Linkified said:The average prices in Newcastle by rightmove.co.uk

Flat Semi-Detached Detached Terraced

Homes sold in the last 12 months 688 892 431 1014

Average house prices £124k £163k £300k £154k

So? ...

Poorest =/= Average.

Linkified said:The average prices in Newcastle by rightmove.co.uk

Flat Semi-Detached Detached Terraced

Homes sold in the last 12 months 688 892 431 1014

Average house prices £124k £163k £300k £154k

So? ...

Empty said:Poorest =/= Average.

blazinglord said:A) What exactly is wrong with wanting to leave something behind for your kids?

brain_stew said:Everything. Those in receipt have done bugger all for it, and don't deserve it anymore than anyone else. Having wealthy parents will have already given them a much better and privileged start in life so that they've had a better chance than most to make a living on their own. Nothing makes them more deserving of that cash than anyone else (in most cases the opposite is probably the case). If I ever do amass a fortune I have no intention to pass it on to one or two people that don't need it.

I live in an average town, economy-wise. The median house price is less than £150,000 around here.Linkified said:No but if the average is higher theres a greater chance of those house prices being elligible to taxation.

blazinglord said:To be fair though, what exactly has the North East contributed to the country other than high unemployment, social breakdown and Bykers grove? The North East needs to stop expecting state handouts - it's wrong for the state to use the rest of the country's hard earned money to prop up unprofitable industries.

Also, you do realise that Clegg too is a 'public school brat' don't you?

Kowak said:Why does the state deserve it? Its done nothing to deserve it, the person who gains a lot of wealth has had to be taxed on it their whole life and then cant even decide who gets their money when they are gone.

brain_stew said:The idea is so that it is redistributed throughout society. Though I agree, that's not ideal but that's why you have the option to give your estate to any charity and not be taxed for doing so. Your able to give it to any worthy and just cause, two lucky kids that have lived a privileged life don't fall into that category though, and nor should they.

Kowak said:It shouldnt be up to the state to decide what someone deems to be a worthy and just cause. People want to do well and then leave it to their kids, regardless of just how rich they are. This is just legal robbery in my eyes.

brain_stew said:All that does is increase inequality in society though. The children of wealthy parents almost certainly have had as good a start in life as anyone, its upto them to earn their living after being given every chance to do so. If people are forever hereditarily wealthy , then wealth will never be properly distributed throughout society. Why should someone that is talented and hard working throughout their life always live in poverty compared to someone that has never lifted a finger in their life?

Its the one significant tax cut that the the Tories have put forward so far and its solely for the benefit of the wealthy. When so many are desperate for jobs why should aristocrats be getting tax breaks?

brain_stew said:All that does is increase inequality in society though. The children of wealthy parents almost certainly have had as good a start in life as anyone, its upto them to earn their living after being given every chance to do so. If people are forever hereditarily wealthy , then wealth will never be properly distributed throughout society. Why should someone that is talented and hard working throughout their life always live in poverty compared to someone that has never lifted a finger in their life?

Its the one significant tax cut that the the Tories have put forward so far and its solely for the benefit of the wealthy. When so many are desperate for jobs why should aristocrats be getting tax breaks?

Linkified said:Right my Gran lives not in the best but neither the worst part of Newcastle. Theres a builder, built his business up from scratch and built an extension on his house - with the help of his mates its put the value into the eligibility for inherritance tax, he wants to leave the house to his kids. So under your view these 'wealthy parents' shouldn't be allowed to do it cos its unfair on the rest of society?

brain_stew said:He'll still be able to leave a very significant sum, tax free, to his children under the current system. You're only taxed on the parts of your estate above the threshold, so in an edge case like that, the inheritance tax he'd have to pay would be very insignificant.

Honestly, ideologically this is something I'm firmly behind, and I understand why people take the opposite stance, and anything I say is unlikely to sway them. Using edge cases isn't a good way to go about this, and I express my sympathy but my point is that after the worst recession in over 50 years, now is not the time to be giving tax breaks to the top 10% of society. If tax cuts are to come from anywhere its just about the last place it should be coming from atm. VAT is just about the most disproportionate tax going and it is very strongly predicted that if a Conservative government do need to raise taxes anywhere to cover the defict this is the one area it will come from. David Cameron couldn't even guarantee no VAT rise within the first 6 months of government when pressed by Paxman. This does not strike me as the sorts of policies that are going to counter inequality and help out those hardest hit by the recession.

Linkified said:Well I would most likely predct if the conservative government got into power they would have an emergency EU meeting to get it passed for at least the next year no country to pay anything into the system just until we are starting to climb out of the pit of recession.

Also going back to your point on that a cut in inherritance tax would benefit the top 10%, if anyone of us was in the top 10% we would want it to be cut.

Linkified said:Well I would most likely predct if the conservative government got into power they would have an emergency EU meeting to get it passed for at least the next year no country to pay anything into the system just until we are starting to climb out of the pit of recession.

Also going back to your point on that a cut in inherritance tax would benefit the top 10%, if anyone of us was in the top 10% we would want it to be cut.

That's quite a tenuous link you've built up between rising mortgages and the credit crunch. It's completely missing the point to focus on the fact that larger (or more) mortgages had to be taken out to finance the inflation in the housing sector, the point is people were not properly income assessed and could not repay. Why does it matter what they were taking the loan for if they couldn't repay it anyway? And for some reason if houses were cheaper these people who lied about their income wouldn't? I'm sorry but all of that is BS. Even in areas of the US where house prices were stable or falling the exact same thing happened, hell it happened to a much larger extent than the UK.Eiji said:You can all thank Gordon Brown for high house prices which was the reason for the Northern Rock run in August 2007 and the subsequent "credit crunch".

Toxic loans were the by-products of liar loans whereby people lied about their incomes to get banks and building societies to approve them larger mortgages. This bid up prices of properties across the UK and the end result you saw as the Northern Rock bank run in Aug '07 followed by tightened lending from banks due to damaged balance sheets and price drops of around 20% from end 2007 to March 2009.

What did Gordon Brown say in 1997?

I will not allow house prices to get out of control and put at risk the sustainability of the recovery.

What did he do? In 2003 he changed the official measure of inflation from RPI which included house prices to the CPI which didn't include house prices and cut interest rates to low levels. This along with cheap credit and the securitisation market caused the biggest house price boom (1997-2007) in the UK housing market history and you have Gordon Brown to thank for that.

Don't you think its unfair that the difficulty of buying a house in the UK is mainly due to your date of birth?

Even worse is that to sustain the housing bubble after the roughly 20% fall from end-2007 to March 2009 the Bank of England cut base interest rates to a 300 year historical low of 0.5% and pumped up the deficit to a massive £167bln and the national debt to over £600bn!

Linkified said:Well I would most likely predct if the conservative government got into power they would have an emergency EU meeting to get it passed for at least the next year no country to pay anything into the system just until we are starting to climb out of the pit of recession.

Linkified said:Also going back to your point on that a cut in inherritance tax would benefit the top 10%, if anyone of us was in the top 10% we would want it to be cut.

It is not for the state to start creating unnecessary jobs or to prop up unprofitable industries. Let the market decide what labour is needed.brain_stew said:Stupidity like this doesn't really deserve a response but I'll bite..............a little. Ever heard of Nissan? Well they're based in Sunderland and its the most efficient car plant in the entire EU. People can't work if there's not the jobs there for them, and after the last Tory government decimated all industry in the region it takes time to replace those jobs. How does specifically targeting the region for more job cuts help the problems of unemployment exactly?

I was under the impression that the Tories do support a high speed rail - the only issue between the two main parties is where the line should run and who should fund it.The Tories won't commit to a comprehensive high speed rail network in their manifesto. If you want the north east to attract private sector jobs you don't go and put projects like that at risk. Currently it takes less time to get to Paris from London than it does to get to Newcastle, I surely don't have to explain how completely ridiculous that is?

Redistribution isn't a human right, nor is it particularly natural. Individuals need incentives to work and establish themselves, rewarding people to use their talent in a productive manner will ultimately benefit the lower sections of society anyway. I know 'trickle-down economics' isn't in vogue right now, but I have yet to see anything of contributory value come from those on benefits other than the continual supply of next generation's cheap labour. Harsh, but true.Dougald said:Yeah, screw poor people, the rich deserve to pay far less of their income as a proportion than them!

Empty said:a) Inheritance tax is like the fairest tax around. The children of the wealthy don't earn or work for that money, they were just fortunate enough to be born to a wealthy family. Cutting it is ridiculous, and just serves to increase inequality and further reward the privileged.

As far as I know, 40% is the highest tax band, so it's impossible to have an estate that you'd have to pay 40% tax on.Ushojax said:Are you saying it is fair, that 40% of this house's value, that is worth slightly more than the current inheritance threshold, should be given to the state upon my grandparents death? That we would have to move out and be left homeless? Is that really the intended purpose of the inheritance tax?

Parl said:As far as I know, 40% is the highest tax band, so it's impossible to have an estate that you'd have to pay 40% tax on.

If it is worth "slighty more" than the current threshold as you say, then if it is worth £350,000 for instance, the tax payment would be £10,000, not £175,0000.

£700,000 is a lot. Joint tax threshold is £650,000, so tax payable is roughly £20,000.Ushojax said:Yeah, I didn't phrase that well at all, apologies. The house is worth just over £700,000 (I understand that the joint tax threshold is around £600,000) , so they would pay around £40,000 in tax. Where the fuck is that supposed to come from?

You won't be left homeless, even with a lower threshold, you'd wind up in a lower value house, but one that's still puts you in that top 5% quite comfortably. Most people don't even get there through working hard, so I'd feel very priviledged that the tax system would allow me to only pay £10,000 on such a huge, effortless increase in wealth.Are you saying it is fair, that 40% of this house's value (above threshold), should be given to the state upon my grandparents death? That we would have to move out and be left homeless? Is that really the intended purpose of the inheritance tax?

Do you not see that Ushojax's family has earned their money from scratch and bought their house with money that was already taxed! Why do other people who haven't done anything deserve to benefit from the toil of Ushojax's family?Parl said:£700,000 is a lot. Joint tax threshold is £650,000, so tax payable is roughly £20,000.

Your grandparents can legally give your parents £12,000 tax free in one year, then £6,000 for each year thereafter. So 4 years, and your grandparents own 93% of it and your parents have been given 7%. This would create 0% inheritance tax.

It's not valid, IMO, to argue that inheriting a house for free, and just because you have to pay some tax on it, it's a desperate situation of inequality, compared with people from poor, deprived backgrounds, with poor education, in towns where there it is incredibly hard to get a job, getting relief from the mass shafting society has given compared to those who have benefited heavily from the societal systems put in place.

Inheritance tax is just like income tax, corporation tax, etc, in that you get taxed on increases in your wealth.

Sir Fragula said:If I were given the chance to re-do inheretance tax, I'd have it as thus:

Every penny is the tax is pooled, and at the end of the tax year redistributed equally to every working person in the country [excluding non-dom no-tax paying types].

Why not raise minimum wage and let the poor independently earn their own living and take pride in their earned money? State handouts is not the answer.Sir Fragula said:If I were given the chance to re-do inheretance tax, I'd have it as thus:

Every penny is the tax is pooled, and at the end of the tax year redistributed equally to every working person in the country [excluding non-dom no-tax paying types].

I'd do that too.blazinglord said:Why not raise minimum wage and let the poor independently earn their own living and take pride in their earned money?

Yes, they often are.State handouts is not the answer.

The welfare system is necessary to prevent entrenched povety.blazinglord said:Why not raise minimum wage and let the poor independently earn their own living and take pride in their earned money? State handouts is not the answer.

Also going back to your point on that a cut in inherritance tax would benefit the top 10%, if anyone of us was in the top 10% we would want it to be cut.

Equally, if any one of the 10% at the top ended up with a poor education because of their background, and lived in a town with few jobs and high unemployment, with a society with growing inequality, they'd support the fact a family who inherits a house for free, doing zero work of their own, would get a tax of £32,000 on £800,000 said luxury house.Linkified said:Also going back to your point on that a cut in inherritance tax would benefit the top 10%, if anyone of us was in the top 10% we would want it to be cut.

That's a bit hypocritical isn't it? You say the poor should independently earn their own money, yet you're advocating getting rid of a tax that would give away money without earning or working for it.blazinglord said:Why not raise minimum wage and let the poor independently earn their own living and take pride in their earned money? State handouts is not the answer.

Many countries function brilliantly under coalition governments. It's very European.arena08 said:If it is a hung parliament then they will HAVE to work together, he's missing the point.

Ushojax said:Yeah, I didn't phrase that well at all, apologies. The house is worth just over £700,000 (I understand that the joint tax threshold is around £600,000) , so they would pay around £40,000 in tax. Where the fuck is that supposed to come from?

Dougald said:Are you seriously saying that Conservatives would pass a resolution to remove VAT? Do you have ANY IDEA how much debt that would take the EU into, especially when the Conservatives are the only party really gunning to cut the deficit?

Yeah, screw poor people, the rich deserve to pay far less of their income as a proportion than them!

arena08 said:If it is a hung parliament then they will HAVE to work together, he's missing the point.

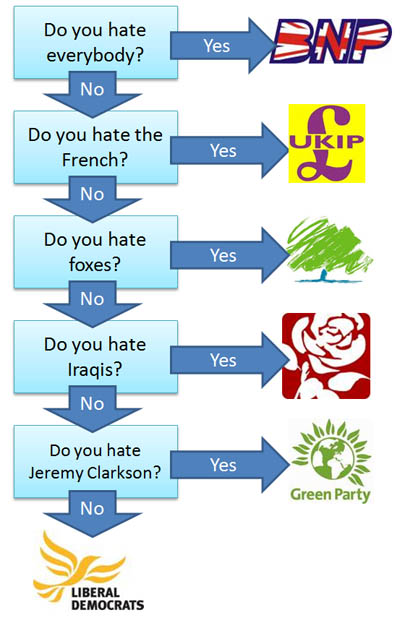

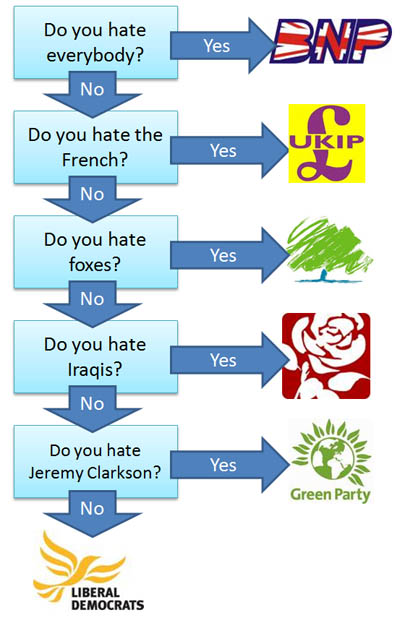

Wes said:This appeared linked on the Guardian LiveBlog:

Chinner said:Taxing inheritance gives an opportunity to the poor to get a better footing in life or at least live a little bit more comfortably.

Ventron said:They also published a not-so-flattering excerpt from Littlejohn's book about New Labour. Holy shit, did Tony Blair really regulate that salt shakers must have 5 holes??

Wes said:This appeared linked on the Guardian LiveBlog:

'Look, you've punished us enough about Iraq, all right? So don't start punishing yourself.'

Zenith said:gobsmacked. Milliband was campaigning and some guy said he wouldn't vote Labour due to Iraq. He replied:

http://www.guardian.co.uk/theguardian/2010/apr/23/david-miliband-interview-labour

Don't they get it? Thousands of people are dead. Thousands more will die. Poor little diddums! People are saying mean things to us due to our little flirtation with mass-murder.

I'm not going to vote for Labour until every member in that party who voted in favour of the war is dead from old age.