are way down recently, but regulations are going to start easing heavily on drilling.

Unknown Soldier

Member

My company had a Panera catered lunch the other day. The sandwiches were delicious. But going to an actual Panera, I always felt the food was dramatically overpriced for the food you got.

They're not Chipotle though, that's for sure. Holding Panera is actually making people money LOL

They're not Chipotle though, that's for sure. Holding Panera is actually making people money LOL

ClosingADoor

Member

Is that going to help though? Might save some costs of course, but the problem right now is simply price. And more drilling is not going to increase the price. We actually need less for that.I wonder if oil & gas stocks would be a good long term strategy. All the oil / gas stocks are way down recently, but regulations are going to start easing heavily on drilling.

My company had a Panera catered lunch the other day. The sandwiches were delicious. But going to an actual Panera, I always felt the food was dramatically overpriced for the food you got.

They're not Chipotle though, that's for sure. Holding Panera is actually making people money LOL

Yeah it can get quite pricy but I don't necessarily think they're overpriced. A much more comprehensive menu than CMG and their online ordering system is number one in the business.

cpp_is_king

Member

Is that going to help though? Might save some costs of course, but the problem right now is simply price. And more drilling is not going to increase the price. We actually need less for that.

Well there's supply and there's demand. Drilling will help with supply, but costs are already low. The current administration could affect demand by removing regulations and de-prioritizing research into renewable energy. I mean, I don't want that to happen, but if it does then prices could shoot back up, even if supply goes up at the same time.

Yeah I am thinking banks but any specific stocks that have a potential to go under or go to zero? Like Lehman did?

As of right now, not likely. The list of at risk banks is at a multi-year low in terms of actually going under. There would need to be a new mechanism of un-miitgated risk like we had with credit default swaps, and the housing collapse to make something like that happen again. And it totally could, but without knowing what that mechanism even is, it's hard to pick individual banks that may fail due to it.

It may just be best to be short XLF, and if you want a few of the larger stocks that the ETF is weighted on.

edit: If you are interested, this is a blog i have in my RSS feed that updates the month "at risk" bank list http://www.calculatedriskblog.com/2017/01/january-2017-unofficial-problem-bank.html

Can anyone recommend any documentaries or movies (most likely the former) that talk a bit about the collapse of -08 from the perspective of people in the financial industry? I'm not entirely sure what I'm looking for, just that I don't want another The Big Short or doc focusing on talking about what a CDS is, but rather how the markets moved and reacted during the following years, and maybe some inside insight on how it was being close to that turmoil?

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

Weren't Tesla's earnings supposed to be today?

Inside Job https://www.youtube.com/watch?v=D9ub25WjEK0

Full of interviews with people from the industry.

Can anyone recommend any documentaries or movies (most likely the former) that talk a bit about the collapse of -08 from the perspective of people in the financial industry? I'm not entirely sure what I'm looking for, just that I don't want another The Big Short or doc focusing on talking about what a CDS is, but rather how the markets moved and reacted during the following years, and maybe some inside insight on how it was being close to that turmoil?

Inside Job https://www.youtube.com/watch?v=D9ub25WjEK0

Full of interviews with people from the industry.

Unknown Soldier

Member

Tesla's earnings were delayed 2 weeks, to Feb. 22nd.

Hold on to your butts guys, because Nvidia day is going to be pretty interesting.

Hold on to your butts guys, because Nvidia day is going to be pretty interesting.

Tesla's earnings were delayed 2 weeks, to Feb. 22nd.

Hold on to your butts guys, because Nvidia day is going to be pretty interesting.

Can you elaborate?

Captain Smoker

Member

AMD rising to heaven, keep growing pal.

Man I hope First Solar has some decent numbers for the last quarter, get me out of this misery.. -30% xD

Man I hope First Solar has some decent numbers for the last quarter, get me out of this misery.. -30% xD

ClosingADoor

Member

Arcelor Mittal results tomorrow. See what they bring. Been doing a few trades last month with them to get a few percent while it goes up and down. Steel industry can go both ways it seems.

cpp_is_king

Member

Tesla's earnings were delayed 2 weeks, to Feb. 22nd.

Hold on to your butts guys, because Nvidia day is going to be pretty interesting.

With the PC market in slow decline, has nvidia been taking steps to diversify? I don't really follow these companies very closely, what should we expect?

ClosingADoor

Member

NVIDIA is making big steps in the self driving vehicle stuff. They will be the number one company to deliver the tech needed for that.With the PC market in slow decline, has nvidia been taking steps to diversify? I don't really follow these companies very closely, what should we expect?

cpp_is_king

Member

NVIDIA is making big steps in the self driving vehicle stuff. They will be the number one company to deliver the tech needed for that.

Wow, literally never heard of this but I googled and it looks interesting

Seems like they are expected to report strong growth in the server market too.

Maybe I should gamble $500 on weekly calls or something

Unknown Soldier

Member

Wow, literally never heard of this but I googled and it looks interesting

Seems like they are expected to report strong growth in the server market too.

Maybe I should gamble $500 on weekly calls or something

$135 calls on NVDA apparently have the highest IV on the market right now. Watch out for that crush.

ClosingADoor

Member

I'm scared to get in since it is so high already. Then again, I've been thinking that for months, so what do I know. I don't do options, but regular stock buying.Wow, literally never heard of this but I googled and it looks interesting

Seems like they are expected to report strong growth in the server market too.

Maybe I should gamble $500 on weekly calls or something

Bornstellar

Member

So, just put everything I had in savings accounts into mutual funds. What is a "good" ROI?

Rabid Wolverine

Member

What are chances of AMD hitting $20 a share by Mid March or so? Seeing Ryzen is on sale.

Tempted to get some call options.

Tempted to get some call options.

ClosingADoor

Member

Good numbers for ArcelorMittal. Up almost 4% this morning. Trailing stop loss, not too close or I'll get stopped out in a small dip again.

Edit: 7%. Going the right way.

As for a good ROI, hard to say. It just follows the market.

Edit: 7%. Going the right way.

Managed mutual funds? Watch the fees! Just pick index funds with tiny fees. Managed funds will not beat the market over time.So, just put everything I had in savings accounts into mutual funds. What is a "good" ROI?

As for a good ROI, hard to say. It just follows the market.

BeforeU

Oft hope is born when all is forlorn.

What are chances of AMD hitting $20 a share by Mid March or so? Seeing Ryzen is on sale.

Tempted to get some call options.

Seems like its already overvalued to me.

What are chances of AMD hitting $20 a share by Mid March or so? Seeing Ryzen is on sale.

Tempted to get some call options.

Not good, you're talking about it going up several billion dollars more in market cap.

Unknown Soldier

Member

What are chances of AMD hitting $20 a share by Mid March or so? Seeing Ryzen is on sale.

Tempted to get some call options.

I hope it goes over $15 by the Ryzen launch. I don't think there is that much upside left and I am very concerned about AMD's complete silence in the weeks before launch. They always go quiet before launching a product when it will disappoint. I have a hair trigger on my stake and I'm ready to bail at any time right now.

Bornstellar

Member

Good numbers for ArcelorMittal. Up almost 4% this morning. Trailing stop loss, not too close or I'll get stopped out in a small dip again.

Edit: 7%. Going the right way.

Managed mutual funds? Watch the fees! Just pick index funds with tiny fees. Managed funds will not beat the market over time.

As for a good ROI, hard to say. It just follows the market.

Funds are through USAA which is also my bank. Invested in 3 funds, half in a medium-low risk, very mature, highly rated fund, a quarter in a medium-high risk fund, and another quarter in a high-risk aggressive growth fund. I'm considering allocating a larger percentage to the latter.

It is refreshing to see growth in my account as opposed to the stagnation I saw in savings.

Funds are through USAA which is also my bank. Invested in 3 funds, half in a medium-low risk, very mature, highly rated fund, a quarter in a medium-high risk fund, and another quarter in a high-risk aggressive growth fund. I'm considering allocating a larger percentage to the latter.

It is refreshing to see growth in my account as opposed to the stagnation I saw in savings.

You should check the fee structure compared to some of the Vanguard options. I was in USAA funds and recently switched everything over to index funds (via USAA).

ClosingADoor

Member

It's a good thing you started investing to do more with your money. I started the same about a year and a half ago and should have started way, way sooner.Funds are through USAA which is also my bank. Invested in 3 funds, half in a medium-low risk, very mature, highly rated fund, a quarter in a medium-high risk fund, and another quarter in a high-risk aggressive growth fund. I'm considering allocating a larger percentage to the latter.

It is refreshing to see growth in my account as opposed to the stagnation I saw in savings.

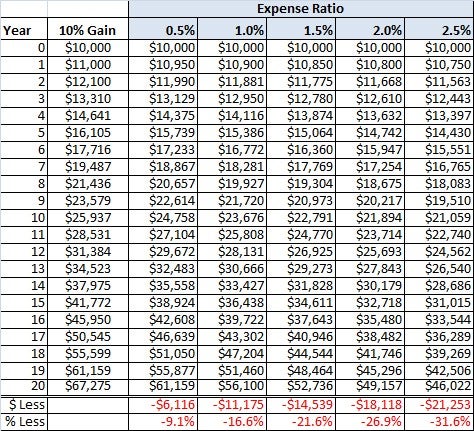

But for those funds, do check the expenses they charge. I see on the USAA website for example their S&P500 fund charges 0,19%. My Vanguard S&P500 charges 0,07%. I also see a few funds on the USAA website with over 1% in the expense ratio, which is rather high and over time will eat a lot of your growth. Investopedia has a nice table with examples:

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

Always tracked this ETF but never bought it. 2% fees, but look at how well it has done over five years:

Quebec's economy seems to have been doing pretty well compared to the rest of Canada for many years now.

Quebec's economy seems to have been doing pretty well compared to the rest of Canada for many years now.

ClosingADoor

Member

Everyone on the steel train. Steel stocks up almost 20% over the last week. Should have bought more...

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

Yeah Tesla going up too quick, but I'm glad they bought SCTY, so my former SCTY shares are slowly climbing back up.