-

Hey, guest user. Hope you're enjoying NeoGAF! Have you considered registering for an account? Come join us and add your take to the daily discourse.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Official Madden '16 PS4 Online league thread #2: Blink Daggers and Backflips

- Thread starter CB3

- Start date

felt like that should've been user picked initially anyways, but the deflection was cool

Green got hot at the end there... pissed because I read I think 3 of 4 perfectly and couldn't make a play on the ball

It would have been user picked if your DPI hadn't moved your CB to the side a little ;-)

I should havemaybe if you ran another screen it wouldn't have happened!

Purple Cheeto

Member

I wish I could make gifs, because I would like to go back and gif the play where phee threw a pass, had it deflect 20 feet into the air and land right on Earl Thomas who stood there and did not catch it even though I was pressing triangle.

It was pretty impressive.

Dang, I didn't have auto archiving on. It is lost forever.

It was pretty impressive.

Dang, I didn't have auto archiving on. It is lost forever.

Wellington

BAAAALLLINNN'

Jabee when are you available my friend

TheLostBigBoss

Banned

I wish I could make gifs, because I would like to go back and gif the play where phee threw a pass, had it deflect 20 feet into the air and land right on Earl Thomas who stood there and did not catch it even though I was pressing triangle.

It was pretty impressive.

Dang, I didn't have auto archiving on. It is lost forever.

http://blog.bahraniapps.com/gifcam/

TheLostBigBoss

Banned

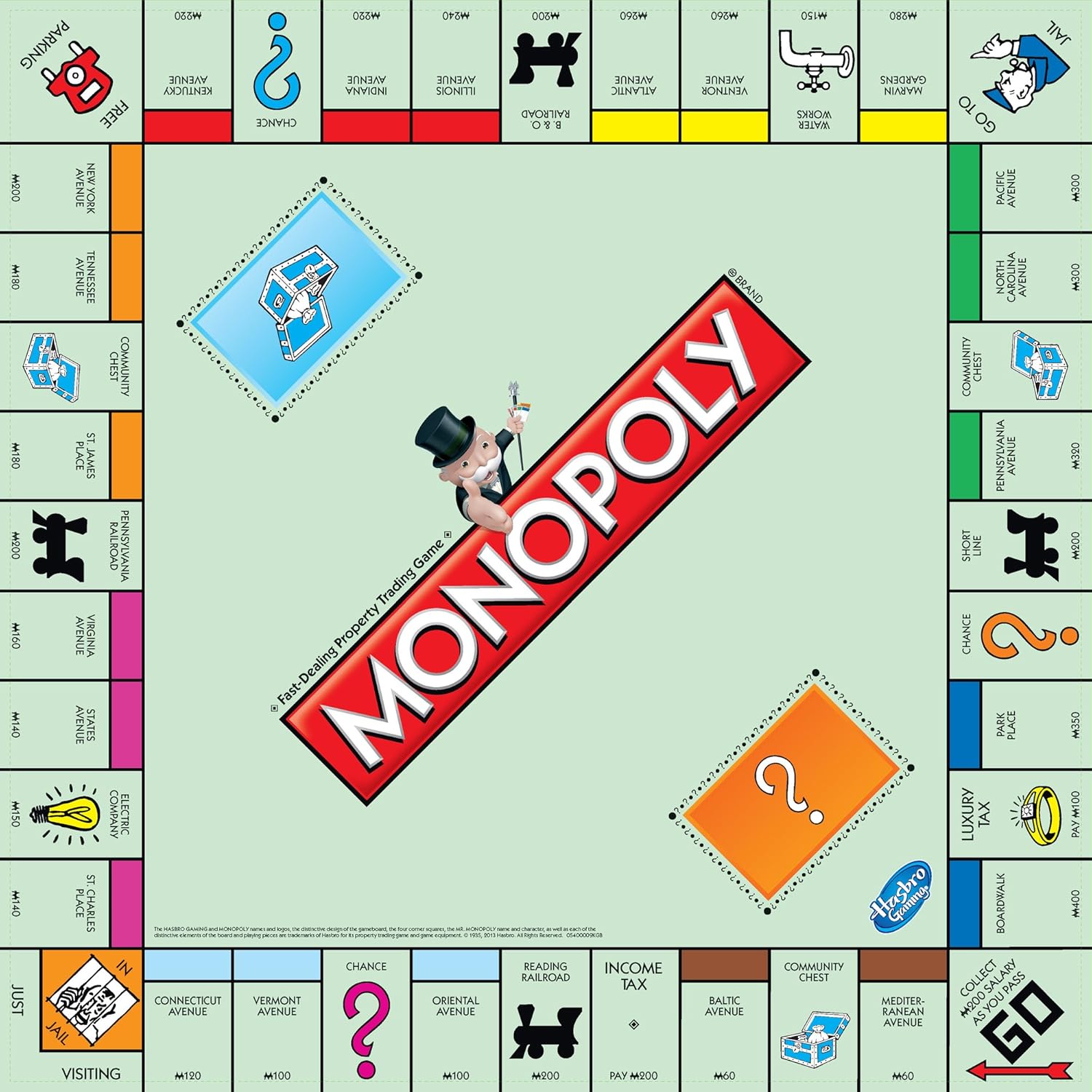

Invest in property

Go for the yellows and reds

Go for the yellows and reds

TheDrizzlerJ11

Member

Az, tonight is a bad night for me, would have to be pretty late start. Tomorrow night would be a lot more reasonable. I'll be home around 11-midnight est tonight.

Any of the brehs in here with 401k/retirement accounts? Wellie?

I think I need to adjust my shit. Oil at < $30 got me shook, and I need enlightenment.

Let's not talk 401k right now, stupid stock market.

Also, Trasher check your PM's yo

I just want to watch Vinny play games all day

I wish he did more live streaming and stuff, I know he's really busy outside of work, but I could watch him play anything really.

I played through Life is Strange, but sat their their play through because of Vinny.

Wellington

BAAAALLLINNN'

What's up?Any of the brehs in here with 401k/retirement accounts? Wellie?

I think I need to adjust my shit. Oil at < $30 got me shook, and I need enlightenment.

Azwethinkweiz

Member

Az, tonight is a bad night for me, would have to be pretty late start. Tomorrow night would be a lot more reasonable. I'll be home around 11-midnight est tonight.

Tomorrow it is!

Got up to Onyx in FFA Halo5

but ferny and somnia said

Sorry moved on to a better shooter called Rainbow Six.

Got up to Onyx in FFA Halo5

but ferny and somnia said

Someday you'll be better than me.

Someday

What's up?

will pm in a few

Sorry moved on to a better shooter called Rainbow Six.

bye felicia

Purple Cheeto

Member

Harbawwwwwwww.

Eating the full bag of Five Guys fries by yourself is a foolish task.

It's the best idea at the time of eating. Afterwards tho, you regret it.

It's the best idea at the time of eating. Afterwards tho, you regret it.

Yep. Now I am filled with regret (and potatoes).

Any of the brehs in here with 401k/retirement accounts? Wellie?

I think I need to adjust my shit. Oil at < $30 got me shook, and I need enlightenment.

Someone check on Shake and make sure he's okay.

ScottSullivan

Member

The thing to remember about 401k accounts is that even when stocks are down, you are still buying in each pay period, so you come out ahead in the long term

Also, can the person in charge of thhe leaguedaddy put my username in there for the redskins? (Sully907) it still shows mcneily

Also, can the person in charge of thhe leaguedaddy put my username in there for the redskins? (Sully907) it still shows mcneily

Smokey,

check out bettermint/wealthfront

Yeah I actually signed up for betterment a few weeks ago. I may put something in there in the next week or so. I'm assuming you use it and like it?

The thing to remember about 401k accounts is that even when stocks are down, you are still buying in each pay period, so you come out ahead in the long term

I dunno man. My company you are able to split your selections into 7 cats from 100% : company stock, equity units, extended market, international equity, bond units, balanced fund units, and common assets. Since I am in my 20s, I've been aggressive. Common and bonds have the least (I think like 5%). The rest is a mixture, but I know stock is the highest. Since I work for an oil company I'm not sure that's a good idea anymore. I rode it out in 2015, but now I'm a little shook. Stay the course or switch it up?

Yeah I actually signed up for betterment a few weeks ago. I may put something in there in the next week or so. I'm assuming you use it and like it?

No, I pay a guy to manage my portfolio. everything I have read about those is great though

No, I pay a guy to manage my portfolio. everything I have read about those is great though

How'd you come across your guy? Referral? I'd like to do something like that tbh.

FrenchMovieTheme

Member

I will tonightThe thing to remember about 401k accounts is that even when stocks are down, you are still buying in each pay period, so you come out ahead in the long term

Also, can the person in charge of thhe leaguedaddy put my username in there for the redskins? (Sully907) it still shows mcneily

TheLostBigBoss

Banned

The thing to remember about 401k accounts is that even when stocks are down, you are still buying in each pay period, so you come out ahead in the long term

Also, can the person in charge of thhe leaguedaddy put my username in there for the redskins? (Sully907) it still shows mcneily

but in our hearts you're mcneily

How'd you come across your guy? Referral? I'd like to do something like that tbh.

yup

Purple Cheeto

Member

Dieter Kurtenbach

‏@dkurtenbach

Read option

Chip: The read option has never been run at the NFL level, its the zone read.

Swoon..

Chris B. Brown ‏@smartfootball 15m15 minutes ago

Chris B. Brown Retweeted Dieter Kurtenbach

Lou Holtz ran the triple option as coach of the New York Jets...

Interesting, I didn't know about Holtz's tenure with the Jets.

Oscar

‏@BetterRivals

Kelly: Trent has control of the 53 and Im very comfortable with that

Bruce Feldman ‏@BruceFeldmanCFB 26m26 minutes ago

Chip Kelly on moving to the Bay Area. "It's the most fertile creative part of the country. You smell the air around here & you get smarter."

ScottSullivan

Member

Interesting kelly comments, ive been really down on the hire because #fuckjedyork , but ill support anyone that can score some damn points

Wellington

BAAAALLLINNN'

Yeah I actually signed up for betterment a few weeks ago. I may put something in there in the next week or so. I'm assuming you use it and like it?

I dunno man. My company you are able to split your selections into 7 cats from 100% : company stock, equity units, extended market, international equity, bond units, balanced fund units, and common assets. Since I am in my 20s, I've been aggressive. Common and bonds have the least (I think like 5%). The rest is a mixture, but I know stock is the highest. Since I work for an oil company I'm not sure that's a good idea anymore. I rode it out in 2015, but now I'm a little shook. Stay the course or switch it up?

Post in the retirement thread breh.

IMO, I get you're with one of the largest companies in the world but you'd prob be way better off going with an index fund/bond mix. My retirement fund is split 80/20, the larger percentage on a Fidelity target date fund and the remaining 20% is with the Fidelity Spartan 500 Index fund. Reason for that is to increase my relative exposure to stocks and decrease my relative exposure to bonds, I just turned 33 years old so my horizon is long. So with that mix, I have around 3% bonds and 97% stock lol. Like I said tho that's my set up, you should check with the retirement thread to get a broader set of advice.

With regards to my taxable (non-retirement accounts), I was with Betterment but I ended up pulling the plug on it because I didn't like their allocation and I was never a fan of their (or any) fee. My allocation there is 75% stock and 25% bonds. Reason for that is say the market tanks and I get fired, most of my "savings" is in there so I want a hedge against volatility.

As for what's going on in the market right now, same as in 2008, I have increased my contribution amount to take advantage of cheap prices.

Edit - For clarity, my taxable money is now with Vanguard.

Yeah I actually signed up for betterment a few weeks ago. I may put something in there in the next week or so. I'm assuming you use it and like it?

I dunno man. My company you are able to split your selections into 7 cats from 100% : company stock, equity units, extended market, international equity, bond units, balanced fund units, and common assets. Since I am in my 20s, I've been aggressive. Common and bonds have the least (I think like 5%). The rest is a mixture, but I know stock is the highest. Since I work for an oil company I'm not sure that's a good idea anymore. I rode it out in 2015, but now I'm a little shook. Stay the course or switch it up?

gotta think about all of it from the longview.

you're realistically 35-45 years from retirement.

I haven't looked at my 401k stuff in awhile in part because I'm still so far from needing to access it.

gotta think about all of it from the longview.

you're realistically 35-45 years from retirement.

I haven't looked at my 401k stuff in awhile in part because I'm still so far from needing to access it.

Pretty much this. You should be shook if you have to retire in 5 years

Appreciate it Wellie

I look at my info at least twice a year to see what's up. Once in beginning and then sometime in middle. Also price of oil is a thing with my job. Well not to my position, but my company. So just curious if I should make some adjustments considering we are diving to $25 and probably $20 by years end.

I look at my info at least twice a year to see what's up. Once in beginning and then sometime in middle. Also price of oil is a thing with my job. Well not to my position, but my company. So just curious if I should make some adjustments considering we are diving to $25 and probably $20 by years end.

Wellington

BAAAALLLINNN'

I'm on Wellington.

I stopped waiting last night at like 8:15pm

Wah? League advanced at 10: 40 PM yesterday.

http://www.twitch.tv/wellingtongaf

CrimsonCommie

Member

Luke can you play tonight?

TheLostBigBoss

Banned

Hey Bird I'm around now, if you wanna play earlier.

I probably have to wait for the wife and kid to go to bed, but I will let you know if I can play before 10.Hey Bird I'm around now, if you wanna play earlier.

Browns vs Ravens to be underway shortly.

I had to wake up early in the morning.

Also, GG. I wasn't sure how to restart the game. I'm not having a good season.