A rebound in the Nasdaq 100 that recouped as much as half of its $1.5 trillion losses from its February high hasn't been enough to deter skeptics. In fact, analysts are warning that the index may yet face more battering

Their concern emanates from the bond market, where rising yields have put pressure on richly valued stocks such as the tech companies that populate the Nasdaq gauge. An increase of 50 basis point in 10-year Treasury yields could lead to a bear market for the index, or a decline of as much as 20%, according to a study from Ned Davis Research.

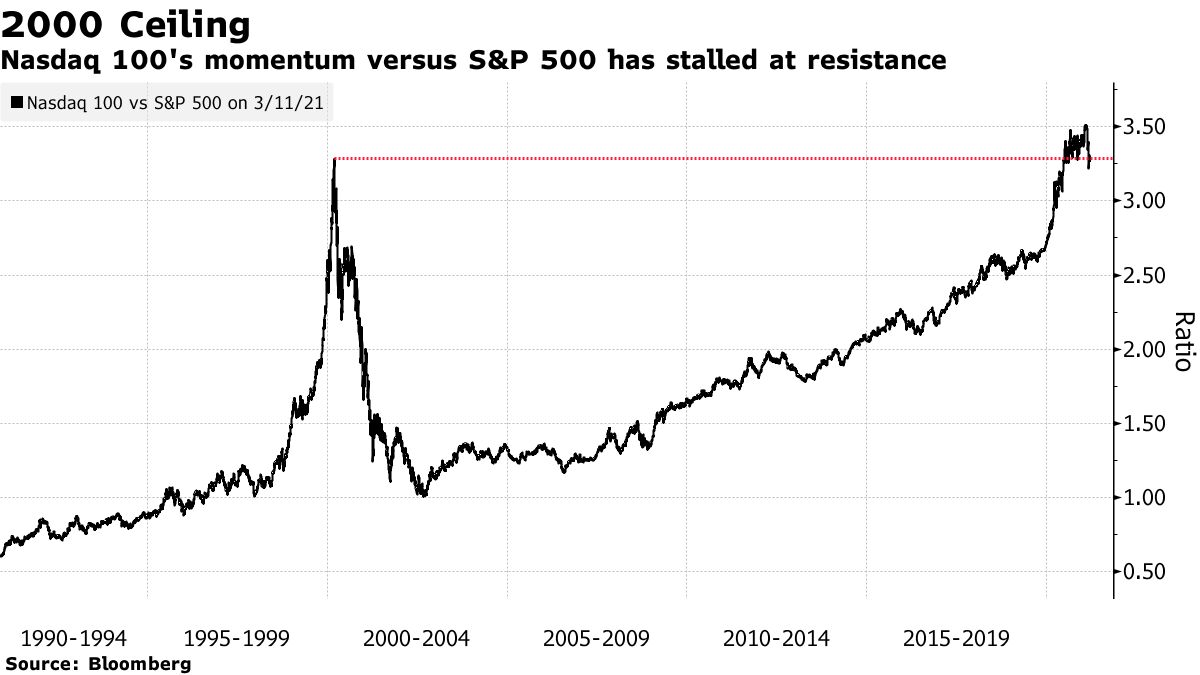

And as the economy heals, investors are embracing sectors such as energy that will likely benefit. One way of seeing the impact of that rotation out of tech is to plot the Nasdaq's relative altitude versus the S&P 500, a gap that after briefly exceeding its level from 2000 has recently narrowed. To DoubleLine Capital LP founder Jeffrey Gundlach, it's a sign that another

collapse may be in store.

A rebound in the Nasdaq 100 that recouped as much as half of its $1.5 trillion losses from its February high hasn't been enough to deter skeptics. In fact, analysts are warning that the index may yet face more battering.

Their concern emanates from the bond market, where rising yields have put pressure on richly valued stocks such as the tech companies that populate the Nasdaq gauge. An increase of 50 basis point in 10-year Treasury yields could lead to a bear market for the index, or a decline of as much as 20%, according to a study from Ned Davis Research.

And as the economy heals, investors are embracing sectors such as energy that will likely benefit. One way of seeing the impact of that rotation out of tech is to plot the Nasdaq's relative altitude versus the S&P 500, a gap that after briefly exceeding its level from 2000 has recently narrowed. To DoubleLine Capital LP founder Jeffrey Gundlach, it's a sign that another

collapse may be in store.