You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

UK PoliGAF thread of tell me about the rabbits again, Dave.

- Thread starter Chinner

- Start date

Yeah, I'd be very interested to see how they calculate the tax rates.

And even more interested to see how the figure would change if it stayed at 50%.

This is what I'm thinking. Mathematically it doesn't make sense. There has to be other factors in play being considered that are not being explained, which is a bit unfair really as there should be more transparency in how it's worked out.

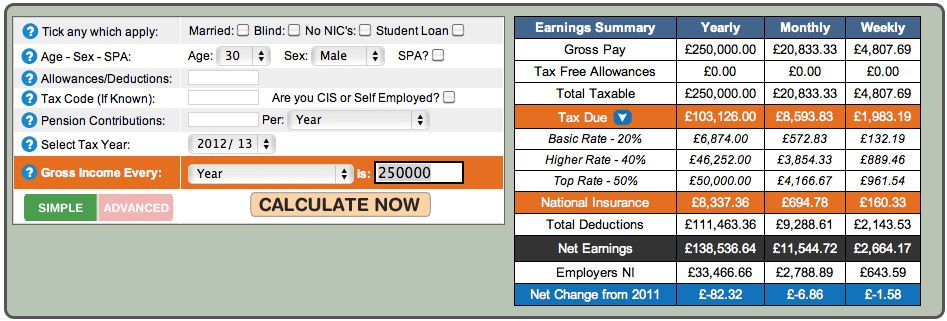

The only increase I can see is a slight lowering of the 40% tax band, which only amounts to a few hundred compared to the £5000 saved from the cut in the top tax rate, so I'm thinking maybe the budget calculator is not completely accurate.

edit: i'm thinking because the cut in the top rate is not coming in till April 2013 that the calculator is not including it in its calculations. Hence the surprise loss

edit: i'm thinking because the cut in the top rate is not coming in till April 2013 that the calculator is not including it in its calculations. Hence the surprise loss

The only increase I can see is a slight lowering of the 40% tax band, which only amounts to a few hundred compared to the £5000 saved from the cut in the top tax rate, so I'm thinking maybe the budget calculator is not completely accurate.

edit: i'm thinking because the cut in the top rate is not coming in till April 2013 that the calculator is not including it in its calculations. Hence the surprise loss

That's correct, I just checked UK tax calculators and it's true, it still factors 50% tax on the upper bracket for 2012-2013. It must be the year after that the 45% tax comes in, and the income barriers get shifted for the middle brackets too. A bit sneaky really.

That's correct, I just checked UK tax calculators and it's true, it still factors 50% tax on the upper bracket for 2012-2013. It must be the year after that the 45% tax comes in, and the income barriers get shifted for the middle brackets too. A bit sneaky really.

THE CONSERVATIVE MEDIA CONSPIRACY

THE CONSERVATIVE MEDIA CONSPIRACY

Well, it's certainly a clever tactic. The way you completely glossed over my questions or the notion of breaking down the calculations is un-surprising however.

EDIT: Here's how the tax percentages are calculated for 2012/13. Before the new tax cuts actually come in to play as evidenced.

Well, it's certainly a clever tactic. The way you completely glossed over my questions or the notion of breaking down the calculations is un-surprising however.

It's because I'm part of the CONSERVATIVE MEDIA CONSPIRACY

Just to add, using forecasted 2013/2014 figures.

The person earning £250k is likely to make a £10k saving a year.

Whilst the person earning £37k and £12k will both save roughly £200.

Just to mix it up a bit, if you're earning £2mil you'd be saving an additional £90k a year.

http://www.uktaxcalculators.co.uk/custom-tax-calculator-2013-2014.php

Still shocks me that they actually pushed through this budget. I would have expected greater savings in the lower or middle brackets and a hold on the upper one's if anything. Especially considering corporation tax was cut as well.

The person earning £250k is likely to make a £10k saving a year.

Whilst the person earning £37k and £12k will both save roughly £200.

Just to mix it up a bit, if you're earning £2mil you'd be saving an additional £90k a year.

http://www.uktaxcalculators.co.uk/custom-tax-calculator-2013-2014.php

Still shocks me that they actually pushed through this budget. I would have expected greater savings in the lower or middle brackets and a hold on the upper one's if anything. Especially considering corporation tax was cut as well.

That's not how it works though Nib. A HUGE number of people in the 50% band were avoiding it, and paying maybe 35% tax on corporation tax/wages/dividends in their own company (normally a company made up of family members as staff, it's a pretty common way of avoiding, see Livingstone). Those people may now find it more attractive to simply pay the 45% instead of hiring accountants and going through loads of hoops to pay 35% (and with that 35% you don't have access to all of your earnings, just the wage that you pay yourself, which is taxed normally).

It's a harsh reality but as long as there isn't some kind of weird flat tax or a different way of taxation then people will avoid it. It's just like when the government back in the days lowered the high earner bracket tax from 83% to 40% and got more revenue from it. Tax policy should be based in reality, not ideology.

It's a harsh reality but as long as there isn't some kind of weird flat tax or a different way of taxation then people will avoid it. It's just like when the government back in the days lowered the high earner bracket tax from 83% to 40% and got more revenue from it. Tax policy should be based in reality, not ideology.

That's not how it works though Nib. A HUGE number of people in the 50% band were avoiding it, and paying maybe 35% tax on corporation tax/wages/dividends in their own company (normally a company made up of family members as staff, it's a pretty common way of avoiding, see Livingstone). Those people may now find it more attractive to simply pay the 45% instead of hiring accountants and going through loads of hoops to pay 35% (and with that 35% you don't have access to all of your earnings, just the wage that you pay yourself, which is taxed normally).

It's a harsh reality but as long as there isn't some kind of weird flat tax or a different way of taxation then people will avoid it. It's just like when the government back in the days lowered the high earner bracket tax from 83% to 40% and got more revenue from it. Tax policy should be based in reality, not ideology.

How about they just close the loopholes and keep the taxes that the people should be bloody paying anyway? I disagree with the idea of pandering to those abusing the system.

On a side note, the loophole you speak of is actually one used by a few of my friends, or should I say, acquaintances actually use. But they're on the middle brackets if that, and living on the edge (i.e only just surviving, managing to pay rent in London etc) so I don't say much.

From what they've explained, instead of paying a crap tonne on taxes, you set up a Ltd company and take minimum wage, and pay the rest to yourself in dividends.

Has this loophole even been closed?

On a side note, this idea that if you play nice and tax the richest less, they won't hire accountants etc to find further loopholes or ways to pay less is an absolute fallacy. Trickle down doesn't really work, and the people at the top will ALWAYS find ways to save more or skim more off the top. Just the way the cookie crumbles. This was an awful budget that just further exemplifies how out of touch and greedy the Tories are.

You can't close that loophole because it isn't really a loophole. Most small-medium businesses in the country will do the same thing to register their earnings (legitimately).

You can't just "close" it because there's no way of telling a "real" LTD from a tax one.

Well there you go then. It's still a better option than just paying higher taxes so this tax cut on the richest was pointless and unfair imo.

The £200 saving to those on £12k and £37k etc is paltry, and barely even covers the rise in inflation or the general increase in cost of living. The balance on savings is seriously broken in this budget with the wrong people being given leeway or financial flex. The fact that they slyly dropped the middle bracket taxing line (from £37k from 2010/11 to £34k in 2012/13) glossing over it but highlighting only the new higher allowance is also disingenuous and sneaky.

Ed Miliband published his donor dinners:

4 November 2010 Nigel Doughty

7 December 2010 - John Hannett (USDAW)

15 December 2010 Dave Prentis (Unison)

5 January 2011 Len McCluskey (UNITE)

13 January 2011 Paul Kenny (GMB)

17 January 2011 Lord Bhattacharyya

2 February 2011 Henry Tinsley (Betterworld Ltd)

3 February 2011 Lord Alan Sugar

16 February 2011 Kevin McGrath

3 March 2011 Len McCluskey (UNITE), Paul Kenny (GMB), Dave Prentis (Unison)

9 March Michael Leahy (Community)

24 March 2011 Nigel Doughty Breakfast at Ed Milibands home

29 March 2011 Andrew Rosenfeld

29 March 2011 Graham Jones

29 March 2011 Lord Waheed Alli (BM Creative Management Ltd)

4 April 2011 John Hannett (USDAW), Michael Leahy (Community), Len McCluskey (UNITE), Paul Kenny (GMB), Gerry Doherty (TSSA), Billy Hayes (CWU) Dinner, House of Commons

26 April 2011 Paul Kenny (GMB)

16 May 2011 Len McCluskey (UNITE)

17 May 2011 Ken Livingstone

20 June 2011 Len McCluskey (UNITE)

27 June 2011 John Hannett (USDAW)

28 June 2011 George Guy (UCATT)

14 July 2011 George Iacobescu (Canary Wharf plc)

14 July 2011 Ken Livingstone

22 July 2011 Andrew Rosenfeld

22 July 2011 Paul Kenny (GMB)

25 July 2011 Dave Prentis (Unison)

2 September 2011 Len McCluskey (UNITE)

6 September 2011 Nigel Doughty

13 September 2011 John Hannett (USDAW)

20 September 2011 - Ken Livingstone

27 October 2011 Andrew Rosenfeld

10 November 2011 Len McCluskey (UNITE), Paul Kenny (GMB), Dave Prentis (UNISON)

19 November 2011 Nigel Doughty Dinner at Ed Milibands house

16 December 2011 Andrew Rosenfeld

20 January 2012 Andrew Rosenfeld Dinner at Ed Milibands home

6 February 2012 Len McCluskey (UNITE)

9 February 2012 Dr Assem Allam

21 February 2012 Dave Prentis (Unison)

1 March 2012 Andrew Rosenfeld

7 March 2012 Michael Leahy (Community)/John Hannett (USDAW)

14 March 2012 Billy Hayes (CWU)

23 March 2012 - Ken Livingstone Dinner at Ed Milibands home

4 November 2010 Nigel Doughty

7 December 2010 - John Hannett (USDAW)

15 December 2010 Dave Prentis (Unison)

5 January 2011 Len McCluskey (UNITE)

13 January 2011 Paul Kenny (GMB)

17 January 2011 Lord Bhattacharyya

2 February 2011 Henry Tinsley (Betterworld Ltd)

3 February 2011 Lord Alan Sugar

16 February 2011 Kevin McGrath

3 March 2011 Len McCluskey (UNITE), Paul Kenny (GMB), Dave Prentis (Unison)

9 March Michael Leahy (Community)

24 March 2011 Nigel Doughty Breakfast at Ed Milibands home

29 March 2011 Andrew Rosenfeld

29 March 2011 Graham Jones

29 March 2011 Lord Waheed Alli (BM Creative Management Ltd)

4 April 2011 John Hannett (USDAW), Michael Leahy (Community), Len McCluskey (UNITE), Paul Kenny (GMB), Gerry Doherty (TSSA), Billy Hayes (CWU) Dinner, House of Commons

26 April 2011 Paul Kenny (GMB)

16 May 2011 Len McCluskey (UNITE)

17 May 2011 Ken Livingstone

20 June 2011 Len McCluskey (UNITE)

27 June 2011 John Hannett (USDAW)

28 June 2011 George Guy (UCATT)

14 July 2011 George Iacobescu (Canary Wharf plc)

14 July 2011 Ken Livingstone

22 July 2011 Andrew Rosenfeld

22 July 2011 Paul Kenny (GMB)

25 July 2011 Dave Prentis (Unison)

2 September 2011 Len McCluskey (UNITE)

6 September 2011 Nigel Doughty

13 September 2011 John Hannett (USDAW)

20 September 2011 - Ken Livingstone

27 October 2011 Andrew Rosenfeld

10 November 2011 Len McCluskey (UNITE), Paul Kenny (GMB), Dave Prentis (UNISON)

19 November 2011 Nigel Doughty Dinner at Ed Milibands house

16 December 2011 Andrew Rosenfeld

20 January 2012 Andrew Rosenfeld Dinner at Ed Milibands home

6 February 2012 Len McCluskey (UNITE)

9 February 2012 Dr Assem Allam

21 February 2012 Dave Prentis (Unison)

1 March 2012 Andrew Rosenfeld

7 March 2012 Michael Leahy (Community)/John Hannett (USDAW)

14 March 2012 Billy Hayes (CWU)

23 March 2012 - Ken Livingstone Dinner at Ed Milibands home

That's not how it works though Nib. A HUGE number of people in the 50% band were avoiding it, and paying maybe 35% tax on corporation tax/wages/dividends in their own company (normally a company made up of family members as staff, it's a pretty common way of avoiding, see Livingstone). Those people may now find it more attractive to simply pay the 45% instead of hiring accountants and going through loads of hoops to pay 35% (and with that 35% you don't have access to all of your earnings, just the wage that you pay yourself, which is taxed normally).

It's a harsh reality but as long as there isn't some kind of weird flat tax or a different way of taxation then people will avoid it. It's just like when the government back in the days lowered the high earner bracket tax from 83% to 40% and got more revenue from it. Tax policy should be based in reality, not ideology.

why would existing top earners go through the hassle of undoing the creative accounting to increase your tax bill? if it's on principle why is the 45% rate palatable when 50% isn't. i find it very hard to understand and it seems like a pitifully small change that amounts to a nice giveaway to the rich.

i mean maybe it'll work but it's a bit of a gamble for the REALITY NOT IDEOLOGY politics you're promoting, and the laffer curve is the ultimate ideological weapon given that no-one really has a clue exactly where it takes place in any given economy outside of it broadly being true in big change cases like 83-40 example you provide.

besides the treasury itself estimates that £100m is being lost by cutting the rate, and only that little because labour were dummies and pre-announced the 50p rate allowing for companies to pay big dividends in the fiscal year before the rate came in inflating the before and deflating the after figures. 100m isn't a massive amount with a one trillion net public sector debt sure, but when we're cutting disability provision or vital legal aid it can go a long way.

But that £100m will be offset by investment potential. A Chinese company that wants to set up a branch in, say, Northampton will feel better about investing in a country that taxes 45% than at 50%. At very least they'll feel better because the budget could be construed as a "tax cut" budget and that gives businesses confidence (the 1% cut in corp. tax too).

But that £100m will be offset by investment potential. A Chinese company that wants to set up a branch in, say, Northampton will feel better about investing in a country that taxes 45% than at 50%. At very least they'll feel better because the budget could be construed as a "tax cut" budget and that gives businesses confidence (the 1% cut in corp. tax too).

I think this is a continuation of the trickle down fallacy that has been proven to be broken time and time again throughout history. It doesn't work. You can keep giving, keep cutting for the richest and for these corporations etc but ultimately they are private enterprises who will always want more and always pursue tactics that save them money and make them more profit. Even IF they are making record profits already etc.

Why would income tax make any relevance to that anyway? Corporation tax maybe, income tax, not really. That's a cost the employee himself takes most of the brunt for.

Seems like a rather unusual and weak argument in favour of it. Ultimately, it's not just about taxes anyway. heck, much of Europe has higher top end tax rates, countries that are doing much better than us. If it was all about tax, everyone would be banking in Dubai. It's about a lot more than that. Supply, demand, business potential, clientele, stability etc.

This is nothing but a greedy little additional payout to the people who least need it.

Income wealth rarely trickles down, you're correct, but I'm more interested in supply chains.

Every time a business sets up because of a tax cut, there are fuck loads of indirect jobs created for a whole bunch of reasons. For example, if a google office opens, there's jobs for cleaners who tidy at the end of the day, sandwich shops near by, petrol stations, etc.

I'd say that the main problems in the UK in terms of lack on economic participation among the "underclass" (beats using the word chavs) is more social than economic. Benefits are extremely generous, even with the cuts, and those from deprived backgrounds have access to basic, or even intermediate services.

I don't think higher taxation of wealthy groups or pouring money into welfare will solve anything. What we need is a change in mindset from many areas, particularly the police and judiciary (don't get me started on ASBOs).

Every time a business sets up because of a tax cut, there are fuck loads of indirect jobs created for a whole bunch of reasons. For example, if a google office opens, there's jobs for cleaners who tidy at the end of the day, sandwich shops near by, petrol stations, etc.

I'd say that the main problems in the UK in terms of lack on economic participation among the "underclass" (beats using the word chavs) is more social than economic. Benefits are extremely generous, even with the cuts, and those from deprived backgrounds have access to basic, or even intermediate services.

I don't think higher taxation of wealthy groups or pouring money into welfare will solve anything. What we need is a change in mindset from many areas, particularly the police and judiciary (don't get me started on ASBOs).

That's not how it works though Nib. A HUGE number of people in the 50% band were avoiding it, and paying maybe 35% tax on corporation tax/wages/dividends in their own company (normally a company made up of family members as staff, it's a pretty common way of avoiding, see Livingstone). Those people may now find it more attractive to simply pay the 45% instead of hiring accountants and going through loads of hoops to pay 35% (and with that 35% you don't have access to all of your earnings, just the wage that you pay yourself, which is taxed normally).

It's a harsh reality but as long as there isn't some kind of weird flat tax or a different way of taxation then people will avoid it. It's just like when the government back in the days lowered the high earner bracket tax from 83% to 40% and got more revenue from it. Tax policy should be based in reality, not ideology.

Again: nobody has ever made the argument that people importing dodgy cigarettes from aboard means we should lower cigarette duty. This is an excuse-making argument, not an intellectually sincere argument for lowering the top tax rates.

Moreover, anyone who has already put tax-dodging accountancy plans in place has virtually nothing to change, and thus will likely still be dodging the 45% and 40% rates.

The government admitted that lowering the rates is going to reduce revenue. They didn't even try and make a shoddy Lafferian argument that revenues would increase. They preferred to cut tax rather than cut tax dodging, and they hoped no-one would notice.

Account hacked? Yeah right, what a cunt.

I wonder if there's any way that Twitter could verify whether it was hacked or not, like tracing the IP/MAC of whoever posted it. Would cause Galloway a real red-face. He obviously only cares about his ego, his manifesto for Bradford kept saying: "I, George Galloway, _____"

what a prick

I wonder if there's any way that Twitter could verify whether it was hacked or not, like tracing the IP/MAC of whoever posted it. Would cause Galloway a real red-face. He obviously only cares about his ego, his manifesto for Bradford kept saying: "I, George Galloway, _____"

what a prick

Smelly Tramp

Member

cant stand reading this thread, makes me so bitter about the state of the UK.

and george galloway XD

what a plum.

and george galloway XD

what a plum.

killer_clank

Member

Ouch.

killer_clank

Member

I fully expect the possibility of a cabinet reshuffle after the local elections.

Tories are really getting damaged by it, but thankfully the Lib Dems might pick up some of their votes.

Really hoping for a bigger slice of the pie for the LDs come 2015. Hopefully they'll get around 70 seats and challenge the Tories/Labour in some marginals!

Tories will get mauled in the locals. LDs probably too. Rise in Greens/UKIP/Independents imo.

Really hoping for a bigger slice of the pie for the LDs come 2015. Hopefully they'll get around 70 seats and challenge the Tories/Labour in some marginals!

Tories will get mauled in the locals. LDs probably too. Rise in Greens/UKIP/Independents imo.

killer_clank

Member

Tories are really getting damaged by it, but thankfully the Lib Dems might pick up some of their votes.

Really hoping for a bigger slice of the pie for the LDs come 2015. Hopefully they'll get around 70 seats and challenge the Tories/Labour in some marginals!

Good luck with that.

Good luck with that.

Just because they don't appeal to you doesn't mean they won't appeal to someone else (those on the center-right)

killer_clank

Member

Just because they don't appeal to you doesn't mean they won't appeal to someone else (those on the center-right)

True, but I really can't see it. If the government as a whole is unpopular, the junior coalition partner really isn't going to randomly gain popularity. Even in popular coalitions they usually get squeezed by the larger party.

At the same time mind you, Labour just don't seem to be really capitalising on the situation as well as an opposition should be.

Just because they don't appeal to you doesn't mean they won't appeal to someone else (those on the center-right)

They appeal to me. But voters are still going to punish them come the election.

killer_clank

Member

My very early prediction for the 2015 elections. Labour missing out on a majority by like 5 seats and allying with SNP (presuming they aren't independent)

They totally despise each other to a ludicrous extent. I guess theoretically if independence is rejected they might have more reasons to work together but I really can't see it. God, I wish we had way more smaller parties and PR. One of the main reasons I support Scottish independence is that I think it'd create a far better democracy than shitty FPTP. Hopefully some good will come out of George Galloway getting elected and the upcoming locals is smaller parties doing well, like the Greens.

killer_clank

Member

yeah, smaller parties are good.

Hopefully the Greens, Plaid, SNP, Respect and UKIP will pick up some seats in the next election.

The Greens are by far the best opposition in the Scottish Parliament, despite there only being two of them. They're fair when the govt succeeds, criticise when they deserve it, and just generally manage to avoid the tribalism, when everyone else is hugely petty, especially at the minute with the independence issue.

The Scottish Greens are a totally different party up here admittedly, but Caroline Lucas seems pretty good too. Hopefully she gets some colleagues next time.

War Peaceman

You're a big guy.

Hopefully not UKIP!

killer_clank

Member

Hopefully not UKIP!

a lot of the tories are basically UKIP already =/

But yes, I hope so too.

Hopefully not UKIP!

UKIP getting some seats isn't something I personally "want" per se, but it would be good for our democracy.

Meatpuppet

Member

http://www.bbc.co.uk/news/uk-politics-17576745

Any thoughts? I'm not entirely sold that this wont be liable to abuse.

Any thoughts? I'm not entirely sold that this wont be liable to abuse.

http://www.bbc.co.uk/news/uk-politics-17576745

Any thoughts? I'm not entirely sold that this wont be liable to abuse.

As one of the few Tory voters in this thread, I'll say that I am totally against this move. There is simply no need for such widespread surveillance.

yeah, smaller parties are good.

Hopefully the Greens, Plaid, SNP, Respect and UKIP will get no seats in the next election.

Fixed that for you, modern politics is no place for 'parties' with only a narrow perspective in policies.

Also the greens would kill the country off in a over-idealised push for horribly expensive renewable energy and left wing benefits payouts, they should be left to organise lesbian cake sales and nothing more.

Any party that cant accept that we require nuclear power and that nuclear power is pretty safe has no place anywhere near anyone who has to make a decision about anything.

Wrestlemania

Banned

Err...Any party that cant accept that we require nuclear power and that nuclear power is pretty safe has no place anywhere near anyone who has to make a decision about anything.

killer_clank

Member

I don't think Nuclear power is totally terrible or evil anything, but the (admittedly small but possibly catastrophic) safety risks and the waste produced are more than enough to put me off it in favour of Wind/Wave power and the like.

travisbickle

Member

Income wealth rarely trickles down, you're correct, but I'm more interested in supply chains.

Every time a business sets up because of a tax cut, there are fuck loads of indirect jobs created for a whole bunch of reasons. For example, if a google office opens, there's jobs for cleaners who tidy at the end of the day, sandwich shops near by, petrol stations, etc.

I'd say that the main problems in the UK in terms of lack on economic participation among the "underclass" (beats using the word chavs) is more social than economic. Benefits are extremely generous, even with the cuts, and those from deprived backgrounds have access to basic, or even intermediate services.

I don't think higher taxation of wealthy groups or pouring money into welfare will solve anything. What we need is a change in mindset from many areas, particularly the police and judiciary (don't get me started on ASBOs).

We need to give rich people a tax break, then they can afford more people to clean their toilets.

This kind of attitude among young people is depressing, I don't mind some old, rich ex-etonian proclaiming a partly public-subsidised shopping mall is a great idea because it will give people an opportunity to pick up litter, but a young person with this attitude is sad.

Do yourself a favour and read "The pleasure and sorrow of work" by Alain de Botton.

StealthGoblin

Banned

I don't think Nuclear power is totally terrible or evil anything, but the (admittedly small but possibly catastrophic) safety risks and the waste produced are more than enough to put me off it in favour of Wind/Wave power and the like.

I currently favour nuclear as a transitional resource until we get our wind/wave projects to an acceptable level.

Whatever happens, we need to get the costs home fuel. By doing so we can also cut down drastically on the winter fuel allowance. If it costs less, we should pay out less.

killer_clank

Member

http://www.bbc.co.uk/news/uk-politics-17576745

Any thoughts? I'm not entirely sold that this wont be liable to abuse.

Lib Dems ignoring/forgetting even more of their principles I see.

I don't think Nuclear power is totally terrible or evil anything, but the (admittedly small but possibly catastrophic) safety risks and the waste produced are more than enough to put me off it in favour of Wind/Wave power and the like.

Unless we turn every space square foot of the UK into a wind turbine and surround the coast with wave then it is all but impossible to supply the UK with renewable.

travisbickle

Member

Unless we turn every space square foot of the UK into a wind turbine and surround the coast with wave then it is all but impossible to supply the UK with renewable.

Citation needed.

Anecdotal, my parents are able to sell back their spare electricity to the grid, they have solar panels on the roof. And the university I work at is totally off the grid, (in South Korea) again from solar, it's a small university with around 5000 students but has housing on campus, and it also has one of those underground low energy heat storage solutions.

I'm not saying you should extrapolate those two instances and it proves we could have the world on renewable, but I'm optimistic about the quality of renewable energy sources even at this point.

Citation needed.

Anecdotal, my parents are able to sell back their spare electricity to the grid, they have solar panels on the roof. And the university I work at is totally off the grid, (in South Korea) again from solar, it's a small university with around 5000 students but has housing on campus, and it also has one of those underground low energy heat storage solutions.

I'm not saying you should extrapolate those two instances and it proves we could have the world on renewable, but I'm optimistic about the quality of renewable energy sources even at this point.

While I have no sources to hand I remember last year a report on the UK's wind farms and that they only generate a third of the power they are listed as due to them being unused in anything but a narrow band of wind speed and the UK isnt suitable for solar power due to being so far north we have very low 'photon density' I believe its called.