kingfey

Banned

https://www.videogameschronicle.com...ys-hes-scared-of-game-passs-potential-impact/

Former Microsoft exec Ed Fries has expressed concern over the potential impact the company's Game Pass subscription service could have on the games industry.

Speaking as part of a wider interview with Xbox Expansion Pass, Fries – who was part of the original Xbox launch team before his departure in 2004 – was asked what he would do were he still part of Microsoft's gaming team today.

Fries didn't give an explicit answer but said that he was 'scared' of the impact Game Pass could have, should it become a dominant business model like Spotify has in the music industry. He also made broad claims about Spotify's impact on the music industry, some of which have been disputed by experts.

Xbox Game Pass launched in June 2017 and has become central to Microsoft's gaming business, offering members access to over 100 titles for a monthly subscription fee.

As of January 2022, Game Pass has over 25 million subscribers, according to Microsoft, so it still has a long way to go before it reaches the level of Spotify (182m) and Netflix (222m). In fact, it was recently estimated that subscription services account for just 4% of annual games revenues in Europe and North America, compared to 65% of global music revenues.

Both Microsoft and PlayStation have said they don't believe subscriptions will ever be the dominant model in video games. However, former MS exec Fries encouraged the platform holders to be "careful" over the business models they create.

"The one thing that they're doing that makes me nervous is Game Pass," he said. "Game Pass scares me because there's a somewhat analogous thing called Spotify that was created for the music business.

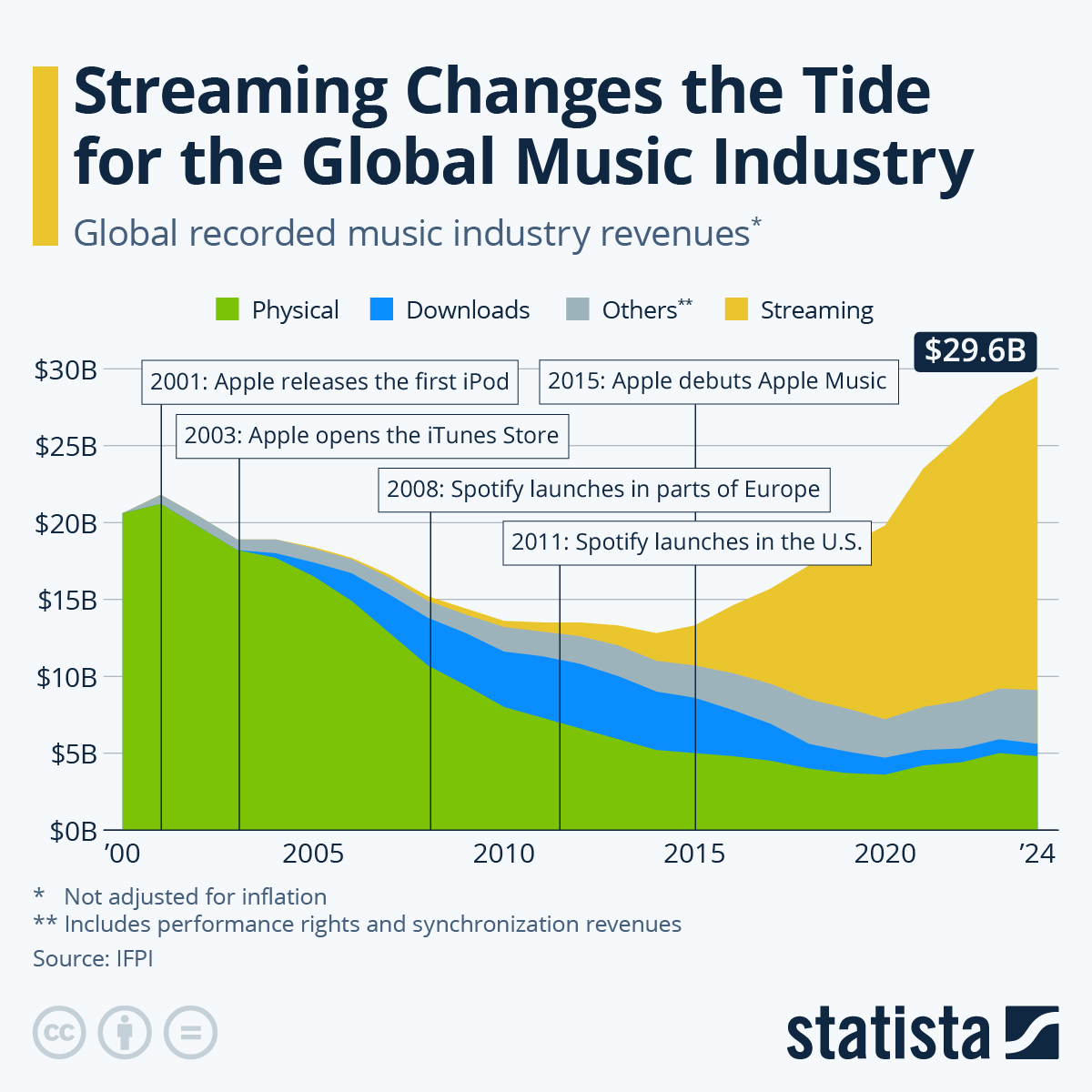

"When Spotify took off it destroyed the music business, it literally cut the annual revenue of the music business in half," the former Microsoft exec claimed. "It's made it so people just don't buy songs anymore.

"People don't buy songs on iPhone for example, because why would you? They're all on your subscription service app. Apple's said they're going to take away buying songs because no one's buying them any more.

"So we have to be careful we don't create the same system in the game business. These markets are more fragile than people realise. I saw the games industry destroy itself in the early 80s. I saw the educational software business destroy itself in the mid-90s… they literally destroyed a multi-billion dollar market in a few years.

"So Game Pass makes me nervous. As a customer, I love it. I love Spotify as a customer: I have all the songs I'd ever want… it's a great deal as a customer. But it isn't necessarily great for the industry."

Fries went on to question whether it was possible for game developers to embrace subscription platforms to the extent seen in the music business.

"At some point it tipped and everything had to be [on Spotify]. The percentage of all games that are on Game Pass is still tiny, and there are a lot of games. 200 games a week come out on Steam and more than that come out on mobile."

Some of Fries' claims regarding Spotify were strongly disputed by music industry journalist Tim Ingham, editor of MusicBizWorldwide, who told VGC that streaming's impact on the music industry had overall been hugely beneficial.

"Spotify didn't cut the music business in half – piracy did," he said. "Spotify, and the cloud-based technology on which it relies, actually gave music fans a more convenient, legal and monetised alternative to piracy.

"And then, once consumers were comfortable with that, Spotify (and its rivals) performed a further miracle: upselling hundreds of millions of music consumers to subscription via monthly billing… despite the fact that the same free alternative, music piracy, remains available in any browser!"

He added: "Arguably the biggest problem the music industry has with Spotify today is whether its free tier remains fit for purpose, because consumers have become so accepting of the paid subscription paradigm. And make no mistake: subscription as a model is loved by the modern music business; it's taken the whole industry back to commercial peaks many thought Napster and Limewire had snuffed out for good."

Ingham pointed to figures from IFPI which show that since 2011 when Spotify launched in the US, the global recorded music industry has grown by 73%, from $15 billion in annual revenues to $25.9 billion in 2021.

Responding to Fries' comments, ReedPop's head of games B2B Christopher Dring acknowledged concerns over the impact subscription models could have if they ever reached the scale of Spotify, but questioned whether they ever would.

"Right now, there are plenty of stories on how subscription services have been additive for game creators. Not only have they been a source of revenue in their own right, but they immediately open games up to millions of people," he said.

"There are many examples of games going into a subs service on one console, becoming hugely popular, and that has caused a spike in normal $60 sales on other platforms.

"There is industry concern about what might happen if subscriptions become dominant, like they have in music and TV," he added. "The subscription model doesn't necessary generate the revenue needed by AAA games, particularly single-player games with no microtransactions… you can see why Sony is reluctant to put its latest releases into PS Plus.

"However, games are very different to music and TV. Those linear forms of entertainment are much shorter, and more digestible. How many songs or TV shows do most people consume vs games?

"If you're someone who only plays a couple of games a year — like FIFA and Call of Duty — how likely are you to subscribe to a service with hundreds of options? It remains to be seen just how big games subscription services will become."

Microsoft has argued that the additional monetisation opportunities in gaming differentiate it from streaming services for other mediums, such as video-on-demand.

Unlike on video streaming platforms, Game Pass users continue spending money via in-game transactions, expansion content and the purchase of additional games, the company has said.

Microsoft CEO Satya Nadella claimed last year that Xbox Game Pass subscribers play approximately 40% more games and spend 50% more than non-members.

Former Microsoft exec Ed Fries has expressed concern over the potential impact the company's Game Pass subscription service could have on the games industry.

Speaking as part of a wider interview with Xbox Expansion Pass, Fries – who was part of the original Xbox launch team before his departure in 2004 – was asked what he would do were he still part of Microsoft's gaming team today.

Fries didn't give an explicit answer but said that he was 'scared' of the impact Game Pass could have, should it become a dominant business model like Spotify has in the music industry. He also made broad claims about Spotify's impact on the music industry, some of which have been disputed by experts.

Xbox Game Pass launched in June 2017 and has become central to Microsoft's gaming business, offering members access to over 100 titles for a monthly subscription fee.

As of January 2022, Game Pass has over 25 million subscribers, according to Microsoft, so it still has a long way to go before it reaches the level of Spotify (182m) and Netflix (222m). In fact, it was recently estimated that subscription services account for just 4% of annual games revenues in Europe and North America, compared to 65% of global music revenues.

Both Microsoft and PlayStation have said they don't believe subscriptions will ever be the dominant model in video games. However, former MS exec Fries encouraged the platform holders to be "careful" over the business models they create.

"The one thing that they're doing that makes me nervous is Game Pass," he said. "Game Pass scares me because there's a somewhat analogous thing called Spotify that was created for the music business.

"When Spotify took off it destroyed the music business, it literally cut the annual revenue of the music business in half," the former Microsoft exec claimed. "It's made it so people just don't buy songs anymore.

"People don't buy songs on iPhone for example, because why would you? They're all on your subscription service app. Apple's said they're going to take away buying songs because no one's buying them any more.

"So we have to be careful we don't create the same system in the game business. These markets are more fragile than people realise. I saw the games industry destroy itself in the early 80s. I saw the educational software business destroy itself in the mid-90s… they literally destroyed a multi-billion dollar market in a few years.

"So Game Pass makes me nervous. As a customer, I love it. I love Spotify as a customer: I have all the songs I'd ever want… it's a great deal as a customer. But it isn't necessarily great for the industry."

Fries went on to question whether it was possible for game developers to embrace subscription platforms to the extent seen in the music business.

"At some point it tipped and everything had to be [on Spotify]. The percentage of all games that are on Game Pass is still tiny, and there are a lot of games. 200 games a week come out on Steam and more than that come out on mobile."

Some of Fries' claims regarding Spotify were strongly disputed by music industry journalist Tim Ingham, editor of MusicBizWorldwide, who told VGC that streaming's impact on the music industry had overall been hugely beneficial.

"Spotify didn't cut the music business in half – piracy did," he said. "Spotify, and the cloud-based technology on which it relies, actually gave music fans a more convenient, legal and monetised alternative to piracy.

"And then, once consumers were comfortable with that, Spotify (and its rivals) performed a further miracle: upselling hundreds of millions of music consumers to subscription via monthly billing… despite the fact that the same free alternative, music piracy, remains available in any browser!"

He added: "Arguably the biggest problem the music industry has with Spotify today is whether its free tier remains fit for purpose, because consumers have become so accepting of the paid subscription paradigm. And make no mistake: subscription as a model is loved by the modern music business; it's taken the whole industry back to commercial peaks many thought Napster and Limewire had snuffed out for good."

Ingham pointed to figures from IFPI which show that since 2011 when Spotify launched in the US, the global recorded music industry has grown by 73%, from $15 billion in annual revenues to $25.9 billion in 2021.

Responding to Fries' comments, ReedPop's head of games B2B Christopher Dring acknowledged concerns over the impact subscription models could have if they ever reached the scale of Spotify, but questioned whether they ever would.

"Right now, there are plenty of stories on how subscription services have been additive for game creators. Not only have they been a source of revenue in their own right, but they immediately open games up to millions of people," he said.

"There are many examples of games going into a subs service on one console, becoming hugely popular, and that has caused a spike in normal $60 sales on other platforms.

"There is industry concern about what might happen if subscriptions become dominant, like they have in music and TV," he added. "The subscription model doesn't necessary generate the revenue needed by AAA games, particularly single-player games with no microtransactions… you can see why Sony is reluctant to put its latest releases into PS Plus.

"However, games are very different to music and TV. Those linear forms of entertainment are much shorter, and more digestible. How many songs or TV shows do most people consume vs games?

"If you're someone who only plays a couple of games a year — like FIFA and Call of Duty — how likely are you to subscribe to a service with hundreds of options? It remains to be seen just how big games subscription services will become."

Microsoft has argued that the additional monetisation opportunities in gaming differentiate it from streaming services for other mediums, such as video-on-demand.

Unlike on video streaming platforms, Game Pass users continue spending money via in-game transactions, expansion content and the purchase of additional games, the company has said.

Microsoft CEO Satya Nadella claimed last year that Xbox Game Pass subscribers play approximately 40% more games and spend 50% more than non-members.