They would normally take the opposite position but since GameStop incident the total short positions in the overall market fell and spread on credit swaps fell. So it seems the market is bullish.

infact very bullish so much so that the slightest hiccup would cause asset prices to fall. If people are borrowing they're most likely using their stocks as collateral against the loan.

So if the market value of the stock falls below the market value of the loan, they're subjected to a margin call.

I'm fearful of two things this heightened risk taking as a result of an explosion in M2 and prolong low rates has made investor complacent that the FED will bail them out so they will take on added levels of risk.

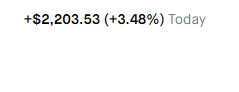

If the market falls 5.0% tomm (for example) we could see fortunes wiped out in an instant.