-

Hey Guest. Check out your NeoGAF Wrapped 2025 results here!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Greece Agreement Reached

- Thread starter Syriel

- Start date

- Status

- Not open for further replies.

Frankfurter

Member

But it is, because debt relief was ruled out.

A hair cut was ruled out, but not the possibility of less/zero interest on the debt and less strict rules in terms of when the money has to be paid back.

Which, essentially, is a form of debt relief.

I would have bet money that this deal would never be reached. Tsipras really collapsed completely. All this nonsense over the last months was for absolutely nothing. The Greek people should really throw him out of office for this nonsensical gambling strategy.

Man, I really hope that somehow this is not another kick of the can down the road, and that Greece can implement structural reforms that fix their administration and kickstart their economy. I seriously doubt it though. The current government will not be exhilarated to implement such reforms, and that is always a bad precondition. I am sure that we will be at this point again in a few months when certain points will have been revoked or weakened again by the administration. And of course, a mild budget deficit would have likely helped Greece more than a target budget surplus.

Assuming that this deal passes the parliaments. It looks like the other Eurozone states won't be a roadblock, given how complete their "victory" has been here.

Forcing Greece to have a 3.5 surplus and have a 50 billions fire sale out of which 25 billions will be used to recapitalise the banks after which the banks will go on fire sale too it's practically a guarantee for another big drop in GDP. On top of the tax raises and other cuts. There's no realistic calculation that can have a different result.

That shouldn't enable him to bring that idea into Germany. Hell, he would've gotten through with it, if it weren't for that meddling Köhler who chipped in last minute to bring that to court.While I'm absolutely against this, don't forget that the US, for example, trains pilots to do exactly that in those cases. I think the first time the idea came up in Germany was years after articles about US pilots being trained to do this showed up. It's not like the Germans came up with that evil idea all by themselves.

My point is that this guy is extremely and unjustified paranoid. Wanting to make civilists acceptable losses, using the army within the country, extreme surveillance, making it legal for the police to watch everyone's computer with a state trojan horse, making torture legal, internment camps for "dangerous people", etc, etc. I thought that he would do less dangerous things when he went from Secretary of the Interior to Finance Minister, even with his corrruption scandal, but I was wrong apparently.

Frankfurter

Member

Forcing Greece to have a 3.5 surplus and have a 50 billions fire sale out of which 25 billions will be used to recapitalise the banks after which the banks will go on fire sale too it's practically a guarantee for another big drop in GDP. On top of the tax raises and other cuts. There's no realistic calculation that can have a different result.

There is no such thing as a fire sale. The 50 billion thing is rather unspecific in terms of when it has to be reached!

Frankfurter

Member

That shouldn't enable him to bring that idea into Germany. Hell, he would've gotten through with it, if it weren't for that meddling Köhler who chipped in last minute to bring that to court.

My point is that this guy is extremely and unjustified paranoid. Wanting to make civilists acceptable losses, using the army within the country, extreme surveillance, making it legal for the police to watch everyone's computer with a state trojan horse, making torture legal, internment camps for "dangerous people", etc, etc. I thought that he would do less dangerous things when he went from Secretary of the Interior to Finance Minister, even with his corrruption scandal, but I was wrong apparently.

Come on, don't blame him for everything just for the sake of it...

There is no such thing as a fire sale. The 50 billion thing is rather unspecific in terms of when it has to be reached!

The assets are to be transferred almost immediately into the fund, isn't it? There will be evaluated at the market value, right? Market value at this moment is the lowest possible due to the whole situation. That's a fire sale.

Edit: in other news

ECB has failed to reward @atsipras for capitulation. No increase in ELA. Banks to remain closed till at least Wednesday night #GreeceCrisis

https://twitter.com/Peston/status/620565299952254976

Frankfurter

Member

The assets are to be transferred almost immediately into the fund, isn't it? There will be evaluated at the market value, right? Market value at this moment is the lowest possible due to the whole situation. That's a fire sale.

No.

I don't blame him for everything. Jesus, no. There are a lot lot lot people at fault for this whole mess,k not to mention whatever it is the current greek government tried to do. But he is nevertheless he is a guy you really shouldn't give power. He has a history of bad ideas and corruption and he plays a big role in the whole play.Come on, don't blame him for everything just for the sake of it...

Negotiator

Banned

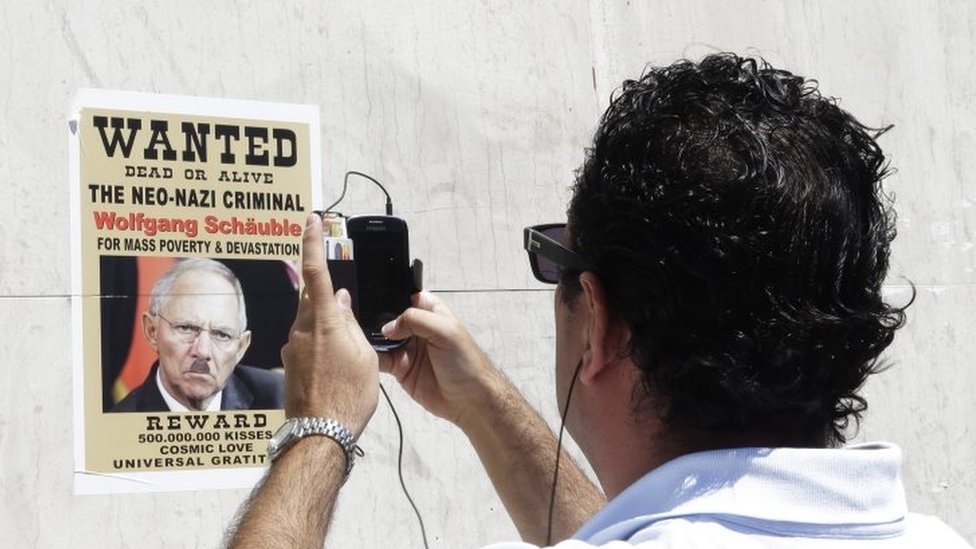

All these horrible ideas make it sound like he's in favor of a totalitarian regime. No wonder some people call him a neo-nazi. He should be sacked ASAP.using the army within the country, extreme surveillance, making it legal for the police to watch everyone's computer with a state trojan horse, making torture legal, internment camps for "dangerous people", etc, etc.

ps: I still don't believe that 70% of the German electorate supports him... that's crazy.

Will see. Even so, it's not like the situation will become better any time soon, so the situation is the same. Unless you think this won't be done in the next years.

Edit: remember the laws to be voted until the end of the week? Let's see if this is among them.

There hasn't been a capitulation, though, has there? Everything needs to be signed off first, right?

Frankfurter

Member

I don't blame him for everything. Jesus, no. There are a lot lot lot people at fault for this whole mess,k not to mention whatever it is the current greek government tried to do. But he is nevertheless he is a guy you really shouldn't give power. He has a history of bad ideas and corruption and he plays a big role in the whole play.

Ministers of the Interior tend to be crazy (and tend to have lots of bad ideas) and I don't think he was particularly bad compared to, say, Schilly or Friedrich.

There hasn't been a capitulation, though, has there? Everything needs to be signed off first, right?

Capitulation isn't my term. But it might fit by the end of the week.

nature boy

Member

Any word of the Greek parliament's reaction to this?

When will they vote on it, and what are the chances they'll put up legal obstacles to this deal?

Opposition will let it pass.

Yannis Koutsomitis

‏@YanniKouts

#Greece | ND's Meimarakis, Potami's Theodorakis & PASOK's Gennimata issue statements; all support #EuroSummit agrmnt; to vote relevant bills

Negotiator

Banned

One word: geopolitics.Why was Greece (or any economically weak/unstable) are allowed to join these multi-national economies? Shouldn't they petition to join and then have thier economies painstakingly reviewed?

Why was Greece (or any economically weak/unstable) are allowed to join these multi-national economies? Shouldn't they petition to join and then have thier economies painstakingly reviewed?

Goldman Sachs allegedly helped Greece cover up their bad finances so that Greece could join the Euro:

http://www.independent.co.uk/news/w...-hide-debts-when-it-joined-euro-10381926.html

Goldman Sachs faces the prospect of potential legal action from Greece over the complex financial deals in 2001 that many blame for its subsequent debt crisis.

A leading adviser to debt-riven countries has offered to help Athens recover some of the vast profits made by the investment bank.

The Independent has learnt that a former Goldman banker, who has advised indebted governments on recovering losses made from complex transactions with banks, has written to the Greek government to advise that it has a chance of clawing back some of the hundreds of millions of dollars it paid Goldman to secure its position in the single currency.

Greece managed to keep within the strict Maastricht rules for eurozone membership largely because of complex financial deals created by the investment bank which critics say disguised the extent of the country’s outstanding debts.

gutter_trash

Banned

shit will not end

things will get worse

Germany and France are really being dicks. Merkel + Hollande are giving the impression towards smaller states that they call the shots.

the EU needs to totally reform its reason to be. Shit like this can't last

Yeah Greece lied and borrowed, that is true. But big banks forcing the government to put the hurt on the "little" people does not bode well for the future of the EU.

things will get worse

Germany and France are really being dicks. Merkel + Hollande are giving the impression towards smaller states that they call the shots.

the EU needs to totally reform its reason to be. Shit like this can't last

Yeah Greece lied and borrowed, that is true. But big banks forcing the government to put the hurt on the "little" people does not bode well for the future of the EU.

Frankfurter

Member

Goldman Sachs allegedly helped Greece cover up their bad finances so that Greece could join the Euro:

http://www.independent.co.uk/news/w...-hide-debts-when-it-joined-euro-10381926.html

+ the Eurozone probably didn't try to find all that much

Fascinating insight:

http://www.ft.com/intl/cms/s/0/f908e534-2942-11e5-8db8-c033edba8a6e.html#axzz3flTmlcs5The closest Greece has come to leaving the eurozone was at around 6am on Monday morning, just as dawn was breaking over Brussels.

Alexis Tsipras of Greece and Angela Merkel, the German chancellor, decided after 14 hours of anguished talks that they had reached a dead end. With no room for compromise, neither saw any reason to carry on. Grexit was the only realistic option.

As the two leaders made for the door it was Donald Tusk, the president of the European Council, who moved to prevent the fatigue and frustration from triggering a historic rupture for the eurozone. Sorry, but there is no way you are leaving this room, the former Polish prime minister said.

The sticking point was the size and purpose of a privatisation fund to be backed by sequestered Greek assets. Ms Merkel wanted the 50bn of sales to be devoted to debt repayments; Mr Tsipras saw that as a national humiliation that would cede control of assets worth almost a third of Greek national income. His alternative was a smaller fund, whose proceeds would be reinvested in Greece.

A compromise was ultimately found after more than an hour discussing nearly a dozen different structures. It was to be the coda to a weekend that featured one of the most exhausting and fraught negotiations in a seemingly interminable crisis that has provided the EUs sternest test.

There is no such thing as a fire sale. The 50 billion thing is rather unspecific in terms of when it has to be reached!

Coming back to this and thinking more about it, half of the 50 bn should go into recapitalising of the Greek banks. If that doesn't mean urgency, I don't know what is? Do you thinks it will take years to capitalise banks that are almost insolvent ?

Has this been posted?

This conversation took place before the deal.

Well let me say that out of six people we were in a minority of two. … Once it didn’t happen I got my orders to close down the banks consensually with the ECB and the Bank of Greece, which I was against, but I did because I’m a team player, I believe in collective responsibility.

We had a small group, a ‘war cabinet’ within the ministry, of about five people that were doing this: so we worked out in theory, on paper, everything that had to be done [to prepare for/in the event of a Grexit]. But it’s one thing to do that at the level of 4-5 people, it’s quite another to prepare the country for it. To prepare the country an executive decision had to be taken, and that decision was never taken.

Negotiator

Banned

Also, let's not forget that Mario Draghi used to work at Goldman Sachs back then...Goldman Sachs allegedly helped Greece cover up their bad finances so that Greece could join the Euro:

http://www.independent.co.uk/news/w...-hide-debts-when-it-joined-euro-10381926.html

Again: due to geopolitics, they used various tricks (swap etc.) to let Greece join the Eurozone. Geopolitics > rigorous economy.

Fascinating insight:

Some people might get angry at Tusk for this, if true.

Some people might get angry at Tusk for this, if true.

yeah, wtf?

D

Deleted member 231381

Unconfirmed Member

A hair cut was ruled out, but not the possibility of less/zero interest on the debt and less strict rules in terms of when the money has to be paid back.

Which, essentially, is a form of debt relief.

I haven't seen any serious talk of zero-interest rates, but zero-interest rates wouldn't help anyway because the Greek economy is deflationary. I've seen serious talk of deferred payments, but they're only helpful if the economy is in a better rather than worse place when you have to repay them, and that seems dubious at this point.

D

Deleted member 231381

Unconfirmed Member

My Greek family in Germany is fairly convinced that this is the worst outcome and that in three years tops we will see another Junta regime.

Fun fun fun.

Eh, the Greek military are probably the only people who don't care, their budget is guaranteed by NATO clauses.

There is always the possibility that Tsipras changes his mind once he is back in Athens and goes into full "Referendum-Tsipras" mode again, rejecting everything with pompous rhetoric. Wouldn't be the first time. Maybe all it takes is some "moral support" from the angry crowd at home.

Frankfurter

Member

I haven't seen any serious talk of zero-interest rates, but zero-interest rates wouldn't help anyway because the Greek economy is deflationary. I've seen serious talk of deferred payments, but they're only helpful if the economy is in a better rather than worse place when you have to repay them, and that seems dubious at this point.

Of course that would help! Greece isn't gonna stay in deflation for the next 30 years. Once Greece has to pay back the debt, it'll be much less (in real terms) and Greece will have spent much less in terms of interest compared to market interest rates.

Some people might get angry at Tusk for this, if true.

Pretty sure everyone is angry everyone else for this. German's angry at the Greeks, the Greeks angry at the Germans, etc.

Really though this deal is all there is on the table and if the Greek people really really don't want it they can push for another referendum on the deal and then batten down the hatches for a Grexit.

Also, let's not forget that Greece cooked the books.Also, let's not forget that Mario Draghi used to work at Goldman Sachs back then...

Again: due to geopolitics, they used various tricks (swap etc.) to let Greece join the Eurozone. Geopolitics > rigorous economy.

Coriolanus

Banned

Huh.

We felt, the government felt, that we couldn’t discontinue the process. Look, my suggestion from the beginning was this: This is a country that has run aground, that ran aground a long time ago. … Surely we need to reform this country – we are in agreement on this. Because time is of the essence, and because during negotiations the central bank was squeezing liquidity [on Greek banks] in order pressurise us, in order to succumb, my constant proposal to the Troika was very simple: let us agree on three or four important reforms that we agree upon, like the tax system, like VAT, and let’s implement them immediately. And you relax the restrictions on liqiuidity from the ECB. You want a comprehensive agreement – let’s carry on negotiating – and in the meantime let us introduce these reforms in parliament by agreement between us and you.

And they said “No, no, no, this has to be a comprehensive review. Nothing will be implemented if you dare introduce any legislation. It will be considered unilateral action inimical to the process of reaching an agreement.” And then of course a few months later they would leak to the media that we had not reformed the country and that we were wasting time! And so… [chuckles] we were set up, in a sense, in an important sense.

So by the time the liquidity almost ran out completely, and we were in default, or quasi-default, to the IMF, they introduced their proposals, which were absolutely impossible… totally non-viable and toxic. So they delayed and then came up with the kind of proposal you present to another side when you don’t want an agreement.

Hrm.

Also, let's not forget that Greece cooked the books.

Moot point when so many others also did exactly that.

D

Deleted member 231381

Unconfirmed Member

Of course that would help! Greece isn't gonna stay in deflation for the next 30 years.

Doesn't matter if Greece stays in deflation for the next 30 or the next 15, it depends on the compound between now and when the debt actually starts getting paid. Greece's deflation now is quite severe. They could still be paying more in real terms even if they have a 15 year run-up of moderate inflation to the pay-back date simply because of the situation now.

EDIT: Varoufakis spitting common sense.

Also, let's not forget that Greece cooked the books.

Another problem was that every administration downplayed the actual amount of Greece's debt, forcing the next administration to release drastically higher "corrected" numbers. This all might have been easier to handle if Europe had known the full extend of the crisis earlier.

Official statement from Tsipras:

http://www.primeminister.gov.gr/eng...lowing-the-conclusion-of-the-eurozone-summit/

http://www.primeminister.gov.gr/eng...lowing-the-conclusion-of-the-eurozone-summit/

We have been fighting hard for six months now, and we fought until the end to achieve the best possible outcome, an agreement that will enable the country to get back on its feet, and for the Greek people to be able to continue to fight.

We faced tough decisions, tough dilemmas. We assumed responsibility for the decision in order to prevent the most extreme objectives from being implementedthose pushed for by the most extreme conservative forces in the European Union.

The agreement calls for tough measures. However, we prevented the transfer of public property abroad, we prevented the financial asphyxiation and the collapse of the financial systemthis was planned to the last detail having recently been designed to perfection, and in the process of being implemented.

Finally, in this tough battle, we managed to gain the restructuring of the debt and a financing process for the medium-term.

We were aware that it would not be an easy task, but we have created a very important legacy. An important legacy, and a much-needed change throughout Europe. Greece will continue to fight, and we will continue to fight, so that we can return to growth, regain our lost national sovereignty. We earned our popular sovereignty. We sent a message of democracy, a message of dignity throughout Europe and the world. This is the most important legacy.

Finally, I would like to thank all of my colleaguesministers, colleagues and associates who gave, along with me, a very tough fight. A fight, which at the end of the day, will be vindicated.

Todays decision will maintain Greeces financial stability and provide recovery potential. However, as we knew beforehand, the agreement will be difficult to implement. The measures include those that Parliament has voted on. Measures that will inevitably create recessionary trends. However, I am hopeful that the growth package of 35 billion euro that we achieved, debt restructuring, as well as securing funding for the next three years will create market confidence, so that investors realize that fears of a Grexit are a thing of the pastthereby fueling investment, which will offset any recessionary trends.

I believe that a large majority of the Greek people will support the effort to return to growth; they acknowledge that we fought for a just cause, we fought until the end, we have been negotiating through the night, and no matter what the burdens will be, they will be allocated we guarantee this with social justice. And it will not be the case that those who have shouldered the burden during the last years will be stuck footing the bill once more. This time, those who avoided payingmany of whom were protected by the previous governmentswill pay now, they, too, will shoulder the burden.

Finally, I want to make this commitment: Now, we need to fight just as hard as we fought to achieve the best outcome abroad-in Europe, to rid vested interests in the country. Greece needs radical reforms in favor of social forces, and against the oligarchy that have led to the countrys current state. And this commitment to this new effort begins tomorrow.

Of course that would help! Greece isn't gonna stay in deflation for the next 30 years. Once Greece has to pay back the debt, it'll be much less (in real terms) and Greece will have spent much less in terms of interest compared to market interest rates.

The issue that Greece faces is more dramatic for the next years (5-10). If it can pass these years, it doesn't matter that much.

Also, any comment on how they will capitalise the banks without setting up the 50 bn fund almost immediately?

Coriolanus

Banned

Official statement from Tsipras:

http://www.primeminister.gov.gr/eng...lowing-the-conclusion-of-the-eurozone-summit/

Oh yes, mate. That debt restructuring is totally coming. #believe

Goodbye Mr. Tsipras, we hardly knew ye. Don't think he'll come back from this one. If this agreement is actually signed (for the better or worse idk) he won't be able to hold his position any longer. Six months ago I was pretty sure him and Varoufakis coming off as clueless in politics and idealistic was just an act, but at least Tsipras actually seems like he has no idea what he's doing. Varoufakis quit at a good time, he seems to be pretty popular in Greece and could a

a) Make a relatively good living as a speaker and maybe by writing books about how all of this played out from the inside

b) Run for office at the next elections (which might be pretty soon)

a) Make a relatively good living as a speaker and maybe by writing books about how all of this played out from the inside

b) Run for office at the next elections (which might be pretty soon)

Frankfurter

Member

Doesn't matter if Greece stays in deflation for the next 30 or the next 15, it depends on the compound between now and when the debt actually starts getting paid. Greece's deflation now is quite severe. They could still be paying more in real terms even if they have a 15 year run-up of moderate inflation to the pay-back date simply because of the situation now.

EDIT: Varoufakis spitting common sense.

They won't be in deflation for another 15 years. That's just nonsense. They might have deflation for another 3 or 4 years at most... (2013 was -.92%, 2014 -.44)

KingSnake said:The issue that Greece faces is more dramatic for the next years (5-10). If it can pass these years, it doesn't matter that much.

Also, any comment on how they will capitalise the banks without setting up the 50 bn fund almost immediately?

I have no freaking clue how that whole recapitalisation is exactly gonna work, I guess there isn't enough information out there to tell yet... Greece is in control of the fund anyway, so why is that so important?

Official statement from Tsipras:

http://www.primeminister.gov.gr/eng...lowing-the-conclusion-of-the-eurozone-summit/

We were aware that it would not be an easy task, but we have created a very important legacy. An important legacy, and a much-needed change throughout Europe. Greece will continue to fight, and we will continue to fight, so that we can return to growth, regain our lost national sovereignty. We earned our popular sovereignty. We sent a message of democracy, a message of dignity throughout Europe and the world. This is the most important legacy.

lol, the audacity...

Greeks: "We don't want you to sign X."

Tsipras: Ready to sign X two days later.

Finally, I would like to thank all of my colleagues–ministers, colleagues and associates who gave, along with me, a very tough fight. A fight, which at the end of the day, will be vindicated.

Today’s decision will maintain Greece’s financial stability and provide recovery potential. However, as we knew beforehand, the agreement will be difficult to implement. The measures include those that Parliament has voted on. Measures that will inevitably create recessionary trends. However, I am hopeful that the growth package of 35 billion euro that we achieved, debt restructuring, as well as securing funding for the next three years will create market confidence, so that investors realize that fears of a Grexit are a thing of the past—thereby fueling investment, which will offset any recessionary trends.

The only mention of debt restructuring is that they will talk about it "later", right?

It probably didn't help that Papadímos was nominated ECB's vice-president in 2002.Another problem was that every administration downplayed the actual amount of Greece's debt, forcing the next administration to release drastically higher "corrected" numbers. This all might have been easier to handle if Europe had known the full extend of the crisis earlier.

How could have he ignored what was going on in Greece?

I have no freaking clue how that whole recapitalisation is exactly gonna work, I guess there isn't enough information out there to tell yet... Greece is in control of the fund anyway, so why is that so important?

If you don't know, why do you feel the need to correct me? Being also very categoric about it?

The info are there. Recapitalisation of the banks must happen as soon as possible.

Oh yes, mate. That debt restructuring is totally coming. #believe

Ireland got better terms on two occasions, if I remember right.

- Status

- Not open for further replies.