The Mad Draklor

Member

Funniest part was how enthusiastic some people were about the stock price rising last week and then, it turned out to be a pump-and-dump.

The stock of Ubisoft is now being obliterated, dropped almost 18% today.

Funniest part was how enthusiastic some people were about the stock price rising last week and then, it turned out to be a pump-and-dump.

The stock of Ubisoft is now being obliterated, dropped almost 18% today.

Tencent shoulda read our posts. We've been warning that the AC Shadows "success" touting has had a waft of bullshit since "players" were the metric without context.This initiative seems to have been agreed on a few months back when there were official discussions of merger and acquisition between Ubisoft and Tencent. Here's an excerpt from October of last year:

But then it appeared that talks were on hold due to disagreement on the value of the newly formed subsidiary.

So naturally Ubisoft delayed ACS's release date to release the game in the best possible state and pushed to maximize the game's early financial performance in order to negotiate a better deal and extract more value in their IPs with Tencent, which I believe they were mostly successful on as they have been touting every new milestone that AC: Shadows has reached in a short period of time.

Funniest part was how enthusiastic some people were about the stock price rising last week and then, it turned out to be a pump-and-dump.

Tencent shoulda read our posts.

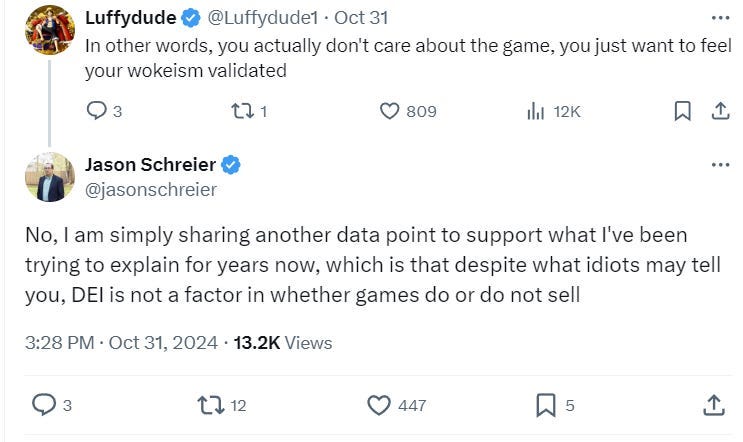

Yup, it reminded me shreier's tweet on x praising da:v sales numbers only to delete it soon afterFunniest part was how enthusiastic some people were about the stock price rising last week and then, it turned out to be a pump-and-dump.

The assumption is that it is in preparation of being separated.

Now any employee still holding shares at the time of spinoff would hold stock in both halves of the company. However, I assume afterwards you would be paid in stock for which ever half of the company you are physically working for. That might mean a massive paycut for many people not working for the more valuable half of the company.

Who are you talking about as far as the "creator" of AC?

I don't remember the exact conditions (I worked there many years ago, and got stocks)

Patrice Desilets, a Canadian dude who modernized PoP and then led the transition from that to Assassins Creed. A visionary, the kind of dude Western companies are kicking out and replacing with talentless drones.

I'm still trying to figure out how IP transferring to a subsidiary within the same company devalues employee stock.

AT&T's shareholders would receive stock representing 71% of the new company; Discovery shareholders would own 29% of the new company.

Because shareholders are no longer exposed to all the potential spoils.

It's not just insider shareholders, it's all shareholders that now get a rough deal while Tencent get exposure to 25% of everything at a minimum.

What usually happens when subsidiaries for publicly listed companies are spun off like this is that they create a new entity that current shareholders also get exposure to. Example:

So in this case it would read as follows:

Ubisoft shareholders would receive stock representing 75% of the new company; Tencent shareholders would own 25% of the new company.

But Ubisoft clearly took the quick and dirty route here, which would suggest there was a great deal of urgency in terms of getting the money in to cover debt liabilities.

The end result - Ubisoft's stock will end up doing all the corrections itself as investors realise they've got the short end of the stick. Oh, and Ubisoft will have to deal with a barrage of shareholder class action lawsuits that will inevitably come their way.

Ok.....but as of right now the new Ubisoft subsidiary hasn't been spun off, correct?

No, it has:

Ubisoft announces the creation of a new subsidiary

UBISOFT ACCELERATES ITS TRANSFORMATION BY LAYING FOUNDATION FOR NEW OPERATING MODEL WITH THE CREATION OF A SUBSIDIARY AND INJECTION OF €1.16BN OF CASH FROM...www.globenewswire.com

Deal was completed on the 27th.

Spin off just means it was registered as a separate entity. Ownership is a separate question altogether. Could be independent, partially owned or fully owned. A subsidiary means it is partially or fully owned by the parent.Ok....maybe I'm not understanding the terminology. When a company is "spun off" doesn't that mean they become bully independent? A subsidiary is still wholly owned by the parent corporation, right?

I'm not debating here. I'm just trying to understand.

In the first instance because Ubisoft shares now (assuming this plan goes through) represent 75% of the good part of the company and 100% of the bad part of the company, compared to before where before they represented 100% of each. That bad part is however somewhat less bad if the Tencent money is used to pay down debt.I'm still trying to figure out how IP transferring to a subsidiary within the same company devalues employee stock.

All the workers / shareholders will get benefited of the company getting over 1B that pretty likely will be used to reduce debt.Because shareholders are no longer exposed to all the potential spoils.

It's not just insider shareholders, it's all shareholders that now get a rough deal while Tencent get exposure to 25% of everything at a minimum.

What usually happens when subsidiaries for publicly listed companies are spun off like this is that they create a new entity that current shareholders also get exposure to. Example:

Or the shareholders may get happy to see that this move may help them get rid of most of the debt without having to sell any asset, but instead by correctly valuate them and allowing to get extra investment without selling the company or losing control over it. And may ask to do the same grouping other assets in other subsidiaries to get additional extra minority investment there, in order to further improve more their finances/debt.The end result - Ubisoft's stock will end up doing all the corrections itself as investors realise they've got the short end of the stick. Oh, and Ubisoft will have to deal with a barrage of shareholder class action lawsuits that will inevitably come their way.

Ubisoft shares represent the 100% of Ubisoft, which includes 100% of this subsidiary.In the first instance because Ubisoft shares now (assuming this plan goes through) represent 75% of the good part of the company and 100% of the bad part of the company, compared to before where before they represented 100% of each. That bad part is however somewhat less bad if the Tencent money is used to pay down debt.

I imagine the greater fear is that restructuring the company into a good part (Newbisoft) and a bad part (Ubisoft) may not bode well for the long term future of the bad part. If the bad part goes bust, the employees' Ubisoft shares will be worth ~nothing.

It is still a spin off though? You can spin off to create subsidiaries as well. Siemens did this recently with Siemens Healthineers (random example, but something that came to mind in my line of work)And nothing spun off, it's a subsidiary of Ubisoft controlled by Ubisoft.

Ok....maybe I'm not understanding the terminology. When a company is "spun off" doesn't that mean they become bully independent?

With its dedicated and autonomous leadership team, it will focus on transforming these three brands into unique ecosystems."

- The new subsidiary would have a dedicated leadership team, supervised by a Board of Directors, focused on enhancing creative vision and streamlining operations, with the authority to make swift, high-impact decisions across development, marketing, and distribution, to ensure these brands continue to evolve, attract new audiences, and deliver groundbreaking gaming experiences for years to come.

A subsidiary is still wholly owned by the parent corporation, right?

I'm not debating here. I'm just trying to understand.

The subsidiary (aka the good part of the company) being valued more highly than the company as a whole doesn't tell us that the valuation of the company as a whole is wrong. It probably tells us that the bad part effectively has a negative value, which is probably true for many companies if you split them into a good part and a bad part.The valuation of the subsidiary highlights that the whole company is highly undervaluated in the stock market. Because that subsidiary is valuated in twice the market value of the whole company.

All the workers / shareholders will get benefited of the company getting over 1B that pretty likely will be used to reduce debt.

And nothing spun off, it's a subsidiary of Ubisoft controlled by Ubisoft.

Or the shareholders may get happy to see that this move may help them get rid of most of the debt without having to sell any asset, but instead by correctly valuate them and allowing to get extra investment without selling the company or losing control over it. And may ask to do the same grouping other assets in other subsidiaries to get additional extra minority investment there, in order to further improve more their finances/debt.

The ones who must be pissed off are the trolls who artificially undervaluated the company.

Overall, revenue was down some 31.4% year-on-year (€990 million), and net bookings (the total value of contracts signed) were down 34.8% (€944 million). Further, back-catalogue net bookings, a significant source of income for a storied publisher like Ubisoft, were down 27.7% (€762 million).

Ubisoft shares represent the 100% of Ubisoft, which includes 100% of this subsidiary.

What do you think Tencent gave Ubisoft $1.2bn for?Ubisoft shares represent the 100% of Ubisoft, which includes 100% of this subsidiary.

Tencent invested 1.16B€ for the 25% of a subsidiary. This doesn't give Tencent control over it, it only gives them pretty likely a small portion of its profits. And allow them to sell that 25% to somebody else (as could be Ubisoft, the Guillemots or somebody else) several years in the future, hopefully at a higher price if they increast the value of that subsidiary.What do you think Tencent gave Ubisoft $1.2bn for?

Seems you don't understand what subsidiary means. Ubisoft continues controlling it because it's part of it, they continue working for Ubisoft, even if somebody else has a minority stake on the subsidiary. In this case of Ubi owning 75% and Tencent 25% means Ubi continues crontrolling everything. It doesn't mean that Tencent bought one of the 3 IPs or something like that.100% of their 75% in the subsidiary. What about that last 25% which Tencent have ownership of?

Pretty much all of their current major money making IP's are being thrown in to that subsidiary. I will do some digging at some point and figure out rough estimates for what percentage of their current revenue comes from the combination of Assassin's creed, far cry and rainbow six, but it's likely to be well over 50%.

Yes, exactly...Tencent invested 1.16B€ for the 25% of a subsidiary.

It gives them 25% of its profits... hence why there is only 75% left for the Ubisoft share...it only gives them pretty likely a small portion of its profits

Yes except 'the whole company' now gets only 75% of the profit from everything in the subsidiary where before this change it got 100%. The upside is it gains the $1.2bn in cash.if you buy Ubisoft stocks, these are stocks of the whole company

No, in France companies as one of their taxes have to pay 25% of their profits. Then they are also forced to pay part of the profits to the workers of the company. And other than that, with what is left after this and other things, companies decide if and how they give a portion of their remaining profits as dividends among their stock holders.It gives them 25% of its profits... hence why there is only 75% left for the Ubisoft share...

As they explained, they had this bad quarter because had important delays (mainly AC Shadows), some cancellation and restructuring. They got more debt because knew that in the next quarter AC Shadows was going to release making a lot of money and they were going to start showing the new strategy to get more value from their assets (as we saw they grouped some assets under a privately handled subsidiary and got specific investment for a minority stake on it, something they may continue doing with other parts of the company in the near future).Nothing about this company is "artificially" undervalued. They cannot afford to pay their quarterly liabilities without outside help:

The only time you want to see levered free cash flow in the negative like that is if a company is margin positive and are neglecting paying their debt in order to achieve bombastic revenue growth and margin expansion.

In Ubisoft's case their margins have shrunk such a degree that they are now negative, and their revenues are shrinking:

All of that is disastrous, and paints a picture of a business in deep trouble.

Let me be clear - they have not been avoiding paying their debt because they don't want to, they have been avoiding paying it because they can't pay it.

All of this and anything similar presumably applies to the entire subsidiary, not uniquely to Tencent's part of the subsidiary. Tencent's 25% remains 25% whatever stage of the process you look at.No, in France companies as one of their taxes have to pay 25% of their profits. Then they are also forced to pay part of the profits to the workers of the company. And other than that, with what is left after this and other things, companies decide if and how they give a portion of their remaining profits as dividends among their stock holders.

Again, the subsidiary/s nominally having a higher valuation than the whole does not show that the 'real valuation of the company is way higher'.Then by doing that and creating maybe a few additional subsidiaries with again a higher valuation each than the whole company and getting some extra investor on board (as could be Sony next year once they get the money from selling their banks stuff, but also any of the usual suspects), they'll show the real valuation of the company is way higher.

They didn't do it for nothing, it's an additional investment on part of a company where they already invested way more money and that needed to get cash injected now without growing the debt more due to the AC Shadows (and others) delay.All of this and anything similar presumably applies to the entire subsidiary, not uniquely to Tencent's part of the subsidiary. Tencent's 25% remains 25% whatever stage of the process you look at.

It's true the royalty is an unknown factor. Is it likely Tencent paid $1.2bn for a 25% share of the subsidiary and one of the conditions is the subsidiary has to give the totality of its profits to Ubisoft as a royalty? No. That would amount to Tencent giving Ubisoft $1.2bn for nothing.

It clearly shows that when properly valuated, just a portion of the company has a value way higher than the entire company valuation in the stock market. So it clearly highlights that the Ubisoft value on the stock market is highly undervaluated.Again, the subsidiary/s nominally having a higher valuation than the whole does not show that the 'real valuation of the company is way higher'.

"Hello all –

By now you have seen the message from Yves about the decision to create a new subsidiary that encompasses the three biggest Ubisoft brands: Rainbow 6, Assassin's Creed, and Far Cry. This new entity will remain part of the Ubisoft family and will continue to be operated by us, with Tencent being a minority shareholder. This important decision is a key turning point for us after the last few difficult years and is an opportunity for Ubisoft to rebuild stronger than ever.

What will this mean for us in Zone 1? Certainly, we can expect some major changes in terms of structure and organization, since these three brands compose a significant part of Zone 1's population. For now, what we can say is that once the agreement is finalized and confirmed by legal authorities, our Quebec, Saguenay and Sherbrooke studios will move entirely to the new entity, while our Montreal project teams will be spread between the new entity and the current Ubisoft organization. Our studios in Toronto, Winnipeg, as well as Red Storm and Blue Mammoth, will continue evolving in the current organization.

It is still very early in the process and I know you must have many questions, but the short answer to the "what's next" question is: we need to take the time to figure this out and the next months will be dedicated to determining the transition plan.

Step one was this announcement, where we shared the decision and kicked off the planning phase.

Step two will be from now until this summer, where we will work out how to support the new entity with the existing organization and determine what the new model looks like on both sides. There will be a variety of guided consultations and discussions over the next few months, and your leaders will be involved as we take this opportunity to set up Ubisoft and the new entity for success.

Step three will be the implementation of the new model, with a longer period to complete the transition. Of course, there are many things that have not been determined yet such as who and how we will manage the new entity, what will happen to the structure we have created around the Zone, what will be the impact on the studios, and more. While there are many things that will only be defined during the planning process over the next few months, I can assure you that Ubisoft will continue to be a world class creator of video games, and your great ideas and energy will always be a critical part of our success.

I'm sure you have many questions for which we have no answers yet. Your MDs have also been just recently briefed on this announcement, and like me, don't have any more information than I do. However, as always, we will try to keep you updated on our progress as we go along and share the latest decisions as soon as we can. In the meantime, we are looking forward to this opportunity of rebuilding a new and stronger Ubisoft, and of maximizing the contributions of all our people.

Thank you for your patience and resilience: living through change is never simple, and this is a big (and important) one for us and for the future of Ubisoft. My ask to you is to keep focusing on what you do best and where you have the biggest impact: making great games that enrich the lives of our players. I'm thankful to be able to count on your cooperation as we move forward together.

Christophe

Managing Director, Zone 1″

It clearly shows that when properly valuated, just a portion of the company has a value way higher than the entire company valuation in the stock market. So it clearly highlights that the Ubisoft value on the stock market is highly undervaluated.

This is completely incorrectUbisoft owns (or will own if this all goes through) $3bn worth of subsidiary (75% of the alleged $4bn subsidiary valuation) and is still only considered by the market to be worth $1.5bn itself. By my reckoning that says the remainder of Ubisoft (ie. excluding its stake in the subsidiary) is considered to be worth minus $1.5bn. If it's holding all the debt and employees they can't get rid of, that's probably true.

This is completely incorrect

What market thinks about valuation is one thing and what Tencent in a block trade thinks about valuation is another thing.

It's not the same thinking and not the same valuation. Big guys can have completely different reasons and valuation from retail investors trading on public exchange. Shouldn't be mixed together.

Same as MS thought that ATVI has a value of x1.5 market cap when it offered buyout.

Yep.This is completely incorrect

What market thinks about valuation is one thing and what Tencent in a block trade thinks about valuation is another thing.

It's not the same thinking and not the same valuation. Big guys can have completely different reasons and valuation from retail investors trading on public exchange. Shouldn't be mixed together.

Same as MS thought that ATVI has a value of x1.5 market cap when it offered buyout.

Let's add 200% premium and Zone1 will be valued positive in this case.Ok, let's add a 50% premium, which probably nobody is going to pay for Ubisoft because it's a total disaster and anything remotely good about it has just been moved into the subsidiary. The remainder (excluding the share of the subsidiary) now has a value of minus $0.75bn.